Key Metrics in Profitability Analysis for Businesses

Profitability analysis is an essential component for evaluating a company’s financial health, providing insights that guide managerial decisions. The key metrics involved in profitability analysis offer a detailed perspective on the effectiveness of a business’s strategy and operational efficiency. One of the foremost metrics is Gross Profit Margin, which illustrates the proportion of revenue that exceeds the cost of goods sold. This margin is essential for assessing product pricing and cost control. Moreover, Net Profit Margin shows the percentage of revenue that becomes profit after all expenses are accounted for, delivering a comprehensive view of overall profitability. Return on Assets (ROA) measures how efficiently a company uses its assets to generate profits, while Return on Equity (ROE) focuses on profitability relative to shareholders’ equity. Both metrics are critical for investors assessing potential returns. Furthermore, analyzing Earnings Before Interest and Taxes (EBIT) provides additional context regarding core operational success. These various metrics collectively empower businesses to identify strengths and weaknesses, allowing them to optimize resource allocation and improve financial outcomes.

Understanding Gross and Net Profit Margins

Gross Profit Margin is calculated by subtracting the cost of goods sold from total revenue and dividing by total revenue. This metric highlights how well a company produces its goods profitably. A declining gross margin can indicate rising production costs or pricing challenges in competitive markets. In contrast, Net Profit Margin is determined by dividing net income by total revenue. It serves as a clear indicator of overall profitability and financial health after all expenses are deducted. Evaluating both gross and net profit margins allows management to pinpoint issues across various operational levels, from production efficiency to expense management. By analyzing these margins, businesses can implement strategic changes designed to enhance profitability. Tracking these key metrics over time establishes trends, helping managers to set realistic growth targets and identify periods of financial strain. Furthermore, the comparison of profit margins with industry peers aids in assessing relative performance. Successful organizations often adopt initiatives focused on improving these margins through better pricing strategies and cost control measures while simultaneously enhancing customer value propositions.

Another vital metric in profitability analysis is Return on Assets (ROA), providing insight into how effectively a company utilizes its assets to generate earnings. ROA is computed by dividing net income by total assets. This metric emphasizes operational efficiency across all asset categories, allowing businesses to identify underperforming assets. A higher ROA indicates that the company is effectively managing its asset base, whereas a declining ROA might signal inefficiencies or a need for improved asset management strategies. Across sectors, benchmarking ROA against industry standards helps businesses understand their relative performance and pinpoint avenues for enhancement. Within the ROA metric, varying asset categories such as equipment and inventory offer additional granular insights into a company’s operations. Another significant metric, Return on Equity (ROE), focuses on shareholders’ returns by dividing net income by average shareholders’ equity. ROE illustrates how well a company rewards its investors while managing equity capital efficiently. A rising ROE encourages investor confidence, impacting stock prices favorably. Evaluating both ROA and ROE together helps businesses ensure a robust balance sheet for sustainable long-term growth.

The Importance of Earnings Before Interest and Taxes

Earnings Before Interest and Taxes (EBIT) is another essential metric used in profitability analysis, focusing on the core operating performance of a business. EBIT enables stakeholders to evaluate how much profit a company generates from its operations, excluding interest and tax expenses. This focus allows for an accurate assessment of operational efficiency without the distortion of financial leverage. By examining EBIT, management can prioritize operational adjustments, identifying which segments of the business are performing efficiently. Furthermore, comparing EBIT across periods helps to highlight trends and areas needing improvement, such as operating costs or production volume. Investors and analysts often utilize EBIT when conducting business valuations, as it represents a more reliable basis for forecasting future cash flows. Moreover, EBIT serves as a gateway metric leading to other analyses, like the calculation of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and the development of financial ratios such as the EBIT Margin. Emphasizing EBIT provides a more transparent view of financial performance, ensuring stakeholders focus on genuine operational strengths rather than financing or tax strategies.

