Managing Debt Covenants: Financial Statement Considerations

Debt covenants play a crucial role in financial management contracts between lenders and borrowers. They are legally binding clauses that ensure the borrower adheres to certain financial metrics and obligations. Understanding these covenants is essential for companies as they manage their financial statements. Key aspects include ensuring compliance with ratios such as debt-to-equity and interest coverage ratios. Companies must consider not only current performance but also future projections. Failure to maintain covenants can result in default, which can have severe repercussions for the borrower. It is important to review loan agreements regularly and communicate with lenders about any potential breaches of covenants. This communication helps mitigate risks associated with sudden financial shifts. Additionally, analyzing historical financial performance can aid in forecasting future compliance. Management should be proactive in addressing potential risks associated with debt governance. A well-structured financial statement reflects adherence to these covenants, enhancing investor and creditor confidence. Investors closely watch these aspects as they assess the profitability and stability of a company. In summary, effective management of debt covenants is vital for financial health and long-term corporate success.

Understanding Financial Ratios

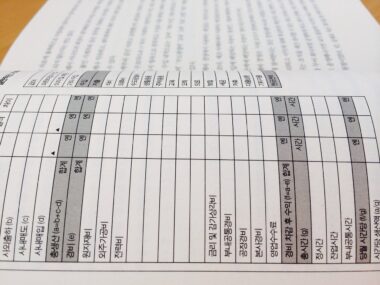

Financial ratios serve as key indicators to assess a firm’s ability to meet debt covenants. Companies should focus on specific metrics that lenders often monitor. Key ratios include the debt-to-EBITDA ratio, which measures a company’s ability to pay off its incurred debt. Lenders typically look for a lower ratio, indicating less risk for repayment issues. Another critical metric is the interest coverage ratio, effectively showing how easily a company can pay interest on outstanding debt. Ideally, this ratio should be above 1.5; otherwise, lenders may express concern. Compliance with these ratios is essential, as any breach can lead to negative consequences, such as a loan being called due. Further, the current ratio, which compares a company’s current assets to its current liabilities, provides insights into short-term financial stability. Companies must track these indicators in their financial statements to avoid covenant violations. Assessing trends over time helps management make better-informed decisions. To maintain a solid financial position, firms should develop strategies for intervention if ratios begin to decline. In summary, understanding and monitoring financial ratios are paramount in maintaining healthy debt relationships.

Effective financial reporting involves being transparent about debt obligations and covenant compliance. This transparency builds trust with stakeholders, especially investors and creditors. Clear disclosures in financial statements indicate how a company is managing its financing arrangements. Companies should provide detailed notes about any significant loan agreements, including the specific covenants required. Keeping stakeholders informed about performance against these covenants can result in enhanced strategic relationships with creditors. Furthermore, establishing a strong governance framework for financial reporting ensures that all information is accurate and up-to-date. Companies should regularly update stakeholders on any changes or trends affecting their compliance with debt covenants. This practice not only helps in maintaining the trust of creditors but also reassures investors about the sustainability of the business. Should any concerns arise regarding covenant compliance, firms must act swiftly to communicate with lenders. Proactive engagement can often lead to renegotiation or amendments to terms, preventing defaults. In conclusion, financial reporting plays a significant role in managing debt covenants and maintaining effective relationships with all stakeholders involved.

Strategic Financial Planning

Strategic financial planning is essential for navigating debt covenants and ensuring ongoing compliance. Companies should adopt a proactive approach by preparing detailed forecasts of future financial performance. This planning helps to identify potential risks in meeting covenant requirements ahead of time. By understanding their financial trajectory, companies can make necessary adjustments to their operations or capital structures. Moreover, strategic use of cash flows is important; prioritizing debt repayments can help maintain healthy ratios. Additionally, management should evaluate alternative financing options that might ease covenant pressures, such as refinancing high-interest debts. Incorporating a flexible financing strategy allows firms to adapt better to fluctuating market conditions. Regularly revisiting and adjusting financial plans ensures that any changes in market conditions are accounted for, thus minimizing risks associated with covenants. Most importantly, aligning financial objectives with overall business strategy guarantees sustainable growth. Companies should develop scenario analysis to visualize the impact of various financial conditions on covenant compliance. The goal is to engage in thorough financial planning that safeguards the company’s future and avoids punitive measures caused by non-compliance. Ultimately, strategic planning is a cornerstone of effective debt management.

