Demand Drivers in the Base Metals Market: What Traders Need to Know

The base metals market operates under the influence of various demand drivers that significantly affect prices and supply dynamics. Understanding these demand drivers is crucial for traders aiming to navigate this complex landscape effectively. One of the primary factors influencing demand is global economic growth. When economies expand, there is a higher need for infrastructure, construction, and manufacturing, all of which depend heavily on base metals like copper, aluminum, and zinc. Furthermore, increased urbanization leads to a surge in demand for housing and transportation, further propelling the need for these metals. Another essential driver is technological advancement. Innovations, particularly in renewable energy and electric vehicles, have led to increased demand for certain metals. For example, copper usage in electric vehicles has soared due to its efficiency in conducting electricity. Traders must monitor these trends closely as they directly correlate with potential price fluctuations. Additionally, geopolitical factors can affect supply chains and trade relations, thereby impacting demand. Therefore, comprehending these demand drivers can provide traders with a significant advantage in the base metals market.

Moreover, seasonal changes can also play a crucial role in demand fluctuations for base metals. In the construction industry, the demand often spikes during specific seasons when weather conditions are favorable for building activities. For instance, spring and summer months typically see an increase in construction projects as companies rush to complete their work before winter sets in. This seasonal demand creates opportunities for traders to capitalize on price increases. Additionally, inventory levels in the supply chain are vital for anticipating demand. Traders should keep an eye on major manufacturers and distributors to understand stock levels and adjust their strategies accordingly. Changes in inventory can lead to sudden price shifts in the market, creating both risks and opportunities. Economic indicators such as employment rates and manufacturing output can give traders insights into future demand. Higher employment usually results in increased consumption and, consequently, a greater requirement for metals. Finally, technological trends that impact manufacturers’ efficiency can alter the demand landscape. Traders need to continuously update their knowledge about these technological changes and adapt their trading strategies to avoid losses and seize opportunities.

Geopolitical Factors Influencing Demand

Geopolitical issues significantly influence the base metals market, impacting supply and demand scenarios crucial to traders. For instance, tensions in metal-producing regions can lead to supply chain disruptions, thus affecting market availability. A prime example is the ongoing situation in mining hotspots where political instability can halt production. These disruptions generally lead to increased prices, affecting traders who must adjust their strategies promptly. Additionally, trade policies and tariffs imposed by countries can alter demand dynamics. For instance, when major economies impose tariffs on imported metals, domestic production may rise to meet local demand, thereby affecting global prices. Traders must stay informed about such developments to predict potential shifts in both demand and supply effectively. Similarly, sanctions on specific countries involved in metal production can squeeze global supply, elevating prices. By understanding these geopolitical machinations, traders can position themselves strategically. Furthermore, international negotiations regarding climate change may also affect demand. Policies promoting sustainability can lead to increased demand for metals used in green technologies, offering traders new market opportunities. As such, constant vigilance concerning geopolitical landscapes is essential for success in base metals trading.

The evolution of consumer preferences is another significant factor driving demand in the base metals market. For instance, as society shifts towards more sustainable practices, the demand for metals used in renewable energy technology, like lithium for batteries and copper for electric wiring, is expected to rise. The shift towards electric vehicles is a prime example, where metals like lithium, cobalt, and nickel are crucial components of battery production. Traders must keep abreast of changing consumer behaviors to identify emerging market trends that impact demand. Additionally, recycling has gained momentum as a sustainable practice, significantly influencing demand for certain metals. As recycling technologies improve, the reliance on newly mined metals may decrease, shifting the market demand landscape. This can lead to increased supply pressures but also create opportunities for metal traders who can adapt to these trends efficiently. It’s essential for traders to analyze market analytics and consumer data to align their strategies with the evolving preferences of the end-users of base metals. By doing so, they can maintain a competitive edge over others operating in this dynamic market.

