Cross-Border Payments and Their Impact on Global Trade

In our increasingly interconnected world, cross-border payments have emerged as a crucial element of international trade. These transactions enable businesses and individuals to send and receive money across national borders effectively. Understanding the dynamics of cross-border payments is crucial for addressing the challenges faced by exporters and importers. The growth of e-commerce has particularly emphasized the importance of these payment mechanisms. Companies can now reach customers in remote markets without the usual hassles that may accompany international transactions. This is true especially with the rise of digital currencies and blockchain technology reshaping the financial landscape. Global trade relies on robust transaction systems ensuring smooth operations between various stakeholders. Nations and businesses must therefore adapt to changing financial norms to facilitate these processes. The shift toward digital transactions aids in minimizing expenses and enhancing efficiency. Consequently, organizations can optimize their international financial operations, significantly impacting their profit margins. Emerging technologies pave the way for faster and cheaper payments, promoting trade flows. Ultimately, the enhancement of cross-border payment solutions is vital for sustaining global trade’s growth.

Understanding the regulatory environments surrounding cross-border payments is essential for compliance and risk management. Various jurisdictions impose differing rules that can complicate transactions. Businesses engaging in international trade must remain vigilant regarding these regulations to avoid hefty fines and disruptions. Various organizations, including the Financial Action Task Force (FATF), work toward establishing common guidelines for cross-border transactions. Factors such as anti-money laundering (AML) and consumer protection regulations play a significant role in shaping payment solutions. Businesses must conduct thorough due diligence to ensure adherence to these rules, which can be time-consuming and costly. Compliance can introduce barriers that may hinder operational capabilities. Financial institutions thus have a pivotal role in ensuring that their systems are robust enough to adhere to regulations while providing seamless user experiences. Enhancements in technology are necessary to streamline regulatory processes, as well as mitigate risks in international payments. By embracing innovations like machine learning and real-time reporting systems, businesses can significantly reduce compliance-related costs. Ultimately, investing in compliance and risk management is not only a regulatory requirement but can also be a competitive advantage in the global marketplace.

