Private Equity Strategies for Enhancing Corporate Governance

Private equity firms can significantly improve corporate governance through innovative strategies that enhance transparency and accountability. In today’s competitive environment, it is crucial for private equity investors to adopt best practices. A structured engagement process helps in identifying key governance issues. Increased ownership interest enables private equity firms to influence decisions effectively. A dedicated board of advisors can bring external perspectives. Moreover, implementing robust performance metrics ensures that all stakeholders are aligned. By establishing clear communication channels, investors can maintain an open dialogue with management. This facilitates informed decision-making and encourages alignment of interests between investors and management. Regular assessments of governance structures can help identify potential weaknesses. Additionally, firms should focus on diversity and inclusion within the board. Diverse perspectives lead to better decision-making and can enhance overall company performance. Finally, integrating sustainability and ethical considerations into governance processes can attract more investors. By prioritizing these strategies, private equity can create long-term value while reinforcing good corporate governance practices.

Corporate transparency is vital for fostering trust with stakeholders, particularly when private equity investments are involved. Investors are increasingly scrutinizing governance practices within portfolio companies. To address these expectations, private equity firms should implement comprehensive reporting frameworks. Regular reports can outline financial performance, governance changes, and progress on strategic initiatives. By keeping stakeholders informed, firms can mitigate risks and ensure compliance with regulations. Enhanced due diligence practices before acquisitions can identify governance gaps early. Additionally, establishing clear roles and responsibilities within management teams is essential. This can assist in preventing conflicts of interest and ensure effective oversight. Furthermore, aligning management incentives with long-term performance can boost accountability. Implementing clawback provisions can deter unethical behavior and reinforce ethical standards. Education programs for management and boards can cultivate a culture of governance. Workshops and training can elevate the understanding of governance principles among team members. Finally, creating a whistleblower policy can protect those who report misconduct, further strengthening governance standards within organizations. By prioritizing transparency, private equity can enhance institutional trust and drive sustainable growth.

Stakeholder Engagement and Accountability

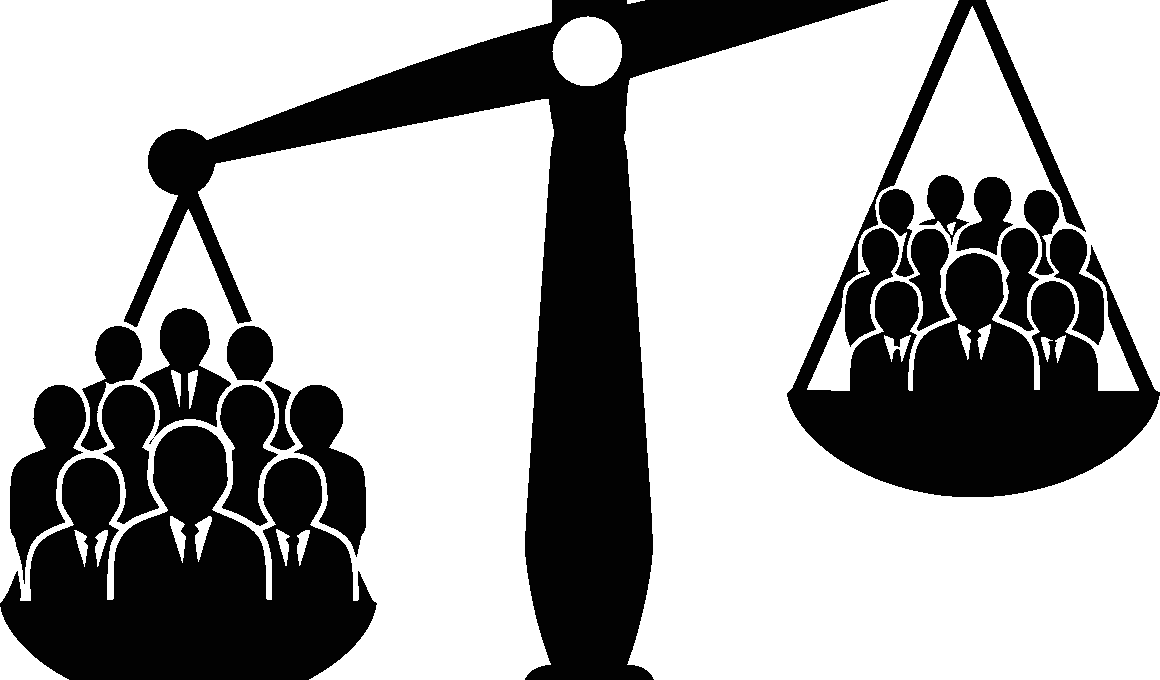

Engaging stakeholders is a powerful approach for enhancing corporate governance in private equity. This involves effectively communicating with investors, employees, clients, and the community. Regular interaction can foster a sense of ownership and enable stakeholder feedback in decision-making processes. Setting up advisory committees can provide valuable insights and encourage diverse perspectives in governance. Furthermore, accountability mechanisms need to be integrated within the governance framework. Implementing checks and balances eliminates potential biases during the decision-making process. Monitoring systems should also be in place to track compliance with governance policies. By establishing a culture of accountability, private equity firms can influence behaviors that align with organizational values. Transparent reporting practices elevate confidence among stakeholders, ensuring that they are informed about key decisions and financial performance. Additionally, fostering long-term relationships with stakeholders can promote sustainability within organizations. Firms that prioritize stakeholder interests are better equipped to identify opportunities and mitigate risks. Ultimately, a strategic approach to engagement can drive corporate governance success. It empowers stakeholders, leading to improved performance and value creation for all involved.

