How to Set Up Your Account on a Trading Platform Successfully

Establishing an account on a trading platform is essential for successful trading. First, to begin this journey, choose a reputable trading platform that meets your needs. Conduct thorough research on various platforms to find one with favorable terms and conditions, user-friendly interfaces, and strong security measures. Investors often prefer platforms with access to a variety of financial products, such as stocks and forex. A little time spent doing this will save ample confusion later on. Another crucial step is gathering necessary documents, such as identification and proof of address. Most platforms require these to verify your identity as part of regulatory compliance processes. Ensuring that you have documents ready will facilitate smooth account creation. Additionally, examine the fees associated with the platform. Many platforms charge trading fees, and understanding how these will impact your trading strategy is vital. Ultimately, choosing the right platform and understanding all requirements will help establish a strong foundation for your trading activities. Navigating this process effectively can enhance your trading experience and foster success in your financial endeavors.

Once you have selected a trading platform, the next step involves creating your user account. This typically requires visiting the website of the chosen platform and locating a prominent “Sign Up” or “Register” button. Click this button to start the account creation process. Expect to fill out a registration form that requests personal information such as your name, email address, and contact number. Ensure that all entries are accurate, as mistakes may lead to account verification issues later. After submitting your registration form, check your email inbox for a confirmation link or a verification code. This step is vital, as it proves ownership of the email address provided and enables your account activation. When verifying your account, follow the instructions provided carefully, as each platform may vary slightly in their approach. After successfully activating your account, you should be able to log in to your new trading platform. Maintain the security of your login details by utilizing strong passwords and enabling two-factor authentication wherever possible. This additional security layer buffers against unauthorized access and trades.

Funding Your Trading Account

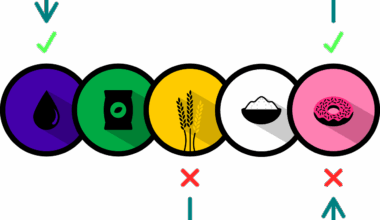

After your account is successfully set up, the next significant step is funding your trading account. Most trading platforms will provide multiple options for depositing funds. Common methods include bank transfers, credit/debit cards, and electronic wallets like PayPal or Neteller. Research each payment method thoroughly in terms of transaction fees and processing times. It is also essential to ensure that the chosen method aligns with your trading needs and habits. Once you’ve chosen your preferred payment method, navigate to the deposit section of your trading platform. Follow the on-screen instructions for entering your payment information and the amount you’d like to deposit. Some platforms may impose minimum deposit requirements, so be sure to check these before proceeding. Approach this step with consideration, as the funds you deposit will directly influence your trading capital and the types of trades you can engage in. Once you’ve completed the deposit process, check your account balance to confirm that the funds have been credited successfully and are available for trading activities as you move forward.

Next in the setup process is familiarizing yourself with the trading platform’s interface and tools. Upon logging into your account, take some time to explore the various features and functionalities available. Most platforms include user-friendly dashboards that present essential market data and trading tools. Familiarize yourself with these features, as they will be instrumental in executing trades efficiently. Pay particular attention to how to navigate charts, manage orders, and analyze market trends. Many platforms also offer educational resources, such as webinars or tutorials, which can help users become more adept at leveraging available tools. It is advisable to utilize these resources as they get accustomed to the platform. Additionally, consider practicing on a demo account, if available. This allows traders to execute trades without risking real money and helps in gaining valuable experience. By adequately understanding the platform’s features, you can develop strategies and execute trades with greater confidence and precision as you embark on your trading career. Your comfort level with the platform will directly impact your overall trading success.

Understanding Market Orders

Once you are comfortable with the trading platform, it’s essential to gain knowledge about different types of market orders. Market orders are the most common type of orders employed by traders. When placing a market order, you buy or sell a financial instrument immediately at the current market price. Understanding the nuances of different order types is crucial, as each holds its significance in trading strategies. In contrast, a limit order allows traders to specify the price at which they wish to buy or sell an asset. It only executes when the desired price is reached, offering greater control over trade executions. Stop-loss orders are essential for risk management, automatically selling an asset at a predetermined price to limit potential losses. Familiarizing yourself with these various orders can significantly enhance your trading precision and efficiency. This knowledge also helps in implementing robust trading strategies tailored to your financial goals. Engage with educational materials and practice these order types through demo accounts to enhance your skills effectively.

Once you understand market orders, it is crucial to develop a trading strategy that aligns with your investment goals. Each trader’s strategy may vary based on individual preferences, risk tolerance, and time commitment. Identify your specific trading objectives, whether they concern short-term profits or long-term investments. Research different trading strategies, such as day trading, swing trading, or position trading, and determine which aligns with your lifestyle. Additionally, consider diversifying your trading portfolio by incorporating various asset classes, such as stocks, bonds, and commodities. Diversification can help manage risk effectively and improve the overall performance of your investments. Assessing your performance regularly and making adjustments as needed will further refine your approach. Tools like analytics software may also assist in tracking trading results and spotting trends. Remember that successful trading eliminates emotional decisions; instead, it relies on tested strategies and data. Make informed decisions based on research and analysis to enhance your trading success as you advance. Your commitment to continuous education will also pave the way for long-term success.

Regularly Reviewing Your Trading Account

Finally, maintaining an active approach to reviewing your trading account and strategies is essential for ongoing success. Markets are ever-changing, and remaining informed about market dynamics helps traders stay competitive. Schedule regular reviews of your trading account to evaluate performance, analyze your gains and losses, and identify areas for improvement. This active engagement compels continual learning and adaptation to market conditions. Many platforms offer analytical tools that can facilitate this process, allowing traders to assess patterns and strategies effectively. Make sure to utilize these resources to enhance your understanding of your trading style. Additionally, engaging with online communities or forums allows for exchanging ideas and strategies with other traders. This networking can yield fresh perspectives and insights, contributing to personal growth. Furthermore, remain updated on market news, trends, and economic indicators that may affect your trading performance. Continual learning, networking, and analysis will empower you to make informed strategic decisions and adapt your plans accordingly. Ultimately, a commitment to consistent review sets successful traders apart in navigating financial markets and achieving long-term success.