The Growth of Peer-to-Peer Lending in Emerging Markets

Peer-to-peer (P2P) lending is rapidly transforming the financial landscape, especially in emerging markets. Traditional banking institutions often overlook vast segments of the population, creating a significant opportunity for alternative financial solutions. P2P lending platforms offer a seamless alternative, enabling individuals to lend and borrow without traditional intermediaries. This approach democratizes access to capital by leveraging technology to connect borrowers directly with investors. By reducing overhead costs, these platforms can provide loans at competitive interest rates. Furthermore, the online nature of such platforms enhances transparency and reduces the time typically required to process loans. The rise of mobile technology in developing regions further facilitates this trend, enabling borrowers to access funds using their smartphones. As more people become digitally savvy, awareness of P2P platforms grows. These changes encourage financial literacy and promote an entrepreneurial spirit among the population. However, for the sector to thrive, adequate regulatory frameworks must be established. Policymakers must embrace innovation while ensuring consumer protection to build trust. This balance is crucial for sustainable growth in the P2P lending landscape in emerging markets.

Challenges and Opportunities in P2P Lending

While the potential of P2P lending is immense in emerging markets, numerous challenges require attention. One significant issue is the lack of regulatory clarity, which hampers the growth of these platforms. Many governments are yet to develop policies that effectively regulate and oversee P2P lending activities. This uncertainty can deter potential investors, stifling growth opportunities. Additionally, the absence of credit scoring systems in many developing regions poses another challenge. Traditional metrics may not be applicable, leading to risky lending practices and higher default rates. To counteract these problems, P2P platforms are exploring innovative credit assessment methods. Utilizing alternative data sources, such as payment history and social media activity, can improve credit evaluations. Moreover, consumer education remains paramount. Many individuals in emerging markets lack familiarity with financial products, resulting in misunderstanding. Consequently, P2P platforms must invest in educational initiatives aimed at increasing financial literacy. This investment will foster trust and encourage broader adoption of P2P lending services. Despite these challenges, the potential rewards for both lenders and borrowers in emerging markets present a compelling case for sustained development in this sector.

The impact of P2P lending on economic growth in emerging markets provides an intriguing perspective on its importance. By facilitating access to loans, P2P platforms empower individuals to start new businesses or expand existing ones. This entrepreneurial drive can significantly boost local economies, creating jobs and fostering innovation. As borrowers successfully repay loans, they also create a positive feedback loop, enhancing the creditworthiness of individuals within their communities. Furthermore, this process can contribute to community development through improved standards of living. Financial inclusion, promoted via P2P lending, ensures that diverse segments of the population benefit from economic opportunities. This inclusion is particularly crucial for marginalized groups, such as women and low-income households, who often face barriers in accessing traditional financing options. Moreover, the growth of this sector can spark competition among financial institutions, encouraging them to improve their services to retain customers. The technological advancements pioneered by P2P platforms can also inspire conventional banks to innovate. In summary, P2P lending serves as a catalyst for economic growth, promoting entrepreneurship and fostering more inclusive financial ecosystems in emerging markets.

The Role of Technology in P2P Lending

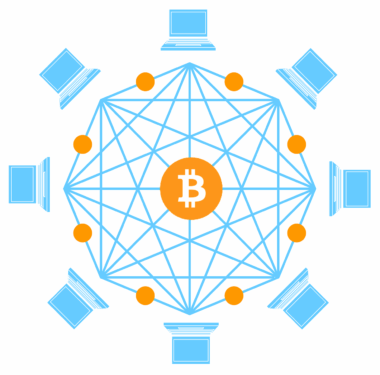

Technology plays a pivotal role in the success of P2P lending platforms, particularly in emerging markets. These platforms rely on sophisticated algorithms and big data analytics to facilitate the lending process, ensuring rapid decision-making. Advanced technologies allow for real-time evaluation of borrowers’ creditworthiness, significantly streamlining the loan approval process. Furthermore, mobile applications have revolutionized user experience by enabling borrowers to access funds quickly and easily. This innovation has made P2P lending more appealing to users accustomed to convenience and speed. Additionally, blockchain technology is emerging as a potential game-changer for P2P lending platforms. By enhancing security and transparency, blockchain can help minimize fraud risks and provide an immutable record of transactions. It also offers the potential for smart contracts, which can automate various lending processes and ensure compliance with terms. Consequently, the integration of blockchain could result in lower operational costs, thereby benefiting both borrowers and lenders. As these technologies continue to evolve, they will undoubtedly enhance the efficacy and attractiveness of P2P lending, solidifying its position in the financial ecosystem of emerging markets.

