The Role of Volume in Forex Price Movements

In the world of Forex trading, understanding volume is crucial for assessing price movements. Volume indicates the number of trades executed during a specified time period. A high volume suggests active market participation, crucial for confirming price trends. Traders often analyze volume to gauge the strength and sustainability of price movements. If prices rise and it is accompanied by significant volume, this is interpreted as bullish sentiment. Conversely, rising prices coupled with low volume may signal a potential reversal. Various technical analysis indicators, such as the Volume Oscillator or On Balance Volume (OBV), aid traders in analyzing these trends. In Forex, this analysis becomes essential given the decentralized nature of the market. Traders can better understand market psychology and sentiment flow through volume analysis. Furthermore, institutional traders use volume metrics to execute large trades, impacting price significantly. Monitoring volume effectively allows traders to enhance their strategies and improve their risk management, which is crucial in the Forex market. For successful trading, not only should price be taken into account, but also the changing dynamics of volume and how it aligns with other indicators.

Market sentiment can be significantly influenced by changes in volume. When average volumes see spikes during price movements, traders often interpret this as a sign of increasing interest or confidence in the asset. Volume analysis becomes even more relevant in forex trading because the market operates 24 hours a day, with trading volumes fluctuating across different sessions. Traders who observe increased volume alongside significant price movements can identify potential breakout or reversal scenarios. This correlation between volume and price assists traders in making informed decisions based on market sentiment. Additionally, volume provides traders insights into market liquidity, which is particularly important in forex, known for its high volatility. Without sufficient liquidity, executing trades at desired prices can become challenging. Volume can, therefore, help determine the best times to enter or exit trades. In Forex, managing liquidity adequately enhances the ability to enter trades without significant slippage. The utilization of volume also assists in identifying potential areas of support and resistance. By comprehensively analyzing price and volume, traders can refine their methodologies, ultimately leading to more profitable trading opportunities over time.

Interpreting Volume Patterns

Recognizing volume patterns is essential for traders attempting to predict price direction in forex markets. Volume patterns can emerge in various forms, including increasing volume during uptrends or downtrends. A classic example is when price approaches a key support or resistance level with rising volume. This scenario suggests that a breakout is imminent, as traders have confidence in the upcoming price movement. Conversely, if a decrease in volume accompanies price movements at these significant levels, it may indicate weakness in the current trend. Traders must consider these signals carefully, as they can provide insight into potential trend reversals. Furthermore, understanding volume trends can enhance traders’ awareness of overall market conditions, giving them a strategic advantage when trading currency pairs. Volume also tends to fluctuate according to market events, such as economic news releases or central bank announcements. Rapid changes in volume can often foreshadow extreme price movements, which may transition into volatility spikes affecting trading strategies. Monitoring volume patterns alongside price action allow traders to better anticipate shifts in trend dynamics and adjust their strategies accordingly. A thorough comprehension of these patterns assists in developing consistent trading methodologies.

The role of volume extends beyond mere price confirmation; it is also integral to managing risk in forex trading. High-volume periods generally suggest a more stable market environment, allowing traders to enter and exit positions more confidently. Conversely, engaging in trading during low-volume sessions can result in wider spreads and increased slippage, negatively impacting overall profitability. Therefore, traders are usually advised to correlate their trading sessions with times of high activity, such as market openings or during the overlap of major forex weather zones. Aligning trades with these high-volume times can elevate the effectiveness of their strategies. Additionally, considering the volatility that often accompanies significant volume spikes is crucial; traditional risk management techniques such as stop-loss orders must be employed judiciously. In circumstances where volume surges accompany unexpected economic events, volatility can increase sharply. Traders must remain vigilant about these conditions, adjusting their risk strategies to accommodate potential disruptions. Understanding the impact of volume on risk management allows traders to safeguard their capital while pursuing profitable trades. Ultimately, effective risk management and volume analysis integrate to bolster decision-making, enhancing trading performance.

