Mobile Payment Solutions Driving Growth in Microfinance

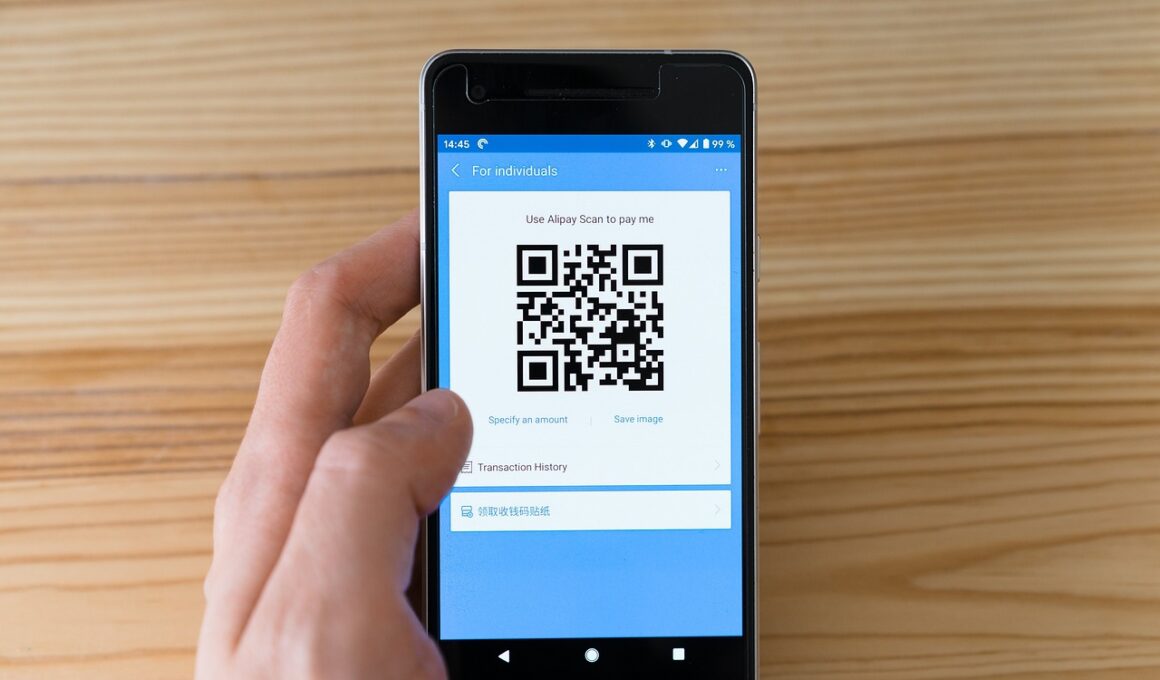

The surge of mobile payment solutions has greatly transformed the landscape of microfinance technology. This innovation allows financial institutions to reach previously unbanked populations more effectively. With the rise of smartphones along with mobile applications, vendors now have the ability to offer financial services directly to consumer handsets. Microfinance institutions are increasingly adopting these solutions for several reasons. Firstly, mobile payments reduce transaction costs significantly, making financial services affordable for clients. Secondly, they enhance convenience for users, allowing them to remit funds and access loans at their fingertips. Furthermore, mobile payment platforms facilitate quicker disbursement of loans, which contributes to increased financial inclusion. A significant number of fintech companies are entering the microfinance space to capitalize on this trend. By leveraging mobile technology, they are catering to the evolving needs of the market. Popular mobile payment systems like M-Pesa have demonstrated tremendous success in various developing countries. As this trend continues, we can expect further investment and innovation in mobile payment technologies that promise to enhance financial accessibility and literacy for all, effectively bridging the gap between unbanked individuals and financial empowerment.

As mobile payment solutions burgeon, they are proving instrumental in revolutionizing the borrowing and saving aspects of microfinance. Many borrowers prefer mobile transactions for their expedience and ease of use. More clients are gravitating towards platforms that provide seamless experiences and allow quick fund management. Microfinance institutions are leveraging these platforms to offer tailored financial products that specifically meet the needs of their clientele. Moreover, data analytics play a crucial role in understanding borrowing behaviors, enabling institutions to customize products effectively. Moreover, mobile payment technology supports the tracking of loan repayments through automated systems, which diminishes the risk for lenders. This automation has resulted in healthier repayment rates across numerous microfinance institutions. Additionally, financial literacy programs integrated into mobile applications further promote responsible borrowing. Users receive real-time notifications and educational content, empowering them to make informed financial choices. The importance of financial education cannot be understated, especially given that many clients may not have prior banking experience. Consequently, mobile payment solutions function as gateways to financial empowerment, connecting individuals to necessary resources that facilitate financial growth while nurturing a culture of responsible financial management.

Impact of Mobile Payments on Financial Inclusion

Mobile payment solutions have demonstrated a profound impact on financial inclusion within the microfinance sector. By allowing unbanked populations to conduct transactions, these mobile platforms are breaking down the barriers that have traditionally left many without access to essential financial services. The adaptability of mobile payment technology is particularly evident in rural areas, where banking infrastructure is often limited. Users in these regions leverage their mobile devices to make payments for goods and services, withdraw cash, and remit funds. Furthermore, mobile payment solutions assist in extending credit to clients who lack conventional credit histories, enabling them to participate in the economy. Microfinance organizations can assess the creditworthiness of users through transaction behaviors captured via mobile apps. This data-driven approach eliminates prior limitations imposed by outdated lending practices. The ability to offer loans to individuals without formal credit scores ultimately propels local economies by promoting entrepreneurship and self-sufficiency among the less fortunate. Overall, as mobile payments proliferate, they yield significant advancements in enabling financial agency among traditionally marginalized groups, solidifying a new era of inclusive financial ecosystems that cater to all demographics.

