Aligning Financial Returns with Social Impact in Private Equity

Impact investing in private equity effectively combines financial performance with measurable social or environmental benefits. Investors seek to not only generate traditional returns but also create positive impacts across various sectors. This investment approach aims at addressing societal issues, such as healthcare access, education, and environmental sustainability. By adopting a comprehensive strategy, firms can align their interests with those of communities and other stakeholders. Investing in companies prioritizing social objectives helps create competitive financial returns while contributing to global solutions. Institutional investors are increasingly focusing on Environmental, Social, and Governance (ESG) factors while assessing potential investments. Private equity firms are adopting strategies that evaluate social performance alongside financial returns, leading to broader acceptance of impact investing. Additionally, the rise of socially responsible investment funds emphasizes this trend. Investors recognize that sustainable practices can drive long-term profitability and resilience. Consequently, the private equity landscape is shifting towards integrating impact considerations into the investment lifecycle. As a result, alignment of fiscal goals with social purpose is achievable, fostering an ecosystem where both investors and society benefit simultaneously, creating a more inclusive and sustainable economy.

Private equity’s evolution involves determined efforts to measure impact accurately. A clear framework is essential for assessing the social value generated by investments. By implementing comprehensive impact measurement systems, firms can quantify their contributions to society while evaluating financial success. Key performance indicators (KPIs) are essential tools for tracking progress in achieving desired outcomes. These indicators enable stakeholders to analyze whether investments are yielding the intended positive effects. In addition, reporting practices play a critical role in transparency and accountability, enhancing investors’ understanding of how their capital is making a difference. Monitoring impact helps investors identify successful business models and further strategic alignment with their financial goals. Moreover, engaging with the communities affected by investments is vital to understanding their specific needs and tailoring strategies effectively. Active stakeholder involvement provides valuable insights into potential improvements and fosters stronger relationships. Ultimately, the effectiveness of impact investing in private equity hinges on the commitment to responsible practices, transparency, and an understanding of local contexts. This approach ensures enduring positive change while achieving the competitive returns expected by investors in a rapidly evolving market.

Challenges in Impact Investing

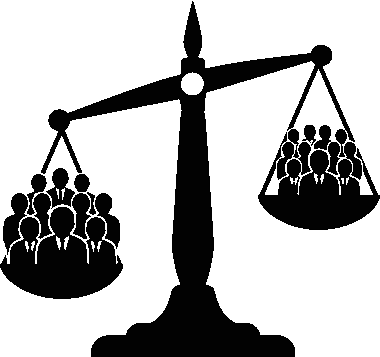

Despite the positive outlook for impact investing, several challenges persist that require thoughtful navigation. One primary challenge is the perception that social and financial goals are inherently contradictory; many stakeholders question whether achieving both is feasible. Investors often fear sacrificing returns for social impact. Overcoming this misconception is crucial to promoting the effectiveness of impact investments in private equity. Additionally, fewer established investment success stories may contribute to hesitation among potential investors. Limited awareness of evidence demonstrating the value addition of social impact within business models may hinder broader acceptance. Moreover, managing trade-offs between financial and social objectives can complicate decision-making processes for private equity firms. Striking the perfect balance becomes essential for sustaining commitment to both impact and returns. Furthermore, insufficient standardized metrics can obscure the measurement of social outcomes, making it challenging to assess the effectiveness of impact strategies. Consequently, there is a need for the industry to create reliable standards that facilitate comparability, enhance data transparency, and improve overall confidence in impact investing. Ultimately, addressing these hurdles enables the realization of significant potential within the realm of private equity impact investing.

Another challenge within this landscape is the limited availability of capital targeting traditional private equity returns while ensuring measurable social benefits. Investors may struggle to find suitable opportunities that genuinely align with their values and financial expectations. Consequently, more resources must be directed toward developing funds focused on sectors aimed at generating social change. Private equity firms must explore innovative financing models that foster this alignment, attracting diverse pools of capital. Collaborative efforts among investors, philanthropists, and public entities have the potential to unlock new funding streams while driving sustainable returns. Capacity building in originative industries is also crucial for the maturation of impactful investment practices. Supporting entrepreneurs and businesses with purpose-driven missions bolsters the ecosystem essential for growth. Furthermore, integrating impact investing within traditional financial markets enhances mainstream acceptance of this approach. Educating investors about the potential of impact investments to provide profitable financial outcomes can foster more widespread interest. Overcoming these capital barriers allows investors to achieve meaningful change without compromising their financial goals. By establishing a robust funding network, private equity can better channel their resources into impactful endeavors that result in social and economic benefits for communities worldwide.

