Private Equity Trends in Emerging Markets: Risks and Rewards

Private equity investments in emerging markets have seen a significant rise in recent years, driven by numerous factors. This surge presents a unique opportunity for investors looking to diversify their portfolios. As economies in regions such as Asia, Africa, and Latin America continue to grow, private equity firms are becoming increasingly interested in tapping into these dynamic markets. These investments not only promise high returns but also allow firms to contribute to the development of industries and infrastructures. However, potential investors should approach with caution due to various risks associated with operating in these environments, such as political instability and regulatory unpredictability. To mitigate these risks, thorough due diligence is crucial. Investors must conduct extensive market research, engage with local experts, and consider partnering with established regional firms. Understanding local cultures and business practices can significantly enhance success rates in these regions. Furthermore, investors should develop a clear exit strategy to maximize potential gains. In summary, while private equity in emerging markets offers substantial rewards, the accompanying risks necessitate a strategic approach that balances profitability with prudence.

One of the critical aspects influencing private equity in emerging markets is the regulatory environment. Many countries in these regions have been working towards improving their business climate by enacting investment-friendly policies. These burgeoning regulations can create significant incentives for private equity firms to enter markets previously deemed too risky. Transparency and stability are essential for attracting foreign capital, and governments are increasingly aware of this factor. By establishing more robust regulatory frameworks, countries can entice investors looking for opportunities in growth sectors such as technology, healthcare, and renewable energy. Nevertheless, it is essential to recognize that changes in government policy can lead to uncertainty. Investors need to stay informed about any shifts or proposed changes that might affect their investments. Collaborating with local legal experts can provide insights into emerging laws and regulations. Moreover, constant engagement with government bodies can benefit private equity firms by allowing them to influence policies beneficial to their operations. Overall, understanding the regulatory landscape is fundamental to successfully navigating the complexities of private equity deals in these developing markets.

The Role of Technology in Private Equity

Emerging markets are experiencing technological advancements, which significantly impact private equity investments. The rapid growth of technology-driven companies is reshaping industries across various sectors. For private equity firms, this environment offers the chance to invest in innovative startups and established companies that leverage technology for expansion. These investments can lead to high returns, given the younger demographics in emerging markets who are quick to adopt new technologies. Despite the attractive opportunities, investors should conduct rigorous assessments of a company’s technological infrastructure, competitive landscape, and scalability potential. Evaluating these factors is crucial to forecasting future growth trajectories accurately. Additionally, private equity firms must consider potential disruptions brought by technological advancements and adapt their investment strategies accordingly. Building strong partnerships with tech-centric firms can enhance market position and generate synergies. By incorporating an understanding of technology into their investment processes, private equity players can not only seize exciting opportunities but also mitigate risks associated with market volatility. As technology continues to evolve, its significance in shaping private equity outcomes in emerging markets cannot be overstated.

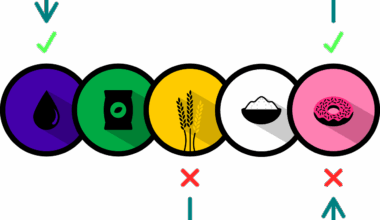

Another vital trend in private equity within emerging markets involves sustainability and socially responsible investing. Investors increasingly seek out businesses that prioritize environmental, social, and governance (ESG) factors. This growing focus on sustainability aligns with the broader global movement towards responsible investment practices. Emerging markets, blessed with abundant natural resources, present unique opportunities to promote sustainable practices while achieving financial gains. Investors in these markets can leverage their capital to encourage clean technology solutions, renewable energy projects, and sustainable agriculture initiatives. Moreover, the rise of conscious consumerism in these regions is pushing companies to adopt more sustainable practices, thus increasing their long-term viability. Private equity firms can enhance their reputation and attract more investments by demonstrating a commitment to social responsibility. Additionally, companies that embrace ESG factors tend to perform better, both financially and reputationally, in the long run. This dual focus on financial returns and positive societal impact can significantly differentiate a firm in a competitive landscape, making ESG-driven investments a strategic priority for private equity players in emerging markets moving forward.

Challenges and Risks in Emerging Markets

While the potential rewards of private equity investments in emerging markets are significant, it is vital to remain mindful of the substantial challenges and risks involved. Political instability, currency fluctuations, and inadequate infrastructure can pose serious threats to investment returns. Furthermore, the lack of transparent financial reporting practices in some regions can lead to unexpected surprises post-investment. To navigate these challenges effectively, private equity firms must adopt a comprehensive risk management approach. This includes diversifying their investments across multiple sectors to offset potential losses in one area. Conducting thorough due diligence is paramount in identifying potential red flags while assessing any opportunities. Another critical consideration is operational risk; investors should evaluate management teams and their capabilities, ensuring they have a solid track record of driving growth. Engaging local partners can help navigate complex regulatory environments and understand cultural differences impacting business operations. By embracing a proactive and informed approach, private equity investors can successfully mitigate many risks associated with emerging markets while tapping into the exciting potential these regions hold.

The competitive landscape of private equity in emerging markets is characterized by a mix of local and global players. Increasing competition has resulted in innovative strategies aimed at capturing market opportunities. Local firms often possess valuable knowledge about regional market dynamics and establish networks that can lead to successful investments. On the other hand, international firms bring capital, global expertise, and refined strategies. Collaborations between local and global private equity firms can create a synergy that benefits both parties, enabling them to harness unique strengths. Moreover, these partnerships can allow for shared resources, knowledge transfer, and improved access to markets, ultimately enhancing the chances of success. However, establishing effective partnerships requires trust and clear communication, as both parties seek to align their interests. In this competitive environment, private equity firms must continuously adapt their strategies to stay ahead. Understanding key trends, monitoring competitors, and embracing innovation are crucial in maintaining a competitive edge. As emerging markets evolve and become more sophisticated, private equity investors must remain agile to navigate the shifting landscape and capitalize on these exciting opportunities.

Conclusion: Navigating Private Equity in Emerging Markets

In conclusion, private equity investments in emerging markets present a wealth of opportunities along with inherent risks. Investors should approach these markets with a balanced perspective, embracing both the potential for high returns and the necessity of strategic risk management. Market research, regulatory awareness, and partnerships with local firms are crucial elements for success in these regions. Moreover, adapting to technological advancements and embracing sustainability will enhance investment performance. The journey of navigating private equity in emerging markets will require diligence, adaptability, and innovation. By recognizing and implementing these strategies, investors can maximize their potential and contribute positively to the development of emerging economies. As these markets continue to evolve, staying informed and engaged will be vital for sustained success. Private equity firms that can navigate these complexities while maintaining a clear focus on their investment goals will undoubtedly reap the rewards that these unique markets have to offer. In an ever-changing global environment, the future of private equity in emerging markets looks promising and full of potential, fostering growth and innovation in a connected world.

With the right strategies and insights, private equity in emerging markets can not only yield significant financial returns but also drive meaningful change.