Impact of Interest Rate Differentials on Currency Valuations

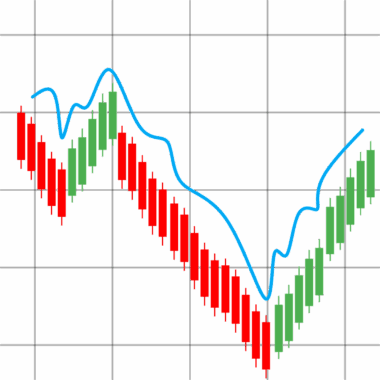

Interest rates significantly influence currency valuations, profoundly affecting the foreign exchange market. The interest rate differential between two countries is a critical factor for investors and traders. When a country raises its interest rates, it typically attracts foreign capital, leading to an appreciation of its currency. Conversely, lower interest rates may drive away investment, resulting in depreciation. Besides the immediate market reactions, these decisions signal economic stability and growth prospects. Hence, understanding how interest rates affect currency valuation helps traders make informed decisions. Traders utilize this information to devise strategies for entering or exiting positions in the forex market. The relationship between interest rates and currency values is particularly seen during economic cycles. Furthermore, when assessing potential trades, it is vital to analyze not just current rates, but also the projections of future movements. Market speculation often drives short-term fluctuations in currency prices. Additionally, central banks play a crucial role in shaping these rates. They aim to balance inflation and economic growth while influencing currency valuations indirectly through monetary policy signals. This delicate balance underscores the importance of interest rates in foreign exchange strategies.

One of the fundamental concepts in forex is the carry trade, which capitalizes on interest rate differentials. This strategy involves borrowing in a currency with a low-interest rate and investing in one with a higher rate. For instance, if the Canadian dollar offers higher returns than the Japanese yen, traders may opt for this approach. However, participants in this market need to be aware of the risks. Changes in interest rates can lead to sudden shifts in currency valuations, impacting the profitability of these trades. Traders are particularly cautious during announcements from central banks, as unexpected moves can lead to volatility. Additionally, geopolitical factors must be considered, as they may influence interest rate expectations. The dynamics of global currencies are intricate, closely linked with economic indicators, inflation rates, and political climates. Understanding this relationship is crucial for those engaged in foreign exchange. A failure to grasp these concepts may result in unwise trading choices. Thus, continuous education on interest rate trends and currency movements is vital for all forex participants. With various online platforms providing real-time data, traders are better equipped to make informed decisions.

The Role of Central Banks in Currency Valuation

Central banks directly influence national currency values through monetary policies, including interest rate decisions. They operate under mandates to maintain economic stability while supporting growth. When a central bank increases interest rates, it usually strengthens the local currency as higher yields attract foreign investment. This was evident when the U.S. Federal Reserve opted for several rate hikes during economic recovery periods, boosting the dollar’s value. Conversely, when facing economic downturns, lowering rates can lead to depreciation. Moreover, central banks also communicate their policy directions clearly, known as forward guidance, impacting market expectations. This guidance is essential because traders react not only to current rates but also to anticipated future adjustments. As a result, a central bank’s credibility can affect the foreign exchange market significantly. Traders often analyze central bank reports and economic indicators to forecast potential currency movements. Additionally, interventions—when central banks directly buy or sell their own currency—can stabilize extreme fluctuations. Such actions underscore the inherent complexities of monetary policy and interest rates in determining currency valuations. Indeed, the delicate interplay between policy decisions and market reactions shapes the landscape of foreign exchange.

Economic factors play a substantial role in forex market dynamics, particularly in relation to interest rate differentials. Indicators such as GDP growth, inflation, and unemployment rates yield insights into a country’s economic health. When a nation’s economy exhibits strength, central banks are inclined to increase interest rates, leading to currency appreciation. For example, a country experiencing robust job growth may prompt central banks to raise rates to curb potential inflation. Consequently, the currency’s value rises against others with lower rates. Conversely, high inflation can lead to higher interest rates, influencing demand for the currency. It’s essential for traders to analyze these indicators comprehensively. Additionally, external influences, including changes in global markets, commodities, and trade agreements, shape currency valuations. Unforeseen events, like natural disasters or political turmoil, can result in rapid shifts in interest rates, causing significant market reactions. Thus, traders must continuously stay informed on geopolitical events and macroeconomic indicators. Market sentiment often influences trading behavior, making it crucial to gauge investor confidence. By closely monitoring these factors, traders can better predict potential currency movements and inform their trading strategies effectively.

