Overcoming Shame Associated with Financial Struggles

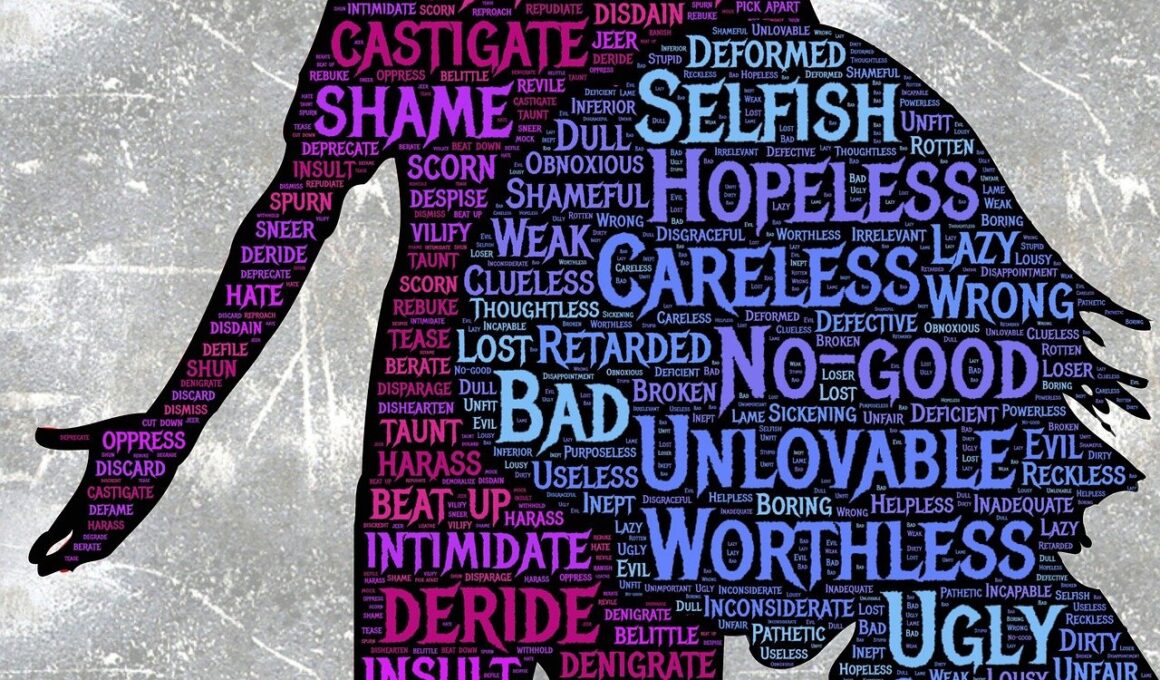

Financial struggles can lead to an overwhelming sense of shame and inadequacy. People often associate their self-worth with their financial status. This perception can create a slippery slope into mental health issues. Consequently, many suffer in silence, believing that others have it better. This can hamper personal growth and happiness. Overcoming shame requires a clear understanding of these feelings. Firstly, acknowledging the shame is vital; accepting that financial issues are common can alleviate guilt. Joining support groups or consult with a financial therapist helps shorten the isolation. Here are essential strategies: 1. Strengthening communication regarding finances within a relationship creates transparency. 2. Developing a budget may help you regain a sense of control. 3. Finding community resources that assist with financial literacy can improve one’s financial health. 4. Overall, embracing vulnerability can lead to self-acceptance. Ultimately, understanding that you aren’t alone is crucial. Remember, discussing financial difficulties openly can reduce stigma and foster healthy conversations about money management and mental well-being. Balancing financial knowledge with emotional support can essentialize healthy financial habits.

Identifying the Roots of Shame

The roots of financial shame often stem from societal pressures, family upbringing, and personal experiences. Understanding these roots can significantly aid in addressing and overcoming them. Family backgrounds significantly influence financial habits and attitudes toward money. Childhood experiences related to finances can have long-lasting effects; for example, growing up in a financially unstable environment may instill fear of failure. This fear can perpetuate a cycle of shame whenever financial issues arise. On a societal level, overwhelming media representations often project idealized versions of prosperity and success. These portrayals can distort reality, making financial struggles seem unique, thereby exacerbating feelings of shame. It’s crucial to analyze these narratives that perpetuate shame. Here’s how you can do this: 1. Reflect on your past and how it shaped your viewpoint on money. 2. Consider talking with a trusted confidant to express these feelings openly. 3. Journaling can be an excellent outlet to process emotions and thoughts. 4. Recognizing these narratives is the first step towards creating healthier financial habits and reducing associated shame.

Practical techniques can help transform financial shame into a strength rather than a burden. One effective approach is reframing negative thoughts. Instead of berating yourself for financial mistakes, recognize them as opportunities for learning. Developing a growth mindset around money can shift your perspective dramatically. Implementing daily affirmations can help combat negative self-talk associated with finances. Statements such as “I am learning to manage my financial situation” can reinforce a positive outlook. Additionally, setting small, achievable financial goals can provide a sense of accomplishment, helping diminish feelings of shame. Celebrating these small wins reinforces positive behavior. Here’s a plan for creative money management: 1. Set specific financial milestones, such as saving a certain amount. 2. Create a visual progress chart to celebrate achievements. 3. Share your goals with supportive friends or family who can encourage and hold you accountable. 4. Maintain a learning approach by attending financial education workshops. Transforming shame into motivation involves patience and dedication to cultivating healthier financial habits. When feelings of shame arise, try to recognize the triggering thoughts and actively work toward reframing them.

