Step-by-Step Guide to Adjusting Entries in Consolidation

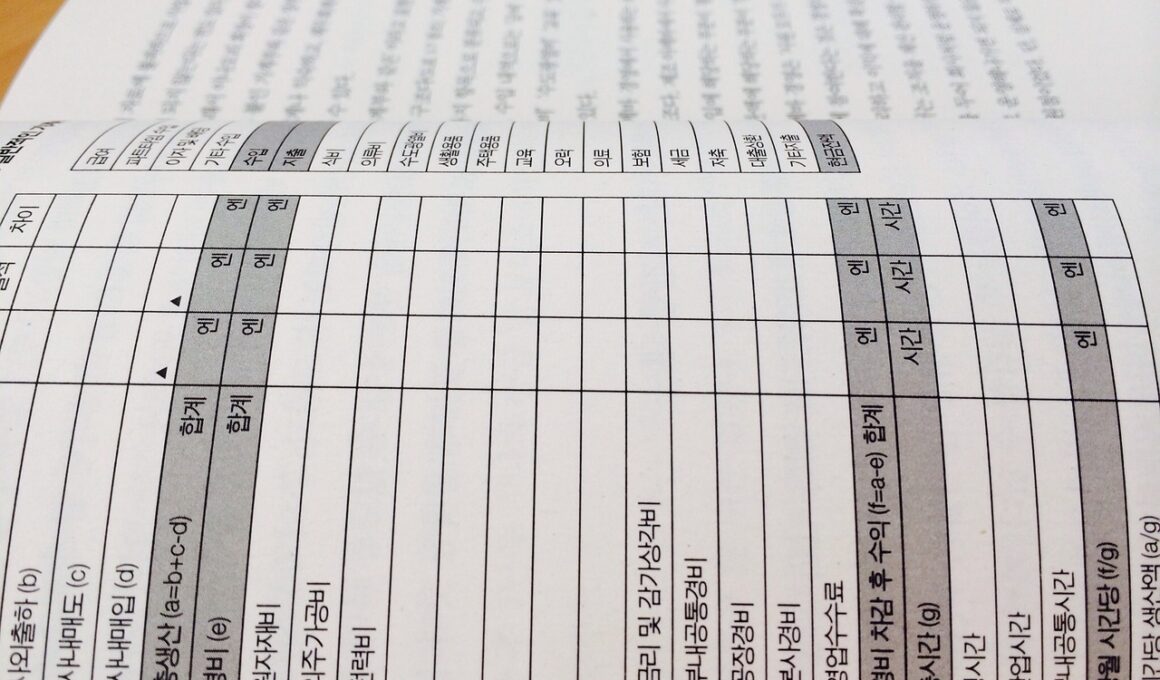

Adjusting entries in consolidated financial statements are crucial for accurate reporting. These adjustments ensure that all financial statements reflect the overall health of the entire group of companies. The first step in this process involves identifying transactions that must be consolidated. The parent company must account for all significant transactions occurring between entities to uphold transparency. Next, the parent company must assess the effect of ownership stakes on these transactions. For example, eliminating inter-company sales must be conducted to avoid inflated revenue figures. Furthermore, adjustments for depreciation are necessary to align asset valuations accurately. One effective way of managing these entries is through a detailed review of all accounts payable and receivable. Additionally, any dividends collected from subsidiaries need to be eliminated from the parent company’s books to reflect actual retained earnings correctly. Special attention should also be paid to any unrealized profits in inventory and investments. Accurate adjustments ensure that consolidated financial statements present a true and fair view of the entity’s financial position.

Once you’ve identified the necessary adjustments, a structured approach becomes essential for success. The consolidation process involves comprehensive documentation about the financial results of each entity in the group. It’s important to regularly assess the sending and receiving companies to establish clear financial positions. By utilizing a unified chart of accounts across all entities, it enhances consistency and simplifies adjustments at every level. Ensure that inter-company transactions have been properly recorded in the financial statements. Furthermore, to comply with regulatory frameworks, understanding accounting standards is vital. Working closely with seasoned accountants can prevent mismanagement of financial data. Furthermore, communicating with subsidiaries during this step aids in maintaining accurate records. Reporting formats such as IFRS or GAAP must be adhered to, allowing for increased reliability in financial statements. After completing these steps, the next phase focuses on documenting adjustments clearly. This transparency provides clarity for audits and reviews, allowing stakeholders to trace and understand the rationale for each adjustment made. Keeping a comprehensive audit trail is essential for operational efficiency.

Understanding Ownership Stakes

One of the most critical aspects of adjusting entries in consolidation is understanding ownership stakes. This concept influences the consolidation method applied, either full consolidation or equity method accounting. Full consolidation applies when the parent company owns a majority stake, typically more than 50%. In this scenario, the parent fully incorporates the subsidiary’s financials into its own. Conversely, if the stake is less than 50% but sufficient for significant influence, the equity method is used. This requires recognizing only a proportional share of profits and losses. Therefore, a deep understanding of ownership stakes helps to clarify financial responsibilities and reporting requirements. Additionally, it is essential to keep an eye on the operational performance of subsidiaries. This ensures that adjustments made reflect both financial gain and actual economic involvement in subsidiary operations. Regular evaluations offer opportunities to adjust ownership stakes or even divest if strategic objectives change. Monitoring trends within subsidiaries also gives valuable insights into emerging opportunities or risks affecting the overall group. Effective communication among stakeholders can further refine this understanding, ensuring accurate and timely decisions are made.

