Integrating Mobile Payment Solutions in International Finance

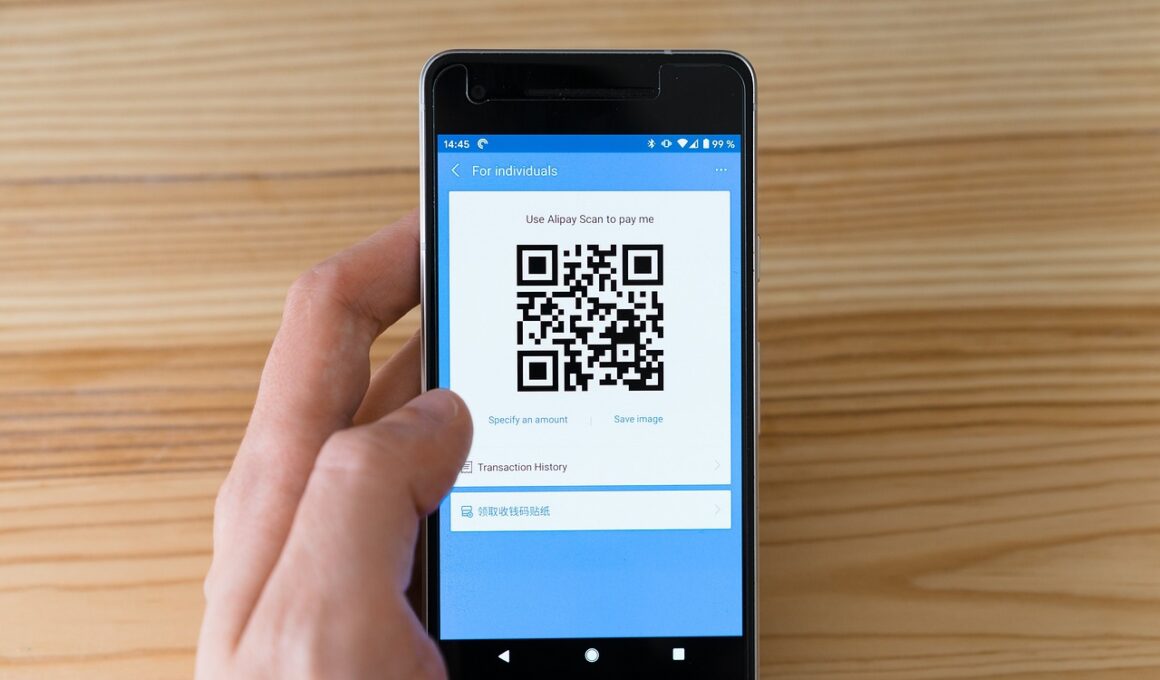

Mobile payment solutions are transforming the landscape of international finance by enhancing speed, convenience, and accessibility for users worldwide. Traditional payment methods are often associated with high fees and lengthy transaction times. In contrast, mobile payment platforms facilitate real-time transactions, significantly reducing costs. By leveraging advanced technologies such as blockchain and mobile networks, these solutions empower users to engage with global commerce seamlessly. Furthermore, they cater to the growing demand for digital transactions amidst a rapidly evolving consumer landscape. The rise of smartphones has made it essential for financial institutions to adapt and integrate mobile payment systems into their offerings, ensuring competitiveness in this crowded marketplace. By embracing mobile payments, businesses can reach a wider audience, especially in developing regions where access to banking services remains limited. The transaction process can be simplified through the use of QR codes and digital wallets, thus enhancing user experience. This paper will explore diverse mobile payment platforms, their functionalities, as well as the implications they hold for international finance moving forward. As the global economy shifts, understanding these trends is critical for stakeholders aiming to capitalize on new opportunities.

Understanding the challenges associated with cross-border mobile payments is pivotal. Currency conversion rates, transaction fees, and varying regulatory frameworks can complicate mobile payments. Additionally, due to fluctuating exchange rates, businesses might incur unexpected costs when transacting globally. This inconsistency poses risks for both consumers and merchants engaging in international trade. To mitigate these challenges, several mobile payment systems offer multi-currency support and transparent pricing structures, helping users navigate complexities effectively. Strategic partnerships between payment providers and local banks can also aid in acquiring regulatory approvals, thus ensuring compliance with local laws. Moreover, raising awareness about the security of mobile payments is crucial because consumers are often hesitant to adopt new technologies without understanding the risks involved. By forging alliances with cybersecurity firms, mobile payment solutions can implement robust security measures, boosting consumer confidence. Education campaigns to inform users about safe mobile payment practices are equally important for breaking down barriers to adoption. Financial institutions must prioritize customer security alongside usability to foster trust in their offerings. Ensuring a smooth transaction process is essential to fostering growth in international finance through mobile payments.

