The Impact of Cryptocurrency Valuations on Traditional Currency and Stock Markets

The rise of cryptocurrency has transformed how we view traditional currency and stock markets, making investors reassess their strategies. Cryptocurrencies such as Bitcoin and Ethereum have gained unprecedented popularity, resulting in significant fluctuations in market values. These changes can directly influence traditional currencies, often leading to a reevaluation of their stability. With the growing adoption of crypto, many investors now consider it a viable alternative to conventional investments. Financial systems around the globe are starting to incorporate cryptocurrency trading, impacting currency valuation metrics. Institutions are rethinking their approaches, creating a ripple effect throughout the stock market. This integration is leading to heightened volatility in established markets, making risk management essential for investors. In this evolving environment, individuals and corporations alike are starting to embrace blockchain technology as a means of securing transactions. The interplay between cryptocurrencies and traditional stocks raises essential questions about future economic stability and inflation rates. Understanding these dynamics is key for investors as they navigate new investment landscapes, demanding thorough analysis and an innovative mindset.

Investors interested in maximizing returns must consider the influence of cryptocurrency on the currency and stock markets. As cryptocurrencies fluctuate wildly, their impact is felt across borders, affecting currency values significantly. For instance, a sudden spike in Bitcoin’s valuation can influence investors’ sentiments towards traditional assets. This phenomenon results in investors reallocating resources to avoid losses due to expected declines in stock prices. Furthermore, the correlation between cryptocurrencies and fiat currencies adds another layer of complexity to market analysis. Many market strategists closely monitor these trends, searching for patterns that can guide investment decisions. As cryptocurrencies become more mainstream, central banks are forced to adapt their monetary policies, which in turn affects traditional currencies. Investors must stay informed about regulatory changes that can alter the crypto landscape, influencing their investment strategies. The increasing interconnectivity of global markets means that a significant investment shift toward cryptocurrencies can potentially lead to widespread market repercussions. For anyone vested in equities, it is essential to appreciate how these new financial instruments can reshape the economy, necessitating ongoing education and awareness.

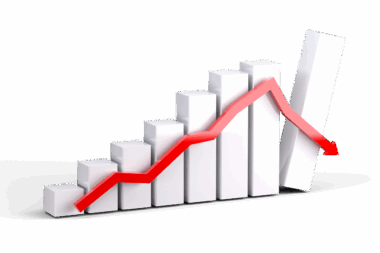

The implications of cryptocurrency fluctuations extend beyond individual stock prices; they impact overall market stability. When a cryptocurrency like Bitcoin experiences sudden decreases in value, traditional investors often react with caution, leading to market sell-offs. As such, these trends contribute to panic selling in stock exchanges and can amplify existing volatility. Consequently, companies facing liquidity issues may find it challenging to raise capital when stock prices drop suddenly. Additionally, the increase in trading volumes caused by crypto volatility can cause disruptions in established financial infrastructures. This raises important questions about the potential for cryptocurrencies to trigger systemic risks within the financial sector. Institutions must develop robust risk assessment frameworks to cope with this volatility, ensuring their strategies are adaptive to these new forces. Moreover, public sentiment can shift dramatically with the tide of cryptocurrency valuations, influencing consumer behavior and purchasing decisions. For businesses, understanding this relationship is crucial as it can affect demand for their products and ultimately their long-term sustainability. Awareness of these market dynamics can help stakeholders make informed decisions while navigating uncertain waters in today’s financial landscape.

Regulatory Challenges

Another aspect to consider in this evolving market is the regulatory landscape surrounding cryptocurrencies. Governments worldwide are grappling with how to manage cryptocurrencies to prevent illegal activities while fostering innovation. The lack of cohesive strategies can lead to confusion and inconsistencies, making it challenging for businesses to operate. Each country has its own approach, which can influence how investors perceive the risks associated with cryptocurrencies. Regulatory updates can also impact how cryptocurrencies interact with traditional markets and currencies. Investors must stay vigilant and adapt to these regulations, as they can create new opportunities or present significant barriers to entry. Moreover, as regulations tighten, certain cryptocurrencies may be forced to adapt or vanish altogether, further influencing market dynamics. Understanding these legal frameworks is key to making educated decisions regarding investments in both cryptocurrencies and traditional markets. Cooperation between governments and regulatory bodies is vital for establishing a coherent system that benefits all market participants. As global economies become increasingly interconnected, the importance of addressing these regulatory challenges for cryptocurrencies cannot be overstated.