Integration of technology is increasingly significant in enhancing corporate governance within private equity. Modern tools can streamline communication, reporting, and oversight processes. Utilizing data analytics can facilitate deeper insights into governance practices and risk assessments. In addition, cloud-based platforms can enhance collaboration among directors and management teams, improving decision-making efficiency. Documenting board meetings using digital tools can ensure accuracy while facilitating transparency in governance. Moreover, technology enables real-time monitoring and reporting, fostering stakeholder trust. Adoption of digital portals for stakeholders allows for better visibility of governance structures and practices. Automation can simplify compliance with regulatory standards by providing timely alerts for necessary filings or changes. Cybersecurity measures also play a critical role in protecting sensitive data related to corporate governance. As private equity firms handle large amounts of information, investing in cybersecurity helps safeguard against breaches that could jeopardize governance integrity. Personal data regulations like GDPR necessitate robust data management strategies. In summary, technology serves as a catalyst for effective governance, providing tools to manage complexities and promote compliance while enhancing overall performance.

Risk Management and Ethical Practices

Managing risks is an essential element of enhancing corporate governance in private equity. Firms must actively identify, assess, and mitigate potential risks that could affect investments and shareholder value. Establishing a robust risk management framework is crucial in order to navigate uncertainties. This involves regular risk assessments that evaluate both operational and strategic risks. Integrating ethical practices within governance structures can also enhance resilience. Compliance training programs can equip employees with knowledge about ethical guidelines, reinforcing the importance of integrity in decision-making. Additionally, private equity firms should promote a culture of accountability where ethical concerns can be openly addressed. This facilitates timely corrections and strengthens governance. Implementing external audits can provide objective reviews of governance processes. Investors tend to favor firms that exhibit strong ethical standards, as this can contribute to long-term sustainability. Effective communication regarding risk management strategies can further instill confidence among stakeholders. Lastly, cultivating relationships with regulatory bodies can help firms remain abreast of compliance changes. By prioritizing risk management and ethical practices, private equity can enhance governance standards, ultimately driving better performance.

Performance measurement is integral to enhancing corporate governance in the private equity sector. Establishing clear financial and operational metrics aligned with governance objectives allows firms to gauge success accurately. These metrics should focus on short-term and long-term goals, including aspects such as profitability, market share, and sustainability initiatives. Regular performance reviews ensure that boards are informed about progress and can pivot strategies when necessary. Analysis of these metrics can reveal insights into governance efficiency and effectiveness. Incorporating stakeholder feedback into performance assessments can provide additional layers of understanding. Moreover, transparent communication of performance results to stakeholders fosters engagement and trust. Benchmarking against industry standards can highlight areas for improvement. Continuous learning and adaptation are vital in today’s dynamic business environment; therefore, firms should embrace innovative practices to enhance governance. Establishing mentorship programs for executive teams can promote best practices in governance. Finally, recognizing achievements in governance can motivate teams and reinforce a culture of excellence throughout the organization. By focusing on meaningful performance measurement, private equity firms can enhance governance frameworks and achieve sustainable results.

Conclusion on the Impact of Corporate Governance

Strong corporate governance practices in private equity are pivotal for driving sustainable growth and creating value. By prioritizing transparency, accountability, stakeholder engagement, technology integration, risk management, and performance evaluation, firms position themselves for long-term success. The dual emphasis on achieving financial returns along with social and governance responsibilities ensures that private equity investments remain attractive in a competitive landscape. As investors demand more robust governance practices, private equity firms must remain proactive in adapting strategies. Continuous dialogue with stakeholders, regular assessments, and the embrace of ethical practices create a resilient governance environment. Sustainable governance frameworks can enhance reputation, supporting effective fundraising efforts. Moreover, as market dynamics shift, firms must embrace flexibility to remain competitive. Investing in governance not only mitigates risks but also fosters innovation and adaptability. Ultimately, the interplay between corporate governance and private equity signifies a commitment to ethical leadership and sustainable growth. By enhancing governance structures, private equity can inspire greater confidence among investors and stakeholders while strengthening the foundations for long-term success. This holistic approach is not only beneficial for portfolio companies but also contributes positively to the overall economy.

This is a concluding paragraph reinforcing the importance of corporate governance strategies in private equity.