Using Volume with Other Indicators

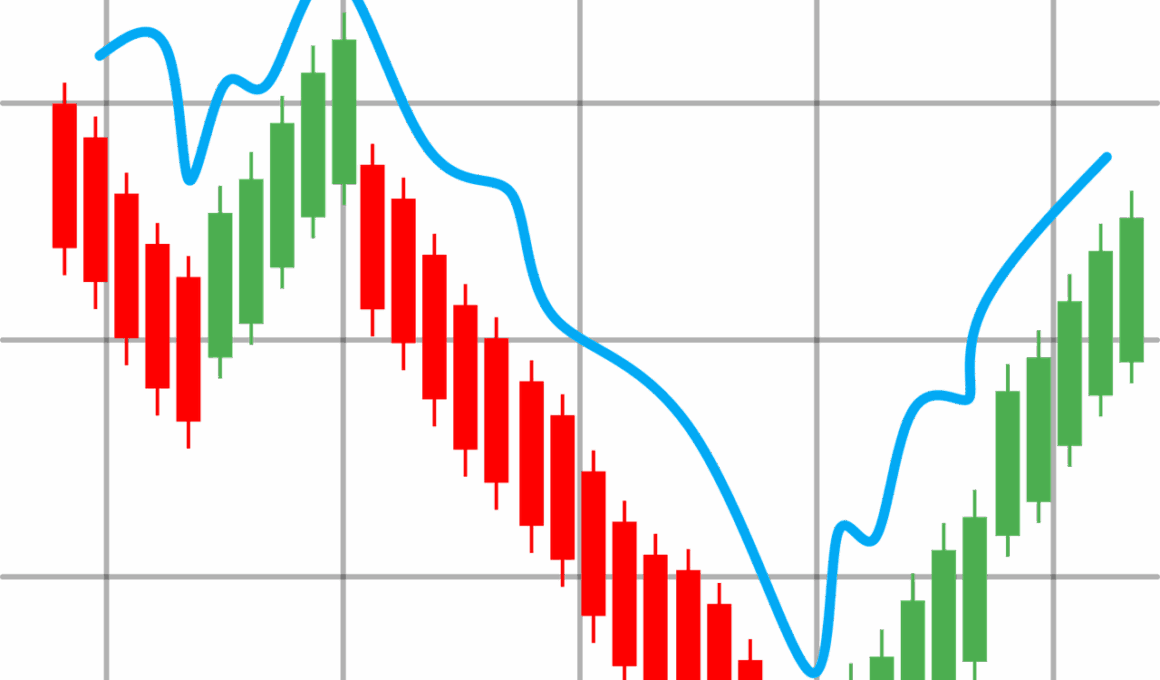

The incorporation of volume analysis with other indicators can significantly improve a trader’s strategy in forex markets. For instance, combining volume with moving averages can offer insights into potential trend confirmation. A price crossing above a moving average, supported by volume increases, suggests a robust bullish trend, whereas declines with high volume signal possible bearish reversals. Additionally, volume can enrich the interpretation of momentum indicators like the Relative Strength Index (RSI). A price increase alongside high volume, matched with an RSI below an overbought level, indicates a healthy price movement versus unsustainable. The synergy of volume analysis with other technical tools can also enhance divergence strategies, where weakening volume during price highs signals potential market exhaustion. Traders equipped with this knowledge can better position themselves within the fluctuating Forex landscape. Furthermore, these combined analyses facilitate a more comprehensive understanding of price movements relative to market fundamentals. As forex trading grows increasingly sophisticated, improved indicators of market behavior translate into enhanced strategic execution. Utilizing volume along with traditional technical indicators heightens the potential for accurate trade setups and effective capital allocation.

Understanding geographic trading volume accents significant variance in forex trading efficacy. Different trading centers around the world impact market dynamics, given specific active trading hours. For instance, the overlapping hours between the London and New York sessions often result in heightened trading volume. Traders who are aware of these operational overlaps can tailor their strategies to leverage the increased activity. Additionally, during various financial reports or events, changes in geographic trading volume can inform traders about potential price fluctuations. Such adaptations can significantly influence trading opportunities as economic news varies by geographical context, affecting trader sentiment. Moreover, recognizing how local economic factors play into currency trading can also aid in developing strategies with a solid foundation. For instance, if a significant macroeconomic announcement is likely to affect a specific currency, understanding local market behaviors around that time can enhance positional strategies. Furthermore, monitoring different regions may introduce diversification opportunities, minimizing localized risks in currency investments. A comprehensive understanding of geographic trading volume trends leads to better-informed decisions and improved trading strategies suited for unique Forex market dynamics.

Conclusion: The Importance of Volume in Forex Trading

Ultimately, the role of volume in Forex price movements cannot be understated. As traders operate in a dynamic environment, volume provides essential real-time insights into market trends and trader sentiment. Leveraging volume analysis, traders are positioned not only to react to existing conditions but also to anticipate future price movements more accurately. The integration of volume into trading strategies enhances the overall decision-making process, driving considerable improvements in trading performance. In the pursuit of successful Forex trading, understanding the implications of volume will empower traders to navigate fluctuations effectively. By being attuned to volume changes, traders can refine their strategies to include market sentiment indicators, significantly increasing their chances for success. In a market characterized by rapid changes, volume becomes a valuable asset for remaining competitive. By employing strategies that capitalize on increased awareness of volume dynamics, traders can better manage their risks and rewards. Thus, recognizing the multifaceted importance of volume empowers traders to engage with the Forex market more strategically, ultimately achieving greater financial outcomes.