The Role of Technology in Cross-Border Payments

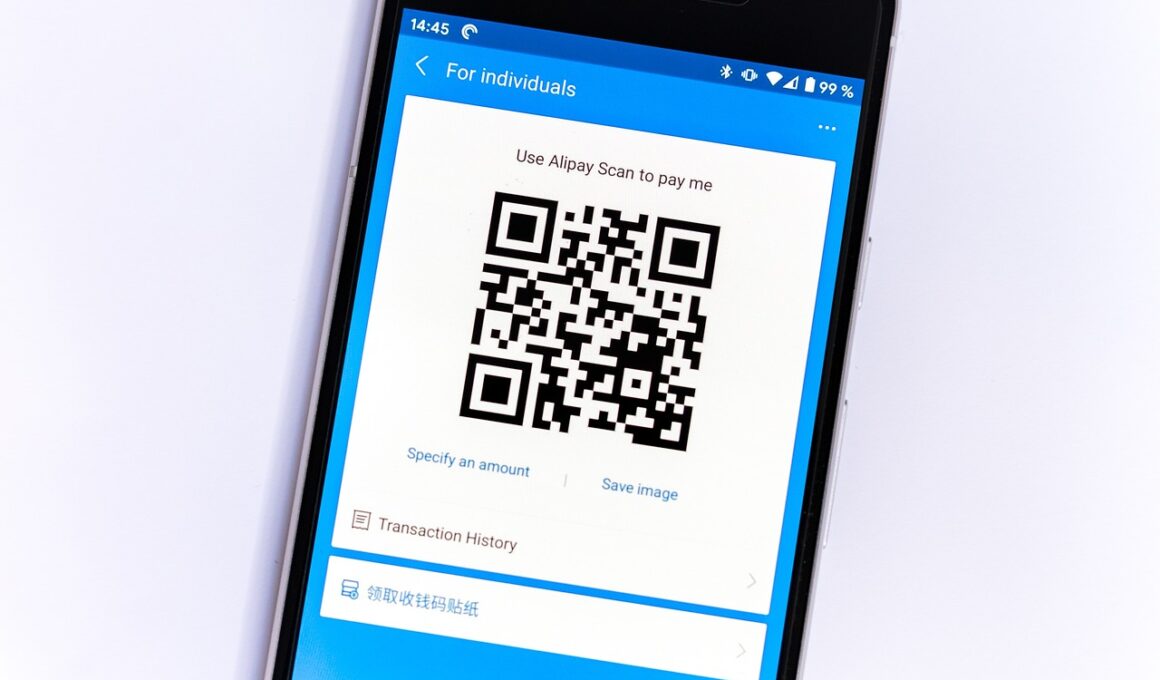

Technological advancements have revolutionized cross-border payment systems, making them faster and more reliable. Digital wallets, mobile banking, and blockchain technology are at the forefront of this transformation. These innovations lower transaction costs while improving accessibility, particularly in underbanked regions. For example, blockchain enables real-time transactions without traditional intermediaries, thereby removing inefficiencies. Peer-to-peer payment systems have enabled customers to send money to friends or businesses instantly, even in different countries. The rise of FinTech has introduced competitive pressures, encouraging traditional banks to enhance their services and reduce fees. Moreover, the development of APIs (Application Programming Interfaces) facilitates seamless integration across platforms allowing businesses to automate payment processes effectively. Companies are increasingly adopting these technological solutions to enhance consumer experience and operational efficiency. Furthermore, new entrants into the market are challenging established financial institutions, pushing for more transparent and speedy services. This competitive landscape nudges service providers to adopt innovative solutions, ultimately benefiting consumers. Therefore, keeping abreast of technological trends is vital for businesses seeking to improve their cross-border payment strategies.

Currency conversion represents a significant challenge in cross-border payments, influencing transaction costs and profitability. Fluctuations in exchange rates can have a substantial impact on both exporters and importers. To navigate this complexity, businesses can utilize various currency hedging strategies, helping mitigate risks associated with adverse currency movements. Financial instruments like forwards and options provide tools for firms to lock in favorable rates. Nevertheless, these strategies also come with costs and potential inconsistencies, complicating their implementation. Additionally, companies should assess the impact of local currency preferences on international transactions. Some regions are increasingly favoring payments in local currencies to reduce reliance on dominant currencies like the US dollar. This shift necessitates a thorough analysis of market trends and adapting payment strategies accordingly. Partnerships with local financial institutions can facilitate smoother transactions, allowing companies to capitalize on market opportunities. Consequently, businesses must remain aware of currency dynamics to optimize their cross-border payment processes, ensuring competitiveness in the global market. Ultimately, mastering currency management is essential for driving successful international trade.

Challenges in Cross-Border Payment Systems

Despite the advancements in technology and the benefits they offer, cross-border payment systems face several challenges. One of the predominant issues is the lack of standardization in payment processes across different jurisdictions. Variations in regulations, currencies, and banking practices lead to inconsistencies that can delay transactions. Businesses often find themselves navigating a complex landscape of compliance requirements, increasing operational costs. Moreover, issues pertaining to cybersecurity pose significant threats to cross-border payments. The rise of online transactions has also led to sophisticated cybercrimes targeting financial institutions. Therefore, investing in security protocols is essential for protecting sensitive information and maintaining customer trust. Furthermore, service providers must ensure that they can scale their offerings as the demand for international transactions increases exponentially. In addition to cyber threats, technological adoption must also consider the unique challenges found in emerging economies, where infrastructure may not support advanced payment systems. Addressing these challenges requires a collaborative approach among stakeholders, ensuring that payment systems remain resilient and secure to meet the evolving needs of global trade.

The future of cross-border payments will undoubtedly evolve as technology continues to advance and businesses adapt their strategies. Several trends are already emerging, indicating a shift toward more integrated and efficient payment solutions. For instance, the rise of central bank digital currencies (CBDCs) presents new opportunities for enhancing cross-border transactions. By embracing blockchain technology, CBDCs can facilitate faster and more cost-effective payments across different currencies. As a result, consumers and businesses alike stand to benefit from these innovations. Additionally, the integration of artificial intelligence (AI) in payment systems can improve fraud detection and streamline compliance processes. AI-driven algorithms can analyze transaction patterns to identify anomalous activities that may indicate fraud, thereby protecting users. Overall, companies must remain agile and focus on leveraging emerging technologies to enhance their payment solutions. By staying ahead of trends and adapting operations accordingly, businesses can maintain a competitive edge in the global landscape. Continuous investment in research and development will ultimately define the pioneers of cross-border payment solutions, shaping the future of international trade.

Conclusion: The Importance of Cross-Border Payments

Cross-border payments are a critical component of global trade, enabling businesses and consumers to transact internationally. As the global economy increasingly thrives on interconnected markets, understanding cross-border payments can provide significant strategic advantages. These transactions facilitate trade, investment opportunities, and access to foreign markets. Businesses optimizing their payment systems stand to gain from enhanced cash flow and broader market penetration. Moreover, embracing technological advancements can pave the way for more accessible and cheaper payment solutions, especially in developing regions. Consequently, a commitment to improving cross-border payment strategies is essential for long-term growth. By addressing the challenges associated with currency conversion and regulatory compliance, businesses can streamline their operations and minimize costs. This focus on optimizing transaction efficiency allows firms to compete effectively in the global marketplace. Ultimately, as the landscape of cross-border payments evolves, staying informed and adaptable will be crucial for capitalizing on new opportunities. The significance of cross-border payments will only continue to expand, making it vital for stakeholders to prioritize these financial mechanisms within strategic planning.