How to Interpret Forex Market Sentiment Indicators

The Forex market is constantly influenced by various factors, one of which is market sentiment. Understanding sentiment indicators can help traders make informed decisions and execute their trading strategies effectively. Sentiment indicators measure the overall attitude of traders towards a particular currency pair or the Forex market as a whole. These indicators can be based on various data points such as trader positions, opinions, and news articles, thereby assessing whether the market is bullish or bearish. Typically, these indicators provide insights into potential market movements and price fluctuations. Traders often analyze sentiment data alongside technical and fundamental analysis to build a comprehensive trading strategy. The belief is that knowing the prevailing sentiment can provide a significant advantage in forecasting future price trends. Hence, incorporating sentiment indicators is essential for successful trading. Popular sentiment indicators include the Commitment of Traders (COT) report, which shows how different market participants are positioned. There are also tools offered by brokers that measure overall trader sentiment for specific currency pairs. Understanding these indicators will enhance the trading performance and strategy of Forex traders in volatile market conditions.

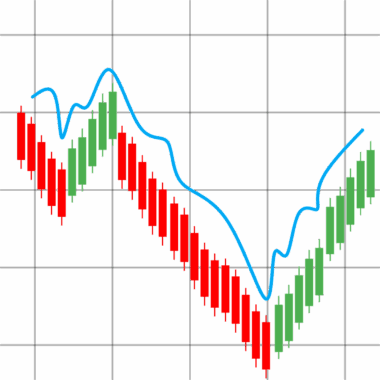

Different types of sentiment indicators can provide unique insights into market expectations. One widely used sentiment tool is the Commitment of Traders (COT) report. This report is released weekly and shows the positions of various market participants, such as commercial traders and institutional investors. By analyzing the COT report, traders can determine whether market participants are predominantly long or short on a currency pair. Another useful indicator is the Forex Sentiment Index, which represents the percentage of traders holding long or short positions. These metrics help in gauging whether the market sentiment is excessively bullish or bearish. If a large majority are long, it may indicate that the market is nearing a reversal point. Moreover, an array of online platforms provides sentiment analysis tools, enabling real-time monitoring of trader positions and reactions to market events. Understanding these dynamics can significantly improve Forex trading strategies. Using sentiment with other analyses, such as chart patterns and indicators, can lead to more accurate predictions. Ultimately, mastering sentiment analysis can contribute greatly to a trader’s success and longevity in the challenging Forex market.

Why Sentiment Indicators Matter in Forex Trading

Sentiment indicators play a vital role in Forex trading due to their ability to forecast market trends. While price action and fundamental data can provide valuable information regarding market conditions, sentiment can often reveal the emotions and psychology driving market movements. Emotional trading can lead to irrational market behaviors, which sentiment indicators are adept at capturing. By understanding and interpreting these emotions, traders can strategize more effectively to capitalize on potential shifts in market trends. It is crucial to recognize that extreme sentiment readings can indicate potential reversals or corrections in the market, allowing traders to position themselves advantageously. For example, when the sentiment shifts dramatically, it can signify that the prevailing trend may be losing momentum. This creates opportunities for trading in the opposite direction of the prevailing trend. Moreover, sentiment analysis enables traders to identify potential bias or overconfidence amongst market participants. By integrating sentiment readings into a broader trading strategy, traders can enhance their ability to respond swiftly to emerging market conditions while managing risk more effectively.

Traders often debate the reliability of sentiment indicators, citing their sometimes opposing signals to traditional analysis methods. Nevertheless, sentiment indicators, when used correctly, can enhance the understanding of market movements, especially in unpredictable environments. One of the key advantages of sentiment indicators is their ability to capture the collective view of market participants. They help in determining whether crowd psychology can lead to market extremes or potential reversals. Nevertheless, it is important for traders to stay grounded in their analysis and not rely solely on sentiment indicators. Instead, they should integrate sentiment with overall market strategies, including technical and fundamental analysis. It’s essential to take a balanced approach, considering various perspectives on market behavior before making trading decisions. Another aspect to keep in mind is that sentiment indicators often lag; therefore, timing the entry and exit points of trades based on these readings is crucial. As market conditions change rapidly, adapting trading strategies will enable traders to navigate fluctuations effectively and manage risks. In summary, the strategic use of sentiment indicators, coupled with other analytical methods, can lead to improved Forex trading results.