Building a healthy relationship with money is key to overcoming associated shame. To accomplish this, it is essential to differentiate between wants and needs. This awareness is foundational for effective money management. Creating a budget based on essential living expenses and allocating money for discretionary spending can empower individuals. Budgeting creates a clear picture of financial flows, reducing anxiety stemming from uncertainty. Additionally, regularly reviewing spending habits can lead to significant insights and adjustments. Consider utilizing budgeting apps and tools to aid in tracking progress seamlessly. Incorporating mindful spending involves assessing whether purchases align with personal values and long-term goals. To strengthen this relationship further, consider these tips: 1. Make note of your financial successes regularly, no matter how small. 2. engage in discussions about money with friends to normalize the conversation. 3. Consider working with a financial advisor to receive professional guidance. 4. Reflect on values to ensure alignments with spending habits and financial decisions. Building this relationship takes time, but acknowledging the emotional aspects linked with money is an integral part of the journey.

Community support can play a significant role in transforming financial shame into empowerment. Engaging with others who share similar struggles can offer solace and understanding. Support groups allow individuals to share their experiences openly, promoting healing and understanding. Many organizations and platforms provide resources specifically aimed at financial literacy, offering valuable information. Consider reaching out to local community centers that host financial management workshops or classes. Online forums and social media groups can also connect individuals facing similar challenges. These are constructive avenues to share tips and resources. Here’s how to engage effectively: 1. Join community financial literacy programs. 2. Participate in local events focused on financial wellness. 3. Contribute by sharing personal experiences to foster an open environment. 4. Create a personal network of financially-minded individuals for mutual support. Engaging with a community fosters accountability and motivation. It provides emotional support, helping individuals recognize they are not isolated in their struggles. Support systems encourage individuals to share their burdens, reminding them that everyone experiences financial ups and downs.

Implementing self-care practices is essential in overcoming feelings of shame related to financial struggles. Mental well-being significantly influences the approach to managing finances. Engaging in activities that promote relaxation and emotional stability can shift focus away from stress. Practices such as mindfulness, meditation, or yoga help cultivate a healthy mindset. Regularly participating in self-care routines can provide the necessary emotional armor to face financial challenges confidently. Amidst financial management, it is essential to carve out time for these practices intentionally. Here are several self-care techniques you might find useful: 1. Set aside dedicated time for relaxation each week; practice methods that soothe you. 2. Engage in physical activities that foster wellness, such as running or hiking. 3. Maintain a journal to express thoughts, including ones related to finances. 4. Seek professional help if feelings of shame persist, as therapy can offer vital support. Taking care of mental health while navigating financial struggles fosters resilience. These routines serve as protective factors, helping maintain a balanced emotional state, thus enabling individuals to tackle financial matters effectively.

Lastly, celebrating progress in overcoming financial struggles and associated shame is crucial. Each step taken deserves recognition, fostering a positive mindset. Whether financial goals are achieved or significant learning experiences are encountered, these should be acknowledged. Practicing gratitude for small accomplishments can enable individuals to shift focus from negative feelings towards resilience. Consider incorporating the following strategies into your routine: 1. Create a reward system for reaching financial milestones; it establishes positive reinforcement. 2. Share achievements with friends or loved ones to amplify celebrations. 3. Consider volunteer work that focuses on financial education for others, creating a sense of fulfillment. 4. Develop an “achievement wall” displaying financial goals and accomplishments visually. Celebrating victories reinforces the notion that everyone has the ability to improve their financial scenario. It’s integral to realize that progress takes time, but every small step matters. Ultimately, by reframing the perception of financial experiences, individuals can convert shame into motivation for future growth. Embrace this journey toward financial wellness with grace and patience for personal development.

The Role of Financial Literacy

Financial literacy plays a significant role in overcoming the shame that often accompanies money struggles. Understanding financial principles equips individuals with the tools needed to take control over their finances. A lack of knowledge can lead to feelings of helplessness, amplifying feelings of shame, so prioritizing financial education is essential. There are numerous resources available, ranging from courses, workshops, books, and online tutorials. By improving financial literacy, individuals can make informed decisions regarding budgeting, saving, and investing. This knowledge enables individuals to develop a strategy for their finances and creates a sense of empowerment. Here are several ways to enhance financial literacy: 1. Research local community resources offering financial education. 2. Explore online platforms like Khan Academy or Coursera for courses. 3. Join forums where discussions about personal finance take place, gaining insight through shared experiences. 4. Regularly read articles or books related to financial wellness. Through consistent learning, individuals can feel more confident in their financial decisions. Cultivating financial literacy reduces feelings associated with shame while fostering a healthier relationship with money, ultimately contributing to better mental well-being.