Transparency in Stress Test Reporting: Challenges and Best Practices

Stress testing has become a vital tool in assessing the resilience of financial institutions. This is particularly crucial during periods of economic instability. Transparency in how these tests are conducted, as well as the results, is essential for stakeholders. Regulators, investors, and the public all rely on the integrity of these tests. Despite their importance, stress test reporting faces significant challenges. Often, findings are not presented clearly, leading to misunderstandings. Inconsistent reporting standards can obscure the level of risk. Moreover, some institutions may selectively disclose results. Such issues undermine stakeholder confidence and complicate risk assessments. To address these challenges, best practices can be adopted. This includes standardized reporting formats that enhance comparability. Institutions can benefit from releasing detailed methodologies alongside results. Additionally, involving third-party reviewers can lend credibility to the reporting process. Ultimately, transparency serves not only the institutions but also the broader financial ecosystem. By fostering clear communication and understanding, financial stability can be strengthened, thereby promoting economic trust. Enhanced recognition of the importance of transparency can guide effective decision-making across all parties involved.

Moreover, it’s essential to understand the implications of inadequate transparency. When banks do not fully disclose their stress test results, it can lead to a lack of trust from investors and regulators. Trust is crucial for the stability of financial markets. If stakeholders believe that they are not getting the full picture, they may react negatively. This might lead to reduced investment, decreased credit availability, and ultimately economic downturns. For this reason, regulators are emphasizing the importance of improved transparency. They seek to ensure that financial institutions adhere to best practices in reporting frameworks. By doing so, they aim to prevent future crises which could emerge from poorly managed risks. Good practices in stress testing promote not only accuracy but public clarity. Transparency should be seen as a mechanism that supports informed decision-making. When stakeholders have access to comprehensive information, they can better assess risks. Comprehensive reporting can also highlight institutions’ strengths, potentially attracting new investors. Ultimately, fostering a culture of openness should be a priority for financial institutions in managing their respective crises effectively.

The Role of Regulatory Bodies

Regulatory bodies play a critical role in fostering transparency within stress test reporting. Their guidelines often dictate the frameworks institutions must follow. This includes specific reporting standards and expectations for disclosures. Stricter regulations established by entities such as the Basel Committee on Banking Supervision aim to enhance the robustness of stress tests. By mandating certain practices, regulators can ensure that results are credible and comparable across different institutions. They also encourage the disclosure of sensitive information in a way that maintains confidentiality while promoting transparency. Regulators can also facilitate public understanding. This means releasing summaries or explanations of stress test outcomes that are accessible to non-experts. Engaging with stakeholders through public forums or consultations can further bridge the gap between institutions and the public. This creates an environment where financial institutions are held accountable. Furthermore, regulators themselves must demonstrate transparency in their operations. This can include explaining how they evaluate institutions’ risk profiles amid stress testing. Moreover, regular updates on regulatory changes related to stress testing can create a more informed financial landscape.

In addition, training and education play a vital role in achieving transparency in stress testing. Both regulators and financial institutions must ensure that their employees understand the importance of clear reporting. Professional development programs aimed at enhancing analytical skills can lead to better interpretations of stress test results. Financial professionals should be well-versed with applicable frameworks and their implications. This educational focus should extend to the public as well, ensuring that both investors and the general public can grasp key concepts. Workshops and webinars can serve as platforms for disseminating knowledge about stress tests. They can clarify what results mean and how they impact investment decisions. Through education, misconceptions can be addressed proactively. Institutions might also benefit from cross-industry collaborations where best practices are shared. This collaborative spirit can drive collective improvement in reporting practices. Additionally, involving academic experts can add depth to the analytical processes by integrating theoretical knowledge with practical applications. Overall, prioritizing training and education can significantly enhance transparency and the effectiveness of stress test reporting.

Data Integrity and Accuracy

Data integrity and accuracy are foundational elements in the context of stress testing. When institutions undertake stress tests, the data used must be both reliable and relevant. Inaccurate data can lead to misleading results and ultimately poor decision-making. Financial institutions should implement robust data governance policies. This includes conducting regular audits to maintain the accuracy of the data used in stress tests. Incorporating advanced technologies, such as artificial intelligence or machine learning, can also improve data validation processes. Utilizing these tools ensures that the data reflects real-time conditions and variables that may affect test outcomes. Furthermore, institutions should establish clear protocols for data collection and processing. This can minimize errors that arise from manual handling or outdated systems. A commitment to data accuracy can enhance trust in stress test results. Stress testing processes should also allow room for revisions when new evidence comes to light. Continuous improvement in data practices can ensure more realistic assessments of financial resilience. By championing data integrity, institutions incentivize stakeholder confidence, which is essential for sustaining economic health.