Interest Rates and Global Economic Trends

The interconnectedness of global economies means that interest rate changes in one country can affect others. For instance, if the European Central Bank raises interest rates while the Bank of Japan maintains lower rates, capital may flow into Europe from Japan. Consequently, this inflow could strengthen the euro while weakening the yen. Such scenarios highlight the ripple effects of monetary policy across borders. Additionally, traders must consider the international economic environment when formulating their strategies. Globalization and technological advancements lead to rapid information dissemination, causing immediate market reactions to rate changes. Moreover, during economic crises, countries may resort to unconventional monetary policies, such as quantitative easing, influencing interest rates and currency valuations. The impact of these strategies is profound, leading to prolonged effects on currency strength and stability. Understanding such trends is essential for successful forex trading. Traders must accurately assess how developments in one region might influence currency pairs involving other currencies. As a result, diversification of trading strategies can be beneficial, allowing traders to hedge against unexpected fluctuations in the market. Adapting to these trends will be critical for navigating the complexities of global forex markets.

Risk management remains one of the cornerstones of successful trading in the forex market, especially in light of interest rate differentials. The unpredictability associated with currency movements necessitates that traders employ robust risk management strategies. Positions can rapidly swing due to economic reports or central bank decisions. Thus, approaches such as stop-loss orders and position sizing become essential tools for forex traders. Moreover, understanding one’s risk tolerance is vital. Each trader must assess their financial capacity to withstand losses, adjusting their strategies accordingly. Furthermore, portfolio diversification can mitigate risks associated with market volatility. Traders should not depend solely on interest rates but also factor in various economic indicators and personal investment goals. Emotional discipline is critical in this highly volatile terrain. Significant market moves in response to interest rate changes can provoke impulsive decisions, which can be detrimental. By adhering to a predetermined trading plan, traders can maintain clarity when making decisions. Additionally, regular evaluations of trading performance and strategies enhance learning processes and long-term success. Therefore, a systematic approach to risk management can substantially increase the chances of sustained profitability.

Future Outlook for Forex Markets

The future landscape of forex markets remains uncertain but is deeply influenced by global economic trends and interest rate differentials. However, as economies recover from downturns, rate adjustments are expected to become more common. Traders will need to be vigilant, adapting swiftly to changing monetary policies. Furthermore, misconceptions about interest rates should be addressed; they are not standalone indicators but rather linked with broader economic conditions. Additionally, shifts in technology, such as algorithmic trading, impact how traders react to changes in interest rates. Such technologies provide traders with tools to analyze data faster and execute trades based on real-time information. Markets will continue being shaped by not only central bank actions but also by overarching geopolitical considerations. Trade relations, supply chain issues, and other factors contribute to currency valuation complexities. Consequently, traders must remain adaptable to improve their strategies. Continuous education about market dynamics and interest rate impacts will empower them to navigate the evolving forex landscape. In conclusion, understanding interest rate differentials and their effects on currency valuations is crucial for traders in achieving sustained success within the volatile forex market.

In summary, the interplay between interest rate differentials and currency valuations remains a vital aspect of forex trading. This dynamic relationship profoundly impacts investment decisions and market strategies. As interest rates fluctuate, their influence extends beyond immediate currency valuations, affecting economic perceptions globally. Traders must meticulously analyze and interpret these shifts while factoring in economic indicators and central bank actions. By comprehensively understanding these elements, forex participants can make informed decisions amid the complexities of the market. Monitoring global economic trends and geopolitical events will continue shaping currency valuations significantly. Moreover, the integration of technology into trading practices will enhance traders’ capabilities to respond to market changes quickly. As central banks adjust their policies in response to economic developments, traders must evolve their strategies accordingly. The future of the forex market promises both challenges and opportunities. An adaptive approach to trading will be essential for navigating these complexities effectively. As traders remain committed to learning and improving their strategies, the understanding of interest rate differentials and economic fundamentals will provide a solid foundation for success in this competitive arena.