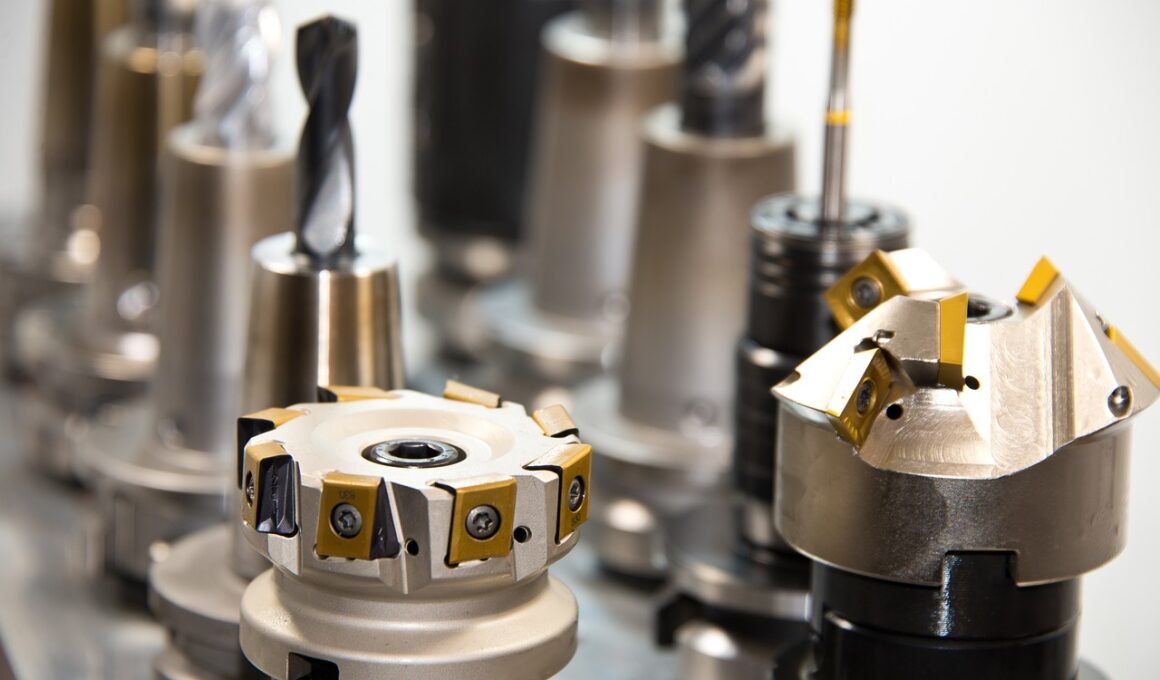

Technological Innovations Impacting Demand

Technological innovations continuously reshape the demand landscape of base metals in profound ways. As industries evolve, new applications for metals are frequently discovered, enhancing their demand across various sectors. A prime example is the rapid growth of the electric vehicle market, which necessitates an extensive amount of copper and aluminum for wiring and structural components. This emergent trend has sparked a wave of investment in mining operations to secure metals crucial for this burgeoning sector. Similarly, advancements in construction technologies have increased the use of lightweight and durable metals, necessitating changes in production and supply strategies. As technological innovations continue to emerge, traders must stay well-informed regarding potential shifts in demand patterns. Additionally, the construction sector’s technological evolution, including 3D printing and prefabrication, influences how metals are sourced and consumed. Innovations in manufacturing processes can lead to increased efficiencies, subsequently affecting demand levels for specific metals significantly. Understanding these technological trends is crucial for traders to anticipate changes in demand, allowing for better planning and strategy implementation. Therefore, technological progress will profoundly influence demand dynamics in the base metals sector.

Furthermore, sustainability and environmental regulations play critical roles in influencing demand for base metals. As governments worldwide implement stricter environmental standards, industries must adapt their practices, shifting demand towards metals produced sustainably. Companies facing regulations will increasingly seek out metals that meet environmental guidelines, impacting where and how these metals are sourced. For criminals trading in base metals, being ahead of the curve in terms of sustainability practices can provide a competitive edge. Many consumers now prioritize sustainability in their purchasing decisions, driving up demand for responsibly sourced metals. Additionally, public pressure for corporate responsibility has incited companies to alter their sourcing policies, further shifting the demand towards lower-impact materials. Traders should actively monitor regulatory changes and market responses to these shifts. By aligning their trading strategies with evolving regulatory landscapes, they can better anticipate demand changes, ensuring they remain competitive in this transitioning market. Hence, as the trend towards sustainability continues to grow, base metal traders must adapt promptly to remain relevant and successful in their trading endeavors.

Global Economic Trends and Their Influence

The global economy’s health invariably affects the demand for base metals and should be at the forefront of traders’ minds. Economic indicators such as GDP growth rates, inflation, and employment statistics provide valuable insights into the potential demand for base metals. For instance, during periods of economic expansion, industries such as construction and manufacturing typically ramp up operations, leading to higher metal usage. As a result, traders may see increased opportunities for profit as demand surges. Conversely, during economic downturns, demand usually diminishes, leading to potential price volatility. Traders need to remain agile and adapt their strategies during these shifting economic climates. Additionally, interest rates set by central banks can influence investment in infrastructural projects, directly impacting demand for base metals. Lower interest rates often stimulate borrowing and spending, which can fuel demand in various sectors. Thus, understanding these economic factors is essential for traders looking to optimize their positions in the base metals market. Awareness of global economic trends allows traders to position themselves strategically, minimizing risks while maximizing potential rewards.

In conclusion, the demand for base metals is influenced by a multitude of factors, including economic growth, technological advances, geopolitical influences, consumer preferences, and sustainability priorities. Traders in the base metals market must be vigilant and adapt to these evolving trends to remain competitive. Knowledge of seasonal demand variations, inventory levels, and emerging technologies is crucial for successful trading strategies. Geographic and political considerations require constant monitoring, as they can significantly impact supply and demand dynamics. By staying informed on these multifaceted factors, traders can position themselves to take advantage of price fluctuations and demand shifts. Additionally, recognizing the growing emphasis on sustainability can lead to new trading opportunities. Adapting to changes in consumer preferences and technological advancements will be paramount for future success. Therefore, a comprehensive understanding of these demand drivers is essential together with an adaptive approach in trading strategies. Looking forward, the base metals market will undoubtedly evolve as new trends emerge, reinforcing the need for traders to be prepared for challenges and opportunities alike. Mastery over these dynamics will ultimately determine success or failure in this competitive environment.