Detecting Financial Health Through Statement Analysis

Understanding financial statements is crucial for anyone wanting to assess the financial health of a company or an individual. Financial statements typically include the balance sheet, income statement, and cash flow statement, among others. Each of these documents provides different insights into overall financial performance and stability. Analyzing these statements can reveal trends in profitability, liquidity, and solvency. It is essential to grasp the components and implications of each statement to gain a complete picture of financial health. For example, the income statement details the revenues, costs, and expenses over a specific period, showcasing profitability. The balance sheet, on the other hand, reflects the assets, liabilities, and equity at a given moment, illustrating net worth. The cash flow statement tracks the flow of cash in and out, indicating how well the entity manages cash to fund obligations and expand operations. Thus, mastering these statements allows for informed decision-making, ultimately enabling individuals and organizations to achieve financial success. Comprehensive analysis helps pinpoint inefficiencies and areas needing improvement, facilitating more effective financial management strategies.

Importance of Balance Sheets

The balance sheet is one of the key financial statements that show a company’s financial position at a specific point in time. It details what the company owns (assets) and owes (liabilities), giving insights into liquidity and net worth. The balance sheets provide an overview of a company’s resources, such as cash, inventory, and receivables, contrasted with its debts, like loans and accounts payable. Understanding the balance sheet can highlight whether a company is over-leveraged, under-capitalized, or financially sound. It’s important to analyze key ratios derived from the balance sheet, such as the debt-to-equity ratio, current ratio, and return on equity. These ratios help gauge financial stability and performance over time. For instance, a high debt-to-equity ratio could indicate increased financial risk. Additionally, by tracking the growth or decline of assets and liabilities, stakeholders can determine trends and forecast future financial health. Regular assessment of the balance sheet empowers management to make timely decisions, ensuring sustained growth and stability, which are vital for attracting investors and maintaining confidence in the company.

Interpreting the income statement is equally important when evaluating financial health. This statement outlines a company’s revenue generation against its costs and expenses. It typically contains three crucial parts: revenues, costs of goods sold (COGS), and operating expenses. By comparing revenues to expenses, investors can ascertain the company’s profitability over a given period. A positive net income indicates a profitable operation, while a net loss warrants further investigation. Additionally, analyzing trends in revenue growth, gross profit margin, and operating income provides insights into operational efficiency and market competitiveness. Various expenses, such as selling, general, and administrative costs, contribute greatly to understanding how effectively the company controls its overhead and employs resources. Potential red flags include consistently rising expenses outpacing revenue growth, signaling financial distress. Thus, regular examination of the income statement empowers business leaders to make informed decisions, drive strategic changes, and enhance profitability. Being conversant with this document is vital for stakeholders, helping them gauge the return on investment and overall operational success.

Cash Flow Statement Analysis

The cash flow statement is crucial for assessing a company’s ability to generate cash and manage its liquidity. It details cash inflows and outflows from operating, investing, and financing activities. Understanding these areas is vital as it reflects how well a company maintains its cash position. Positive cash flow, particularly from operating activities, suggests a company is generating sufficient revenue. In contrast, negative cash flow signals potential trouble, indicating that the company may be struggling to meet its obligations. Key metrics, such as free cash flow and cash flow from operations, provide deeper insights into liquidity and flexibility. Investors often scrutinize these metrics to understand how well a company can reinvest in operations, pay dividends, or reduce debt. Analyzing variations in cash flow over time can also reveal trends in operational efficiency and capital management. Moreover, anomalies in cash flow should prompt further investigation, possibly indicating underlying issues. Therefore, investors and stakeholders must comprehend cash flow statements, as they serve essential roles in financial forecasting and strategic decision-making.

In addition to standalone analysis, evaluating these financial statements collectively offers deeper insights into overall financial health. For instance, a company may report high revenue but simultaneously show increased liabilities on the balance sheet. This discrepancy necessitates a thorough review to understand the true financial health. Furthermore, complementary analysis of profitability ratios alongside liquidity ratios allows stakeholders to comprehend how well a company balances income generation with cash management. This holistic approach highlights the interconnectedness of the various statements and shows how decisions in one area can impact another. Analysis might also include benchmarking against industry peers to assess relative performance. By studying trends across multiple periods, analysts can identify patterns, seasonal fluctuations, and forecasting opportunities. Engaging in comprehensive analysis enables stakeholders to delineate strengths, weaknesses, and potential risks. It empowers effective communication of financial health to investors, management, and regulators, fostering transparency. Thus, integrating the analysis of various financial documents equips decision-makers with a robust understanding of a company’s financial landscape.

