Estate Planning Tools: Safeguard Your Assets Efficiently

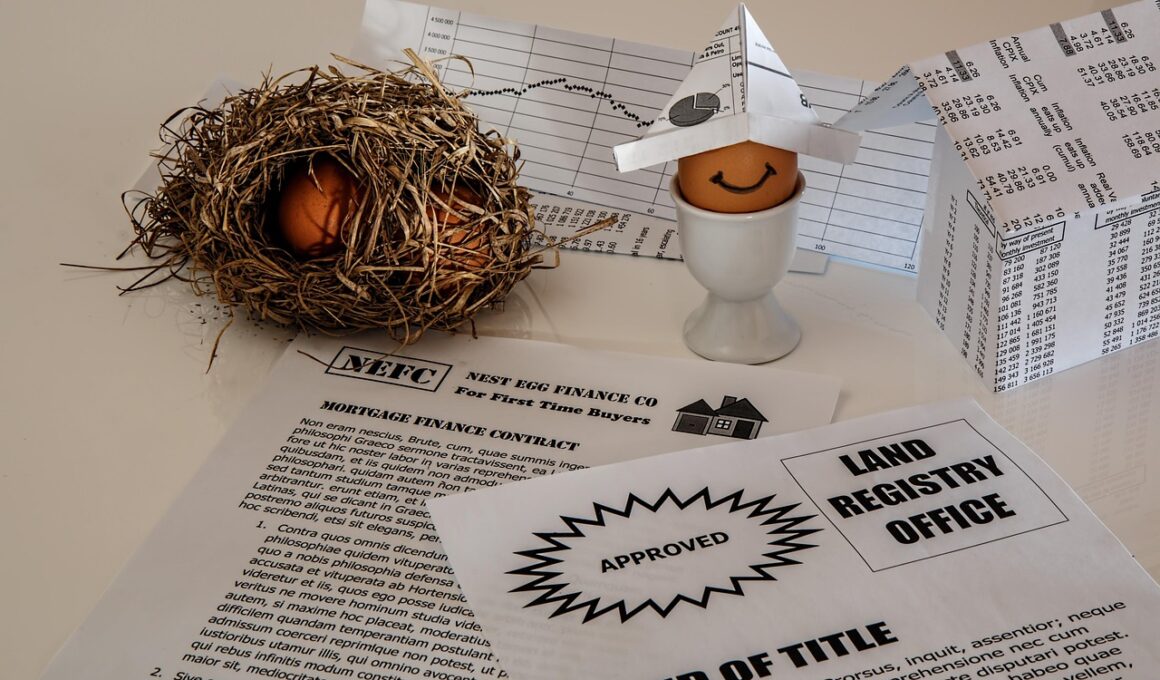

Estate planning plays a crucial role in shaping the financial future of individuals and their families. It involves the management of a person’s asset base in the event of incapacitation or death. The estate plan typically includes directives for how assets should be distributed among heirs or beneficiaries after one’s passing. As part of this planning process, several essential tools can help manage and protect these assets effectively. A well-structured plan ensures that your wishes are respected while minimizing taxes and avoiding the lengthy probate process. Crafting these documents might seem daunting, but utilizing estate planning tools streamlines the process. These tools help eliminate potential conflicts among heirs and can safeguard assets for future generations. In addition, several online platforms exist that simplify this process. These services often provide templates, guidance, and even legal advice to ensure proper completion of your estate documents. Understanding these tools can significantly enhance your estate planning and provide peace of mind knowing your assets will be handled according to your wishes. Investing time in understanding and utilizing these tools is a critical step in securing your family’s financial future.

One important aspect to consider in estate planning is the creation of a will. A will is a legal document that expresses your final wishes regarding the distribution of property and assets. It serves as a foundational element in an estate plan and should be crafted thoughtfully. Without a will, state law determines how your assets will be distributed, which may not align with your wishes. With proper tools, setting up a will becomes straightforward and accessible. Many online services allow you to create a will quickly, often featuring user-friendly interfaces and helpful FAQs. Another vital estate planning tool is the living trust, which helps avoid probate. This tool allows you to manage your assets while you’re alive and designates how they should be handled upon your death. The primary advantage of a living trust over a will is the bypassing of probate, thus saving time and money. Moreover, a living trust can provide privacy, as it doesn’t become part of public record. Regardless of which tools you choose, obtaining professional advice remains beneficial for ensuring compliance with laws and regulations.

Power of attorney (POA) is another significant tool in estate planning that grants someone else the authority to manage your affairs if you become incapacitated. Designating a trusted individual as your agent can help streamline your financial and medical decisions during difficult times. A durable power of attorney specifically remains valid even if you lose mental capacity. This document can include various powers, such as selling property, managing bank accounts, and authorizing medical decisions. Selecting the right person for this role is vital, as they will have significant control over your financial and personal matters. Regularly reviewing and updating your power of attorney ensures that your chosen agent aligns with your current wishes. Alongside appointing a POA, establishing a healthcare directive is essential. This document details your preferences for medical treatment when you can’t communicate your wishes. Healthcare directives vary by state but typically allow you to outline the types of medical interventions you wish to receive or decline. Together, these tools provide a comprehensive strategy for managing your health and finances in unforeseen circumstances, offering you peace of mind.

