Investment Scams Targeting Seniors: What to Watch For

Seniors are increasingly becoming targets for investment scams, which can lead to significant financial distress. Scammers often prey on the vulnerability of older adults, leveraging their desire for financial security and stability. These schemes can take on various forms, including Ponzi schemes, deceptive real estate deals, and fraudulent investment opportunities that promise unrealistic returns. Elderly individuals may be drawn into these scams due to a lack of awareness or understanding of investment processes. It is crucial for seniors to remain cautious and informed about the tactics used by fraudsters. Effective education on recognizing red flags can significantly reduce the risk of falling victim to these scams. Seniors should also consider consulting with a trusted financial advisor before making any investments. Their expertise can help identify legitimate opportunities versus potential scams. Engaging family members in discussions about finances can also provide seniors with additional perspectives. Taking proactive steps to safeguard financial assets is essential for maintaining security and peace of mind. Open communication can help ensure that seniors feel supported and less isolated in their decision-making processes regarding investments.

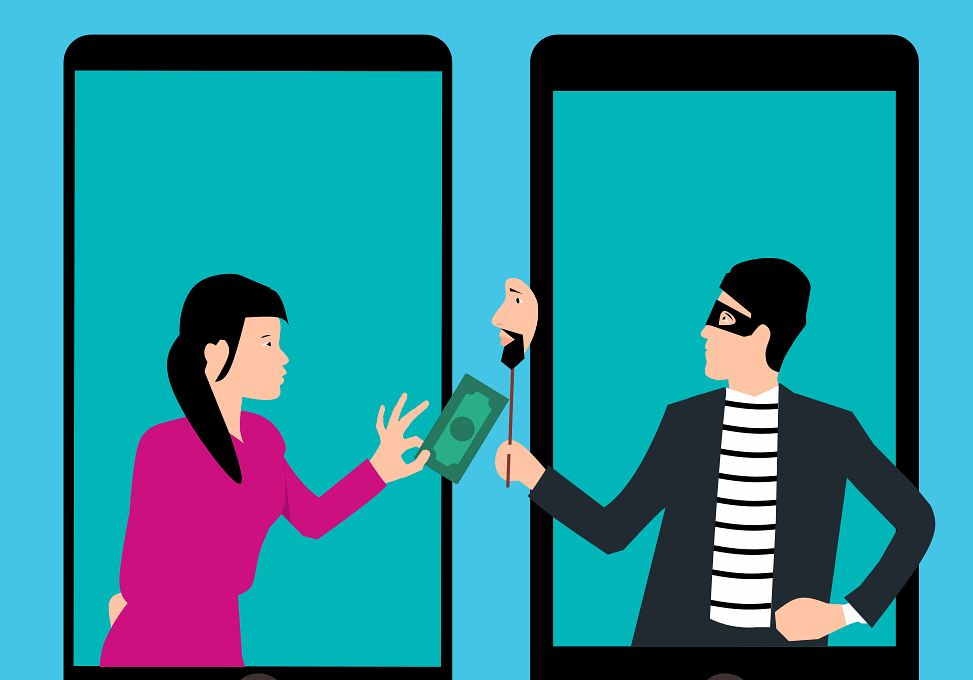

Investment fraud may appear legitimate, making it challenging for seniors to decipher what is a scam. Fraudulent schemes frequently involve high-pressure tactics, urging potential victims to act immediately to seize an opportunity. Unfortunately, this urgency often clouds judgment and leads to hasty decisions. Scammers might present themselves as reputable individuals or organizations while using sophisticated marketing materials that mimic those of genuine businesses. For instance, they might employ fake websites or testimonials to create a sense of credibility and trustworthiness. Seniors should be especially vigilant when approached via unsolicited calls, emails, or social media. Scammers may appear friendly, luring victims with promises of quick profits with little risk. Seniors must critically evaluate every investment opportunity, conduct thorough research, and check the legitimacy of the company involved. The U.S. Securities and Exchange Commission (SEC) offers resources on how to recognize fraud and helps identify registered investment professionals. Verifying registration can provide a layer of protection against fraud. Thoroughly observing the background and reputation of individuals and companies before investing is essential in today’s complex financial landscape, where scammers are becoming increasingly creative.

Common Types of Investment Scams

Understanding the various types of investment scams can empower seniors to protect themselves against potential fraud. One common type is the Ponzi scheme, where returns for earlier investors are paid using the capital from newer investors rather than originating from profit earned by the business. Many seniors may not realize how quickly they could lose their money in such arrangements, especially if they appear to be stable. Another prevalent scam is the promise of high-yield investment programs that guarantee unusually high returns with little risk involved. Scammers use this tactic to lure vulnerable individuals seeking to grow their retirement savings quickly. Additionally, real estate investment scams are rampant, where fraudsters sell non-existent properties or involve investors in projects that have no chance of success. It’s crucial to remind seniors that if an investment sounds too good to be true, it likely is. Seniors are urged to perform due diligence before committing their hard-earned savings to any investment. Building awareness about these scams can create a substantial preventive layer, helping seniors recognize and report fraudulent behavior effectively and promptly.