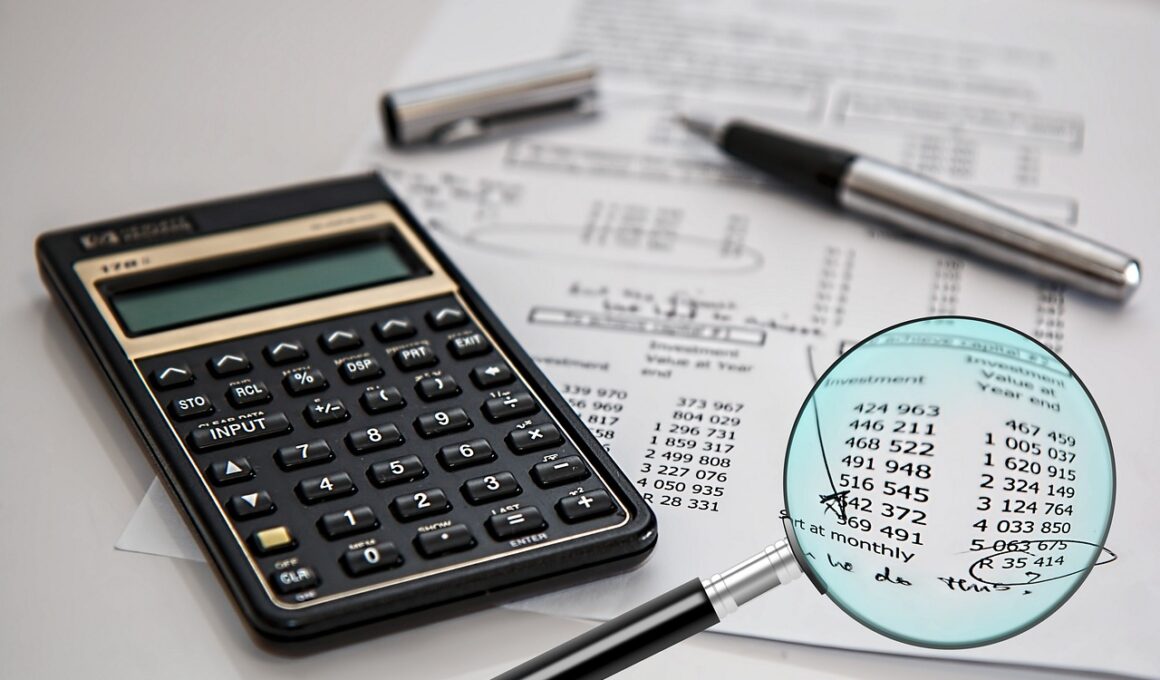

Tools for Financial Analysis

To facilitate effective financial analysis, various tools and techniques can be employed. Tools such as financial modeling software provide a structured approach to forecasting and scenario analysis. Excel spreadsheets remain indispensable for many analysts, aiding in organizing data, calculations, and creating graphical representations. Moreover, ratio analysis tools, often available in accounting software, provide quick and accessible insights into financial performance. Key performance indicators (KPIs) can also be established, allowing businesses to monitor progress towards strategic goals. Another effective method is the use of financial dashboards, which condense various financial metrics into visual formats for easier understanding and analysis. Additionally, utilizing industry benchmarks enables comparisons against competitors, creating a context for performance evaluation. Subscription-based platforms, such as Bloomberg or Reuters, offer detailed analyses and data required for high-level insights. Several companies also engage financial advisors or analysts to leverage expert insights, adding significant value to the analysis. Combining various tools can enhance the efficiency and effectiveness of financial analysis, contributing to well-informed strategic decision-making processes.

Regular analysis of financial statements is essential for maintaining ongoing financial health awareness. Establishing a routine for assessing these documents enables proactive identification of potential issues before they escalate. Businesses should prioritize conducting quarterly and annual reviews, ensuring stakeholders remain informed. Additionally, organizations may consider integrating this analysis into strategic planning processes, aligning financial performance with long-term objectives. Engaging management teams in finances can foster a culture of accountability and promote informed decision-making across the board. Training employees on financial literacy can also help employees recognize their role in the organization’s financial health. These efforts can lead to improved synergy within departmental functions, since financial awareness influences operational decisions. Furthermore, producing analytical reports summarizing the financial assessments provides clear communication to stakeholders, encouraging discussion and prompt actions if necessary. This organizational commitment to financial oversight creates an environment conducive to growth and stability. Regular review helps prevent surprises while ensuring strategic agility and adaptability to changing market conditions, ultimately creating a more resilient organization capable of navigating challenges successfully.