Impact of Lobbying Activities on Non-Profit Tax Status

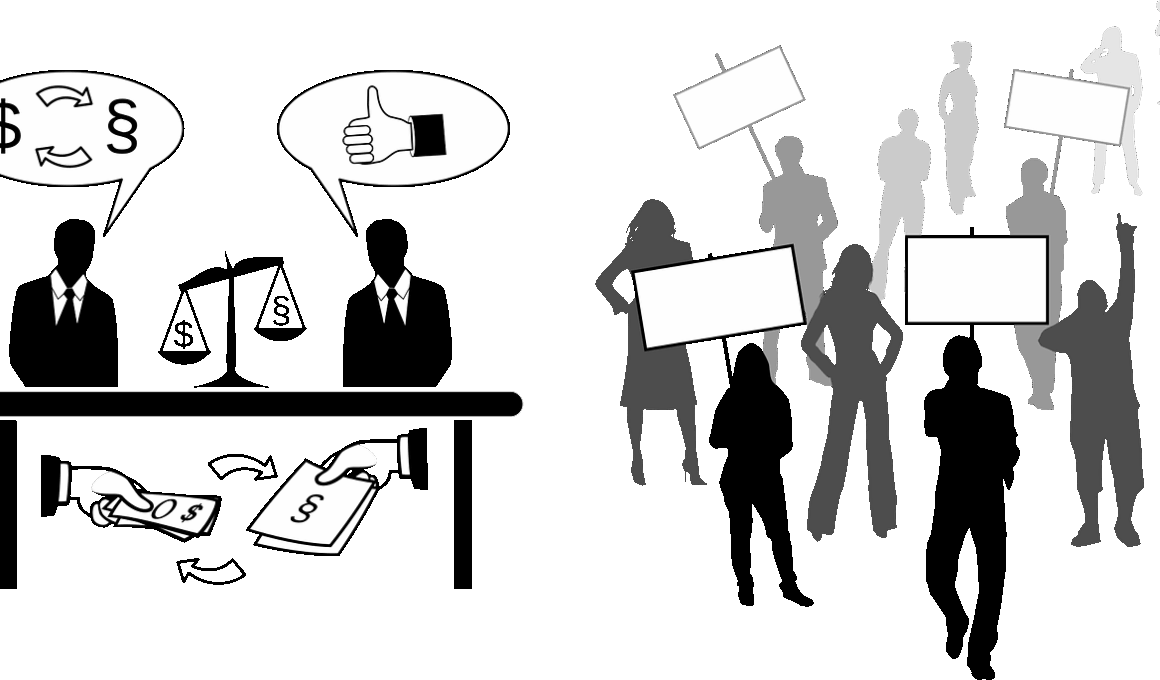

Lobbying activities undertaken by non-profit organizations can significantly impact their tax-exempt status. The Internal Revenue Service (IRS) has strict regulations governing the extent to which non-profit organizations can engage in lobbying efforts. If these organizations exceed allowable limits, they risk losing their tax-exempt status. It is essential for non-profits to carefully navigate these regulations to maintain their tax benefits. For example, lobbying expenses must be reported and cannot represent a substantial part of an organization’s overall budget. Therefore, awareness of both federal and state regulations is crucial. Non-profits need to clearly define their lobbying efforts and align them with their overarching mission. The IRS uses a variety of criteria to assess whether an organization is primarily engaged in lobbying, including the percentage of funds allocated to advocacy versus charitable endeavors. Consequently, organizations must keep accurate records and consider consulting legal experts to ensure compliance. This diligence can ultimately safeguard their mission and financial health, allowing them to focus on serving their communities effectively. Failure to adhere to these guidelines may lead to significant penalties and jeopardize essential programs.

This brings us to the definition of lobbying for non-profits, which is crucial for understanding its implications. Lobbying generally refers to attempts to influence legislation or government policy. Non-profits conduct lobbying to advocate for various causes, from health care reforms to education initiatives. However, the IRS distinguishes between permissible lobbying efforts and excessive activism that could jeopardize a non-profit’s status. Understanding this distinction is vital for non-profits. Organizations should be aware of the specific rules that apply to their activities, including the guidelines related to the percentage of budget spent on lobbying. A strong legal framework helps protect non-profits by clarifying what actions constitute lobbying. Failure to comply with lobbying rules not only risks tax-exempt status but could also damage an organization’s public image. According to IRS regulations, non-profits can spend up to a defined percentage of their budget on lobbying-related activities without risking tax-exempt status. It’s advisable to track expenditures diligently and reflect them accurately in financial reports. This transparency fosters greater accountability, potentially leading to enhanced trust from donors. Ultimately, understanding lobbying’s complexities is essential for effective non-profit governance.

Permissible Lobbying Activities

Identifying permissible lobbying activities for non-profits is a vital aspect of tax planning. The IRS permits some lobbying as long as these activities remain minor compared to the organization’s overall operations. Non-profits must develop a clear understanding of what constitutes permissible lobbying under IRS guidelines. Generally, lobbying that seeks to influence specific legislation is acceptable as long as it does not consume more than a threshold percentage of total expenditures. Non-profits are encouraged to focus on advocacy efforts that align with their missions. For example, organizations that focus on environmental conservation may advocate for specific environmental legislation as part of their efforts. Non-profits should also maintain detailed records of lobbying activities, including time spent and resources dedicated to each lobbying effort. Accurate documentation is key to demonstrating compliance should the IRS investigate. Building an advocacy strategy within the confines of the law can enhance the credibility of non-profits and attract more funding. By clearly defining lobbying activities, organizations not only protect their tax status but also advance their missions effectively. Careful planning and adherence to IRS guidelines ultimately ensure sustainability and continued service to their communities.

