How to Choose the Best Currency Pairs to Trade

Choosing the right currency pairs to trade involves understanding several critical factors. Traders need to consider volatility, liquidity, and spread. Currency pairs represent the value of one currency in relation to another, making it essential to select pairs that align with your trading strategy. First, volatility measures how much the price of a currency fluctuates, greatly affecting potential profits and losses. A good strategy can involve pairs with higher volatility, as they may present more trading opportunities. Second, liquidity refers to how easily a currency pair can be bought or sold without causing drastic price changes. The more liquid the pair, the easier it is to enter and exit positions. Lastly, the spread is the difference between the buying and selling prices. A tighter spread lowers transaction costs, making it more affordable to trade. Careful consideration of these factors enables traders to identify the pairs that align best with their risk tolerance and market outlook, thereby enhancing their overall trading strategy and outcomes.

Understanding major currency pairs is crucial when selecting what to trade. Major pairs typically consist of the most widely traded currencies globally, including the US Dollar (USD), Euro (EUR), British Pound (GBP), and Japanese Yen (JPY), among others. These pairs possess high liquidity, ensuring that traders can enter or exit the market quickly with minimal slippage. By focusing on these major pairs, traders benefit from tighter spreads and significant market movements. It’s also helpful to pay attention to economic news and indicators related to these currencies. Economic events such as interest rate decisions, employment reports, and GDP announcements can affect currency value drastically. For instance, a strong employment report from the US can strengthen the USD against other currencies, affecting related pairs. Additionally, major currency pairs often experience more predictable movements, making analytical and technical strategies easier to apply successfully. Traders are encouraged to develop a comprehensive understanding of the economic factors influencing major pairs for optimal trading outcomes.

Minor and Exotic Currency Pairs

Minor and exotic currency pairs can serve as viable alternatives to major pairs, depending on trading strategies. Minor pairs consist of currencies that do not involve the US Dollar, often including pairs like the EUR/GBP and AUD/NZD. While these pairs may exhibit lower liquidity than majors, they can still present opportunities for traders willing to analyze them deeply. The price movements towards minor pairs are influenced by economic events specific to the involved countries, allowing informed traders to capitalize on trends. Exotic pairs, on the other hand, include currencies from emerging markets, such as the Turkish Lira (TRY) or the South African Rand (ZAR). Trading exotic pairs entails higher risk due to increased volatility and wider spreads. However, these pairs can experience substantial price changes, offering considerable profit potential. For traders, understanding the specific dynamics and economic conditions surrounding these currencies is essential for developing strategies that ensure successful trading in less frequently traded pairs.