After determining ownership stakes, the next step is to eliminate unrealized gains and losses from inter-company transactions. This process is vital for a true representation of the financial condition and results of operations within consolidated statements. Unrealized gains and losses affect inventory and investments, often arising from transactions between the parent company and subsidiaries. For example, if a parent company sells a product to its subsidiary and the subsidiary hasn’t sold the inventory as of the reporting date, adjustments must be made. The profit recognized by the parent from this sale needs to be reversed to accurately reflect consolidated earnings. Similarly, if the subsidiary has increased its inventory due to purchases from the parent, this must be noted. Recording these adjustments helps maintain the integrity of the overall financial statement by ensuring all revenues and expenses are recognized accurately. This meticulous elimination process fosters genuine accountability within the consolidated group. Clear documentation regarding these eliminations will facilitate smoother audits and ensure that the financial statements are reflective of true financial performance, free from any inflated figures.

Asset Depreciation Adjustments

Another significant area requiring attention is depreciation adjustments concerning assets held by subsidiaries. The accurate valuation of assets is paramount to presenting fair financial statements, as it reflects the true worth and utility of the organization’s resources. Each subsidiary might employ different depreciation methods, which could lead to discrepancies. Therefore, determining a common depreciation method is essential for consolidation. This ensures an equivalent representation for fixed and intangible assets across the group. The next phase involves calculating accumulated depreciation for each category of assets. Each entity must meticulously account for depreciation schedules, ensuring that statutory calculations align correctly. It’s important to ensure that any asset impairment is also factored into the consolidation process. This assessment provides crucial insights regarding the ongoing viability and value of the organization’s assets. Any significant fluctuations must be documented and understood more comprehensively, leading to adjustments made reflecting both financial foresight and compliance. In conclusion, ensuring accurate asset valuation through depreciation is fundamental for capturing the financial essence of overall consolidated positioning.

In addition to asset depreciation, adjustments for deferred taxes also demand careful monitoring and execution. Deferred tax liabilities arise from the timing differences in the recognition of revenues and expenses in financial statements. When consolidating, it’s important to reflect these deferred tax amounts accurately. Each subsidiary may operate under different tax regimes, which can complicate reporting. By performing a thorough examination of tax implications across entities, one can determine the cumulative tax liabilities effectively. Understanding tax valuation allowances contributes significantly to the overall financial accuracy during the consolidation process. Throughout this phase, collaboration with tax professionals can ensure compliance and aid in deriving more precise figures. Furthermore, recognizing that tax regulations continuously evolve is important, prompting teams to stay updated with the latest laws. Knowing how these changes impact the consolidated results aids in mitigating risks associated with financial reporting. This ensures that stakeholders receive reliable information based on current rates and regulations. Ultimately, accurate tax adjustments provide a clearer picture of net income, further enhancing stakeholder trust.

The Role of Documentation

Documentation plays a critical role in navigating the complexities of adjusting entries within consolidation. Without proper records, errors may go undetected, leading to misleading financial statements and potentially severe compliance issues. Proper documentation includes everything from reconciling inter-company accounts to justifying the adjustments made. Each entry should be well documented, allowing stakeholders to understand the basis for these adjustments. This clarity assists during external audits, where auditors require comprehensive evidence supporting reported figures. Auditors assess financial risks based on the documentation of adjustments, necessitating attention to detail during preparation. Comprehensive documentation not only supports external reviews but also provides insight for internal management. It aids decision-making by revealing areas for improvement in financial operations and reporting. Furthermore, technological tools can enhance the documentation process, automating routine aspects of financial reporting. By leveraging these technologies, organizations can streamline their consolidation processes and reduce the chance for human error, ultimately resulting in more accurate financial statements. Emphasizing thorough documentation fosters transparency and accountability, ensuring stakeholders maintain confidence in the organization’s financial practices.

Finally, reconciling the consolidated financial statements serves as the concluding stage in this comprehensive guide. This process involves reviewing all adjustments made and ensuring they align with underlying accounting principles. Proper reconciliation confirms that all financial statements represent a coherent picture of the group’s financial standing. Each component, including assets, liabilities, equity, revenues, and expenses must be cross-verified. Through effective communication among accounting departments, discrepancies can be resolved promptly, ensuring the accuracy of reported figures. Furthermore, employing analytical tools can enhance the reconciliation process, revealing unexpected variances in financial results. A well-documented and accurate reconciliation will streamline the preparation for financial reporting periods. It shines a light on previously overlooked issues or adjustments that might be necessary. In the end, a successful consolidation process not only ensures compliance with regulations but also lays the groundwork for informed strategic decisions. Financial stakeholders and management can comprehend the overall health of their organization through sound adjustments. This holistic view is paramount in steering future corporate strategies and securing financial stability for all entities involved in the consolidation process.