Strategies for Maintaining Liquidity in Turbulent Markets

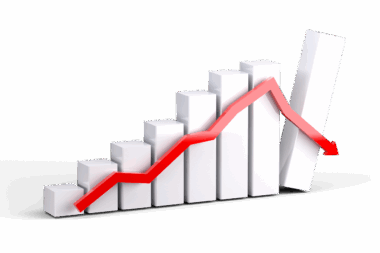

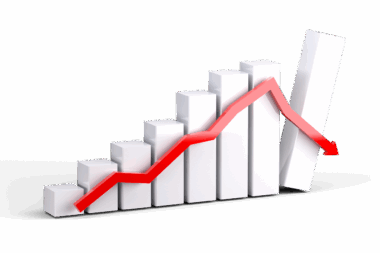

Maintaining liquidity during volatile market conditions requires implementing strategic measures that can adapt to changing circumstances. Liquidity, crucial for financial health, involves ensuring access to cash and liquid assets to meet obligations. During turbulent times, firms face challenges like rapid price fluctuations, market uncertainties, and demand shocks. Strategies include accurately forecasting cash flows based on realistic assessments of market conditions. Companies should also establish liquid reserve buffers, allowing them to respond to unexpected demands promptly. Furthermore, diversification of funding sources becomes vital; tapping into different funding avenues can minimize reliance on single markets that may become illiquid. Utilizing cost-effective financial instruments, such as lines of credit, ensures that businesses have immediate access to liquidity when necessary. Regularly stress-testing financial positions helps identify vulnerabilities within business operations, allowing proactive rather than reactive strategies. Continuous monitoring of market trends and adjusting liquidity strategies accordingly is essential in these uncertain times. With robust liquidity management strategies, firms can not only weather turbulence but emerge stronger in the aftermath of market volatility.

Effective cash flow management stands as a fundamental aspect of maintaining liquidity in challenging environments. Businesses must focus on optimizing receivables and payables to ensure funds are available when needed. Analyzing customer payment trends aids in determining when cash is likely to be received, enabling businesses to plan for potential cash shortfalls. Implementing stringent credit policies can mitigate the risks of bad debts while ensuring that customers are creditworthy before extending terms. Additionally, leveraging technology enhances visibility into cash positions, making it easier to manage day-to-day transactions. Automated systems can track outstanding invoices effectively, allowing for timely follow-ups. Establishing clear payment terms with vendors ensures businesses can negotiate favorable conditions, enhancing their cash management. Maintaining open communication with clients regarding payments fosters a more collaborative environment, which can help mitigate risks. Companies should also consider offering discounts for early payments, incentivizing quicker cash inflows. Restructuring payment terms during crises can further protect liquidity. Through diligent cash flow management, organizations can sustain operations while strategically positioning themselves to navigate market fluctuations.

Diversification of Revenue Streams

Diversifying revenue streams is another effective strategy for maintaining liquidity amid market volatility. Relying heavily on a single income source can expose businesses to greater risks during economic downturns. By expanding into new markets or offering additional services, companies can stabilize their revenue base. For instance, entering complementary product lines or geographical areas can create additional sales opportunities. Cross-selling existing products to current customers is also an excellent method for enhancing revenue without significant marketing expenditure. Digital transformation provides various avenues for companies to enter new markets. Businesses can utilize e-commerce platforms to reach broader audiences and tap into online sales channels that may not have been previously explored. Additionally, forging partnerships with other businesses allows for shared resources and access to new customer bases. Engaging in joint ventures can mitigate risks while enhancing growth potential in unpredictable markets. Customer feedback should be continuously collected to understand changing preferences, allowing businesses to align their offerings accordingly. With a diversified approach to revenue, companies can create a more resilient financial structure capable of weathering market fluctuations more effectively.

Effective risk management practices play a crucial role in maintaining liquidity during volatile markets. Identifying potential risks associated with liquidity, market approaches, credit risks, and operational causes ensures that businesses are adequately prepared. Setting clear risk management guidelines can help organizations respond to sudden market changes. It is essential to establish internal controls to monitor liquidity risks continually; these controls can involve regular assessments of financial health and risk exposure. Businesses should consider implementing scenario planning exercises to analyze different economic scenarios and how they would impact liquidity. Creating contingency plans allows firms to respond swiftly to various situations such as economic slowdowns or disruptions. Additionally, risk diversification across products and services mitigates the impact if one sector experiences a downturn. Communication across departments is vital; ensuring everyone understands the liquidity strategies informs decision-making across the organization. Training staff to recognize red flags and act upon them leads to better preparedness. By effectively managing risks, firms can safeguard liquidity, allowing for smoother operations during turbulent periods and positioning them for successful recovery when markets stabilize.

