Swing Trading with Candlestick Patterns in Forex

Swing trading in Forex offers a strategic approach to trading that allows traders to capitalize on short to medium-term price movements. By utilizing candlestick patterns, swing traders can identify potential market reversals and continuation patterns effectively. Understanding candlestick formations is critical as each pattern can represent varying market psychology. Recognizing bullish and bearish signals can provide traders with the confidence needed to enter or exit trades. Candlestick patterns, such as dojis, hammers, and engulfing patterns, help traders predict possible future price actions. Therefore, it is essential to evaluate these patterns within the context of the overall market trends. Additionally, swing traders must be aware of trading volume, as this can confirm the authenticity of a pattern. Combining candlestick analysis with supportive technical indicators can enhance a trader’s decision-making process and improve overall performance. Researching historical patterns can also contribute to building a solid trading strategy, fostering long-term success in their trading journey. Furthermore, learning to manage emotions, particularly fear and greed, is vital for maintaining a disciplined approach in Forex trading.

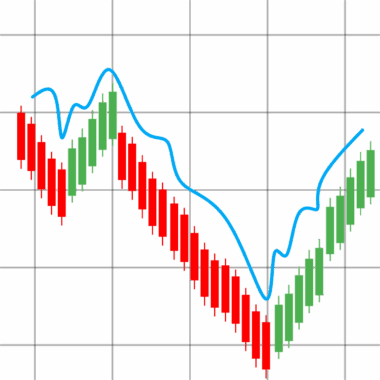

Traders can utilize various candlestick patterns to gain insights into market trends. These patterns reflect significant sentiment shifts between buyers and sellers and indicate possible direction changes. Among the most popular candlestick formations are the bullish engulfing and bearish engulfing patterns. The bullish engulfing pattern occurs when a larger bullish candle fully engulfs a preceding bearish candle. This typically signifies a potential trend reversal from bearish to bullish. Conversely, the bearish engulfing pattern appears when a larger bearish candle completely engulfs a preceding bullish candle, indicating a potential reversal from bullish to bearish. Recognizing these powerful reversal signals can provide swing traders excellent trading opportunities. Moreover, traders should improve their skills by practicing on demo accounts to enhance their proficiency in identifying and interpreting these patterns. It is recommended that every trader maintains a journal documenting their trades and reflections on the effectiveness of specific candlestick patterns. By reviewing their successes and learnings, traders can refine their strategies and increase their understanding of trading psychology. This thorough reflection and iteration will enable them to progress significantly within the dynamic Forex market.

In addition to standalone patterns, swing traders should be mindful of candlestick patterns in conjunction with other technical analysis tools. Utilizing indicators such as moving averages, Relative Strength Index (RSI), and Fibonacci retracements can help reaffirm the analysis derived from candlestick patterns. These indicators provide additional confirmation, which can reduce the likelihood of false signals, allowing for more reliable trade entries and exits. For instance, a bullish engulfing candle occurring above a key moving average may suggest a stronger buy signal than one appearing in isolation. Similarly, if this candle formation coincides with the RSI entering the oversold territory, the probability of a successful trade increases. Additionally, employing proper risk management techniques is crucial for protecting capital and ensuring long-term profitability. Setting appropriate stop-loss levels based on the candlestick pattern’s high or low can shield traders from significant losses. Furthermore, swing traders should work on position sizing to ascertain how much capital to risk on each trade. By following these guidelines alongside candlestick analysis, traders can foster a more disciplined trading approach and enhance their overall trading results.

Psychology of Candlestick Patterns

The psychology behind candlestick patterns is another essential factor for effective swing trading. Each candlestick represents market sentiment during a specific period, thus reflecting traders’ emotions and decisions within that timeframe. For example, a long-bodied candle suggests strong buying or selling pressure, while a doji indicates market indecision. Understanding these nuanced sentiments can empower traders with better insight and interpretation of price movements. It is fundamental that traders remain aware of their emotions, as they can greatly impact the effectiveness of their strategy. Fear and greed are significant psychological roadblocks that often lead to impulsive trading decisions, resulting in losses. To mitigate these emotional factors, traders should maintain a clear and structured trading plan, which encompasses entry and exit strategies based on sound analysis, rather than gut feelings. Regularly practicing self-discipline through trading plans can help eliminate psychological bias when making crucial trading decisions. Furthermore, incorporating mindfulness techniques can enable traders to stay calm and focused during volatile market situations, fostering a healthier, more balanced approach to Forex trading and better adaptability to market changes.