Technological Innovations Driving Mobile Payments

Emerging technologies play a significant role in shaping the future of mobile payment systems. Innovations like Near Field Communication (NFC) and biometric authentication are revolutionizing how payments are made and secured. NFC allows users to make contactless transactions, which are particularly convenient in busy international environments where speed is paramount. Nesting biometric features, such as fingerprint scanning and facial recognition, enhances security by ensuring that only authorized users can complete transactions. Additionally, the implementation of artificial intelligence and machine learning enables payment systems to analyze transaction patterns effectively, flagging suspicious activities. Such technologies ensure a high level of security as they contribute to fraud prevention efforts. As the mobile payment ecosystem continues to expand, integration with major e-commerce platforms is becoming more commonplace. This alliance allows retailers to streamline their checkout processes, improving customer experience. Payment providers are also exploring blockchain technology to enhance transparency and traceability in transactions. By securing data on decentralized ledgers, users can have confidence in the integrity of their transactions. These technological advancements are instrumental in addressing the growing demand for secure and efficient mobile payments in international finance.

Regulatory challenges remain a significant hurdle in the widespread adoption of mobile payment solutions. Different countries have varying regulations that govern financial transactions, requiring mobile payment providers to navigate complex legal landscapes. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is particularly crucial and can differ markedly across jurisdictions. However, addressing these regulatory concerns can open up new markets for mobile payment services. Working closely with regulators can lead to more robust frameworks that not only protect users but also support innovation. Furthermore, international collaboration among regulators can help standardize mobile payment regulations, reducing barriers for providers aiming to enter foreign markets. Security concerns surrounding data privacy and consumer protection must also be prioritized. Businesses offering mobile payment solutions must be transparent about how they handle customer data to avoid eroding trust. Establishing industry standards around data security practices will benefit both providers and users. As nations continue to explore the future of fintech, fostering an open dialogue among industry players, regulators, and consumers is essential in driving the evolution of mobile payments within the global financial ecosystem.

The Future of Mobile Payment Solutions

The future of mobile payment solutions appears promising as technological advancement continues to reshape transactions. Enhanced security features and user-friendly interfaces will drive greater adoption among consumers. Increasing interconnectedness between payment systems globally will facilitate international transactions, paving the way for a more inclusive financial ecosystem. The emergence of digital currencies, including Central Bank Digital Currencies (CBDCs), represents a significant shift in the financial landscape. By integrating these currencies into mobile payment solutions, users can transact with lower costs and enhanced transparency. Furthermore, social media platforms are beginning to introduce payment functionalities, signifying a convergence between e-commerce and social networking, which is set to change consumer behavior profoundly. As businesses shift towards omnichannel strategies, equipping themselves with versatile payment options through mobile devices will be crucial. The seamless integration of mobile payments into everyday activities is likely to bolster both consumer confidence and business revenues. Continued investments in fintech innovation and partnerships among stakeholders will be key drivers in shaping a future where mobile payment solutions are the norm worldwide. Consequently, stakeholders must remain agile to adapt to these emerging technologies.

Integration of mobile payment solutions into international finance necessitates collaboration across multiple stakeholders, including banks, merchants, consumers, and governments. Financial institutions must play a pivotal role in creating a seamless ecosystem that supports mobile transactions. By investing in technology upgrades, banks can facilitate faster and more secure payment solutions. Merchants equally need to evaluate their payment infrastructure, ensuring compatibility with emerging payment methods. Engaging customers through viable options like mobile wallets or app-based payment services will enhance satisfaction and loyalty. Moreover, consumers play a crucial role in driving acceptance through their willingness to adopt mobile payments on a larger scale. Educating consumers about the benefits and security measures of mobile transactions will mitigate apprehensions surrounding new technology. Additionally, governments must establish frameworks that encourage innovation while protecting users. This strategic collaboration among stakeholders will foster a more efficient and inclusive financial system. As mobile payments continue to redefine international transactions, embracing change and adaptability will be key. In this evolving landscape, understanding customer behavior and preferences will be pivotal for businesses aiming to thrive in international finance.

In conclusion, the integration of mobile payment solutions into international finance represents a profound opportunity for growth and transformation. The rapid advancements in technology coupled with the shift in consumer behavior indicate a clear movement towards digitalization in payment methods. Addressing challenges related to regulation, security, and technology will be essential in unlocking this potential fully. As businesses embrace mobile payment systems, they can enhance operational efficiencies and broaden their client base. The continuous evolution of these solutions will ultimately determine their success in the international finance ecosystem. Educational initiatives to promote consumer confidence, alongside strategic partnerships, will aid in achieving a smoother transition towards mobile transactions. Stakeholders must remain aware of trends that influence the financial landscape, such as increasing demand for seamless payment experiences and transparency in transactions. As the financial world navigates these changes, fostering trust among users and ensuring robust security practices will remain paramount. In summary, integrating mobile payment solutions is not just a trend but a pivotal shift in how international finance operates moving forward.