Building Strong Banking Relationships

Establishing strong relationships with financial institutions is essential for maintaining liquidity during economic volatility. Reliable banking partners can provide access to financing options, such as lines of credit, which are critical for managing short-term liquidity needs. Regular communication with banking contacts ensures that businesses can navigate changing credit conditions and understand available options. Developing a long-term relationship fosters trust and can lead to more favorable terms, especially during market fluctuations. Financial institutions may be more willing to offer support when a company demonstrates good credit practices and a strong financial history. Additionally, leveraging these relationships can provide access to market insights and resources that aid decision-making during turbulent times. Companies should actively engage in discussions with bankers regarding their financial requirements and the strategies they employ. Awareness of the bank’s lending criteria and policies becomes crucial when seeking assistance in challenging conditions. Building a solid credibility foundation paves the way for negotiations and securing necessary support. As liquidity needs arise, a well-established banking relationship can make a significant difference in maintaining robust financial operations amidst market challenges.

Another critical aspect to consider is the importance of effective inventory management. Managing inventory levels efficiently can enhance a company’s liquidity position by reducing holding costs and freeing up cash. Businesses should regularly analyze their inventory turnover rates to make informed purchasing decisions. Implementing just-in-time (JIT) inventory systems can minimize excess stock, ensuring that products are available without overcommitting resources. Leveraging technology can aid businesses in tracking inventory levels accurately, providing insights into demand patterns and helping forecast future sales effectively. Collaborating with suppliers to improve supply chain efficiency plays a crucial role in mitigating excess inventory risks. Establishing flexible contracts with suppliers ensures businesses can adapt to changing market conditions more easily. Regular reviews of inventory strategies enable companies to identify slow-moving or obsolete items that might tie up cash unnecessarily. Promptly liquidating underperforming inventory can recover much-needed funds. By maintaining optimal inventory levels and employing technology, businesses can significantly enhance their liquidity while ensuring operations smoothly progress without disruption caused by excess stock.

Utilizing Financial Technology

In today’s fast-paced environment, leveraging financial technology becomes a vital strategy for liquidity management. Digital tools and platforms can streamline financial processes, offering real-time insights into cash positions and liquidity needs. Implementing financial management software enhances visibility into cash flows and allows for more effective budgeting and financial planning. Automated systems can facilitate faster invoicing and payment collection, reducing the time between transactions and enhancing cash inflows. Utilizing data analytics to track spending trends can help businesses identify areas for cost reduction, thereby freeing up cash for operational needs. Moreover, mobile banking applications offer convenient ways to manage finances on the go, ensuring that decision-makers can access information anytime, anywhere. Incorporating artificial intelligence (AI) into forecasting tools can lead to better predictions of cash requirements based on historical data. Integrating these technologies drives efficiency and enables more informed decision-making during uncertain times. As businesses seek to bolster their liquidity, investing in financial technology will enhance responsiveness, optimizing available resources and ensuring smooth operations even amid challenges.

To sum up, maintaining liquidity during turbulent market conditions necessitates a multifaceted approach that integrates various strategies. Critical elements include solid cash flow management, diversification of revenue streams, proactive risk management, strong banking relationships, effective inventory management, and leveraging financial technology. Each of these components plays a significant role in ensuring that businesses remain agile and capable of responding to unforeseen challenges. By prioritizing liquidity management, firms can navigate difficult waters and position themselves for recovery in the aftermath of turbulence. Continuous monitoring and revising strategies help organizations adapt to changing market conditions. Encouraging open communication across departments contributes to a more collaborative approach toward liquidity management. Furthermore, regularly engaging with financial partners enhances the business’s ability to access essential funds during crises. As new challenges emerge, the ability to remain agile in liquidity strategies becomes a clear competitive advantage. By proactively addressing these critical areas, organizations not only safeguard their financial standings but also foster long-term resilience against market volatility.