Another vital aspect of successful swing trading lies in the importance of ongoing education and skill development. The Forex market is dynamic, often presenting new challenges and evolving trends. Therefore, staying informed through books, online courses, webinars, and market analysis can equip traders with fresh insights and strategies. A solid grasp of trading fundamentals and advanced candlestick pattern recognition is essential for continued success. Traders are encouraged to engage with trading communities, forums, and social media groups to share knowledge and experiences. Such engagement not only fosters a sense of camaraderie but also introduces traders to diverse strategies that may further refine their techniques. As they advance in their trading journey, attendees can also seek mentorship from experienced traders who have a proven track record. This guidance can prove invaluable in refining strategies and overcoming common pitfalls. The amalgamation of real-world experience, theoretical knowledge, and community engagement creates a comprehensive learning environment. Embracing the mindset of perpetual improvement can significantly enhance traders’ ability to adapt to ever-changing market conditions and ultimately improve their performance.

Risk management remains at the core of successful swing trading strategies. Without an effective risk management strategy, even seasoned traders can suffer significant losses that can alter their trajectory. Understanding how much to risk per trade and establishing risk-reward ratios are critical components of a comprehensive risk strategy. A common recommendation is to risk no more than one percent of total trading capital on a single trade. This conservative approach helps mitigate potentially devastating losses. Moreover, calculating appropriate stop-loss levels is essential to protect capital. Swing traders should base their stop-loss orders on market conditions and specific candlestick patterns to optimize safeguard measures. For instance, placing a stop loss just below the swing low in a bullish setup can manage risk effectively. Implementing trailing stops can lock in profits while allowing for flexibility as the market moves in favor of the trade. As traders refine their skills and gain experience, it is crucial to evolve their risk management strategies to reflect their growing confidence and understanding of the Forex market, ensuring sustainable profitability over the long term.

Final Thoughts on Swing Trading

Embracing swing trading with candlestick patterns in Forex requires dedication, patience, and a willingness to learn. Traders need to effectively combine analytical skills with psychological awareness, consistently reflecting on their trading experiences. Each trader’s journey is unique, given the vast complexity of the Forex market and the diverse strategies available. However, the foundation of success lies in creating a structured trading plan, employing risk management techniques, and continuously honing one’s skills. As a trader progresses, they will naturally develop their style, preferences, and decision-making criteria based on individual experiences. Building consistency and discipline is crucial; traders should not be discouraged by setbacks, but rather view them as opportunities for further learning. Moreover, integrating candlestick patterns within a broader trading strategy enables traders to adapt to fluctuating market conditions effectively. In conclusion, successful swing trading with candlestick patterns integrates technical analysis with psychology, education, and risk management practices. By fostering a committed approach while embracing these essential principles, traders enhance their potential for long-term success and profitability in the dynamic realm of Forex.

Identifying candlestick patterns effectively requires practice and observation, as each pattern can yield different implications based on context. Traders are encouraged to familiarize themselves with various patterns, testing their understanding through simulated trading environments or back-testing strategies on historical data. This proactive approach allows traders to become comfortable with recognizing patterns seamlessly during live trading. Additionally, supplementing candlestick pattern recognition with external analysis, such as fundamental news events or economic indicators, can provide context and further reinforce trading decisions. This comprehensive approach can lead to well-rounded trading strategies, adapting to market dynamics while exploiting profitable opportunities. Finally, a support network within trading circles can foster morale and motivate traders during challenging times. Together, traders can share experiences, lessons learned, and celebrated successes, which can foster a sense of belonging in the often-isolating world of Forex trading. By collaborating with others, individuals can broaden their perspectives, subsequently refining their strategies. Ultimately, successfully swing trading using candlestick patterns is achievable through diligent study, persistent practice, and a focus on risk management, allowing for sustainable trading prosperity.