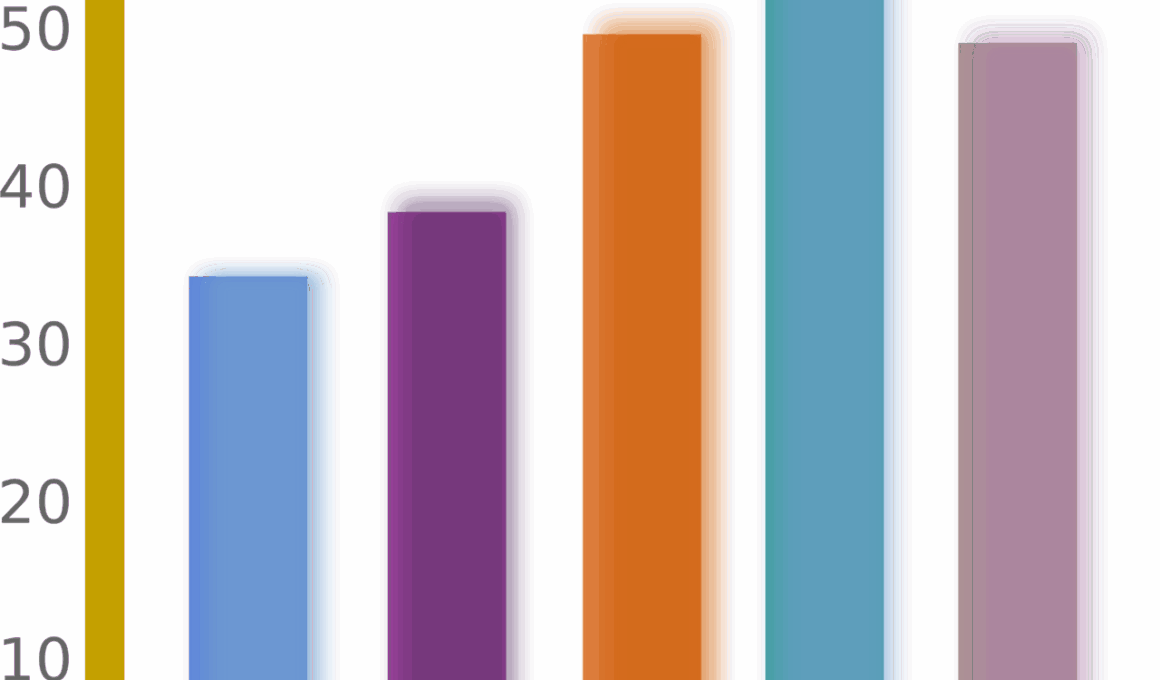

Financial forecasting and trend analysis further enrich the insights gained from profitability analysis. By leveraging historical financial data, businesses can project future profitability based on selected metrics, guiding strategic decisions. Implementation of forecasting techniques, such as regression analysis and scenario planning, allows organizations to simulate various market conditions and their predicted impacts on profitability. Moreover, understanding seasonal demands helps identify trends that can influence pricing strategies and expense management throughout the fiscal year. Trends derived from profitability metrics such as Gross and Net Profit Margins equip management to navigate through various economic conditions. Additionally, benchmarking against industry standards offers a vital perspective on market positioning, revealing where a company excels or lags. Regularly assessing profitability trends ensures timely interventions can be enacted, keeping businesses on track towards achieving their financial goals. Ultimately, well-executed trend analysis not only aids in forecasting but also strengthens organizational agility, enabling responsive strategies to capitalize on emerging opportunities. Businesses committed to continuous improvement can use insights from profitability analysis to innovate and adapt effectively.

Role of Comparative Analysis in Profitability Metrics

Comparative analysis of profitability metrics offers businesses a strategic advantage by enabling them to measure their performance against competitors or industry standards. Recognizing patterns in profitability can reveal essential insights that inform decision-making and strategic planning. By benchmarking key profitability ratios like ROE, ROA, and profit margins against industry peers, companies can identify performance gaps that need addressing. This assessment often brings to light inefficiencies in operations or areas of potential improvement. Companies that actively engage in comparative analysis regularly can recognize changes in market conditions faster, thus enabling timely adjustments in their business strategies. Besides competitive benchmarking, this analysis allows for the evaluation of profitability over different time frames to observe trends and shifts in the operational landscape. Moreover, understanding sector-specific nuances aids businesses in tailoring strategies to align best with market expectations. This strategic approach not only boosts the ability to attract investors but also encourages better resource allocation based on performance indicators. Overall, comparative analysis is vital for continuously improving organizational processes, ensuring sustained competitive advantage and profitability enhancement.

Lastly, communication of profitability results plays a crucial role in transparency and stakeholder confidence. Effectively presenting financial data related to profitability analysis fosters trust among investors, employees, and stakeholders alike. Utilizing visual aids such as graphs and charts can enhance understanding, especially when communicating complex metrics. Moreover, ensuring that profitability reports are timely, accurate, and comprehensive further solidifies the credibility of the information shared. Prospective stakeholders and investors closely analyze profitability metrics as indicators of risk and potential returns, making effective communication essential for securing investments. Shareholders expect clarity regarding how decisions impact overall profitability, emphasizing the importance of detailed reporting. Engaging with stakeholders to explain profitability trends augments understanding and collectively drives strategic alignment across the organization. Companies that prioritize clear communication regarding their profitability analysis tend to empower their teams to implement decisions confidently, leading to better financial outcomes. For businesses seeking to remain competitive, ongoing dialogue surrounding profitability metrics ensures adaptive strategies that meet evolving market demands and stakeholder expectations.

Conclusion

In conclusion, the meticulous analysis of profitability metrics is essential for any business aiming to achieve sustainable growth and success. Metrics such as Gross Profit Margin, Net Profit Margin, ROA, ROE, and EBIT are critical for understanding a company’s financial health and operational efficiency. Implementing rigorous profitability analysis allows managers to uncover valuable insights leading to strategic improvements. Trend analysis and comparative frameworks further enhance this analysis, providing in-depth understanding essential for informed decision-making. Particularly, communication plays a pivotal role in fostering stakeholder trust and aligning internal goals with overarching mission strategies. As businesses navigate increasingly complex market environments, leveraging profitability metrics is vital. Over time, continuous improvement informed by these metrics leads to optimized resource allocation, ultimately enhancing profitability and creating lasting stakeholder value. Businesses that embrace comprehensive profitability analysis stand to gain significant advantages in competitive landscapes, ensuring they remain resilient and capable of meeting changing demands. By fostering a culture of financial analysis, companies can empower themselves and their teams, driving not just profits but also sustained success in the marketplace.