Understanding Spread and Its Effect on Forex Trading Costs

In the Forex market, the term ‘spread’ refers to the difference between the buying price (ask) and the selling price (bid) of a currency pair. This difference represents the transaction cost traders incur when entering a trade. The spread can vary widely based on market conditions, liquidity, and the specific currency pair being traded. For traders, understanding the spread’s components is crucial for calculating the overall transaction costs associated with trades. A narrower spread generally indicates more liquidity and potentially lower trading costs, while a wider spread may reflect market volatility or lower liquidity. Traders must consider how spreads affect their profit margins, especially in high-frequency trading scenarios. When spreads widen, it becomes more challenging to realize a profit, which can deter traders from executing their strategy effectively. Thus, it’s vital for Forex traders to account for spreads in their trading plans and to stay agile in various market situations. They should seek brokers offering competitive spreads, which can enhance trading efficiency and reduce overall costs significantly in the long run.

There are two main types of spreads in the Forex market: fixed spreads and variable spreads. Fixed spreads remain constant regardless of market conditions, providing more predictability in trading costs. This is particularly advantageous during times of market volatility when variable spreads might widen significantly. Conversely, variable spreads fluctuate based on liquidity and demand. Traders should weigh the pros and cons of each type based on their trading style. Generally, scalpers and day traders tend to favor accounts with variable spreads, which can offer lower costs in tighter market conditions. In contrast, swing traders and longer-term investors might prefer fixed spreads to ensure cost stability over longer periods. Furthermore, some brokers offer a spread with an additional commission that results in lower spreads, which can enhance net trading gains. Understanding which spread type best aligns with their trading strategy is crucial for traders who wish to maximize their profitability and manage costs effectively. It’s advisable for traders to consistently monitor spreads and evaluate them during different times of the trading day for the most accurate cost assessment.

The Impact of Spread on Trading Strategies

The impact of spread on trading strategies can be significant, particularly for those employing high-frequency methodologies. Traders who frequently buy and sell positions are more sensitive to transaction costs associated with spreads. For example, if a trader places numerous trades with high spreads, their overall profitability can be drastically reduced. Conversely, if they can execute trades with lower spreads, they can achieve a higher success rate for their trading strategy. It’s essential to conduct thorough analysis and backtesting to determine how much the spread will factor into each trading strategy’s effectiveness. Strategies that rely on small price movements often become less effective when significant spreads are part of the equation. Effective risk management in an environment influenced by spreads is also critical; traders must adjust their stop-loss and take-profit levels accordingly. Ideally, traders must incorporate a strategy that considers spread fluctuations while remaining considerate of individual trading goals. Ultimately, knowing how to account for the spread is vital in developing successful Forex trading systems and ensuring profitability over time.

In Forex trading, understanding how spreads behave during different market events can help traders prepare for potential impacts on trading costs. Spreads can widen significantly during major economic announcements, geopolitical events, or periods of low liquidity. Traders should stay informed about scheduled news releases and other pertinent events that could affect market conditions. For instance, during central bank monetary policy announcements or employment data releases, spreads may become exceedingly volatile. This lack of predictability can lead to unexpected costs that deviate from standard trading conditions. Consequently, Forex traders must exercise caution when initiating trades during such events, possibly preferring to wait until the market stabilizes. Having a well-laid-out plan in place for these situations, including setting appropriate risk tolerance levels, can be beneficial. Furthermore, traders should practice strategic entries and exits, particularly in periods when spreads are known to fluctuate. Understanding market dynamics and how they correlate with spread behavior can enhance traders’ ability to navigate Forex successfully.

Comparison of Broker Spreads

When selecting a Forex broker, evaluating their spread offerings is an essential step in optimizing trading costs. Different brokers provide various spread types, which can significantly influence overall expense in trading. Forex traders should compare spreads across multiple brokers to identify the most competitive rates that align with their trading strategies. Online broker comparisons can be a practical resource for viewing average spreads for specific currency pairs. Furthermore, promotional offerings or incentives can occasionally adjust these figures, making direct comparisons more complicated. Many brokers provide demo accounts for potential clients to test specific trading conditions. Traders should utilize this opportunity to understand the spreads in real-time situations and assess how they affect simulations of their trading strategy effectiveness. A broker’s reputation regarding spread handling and their execution policy should also be checked, as these factors can lead to disparities in expected costs and actual trading results. Ultimately, choosing a broker based on their spreads can pave the way for ensuring favorable trading conditions and bolstering the success of trading results.

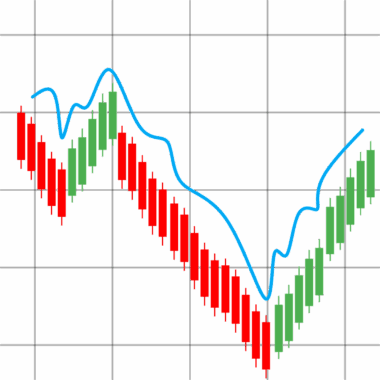

Spreads not only influence the cost of trades but can also provide insights into market sentiment and volatility. A narrowing spread might indicate increased competition and liquidity, suggesting that market participants have a strong interest in a particular currency pair. Conversely, widening spreads can signal uncertainty or reduced enthusiasm on the part of traders. Being aware of how spreads reflect market sentiment can enhance a trader’s ability to make informed decisions. By closely monitoring spreads, traders can gauge market trends and adjust their positions accordingly. Understanding how spreads behave during specific market conditions enables traders to capture possible opportunities efficiently. Further, incorporating additional indicators related to spread fluctuations can enhance trading strategies and bolster risk management plans. This comprehensive analysis facilitates better foresight for potential trading pitfalls. It highlights the importance of maintaining an adaptive trading mindset that can switch strategies based on spread behavior. In summary, traders can utilize spreads to not only calculate trading costs but also gauge market sentiment and improve decision-making processes in their trading endeavors.

Conclusion: Mastering Spread for Better Trading

Mastering the concept of the spread is an essential competency for successful Forex trading. Understanding its implications on costs, strategies, and broader market dynamics can empower traders to make more informed decisions. As profound as they are in determining trade profitability, spreads should be carefully analyzed and incorporated into every aspect of trading plans. Traders can improve their overall performance by being mindful of how spreads relate to their function in the larger trading picture. Continuous learning and adaptability in response to changes in market conditions are key fundamentals to trading success. Embracing a comprehensive approach allows traders to utilize spreads to enhance their decision-making and profitability effectively. Additionally, staying informed about varying broker offerings enables traders to navigate their choices strategically. Trading in Forex offers vast opportunities, and a deep understanding of spreads can be a significant advantage. Ultimately, the goal should be to create a holistic trading strategy incorporating the spread, minimizing overall trading costs while maximizing opportunities for profit in the dynamic Forex landscape.

Embarking on a successful Forex trading journey requires mastering both fundamental and technical analysis, alongside comprehensively understanding the implications of trading costs. Thus, traders must prioritize learning about spreads while honing their skills in other critical areas. This ensures a well-rounded readiness to face the challenges of foreign exchange trading. Overall, traders dedicated to persistently updating their knowledge and strategies will find themselves better equipped to thrive in this complex market. Investing time in education, research, and practice can lead to more significant gains over time. By continuing to improve their strategies, traders can attain mastery over spread management, ensuring a more profitable trading experience.