To fully realize the benefits of P2P lending in emerging markets, collaboration between stakeholders is imperative. Key players, including technology providers, regulatory bodies, and lending platforms, must work together to address existing challenges while promoting sustainable growth. Public-private partnerships can enhance the development of infrastructure needed for effective P2P lending operations. Moreover, knowledge sharing between established players and emerging platforms can encourage best practices and facilitate learning. Workshops and forums focused on P2P lending can serve as excellent platforms for stakeholders to engage, exchanging ideas on innovation and consumer protection. Additionally, financial institutions can collaborate with P2P platforms to create hybrid models that combine traditional lending practices with innovative approaches. This collaboration can broaden the reach of financial services and improve customer experiences. Consequently, all involved entities must prioritize collaboration to create a supportive ecosystem that drives growth. Furthermore, it is essential to advocate for stronger regulatory frameworks that provide adequate safeguards without stifling innovation. By fostering cooperation and understanding across various sectors, P2P lending in emerging markets can gain momentum and sustainably thrive.

Future Trends in P2P Lending

The future of P2P lending holds immense promise for emerging markets, characterized by several key trends. One notable trend is the increasing adoption of artificial intelligence (AI) in loan evaluation and risk assessment. AI technology can analyze vast amounts of data to predict the likelihood of repayment success, thereby minimizing the risk to investors. Furthermore, as users become more financially literate, demand for P2P lending will likely continue to grow. This increased awareness will spur innovation among platforms striving to differentiate themselves through unique products and services. Additionally, environmental sustainability will become a significant factor in borrowing and lending decisions. Investors are increasingly seeking to support environmentally conscious projects, which can lead to the emergence of green P2P lending initiatives. These initiatives could provide funding for solar energy projects, eco-friendly businesses, and more. Moreover, the ongoing global pandemic has accelerated digital transformation, further embedding online financial solutions in daily life. As remote transactions become normalized, the potential for P2P lending in emerging markets will expand, paving the way for sustainable financial ecosystems that are accessible and inclusive.

In conclusion, the growth of P2P lending in emerging markets presents exciting opportunities and challenges. As financial technology continues to evolve, P2P lending stands as a vital solution for addressing the financing gap left by traditional banks. It promotes economic development, encourages entrepreneurship, and enhances financial inclusion. However, for P2P lending to reach its full potential, regulatory clarity and consumer education are crucial. Stakeholder collaboration will also play a pivotal role in ensuring the long-term success of the industry. Embracing new technologies and adapting to changing market demands will be essential for platforms operating in this dynamic sector. The future trend towards sustainable lending practices reinforces the need for conscientious investment decisions that support social and environmental goals. Overall, the potential of P2P lending can be fully realized by building trust among borrowers, lenders, and regulators. By fostering an environment conducive to growth, the P2P lending ecosystem in emerging markets can thrive and transform lives, providing individuals with the capital they need to achieve their aspirations.

Case Studies and Real-World Examples

When exploring the growth of P2P lending in emerging markets, various case studies illustrate its impact. In India, several successful P2P lending platforms have emerged, such as Faircent and LenDenClub. These platforms have enabled millions of borrowers to access necessary funds for education, healthcare, and business ventures. By connecting borrowers with individual investors, these platforms reduce transaction costs significantly compared to traditional lending institutions. Similarly, in Kenya, platforms like Pezesha and Tujijenge have gained traction, empowering small businesses and entrepreneurs to secure loans. Tujijenge, for instance, uses group lending models that promote accountability and support within borrower networks. These case studies highlight the potential of P2P lending to address pressing financial needs while fostering community support. Moreover, they demonstrate the significant social impact that can stem from creating access to financing. As a result, more individuals can rise above economic challenges, contributing to local economies. By sharing such successful examples, P2P lending can inspire the establishment of similar models across various emerging markets, encouraging innovation and collaboration.