Adopting mobile payment systems not only addresses financial inclusion but also aligns with broader economic development goals. Countries that foster environments conducive to fintech innovation experience accelerated growth due to enhanced banking frameworks. Moreover, easier access to finances encourages micro-entrepreneurship, contributing to job creation and income diversification. By empowering individuals to start their businesses, these technologies enable them to take control of their financial futures. Customers are provided with improved transparency and tracking for their expenditures, allowing them to manage their financial resources better. The ability to save digitally through mobile applications has also become a game changer for many. Users can access savings products designed to encourage disciplined saving habits. Consequently, microfinance institutions can offer specialized savings plans that cater to varying income levels. Furthermore, governments keen on promoting financial literacy and inclusion often collaborate with fintech companies to devise strategies that broaden access to financial tools. Such partnerships amplify the positive effects of mobile payment solutions. By harnessing collective efforts, stakeholders can craft systemic changes that assure economic stability and growth throughout regions while optimizing the potential of microfinancing in society.

Challenges and Solutions in Adoption

Despite the numerous benefits offered by mobile payment solutions in microfinance, several challenges still impede widespread adoption. One prominent barrier is the digital divide, which highlights significant disparities in technology access, particularly in rural regions. As a result, unconnected populations continue to miss the opportunities presented by these fintech solutions. Furthermore, concerns related to cybersecurity and the protection of sensitive financial information deter potential users from fully embracing these platforms. To address these issues, microfinance institutions must invest in robust mobile security infrastructure while conducting educational initiatives. Such measures will increase consumer trust and reassure users about the safety of mobile transactions. Partnerships with telecom providers can further facilitate the development of affordable data packages, thus enhancing accessibility for underserved communities. Additionally, incorporating multi-lingual platforms will significantly bridge the linguistic barriers that hinder the understanding of available services. By prioritizing consumer education and technical support, institutions can empower their clientele, equipping them with the knowledge to utilize mobile payment systems effectively. Ensuring a shared commitment from various stakeholders is essential for overcoming challenges. This collaborative approach will ultimately pave the way for a flourishing microfinance sector, bolstered by mobile technology.

Moreover, regulatory frameworks play an essential role in establishing safer environments for mobile payment solutions to thrive within microfinance. Clear guidelines can foster trust and promote consumer protection, essential always to remain a priority. Regulatory bodies must review and adapt their policies continually to keep pace with ever-evolving fintech landscapes. This proactive approach will ensure that users receive comprehensive safeguards, which is particularly vital in a passing era of heightened cybersecurity concerns. Close collaboration between fintech companies and regulatory agencies is vital for achieving comprehensive compliance. Creating a standardized set of operational guidelines can significantly minimize fragmentation within the sector. As innovative solutions develop rapidly, regulators should pursue dialogue with sector participants to adapt and implement forward-thinking measures. Not only does this enhance the legitimacy of the industry, but it also lays a solid foundation for sustainable growth. By scrutinizing regulatory challenges, stakeholders can work towards building frameworks that support innovation while minimizing risks. A symbiotic relationship between fintech players, consumers, and regulatory bodies will encourage a strong, trustworthy ecosystem, fostering the advancement of mobile payments within microfinance.

Future Outlook for Mobile Payments in Microfinance

Looking ahead, the future of mobile payments in microfinance appears promising and transformative. The ongoing advancement of technology signifies that more innovative solutions will emerge, enhancing how recipients use financial services. As competition intensifies in the fintech landscape, financial services will likely become even more affordable and accessible. Increased integration of artificial intelligence and machine learning into mobile payment platforms will offer users personalization opportunities and smart financial advice. Through these advanced technologies, microfinance institutions can identify potential borrowers more efficiently, allowing them to tailor their products to specific needs. Furthermore, partnerships between banks, fintech start-ups, and even tech giants will likely evolve, optimizing product offerings for users. As traditional banking institutions begin to recognize the importance of digitalization, we will witness an influx of resources dedicated to enhancing mobile payment infrastructure. Additionally, as mobile internet connectivity continues to expand, especially in developing economies, the gap in service availability will gradually close. The confluence of greater access, improved technological infrastructure, and robust consumer education programs will ensure that mobile payment solutions remain at the forefront of microfinance growth while paving the way for sustainable financial solutions for all.

In conclusion, it is evident that mobile payment solutions are pivotal in advancing microfinance technology and driving sustainable growth. The impact of these innovations on financial inclusion, economic empowerment, and consumer empowerment cannot be overstated. As more individuals gain access to financial services via mobile payment systems, their quality of life will improve significantly. Thus, financial institutions must continually adapt to this rapidly changing landscape to remain relevant. Investing in technology will be critical in ensuring that they stay competitive. The synergy between mobile payments and microfinance fosters greater collaboration among various stakeholders, including fintech companies, traditional banks, and local governments. When these entities come together, the sector will be empowered to develop effective strategies that address users’ specific needs while promoting responsible financial practices. Moreover, by prioritizing consumer education and security, stakeholders can mitigate potential risks associated with mobile transactions. Ultimately, the future of microfinance lies in adopting transformative solutions that embrace technological innovations. As mobile payments continue to reshape the evolution of microfinance, we will likely see unprecedented growth and equitable financial access for all, heralding a new age of financial democratization and empowerment.