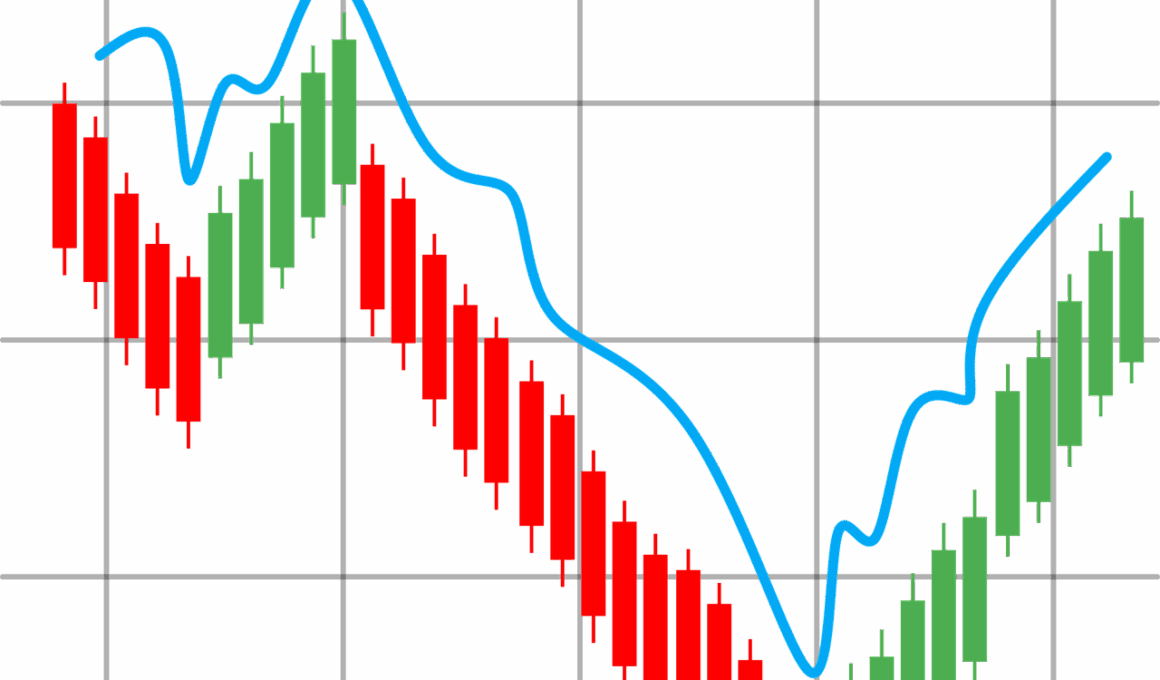

When selecting currency pairs for trading, analyzing technical and fundamental factors is imperative. Technical analysis involves examining charts and market data to identify potential trading setups. Traders utilize tools such as moving averages, Fibonacci retracements, and candlestick patterns to make data-driven decisions. Understanding price action and market sentiment allows traders to make more accurate predictions about potential trends. Conversely, fundamental analysis entails evaluating economic indicators and news releases that affect currency values. Key economic reports, interest rate decisions, and geopolitical events can significantly sway currency markets. A well-informed trader will consider both technical and fundamental aspects when selecting currency pairs, blending analysis for optimal outcomes. It’s crucial to stay updated on global news, economic calendars, and financial reports pertaining to the currencies involved. This dual approach helps in identifying trends early while also setting up risk management protocols to mitigate unforeseen events that could impact trades. Balancing technical proficiencies with a strong understanding of economic fundamentals will offer an edge in the Forex market.

Risk Management Strategies

Implementing effective risk management strategies is vital in Forex trading. As volatility can lead to rapid price changes, traders should establish loss limits to protect their accounts. One such strategy involves using stop-loss orders that automatically close a position at a predetermined price level, thus minimizing potential losses. Additionally, it is essential to diversify among different currency pairs to spread risk effectively. Concentrating capital on a single pair may yield higher rewards, but it also increases exposure to risk. By diversifying, traders can enhance their potential for profit while reducing overall risk. Position sizing is another crucial factor that determines how much capital is risked per trade. Traders should never risk more than a small percentage of their overall portfolio on a single trade. This approach enables traders to withstand drawdowns and maintain long-term trading viability. Furthermore, consistent evaluation of the market conditions and personal trading strategies will also enhance adaptability, allowing traders to adjust their methods as necessary while keeping risk within manageable levels.

Understanding market timing is also essential when choosing the best currency pairs. Forex markets are open 24 hours a day, five days a week, offering opportunities across different time zones. Traders must pay attention to which markets are open and how this affects liquidity and volatility. Certain currency pairs will react more significantly during specific sessions. For instance, the London session often brings higher volatility for EUR and GBP pairs due to increased trading volume. Meanwhile, pairs involving the JPY may experience greater movements during the Asian trading hours. Learning to recognize when specific currency pairs typically exhibit greater activity allows traders to plan their trades strategically. Additionally, aligning trades with economic announcements can amplify market movements. Traders need to take advantage of higher volatility during major news events, while also being cautious of potential reversals post-announcement. A thorough understanding of market timing can help maximize potential profits and minimize losses based on individual trading styles and preferred currency pairs.

Continuous Learning and Adaptation

Lastly, continuous learning and adaptation are vital components of successful Forex trading. The currency markets are dynamic, with trends evolving due to various geopolitical, economic, and social factors. Traders should commit to ongoing education, learning new trading strategies, and adapting previously used methods based on recent market conditions. Resources such as online courses, webinars, and trading forums can provide valuable insights. Moreover, leveraging technology, such as trading simulations and analysis software, can enhance traders’ abilities to adapt to changing environments. Practicing with demo accounts allows traders to refine strategies without risking real money, facilitating skill development. Regularly reviewing past trading performance will also provide insights and lessons that can be used to enhance future trades. Identifying both successful and unsuccessful strategies allows traders to focus on what works best while continuously improving risk management and analysis techniques. Staying informed about market changes can give traders the competitive edge necessary for long-term success in the forex trading landscape.

In conclusion, selecting the best currency pairs is a multifaceted process requiring thorough research and strategy. Recognizing key factors such as volatility, liquidity, and economic news significantly influences the decision-making process. Traders must focus on both major and minor pairs tailored towards their specific trading goals while employing comprehensive risk management to protect their investments. Utilizing effective risk management techniques through stop-loss orders, diversification, and position sizing will enhance a trader’s sustainability and success in the market. Additionally, mastering technical and fundamental analysis will further augment a trader’s proficiency in making informed choices. Lastly, continuous learning to adapt to ever-changing market conditions contributes to long-term profit opportunities. By developing a balanced approach in all these areas, traders can optimize their trading experience and performance in the Forex market.