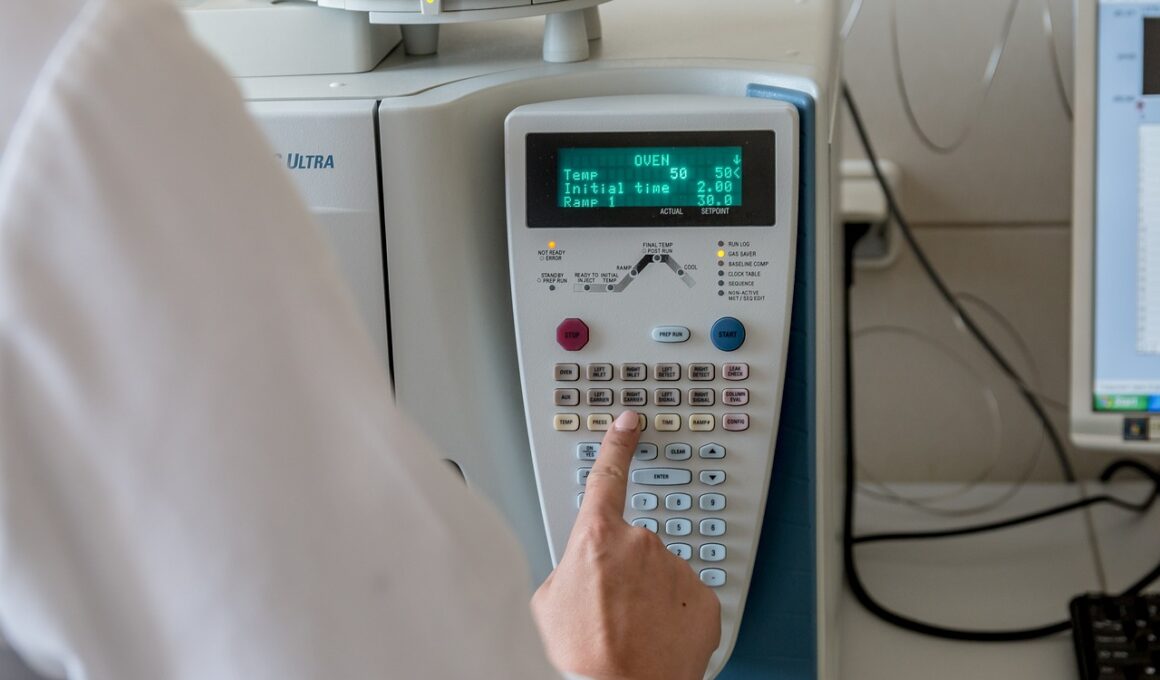

Another key aspect of transparency involves effective communication strategies during stress test disclosure. Clear and concise communication is essential to ensure stakeholders grasp the significance of stress test results. Poorly articulated findings can lead to confusion and misinterpretation. Institutions should strive to format their reports in a user-friendly manner. Utilizing graphical representations can make complex data more accessible. Infographics, charts, and tables can help convey essential information succinctly and engagingly. Alongside these visual aids, institutions should include executive summaries to highlight key outcomes. These summaries should offer insights into the implications of the tests conducted. Public engagements can also promote dialogue around these tests. Hosting webinars or community discussions allows stakeholders to ask questions, clarifying any misunderstandings. Regular updates and proactive communications about ongoing analyses also contribute to a culture of transparency. Engaging with media outlets can further amplify institutions’ messages, reaching broader audiences. In essence, effective communication strategies reinforce transparency, enhancing public trust and understanding of stress test implications.

Conclusion: Moving Forward with Best Practices

In conclusion, transparency in stress test reporting is crucial for safeguarding financial stability. Adopting best practices serves as a pathway to overcoming existing challenges associated with stress tests. Ensuring consistency in reporting, enhancing methodologies, and communicating effectively all contribute to better stakeholder engagement. As financial systems evolve, institutions must strive for continual improvement in their stress testing protocols. This evolution should include integrating technological advancements to enhance data reliability and integrity. By working collaboratively with regulators and educational institutions, they can cultivate a culture of transparency. Ultimately, a commitment to transparency benefits not just individual institutions, but the entire financial ecosystem. When stakeholders are well-informed about risks, they can make better investment decisions. Furthermore, this understanding builds public trust, which is vital for economic health. Stakeholders, including government bodies, private sector players, and civil society, must unite to demand and uphold standards of transparency. As the field of financial crisis management progresses, prioritizing transparency remains a shared responsibility among all actors. The journey towards improved practices in stress test reporting has the potential to foster resilience in financial systems.

This is another paragraph with exactly 190 words…