How Does Forex Trading Work? A Simple Guide

Forex trading, or foreign exchange trading, is the process of exchanging one currency for another. This market is one of the largest and most liquid in the world. Every day, trillions of dollars are exchanged in the forex market. Traders can make money based on fluctuations in currency values. The forex market operates 24 hours a day, five days a week, allowing traders from different time zones to participate at any time. To trade successfully, one must understand market dynamics, as currency pairs come in various forms. The most popular pairs include EUR/USD, USD/JPY, and GBP/USD, where the first currency is the base and the second is the quote. Additionally, traders often utilize leverage to maximize their trading potential. This means they can control larger positions with a smaller initial investment. While this amplifies profits, it also increases the risk of losses. Thus, educating oneself through training, demo accounts, and market analysis is crucial. Overall, forex trading offers many opportunities, but it also requires diligence and a solid strategy to navigate effectively.

To begin your journey in forex trading, it’s essential to understand how to read forex quotes. Each currency pair will have a bid price and an ask price. The bid is the price at which you can sell the currency pair, while the ask is the price at which you can buy it. The difference between these prices is called the spread. Understanding spreads helps gauge trading costs, which can impact profitability. Leverage is another vital aspect of forex trading. It allows traders to open larger positions by borrowing capital from their broker. For example, a leverage of 100:1 means you can control $100,000 with just $1,000. While leverage increases potential profits, it can also intensify losses, underscoring the necessity of risk management techniques. Stops and limits can help mitigate risk by automatically closing trades at predetermined levels. Additionally, understanding economic indicators and market trends will assist traders in making informed decisions. Overall, entering the forex market requires careful consideration of various factors to enhance your chances of success.

Understanding Forex Trading Platforms

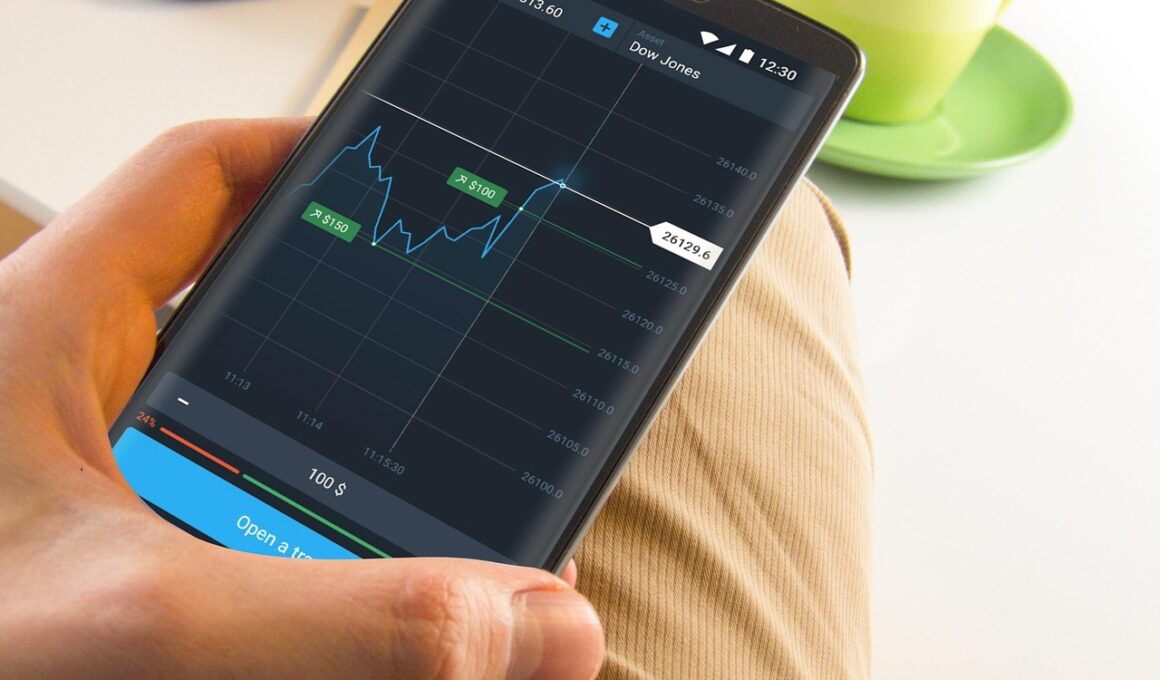

To engage in forex trading, you need a reliable trading platform. Most forex brokers offer proprietary trading software or third-party platforms to execute trades and manage accounts efficiently. Common platforms include MetaTrader 4, MetaTrader 5, and cTrader, each providing various tools and features for traders. These platforms enable traders to analyze market trends, execute trades, and monitor positions in real-time. Many platforms also offer demo accounts to practice without risking real money, which is a wonderful opportunity for beginners. With these demo accounts, traders can familiarize themselves with the interface, strategies, and risk management without financial exposure. Trading platforms also support various order types, such as market orders, limit orders, and stop-loss orders, giving traders flexibility in their trading approach. Furthermore, most platforms now offer mobile apps, allowing traders to stay connected and make trades on-the-go. Choosing the right platform significantly impacts trading experience, so consider features, fees, and customer support when selecting one.