Communication is a critical component when managing debt covenants effectively. Continuous dialogue with lenders about financial health and potential covenant breaches fosters trust. A well-informed lender is often more willing to renegotiate terms in times of difficulty. For example, during economic downturns, a company may request temporary waivers or modifications to existing debt conditions. These discussions should be transparent and supported by robust financial forecasts and analyses. Furthermore, having a dedicated team responsible for managing these communications can streamline the process, making interactions smoother. Regular disclosures regarding the company’s performance against covenants allow stakeholders to engage effectively. This transparency can significantly reduce uncertainty and concerns about the firm’s financial position, as well as enhance strategic relationships with lenders. Proactive communication also serves as a risk management tool, helping preemptively address any emerging challenges related to covenants. Effective corporate governance includes setting up internal policies for such disclosures. Ultimately, maintaining healthy communication channels can be the key differentiator in successfully managing debt covenants and ensuring a firm’s financial stability. In summary, ongoing communication with lenders is essential for effective covenant management.

Monitoring Compliance

Monitoring compliance with debt covenants is essential for preventing financial distress and maintaining lender relationships. A systematic approach to tracking all relevant financial ratios is imperative, ensuring early detection of potential issues. Companies should implement regular internal audits or reviews of financial statements to confirm that they remain compliant with all debt covenants. Utilizing financial management software can significantly streamline this monitoring process. These tools can automatically calculate necessary ratios, flagging any deviations from established benchmarks. Periodic assessments allow firms to adjust their strategies proactively if forecasts indicate impending non-compliance. Additionally, developing an internal reporting framework can simplify the process of informing all stakeholders about covenant status and related issues. Regular updates foster better financial decision-making and align corporate strategies with covenant requirements. Companies should also conduct stress testing exercises to evaluate how various scenarios impact covenant compliance. This proactive approach can help management prepare for adverse economic conditions or unexpected significant changes to the business environment. By closely monitoring compliance, companies safeguard their financial health, ensuring sustainable operations in the long run. Overall, structured compliance monitoring is vital for effective debt governance and financial management.

The importance of contingency planning cannot be overstated when dealing with debt covenants. Preparing for potential breaches requires a well-thought-out strategy that outlines steps to take in adverse situations. Companies should analyze worst-case scenarios and establish a plan to mitigate risks associated with covenant violations. Contingency planning should include identifying available resources, such as reserves or alternative financing options. This strategic foresight allows firms to act swiftly if they find themselves on the brink of breaching covenants. In addition to immediate tactical measures, companies must review their overall business strategies in times of financial uncertainty. Addressing operational efficiencies and cost management can improve financial performance and support improved compliance. Furthermore, engaging with financial advisors or third-party experts can offer valuable perspectives and solutions. Firms must ensure that contingency plans are not only effective but also remain adaptable to changing circumstances. Incorporating regular reviews of these plans into annual assessments can better prepare companies for evolving market conditions. In conclusion, thorough contingency planning is fundamental to managing debt covenants and safeguarding a company’s future financial stability.

In conclusion, effectively managing debt covenants requires a multi-faceted approach encompassing financial understanding, transparent reporting, and consistent communication. Companies must monitor financial ratios and adhere to their obligations laid out in debt agreements. Furthermore, it is essential to engage with stakeholders, providing updates regarding compliance and potential risks. Proactive financial planning ensures that companies are prepared to face any obstacles related to their debt structures. Through a strategic lens, contingency planning will enhance resilience against unforeseen financial challenges. Investors will likely appreciate a company dedicated to maintaining healthy financial relationships and practices. This can bolster confidence and potentially improve the company’s valuation in the market. As a final note, organizations should consider conducting periodic reviews of their financial health and covenant compliance. This diligence can uncover potential issues before they escalate, allowing management to take corrective measures early. Remember that maintaining a strong connection with lenders also plays a crucial role in the long-term success of the company. In the fast-paced financial environment, companies that execute these principles effectively will stand a greater chance of thriving and achieving sustainable growth.