Family members play a crucial role in preventing seniors from falling victim to investment scams by encouraging open conversations about finances. Communication can help identify unusual financial behaviors that might indicate a scam is at play. Family members should frequently check in on their elderly loved ones while fostering an environment where seniors feel comfortable discussing their financial decisions. Building a supportive and understanding relationship can empower seniors to seek advice when approached with potential investment opportunities. Engaging in joint meetings with financial advisors can help ensure the seniors are making well-informed choices. Additionally, sharing common red flags can help educate all family members about risk signs, such as unsolicited offers, promises of high returns, and entities lacking regulatory registration. Family support can be a critical defense against investment fraud, reinforcing the idea that it’s always acceptable to ask for help and advice. Encouraging seniors to question any financial information that seems sketchy or inconsiderate can enhance their overall safety. Ultimately, strengthening family bonds can help create a protective network that safeguards vulnerable seniors from scam tactics.

Reporting and Recourse Options

When an individual suspects that they or someone they know has fallen victim to an investment scam, it is essential to take action immediately. Reporting the crime not only aids in the investigation but also helps prevent others from falling into the same trap. Seniors should contact state or federal agencies, such as the SEC or the Federal Trade Commission (FTC), to report fraudulent activities. These agencies are equipped to investigate scams and can provide guidance on recovering lost funds. It’s advisable for victims to document all interactions regarding the investment, including emails, promotional materials, and any communications with the scammer. These records can be fundamental evidence in any investigation. Filing a police report is also recommended, as local law enforcement can assist in addressing the fraud. Seniors are encouraged to notify their banks, as they may offer assistance in monitoring accounts for suspicious transactions. Promoting awareness and educating more individuals about these scams is vital if communities are to protect one another. The more victims who report these scams, the more data agencies gather, potentially preventing future occurrences.

Investing with caution is crucial for seniors to safeguard their financial future. Many investment scams exploit the naivety and trusting nature of individuals in this demographic. By prioritizing education on the signs of scams, seniors can actively protect themselves and their savings. Trusted resources can assist them in making informed decisions while evaluating investment opportunities. Furthermore, participating in senior workshops or information sessions can build a community foundation for sharing knowledge and insights about investment scams. Regularly updating themselves on new scams and tactics employed by fraudsters allows seniors to stay one step ahead. Knowledge is empowering, and seniors equipped with information are less likely to become victims. Encouraging skepticism toward unsolicited offers is vital. Seniors should feel confident in questioning the legitimacy of an opportunity, especially if pressured into making immediate decisions. Regularly reviewing financial plans with a professional can also help mitigate risks, ensuring a meaningful backup in financial processes. Ultimately, balancing caution with the desire for reasonable returns can help seniors navigate the investment landscape more safely and enjoy financial peace of mind.

Final Thoughts on Prevention

Investment scams targeting seniors are a serious issue that requires heightened awareness and proactive strategies for prevention. Seniors must educate themselves about potential schemes, keeping an eye on red flags while remaining open to educational resources available through various organizations. Establishing strong networks of support among family members can significantly reduce isolation and vulnerability to scams. These support systems can enable seniors to feel more comfortable discussing their financial decisions and experiences, thus preventing fraud. Additionally, creating an environment that encourages questions, skepticism, and dialogue fosters higher caution and engagement. By continuously staying informed, seniors can better navigate financial decisions in today’s market. It is paramount to remember that seeking help does not imply failure; instead, it demonstrates wisdom and responsibility. Maintaining awareness can lead to identifying and avoiding investment schemes successfully. Furthermore, by empowering others to share their experiences and knowledge, seniors contribute to a collective effort in combating investment fraud. This collaborative approach will foster a safer financial environment for everyone, ensuring the community is well-informed and protected from the threat of scams.

Financial literacy must be reinforced to stem the tide against targeted investment scams. The better equipped seniors are with knowledge about safe investing practices, the less likely they are to become victims of fraud. Institutions can be pivotal in this educational process, providing workshops and resources aimed at empowering older adults with essential financial knowledge. Such initiatives can enhance seniors’ confidence in their investments, allowing for informed decision-making that mitigates risks. Additionally, involving caregivers in these education efforts fosters understanding and awareness, promoting standards of transparency that protect seniors. Utilizing technology can broaden access to information, allowing seniors to gain insights on investment trends and fraudulent activities regularly. Online forums and webinars can serve as platforms for learning and sharing real experiences about scams and how to avoid them. Furthermore, such resources promote an engaged community actively combating financial fraud. Engaging with non-profits and organizations that specialize in senior education and advocacy can also help position seniors and their families for success. Overall, the dialogue surrounding investment scams must continue to evolve, adapting to new challenges while emphasizing the importance of diligence and oversight.