Moreover, the impact of recent legislative changes on non-profits cannot be ignored. Tax laws frequently evolve, and non-profit organizations must stay informed about current rules regarding lobbying activities. Recent amendments in tax legislation may affect how non-profits report and manage lobbying expenditures. It is crucial for non-profits to monitor these changes to ensure compliance and protect their tax-exempt status. Non-profits might consider engaging in advocacy training for staff members to build familiarity with new regulations. Keeping abreast of changes in federal and state laws can help non-profits adapt their strategies appropriately. They often find themselves at the forefront of social change, making it vital to inform policymakers about pressing issues. By doing so, they ensure that their advocacy work remains relevant and impactful while staying compliant with IRS regulations. If necessary, organizations should seek advice from legal professionals to navigate the complexities of tax law. Continuing to learn and adapt is key to effective governance in the non-profit sector, ensuring that mission-driven initiatives continue without risking financial penalties or loss of valuable tax privileges. Compliance fosters resilience against external challenges that non-profits face today.

Challenges Faced by Non-Profits

There are various challenges faced by non-profits when engaging in lobbying activities. Many non-profit organizations struggle with limited resources, making it difficult to allocate funds towards lobbying expenditures. Restricted budgets can lead to a lack of awareness about compliance regulations. Furthermore, the complexity of tax laws may deter non-profits from engaging fully in lobbying activities. Inadequate understanding of permissible actions could result in unintentional violations of IRS guidelines. Additionally, the fear of losing tax-exempt status often discourages non-profits from pursuing full advocacy efforts. This creates a paradox wherein they choose not to advocate for essential issues essential to their missions. Moreover, non-profits also compete for funding opportunities, and those that engage more in lobbying may find themselves at a disadvantage. This competition can lead organizations to shy away from lobbying despite its potential benefits. In response to these challenges, non-profits must prioritize education and best practices. By doing so, they can navigate the intricacies of lobbying, reduce risks, and focus on fulfilling their organizational goals. Continuous education equips non-profits to advocate constructively while adhering to necessary regulations.

Moreover, collaboration with legal experts can assist in overcoming challenges associated with lobbying compliance. Non-profits may find partnering with experienced lawyers invaluable in understanding the legal landscape surrounding their lobbying efforts. These experts can help organizations structure their activities and budgets to fit within allowable parameters. This guidance is crucial in forming effective campaigns while protecting tax-exempt status. Additionally, by leveraging networks of like-minded organizations, non-profits can work collectively to advocate for shared interests. Building coalitions might allow organizations to amplify their voices without overspending on lobbying efforts individually. These different advantages highlight the importance of strategic partnerships in non-profit lobbying. Reviewing past cases can provide insights into successful lobbying that adheres to IRS regulations. This knowledge will assist organizations in crafting responsible advocacy plans that respect limits imposed on lobbying activities. Non-profits must remember that effective lobbying strategies align closely with their missions. Achieving these goals strengthens their overall impact within their communities, building goodwill among stakeholders. By maintaining an accountable structure, non-profits can continue their essential work without risking penalties associated with the complex tax laws that govern lobbying.

Conclusion: Safeguarding Tax Exempt Status

In conclusion, understanding the impact of lobbying activities on a non-profit’s tax status is essential for effective management. Non-profits can successfully exercise their advocacy roles while preserving their tax-exempt status with careful planning and compliance with IRS regulations. Organizations must know their allowable limits and work within those parameters to avoid non-compliance issues. Additionally, effective tracking and transparent reporting of lobbying expenditures are vital to safeguarding their tax-exempt status. By investing in legal guidance and strategic education, non-profits can navigate legislative complexities successfully. This approach not only ensures adherence to IRS guidelines but also empowers organizations to advocate for essential causes effectively. Lobbying plays a crucial role in influencing policy changes that align with the mission of non-profits. Cultivating partnerships and coalitions can enhance their advocacy efforts while mitigating risks associated with tax compliance. As the regulatory landscape continues to evolve, ongoing education is paramount. Non-profits must remain informed about changing rules related to lobbying to sustain their advocacy efforts. Ultimately, through strategic planning and informed decision-making, non-profits can thrive while positively impacting society.

By understanding the nuances of tax planning for lobbying activities, non-profits ensure they can fight for their missions without risking their precious tax-exempt status. Building a robust compliance framework coupled with clear definitions of lobbying versus charitable activities can create a strong foundation for future advocacy. Organizations must work diligently to uphold their commitments to social good while complying with the law. Engaging stakeholders and keeping donors informed can also strengthen their position, allowing better community engagement and support for their lobbying endeavors. Moreover, emphasizing transparency is essential in building trust among supporters and beneficiaries. This is especially important in today’s environment where accountability is crucial. As non-profits navigate the complexities of lobbying, the goal remains to bring about meaningful change without compromising their operational integrity. In this pursuit, ensuring that policies reflect ethical standards is paramount. Non-profits hold a unique position to influence legislation that ultimately impacts various communities positively. Therefore, remaining compliant while effectively advocating for broader policy changes will enhance their sustainability. For non-profits, the careful balance between advocacy and compliance ultimately creates a lasting legacy of positive social impact.