Common Pitfalls in Interpreting Sentiment Indicators

While sentiment indicators provide valuable insights, there are also common pitfalls traders must be aware of. One of the significant misunderstandings is viewing sentiment readings as definitive buy or sell signals. Sentiment should be interpreted as a gauge of current market behavior rather than a concrete directive. Misinterpretations can lead to premature trading decisions, ultimately resulting in losses. Additionally, many traders make the mistake of ignoring the broader context of market conditions when analyzing sentiment. It is essential to consider how the indicators relate to overall economic data, market news, and geopolitical events, as these factors can significantly impact currency dynamics. Traders can also fall into a herd mentality, overly influenced by extreme sentiment readings without critically analyzing the data. This could lead to chasing trends instead of following a trading plan. Instead of relying solely on sentiment indicators, utilizing them alongside comprehensive risk management strategies, technical analysis, and fundamental insights will enhance a trader’s success. Regularly assessing sentiment indicators while remaining adaptable to market changes will help traders maximize their potential in Forex trading.

Another common error is failing to recognize that sentiment can remain extreme for longer than expected. Traders might anticipate a reversal based on sentiment indicators, only to find that the prevailing trends continue. This can lead to frustration and detrimental trading decisions. Patience and discipline are essential traits in trading effectively with sentiment indicators. Additionally, traders should be mindful of the potential for false signals. Market noise can cause sentiment readings to fluctuate dramatically, leading to misinformed decisions if not contextualized correctly. This emphasizes the importance of vigilance and ongoing monitoring of sentiment alongside other analytical tools. Another pitfall is overlooking the importance of different market conditions. For example, during high volatility periods, sentiment indicators may signal heightened uncertainty and may not reliably represent market direction. Therefore, adjusting trading strategies in line with changing market conditions, like significant news announcements or economic reports, is crucial. Incorporating flexible strategies while utilizing sentiment indicators can enhance overall trading performance. The effective combination of these approaches will yield more informed decision-making and better Forex trading outcomes.

Conclusion: Mastering Forex Sentiment Indicators

To conclude, mastering sentiment indicators is essential for Forex traders aiming to improve their strategy and outcomes. By comprehensively understanding how to read sentiment, traders can gain insights into the psychology behind market movements. Familiarity with tools like the Commitment of Traders (COT) report and sentiment indexes can enhance trading accuracy. Building a foundation of knowledge around how sentiment indicators work and their advantages, along with potential pitfalls, is critical to success. It is also crucial to integrate sentiment analysis with other trading methods for a full understanding of market conditions. Engaging with education resources, forums, and market analysis can further build on this knowledge. Utilizing sentiment as part of a broader strategy allows for improved risk management and informed decision-making. As the Forex market is inherently volatile and driven by human emotion, incorporating sentiment analysis will equip traders to navigate fluctuations better. Ultimately, Forex trading success involves harnessing sentiment indicators intelligently, applying them correctly, and continuously adjusting to market dynamics. With practice and ongoing learning, traders can master sentiment indicators and enhance their overall trading efficacy.

Applying sentiment analysis in the Forex markets can significantly contribute to traders’ profitability. By utilizing sentiment indicators thoughtfully, traders can remain adaptable in rapidly changing environments. This approach to trading emphasizes the importance of keeping a well-rounded analysis and understanding market psychology to position themselves for success. Continuous learning, monitoring advancements in sentiment analysis tools, and self-reflection on previous trades will provide valuable insights for improving strategies. Therefore, incorporating these indicators into trading may facilitate not only short-term gains but also long-term success in handling Forex trading activities.