Beneficiary Designations and Asset Distribution

In addition to wills and trusts, understanding beneficiary designations is essential for effective estate planning. Financial accounts such as life insurance policies, retirement plans, and bank accounts often allow account holders to name beneficiaries who will receive assets directly upon their death. This method bypasses the probate process, enabling heirs to access funds quickly. Regularly reviewing beneficiary designations is crucial to ensure your wishes remain adequately represented. Life changes such as marriage, divorce, or the birth of a child may necessitate updates to these designations. Furthermore, naming contingent beneficiaries adds an extra layer of security, ensuring that your assets go to your selected heirs even if your primary beneficiaries are unavailable at the time of your passing. Adequate asset distribution planning minimizes disputes among heirs and can significantly reduce tax liability. Engaging a financial planner or attorney to evaluate your estate can help identify potential tax implications and offer strategies to mitigate them efficiently. Choosing the right planning tools makes a difference in ensuring your family’s financial well-being and ultimately achieving a positive legacy.

Tax implications are an important consideration in any estate planning process. Estate taxes can significantly reduce the value inherited by your beneficiaries, highlighting the importance of strategic planning. Understanding the current tax laws and regulations can help you devise a strategy that minimizes the overall tax burden. Various estate planning tools and methods can be adopted to reduce potential taxes, such as gifting assets during your lifetime or establishing charitable trusts. These tools allow you to gift portions of your estate to heirs while potentially reducing estate taxes. Additionally, irrevocable trusts can efficiently shield assets from taxation while providing income for beneficiaries. Working with estate planning professionals and tax advisors enables you to navigate the complexities of tax codes effectively. They provide tailored strategies focused on your unique financial situation and family dynamics. Keeping abreast of legislative changes and evolving tax laws further reinforces the importance of periodic reviews and updates to your estate plan. Overall, an effective estate planning approach ensures that your financial legacy continues in accordance with your wishes, simultaneously protecting your family and minimizing tax liabilities.

Another valuable estate planning tool is life insurance, which plays a multifaceted role. Life insurance provides immediate financial support to beneficiaries and helps cover expenses related to funerals and estate taxes. Selecting the right type of policy, such as term or whole life, is crucial to align it with your financial goals. Whole life insurance accumulates cash value over time, offering a borrowing option for policyholders while they’re still alive. Alternatively, term life insurance offers lower premiums for specific time periods, thus protecting your family during crucial financial stages. Furthermore, establishing irrevocable life insurance trusts can provide significant benefits by removing the policy’s death benefit from your taxable estate. This strategy helps to preserve more of your assets for your heirs. Additionally, life insurance can provide liquidity to pay debts and keep your estate intact. The key is comprehensive planning, ensuring that the life insurance policy aligns with overall objectives while addressing potential financial hurdles your beneficiaries might face. By utilizing life insurance effectively, you enhance your estate plan and provide essential financial support to your loved ones.

Final Thoughts on Estate Planning Tools

Estate planning involves a combination of various tools designed to protect your assets while ensuring your wishes are honored after you pass away. Engaging in a thoughtful and thorough planning process is imperative for long-term peace of mind and financial security for your loved ones. Each tool discussed has a distinct purpose, contributing to a comprehensive estate plan that reflects your needs and desires. From simple wills to complex trusts and designations, incorporating these tools provides versatility and clarity in the management of your estate. Regularly reviewing and updating your estate plan is essential, as life changes frequently necessitate adjustments. Professional guidance is invaluable, ensuring compliance with changing laws and helping you optimize your strategy for asset protection. Remember that the primary goal of estate planning is to create a secure financial future for your family, and the right tools enable you to achieve this effectively. Conveying your desires without ambiguity helps simplify the process for your loved ones, leaving them one step closer to achieving a legacy. Ultimately, proactively addressing estate planning leads to a well-structured financial future for you and your heirs.

In conclusion, estate planning tools are vital for managing your assets and ensuring that your wishes are followed after your death. The journey through financial planning requires careful consideration and a proactive approach. Identifying and understanding various tools available empowers you to create a personalized estate plan aligning with your values and objectives. Whether utilizing wills, trusts, powers of attorney, or life insurance policies, each serves a unique purpose in the bigger picture. Start by assessing your financial landscape and determining which tools would best suit your needs most effectively. Moreover, make a habit of revisiting your estate plan regularly to adjust it according to life changes or financial shifts. In turn, this ensures that your estate planning remains relevant, adapting to present conditions and your family dynamics. The peace of mind that comes from knowing your loved ones will be taken care of is invaluable. By actively engaging in this process, you not only safeguard your assets but also provide a lasting impact that continues beyond your lifetime. Take charge of your future today, and implement the necessary estate planning tools to protect what matters most.