One significant aspect of forex trading is the choice of a forex broker. A broker acts as an intermediary between traders and the market. They facilitate the execution of trades, provide access to trading platforms, and offer customer services. Brokers earn money via the spread or commission on trades. Therefore, selecting a reputable and regulated broker is critical for safety and reliability. Look for brokers who are registered with financial authorities to ensure compliance and transparency. Additionally, regulatory bodies can vary by country; for example, in the United States, the National Futures Association (NFA) governs forex brokers. When evaluating brokers, consider account types, trading conditions, and fees, as they can greatly impact your trading profitability. Many brokers now offer educational resources, analysis tools, and market insights to help traders improve their skills and knowledge. Researching and selecting the right broker can streamline your trading experience and enhance your chances of success in the forex market.

Developing a Forex Trading Strategy

Successful forex trading revolves around having a well-defined trading strategy. A trading strategy is a plan that helps traders make consistent, informed decisions about when to enter or exit trades. Traders can use various methods to develop their strategies, including technical analysis, fundamental analysis, or a combination of both. Technical analysis involves studying price charts and indicators to identify potential entry and exit points. Examples of popular indicators include Moving Averages, RSI, and Fibonacci retracement levels. Conversely, fundamental analysis requires evaluating underlying economic indicators and geopolitical events that can impact currency values. Traders often monitor news releases, interest rate changes, and economic data from significant economies. Moreover, risk management is crucial in developing a strategy. Setting clear risk levels for each trade reduces the likelihood of substantial losses. Establishing goals and measuring performance consistently can also improve the forex trading strategy over time. Ultimately, a solid trading strategy can increase confidence, discipline, and profitability.

Psychological factors play a crucial role in forex trading success. Emotions such as fear, greed, and overconfidence can influence trading decisions and lead to impulsive actions. Many traders struggle with the psychological aspects of trading, which can result in significant losses. Therefore, managing emotions is essential for long-term success. Developing a trading plan helps instill discipline, as it guides traders to stick to their strategies instead of making decisions based on emotions. It is also beneficial to adopt mindfulness practices to maintain focus and control over emotional responses. Additionally, maintaining a trading journal is a helpful tool for tracking progress, analyzing past trades, and identifying emotional patterns. Reflecting on these patterns allows traders to learn from mistakes and improve their decision-making process. Trading in a calm demeanor can enhance being methodical when executing trades. Furthermore, engaging in continuous education keeps traders updated on strategies and market behavior, contributing to emotional stability. Ultimately, mastering the psychological aspect of forex trading can significantly enhance performance and productivity.

Conclusion: The Path to Forex Trading Success

In conclusion, stepping into forex trading can be both exciting and challenging. To succeed, traders must understand how the forex market operates, choose the right tools and brokers, develop a robust trading strategy, and manage their emotions effectively. Additionally, continuous education and practice are vital to honing trading skills and staying updated on market trends. Building a solid foundation in forex trading principles will empower traders to navigate the complexities of this lucrative market. While risks are inherent in trading, using risk management techniques and analysis tools can help in mitigating potential losses. Remember, experience is a significant teacher in the long run, and learning from both successes and failures will contribute positively to one’s trading journey. Lasting success does not come overnight; it requires patience, persistence, and a willingness to adapt. By following the guidelines outlined in this guide, traders can embark on their forex trading path equipped with the knowledge and mindset needed for success.

Forex trading can lead to significant financial growth when approached with discipline and strategy. Aside from the financial rewards, participating in the forex market also opens doors to a global community of traders sharing insights and experiences. Engaging in forums, webinars, and courses can further assist in enhancing trading acumen. Connecting with fellow traders allows one to gain different perspectives and learn from their strategies. This collaborative approach fosters knowledge exchange and may present new trading opportunities. Moreover, as technology continues to evolve, innovative tools and resources emerge, enhancing trader capabilities. Social trading platforms allow traders to copy successful traders’ strategies, effectively minimizing the learning curve for beginners. In summary, with the right approach, forex trading offers robust potential for success. Remaining dedicated to learning and adapting to market changes will further pave the way to profitable trading experiences. By following these guidelines and prioritizing continuous self-improvement, traders can achieve their financial goals while enjoying the adventure of engaging in global currency markets.