Strategies for Success

Success in aligning impact with financial returns requires thoughtful strategies that incorporate industry best practices. First and foremost, extensive due diligence is crucial for identifying investment opportunities that align with mission-driven objectives. This involves evaluating potential investees not only on profitability but also their potential to generate positive social outcomes. Secondly, forming partnerships with organizations that understand local contexts can significantly enhance investment effectiveness. Engaging with social enterprises or nonprofits involved in similar missions can lead to fruitful collaborations that amplify impact. These partnerships allow for improved understanding of community needs and tailored solutions adaptable to existing challenges. Moreover, proper governance structures that prioritize transparency and accountability encourage responsible investment practices. Developing mechanisms for tracking and reporting social and environmental outcomes engenders trust among stakeholders, fostering longer-term relationships. Implementing feedback loops is also beneficial for measuring progress and improving strategies over time, propelling ongoing evolution in impact investing practices. Furthermore, leveraging technology to streamline processes and collect data can transform decision-making, allowing firms to analyze trends and patterns more efficiently. This comprehensive approach creates a robust framework for integrating impact and financial performance effectively.

Another pivotal component of success within impact investing is ongoing education and advocacy. Private equity firms must take the initiative to educate their investors and stakeholders about the significance of incorporating social impact into investment strategies. Providing resources, training, and workshops can significantly enhance knowledge retention within the organization. Promoting an organizational culture that values social responsibility encourages every team member to embrace these principles fully. Moreover, showcasing successful case studies highlights the tangible benefits of aligning financial returns with social objectives. This serves to further entice potential investors while illustrating the impact generated by existing funds. Engaging in industry forums and discussions facilitates collaboration, allowing firms to learn from one another’s experiences and insights. Sharing knowledge and practices encourages innovation, driving positive developments within the private equity sector. Additionally, staying informed about emerging trends and evolving investor preferences positions firms at the forefront of the impact investing movement. Ultimately, the commitment to knowledge-sharing and advocacy can reshape perceptions while generating interest in private equity investments that prioritize both profit and positive impact across the globe.

The Future of Impact Investing

As impact investing continues to evolve, it becomes increasingly important to anticipate future trends likely to shape the landscape within private equity. One emerging trend is the increased focus on climate change and environmental sustainability. Investors are recognizing the urgent need to address ecological issues, which presents unique opportunities for innovative financing solutions. Impact investing is poised to play a vital role in directing capital toward renewable energy, sustainable agriculture, and conservation initiatives. Additionally, the incorporation of technology in addressing social challenges will drive unprecedented growth in the sector. From fintech solutions providing financial access to underserved populations, to health tech revolutionizing patient care, opportunities are abundant. Moreover, regulatory frameworks are evolving to support the proliferation of impact investing. As governments and organizations adopt policies promoting responsible investment practices, private equity firms can leverage these developments. Furthermore, as investors become increasingly concerned with social equity, demand for transparent disclosure and reporting practices will rise. Activism from younger generations of investors also fuels this dynamic, as they prioritize purpose-driven investments over traditional ones. In this rapidly changing environment, the private equity sector must adapt to harness the potential of impact investing effectively, ultimately benefiting society as a whole.

In conclusion, the opportunity for transforming private equity through impact investing is significant and imperative. Aligning financial returns with social impact not only fulfills investors’ desires for profitability but also contributes positively to society and the environment. By overcoming existing challenges and implementing effective strategies, private equity firms can play a critical role in shaping a more resilient and sustainable future. Encouraging collaboration across sectors will drive innovation, fostering an ecosystem responsive to evolving needs. As the sector matures, continuous adaptation to trends, regulations, and investor expectations will be pivotal for success. The future landscape is bright, with growing awareness and acceptance of the potential for impact investing to address pressing global challenges. Thus, the alignment of capital with purpose can catalyze social change while generating financial rewards. Private equity has the unique ability to wield substantial influence, creating not only substantial economic returns but also promoting transformative societal benefits. The journey towards achieving equitable, sustainable growth relies on commitment from all players within the private equity domain. Together, they can manifest the immense potential that impact investing holds for generations to come.