In addition to regulatory challenges, technological advancements play a significant role in shaping the interaction between cryptocurrencies and traditional markets. Blockchain technology, which underpins most cryptocurrencies, offers benefits such as transparency, security, and speed. These attributes can enhance operations in traditional finance, leading to increased investor interest. Financial institutions are exploring ways to integrate blockchain solutions, which can streamline operations and facilitate innovative financial products. Moreover, improved efficiencies can attract more investors to both cryptocurrencies and traditional assets. However, embracing such technologies also comes with its own set of risks and challenges. Security vulnerabilities and the potential for technological disruptions must be addressed as the digital landscape evolves. Furthermore, the fast-paced technological environment may leave some investors behind, creating a gap between those who adapt and those who do not. The implications of technological advancements require stakeholders to update their knowledge continually. Staying informed about innovations in finance and technology can provide significant advantages for investors looking to navigate this complex terrain. Ultimately, understanding the technological implications will help market participants make informed decisions.

Market Sentiment Analysis

Moreover, market sentiment plays a critical role in the performance of cryptocurrencies and their subsequent effects on traditional markets. The rise of social media platforms and online forums has amplified the speed at which information spreads, affecting investor behavior dramatically. A tweet from a prominent figure can lead to immediate influences on both crypto and stock valuations. Investors need to be proactive in their analysis of market sentiment, as these influences can lead to irrational market behaviors, causing prices to soar or plummet unpredictably. Monitoring investor sentiment and broader trends is therefore essential for making informed investment decisions. Tools such as sentiment analysis and social media monitoring can give investors insights into market movements. Additionally, understanding the psychology behind market reactions can aid in anticipating significant shifts, allowing investors to act strategically. Traditional markets are increasingly affected by factors originating from the highly volatile crypto space. Hence, investors in stocks should pay attention to cryptocurrency trends to anticipate potential impacts on the equity market. Awareness and adaptability are fundamental to success in this rapidly evolving financial environment.

Finally, as the influence of cryptocurrencies on traditional markets continues to grow, stakeholders must prioritize strategies to stay ahead of these trends. The integration of cryptocurrencies into mainstream finance highlights the urgency for education and innovation. Investors should consider diversifying their portfolios to include both traditional assets and cryptocurrencies. This approach can mitigate risks and capture potential growth opportunities arising from these fluctuations. Furthermore, investment strategies must adapt to changing market conditions, embracing flexibility and agility. Market participants should also consider collaborating with knowledgeable professionals who specialize in cryptocurrency investments. Such partnerships can provide valuable insights and guidance in navigating this intertwined landscape. As the financial world evolves, continuous learning and adaptation will remain paramount for success. The interaction between cryptocurrency valuations and traditional stocks is a dynamic arena rich with potential. Therefore, an informed approach is vital for those engaged in this sphere, balancing risks with opportunities. In this new age of finance, understanding the position of cryptocurrencies and assessing their implications on traditional markets will be crucial.

In conclusion, recognizing the impact of cryptocurrency fluctuations on traditional currency and stock markets is essential for all investors today. The importance of a strong analysis framework cannot be underestimated, as it allows one to foresee potential consequences and adapt accordingly. As the lines blur between digital and traditional finance, investors must develop a keen sense of the interplay between these segments. Ongoing research into market trends, regulatory changes, and technological developments will equip stakeholders with the knowledge necessary to thrive. The synergy between cryptocurrencies and traditional assets signifies a transformative period in finance, necessitating new ways of thinking. Investors must prepare for the inevitable changes as these forces reshape market landscapes. Embracing education, strategic diversification, and collaboration will unlock potential within this evolving environment. Most importantly, understanding how digital currencies affect traditional assets will pave the way for future investment success. Stakeholders who remain vigilant and adaptive will be best positioned to navigate the complexities introduced by cryptocurrencies. The dialogue around cryptocurrencies and traditional financial products will continue to evolve, making continuous engagement in learning essential for maintaining competitive advantage.