Exploring Currency and Equity Market Interactions for Forex Traders

Understanding the dynamics between currency markets and equity markets is vital for Forex traders. The interactions are complex and involve various factors, including interest rates, economic indicators, and market sentiment. Forex traders need to analyze the correlations that exist between currencies and stock indices, as shifts in equity markets can significantly impact currency valuations. For example, when equity markets are bullish, it often leads to an increase in capital flows towards riskier assets, which can cause specific currencies to appreciate. Conversely, bearish trends in equities might lead traders to seek safe-haven currencies such as the US dollar or Swiss franc. Forex traders must incorporate equity market analysis into their strategies. This knowledge allows them to make informed decisions based on macroeconomic conditions. Moreover, understanding the relationships among currencies and equities can lead to improved risk management practices. Traders can develop better hedging strategies and take advantage of arbitrage opportunities. With such insights, they can enhance their overall trading performance, thereby achieving more consistent results in the Forex market. Mastering these interactions can provide a competitive advantage in the fast-paced world of currency trading.

Key Economic Indicators Influencing Markets

Several key economic indicators significantly influence both currency and equity markets. These indicators include interest rates, inflation data, and GDP growth rates, all of which can affect investor sentiment and trading behavior. For instance, rising interest rates typically strengthen a country’s currency, attracting foreign investments and driving up demand. In contrast, low-interest rates can lead to a weaker currency, as fewer investors seek to hold assets denominated in that currency. Additionally, inflation figures provide insight into economic stability and growth potential. High inflation can lead to uncertainty, prompting investors to pull back from equities while flocking to stable currencies. Traders should closely monitor these indicators, as they can predict market movements and inform trading decisions. Another critical aspect is GDP, which indicates the overall economic health of a country. Strong GDP growth generally boosts both equity markets and currency strength. By comprehensively analyzing these indicators, Forex traders can make better-informed decisions, improving their ability to capitalize on market fluctuations. Thus, understanding the implications of economic data releases is essential for traders looking to navigate the interconnected landscape of Forex and equity markets effectively.

In addition to economic indicators, geopolitical events can have profound effects on both currency and equity markets. Events such as elections, trade negotiations, and international conflicts create volatility and uncertainty. These factors may lead to sudden fluctuations in currency valuations, while also influencing investor confidence in equity markets. Consequently, Forex traders should stay updated on global news and developments, as these can present both opportunities and risks. For example, unexpected election outcomes can dramatically shift market sentiment, leading to significant currency movements. Likewise, trade tariffs and agreements can create ripple effects, impacting the value of not only national currencies but also their respective stock indices. By staying informed about geopolitical happenings, Forex traders can adjust their trading strategies accordingly. This adaptability is key to navigating the complexities of intermarket analysis, enabling traders to seize advantageous positions. Moreover, having a solid grasp of how geopolitical factors interplay with markets allows traders to implement more robust risk management practices. Understanding these dynamics is essential in establishing a successful trading plan aimed at long-term profitability. Ultimately, effective Forex trading demands a comprehensive approach that considers both global events and market mechanics.

The Role of Sentiment Analysis in Forex Trading

Sentiment analysis is another vital component for Forex traders aiming to understand market interactions. By gauging market sentiment, traders can interpret collective investor attitudes toward currencies and equities effectively. Tools such as social media trends, news sentiment scoring, and market surveys can provide invaluable insights into trader behavior. In many cases, sentiment shifts precede tangible market movements. When bullish sentiment prevails in equity markets, optimism can spill over into the Forex market, boosting specific currency values. Conversely, a bearish sentiment swing can lead to a decline in currency performance as investors seek safety. Recognizing these patterns allows traders to make timely market entries or exits, enhancing their overall performance. Moreover, sentiment analysis can also assist in identifying potential reversals, providing opportunities for contrarian trading strategies. By integrating sentiment analysis into their trading toolkit, Forex traders can develop a more comprehensive view of market dynamics. This understanding fosters better decision-making and enables traders to align their strategies with prevailing market moods. Ultimately, successful Forex trading hinges on the ability to interpret sentiment shifts, benefiting traders with a competitive edge in volatile environments.

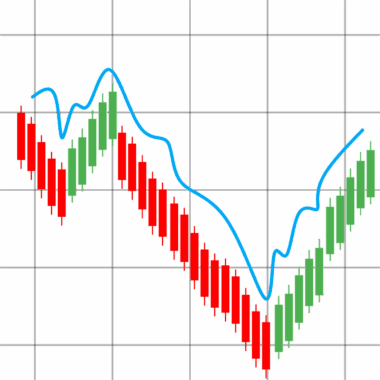

Correlation analysis is an indispensable method when exploring the ties between currencies and equities. Identifying correlations helps Forex traders understand how specific currencies react relative to movements in the stock market. A strong positive correlation, for example, indicates that a currency may appreciate as equity prices rise. Conversely, a strong negative correlation suggests that a currency’s value may decline in tandem with falling equity prices. Using statistical tools, traders can assess these relationships over time, enhancing their overall trading strategies. For instance, if a trader notices a strong correlation between the Euro and a European equity index, they might place trades accordingly to leverage this connection. It’s important to note that correlations can change over time, influenced by economic conditions and market sentiment. Therefore, continuous monitoring and adjustment are necessary to maintain effective trading strategies. Identifying shifts in correlation can present new opportunities and risks in trading execution. Employing correlation analysis allows traders to create diversified portfolios by strategically hedging against potential losses. This approach can enhance overall risk-adjusted returns. The ability to interpret and act on these correlations can set successful Forex traders apart from their peers in a competitive market environment.

Technological Advances in Market Analysis

Technological advancements have revolutionized how Forex traders analyze intermarket dynamics. With the introduction of algorithmic trading, traders can leverage sophisticated algorithms to process massive datasets quickly. This capability allows for real-time analysis of market conditions, correlations, and potential trading signals. Modern platforms provide extensive analytical tools, including charting features, automated alerts, and back-testing capabilities. Such technology empowers traders to adapt their strategies based on comprehensive data insights and emerging trends. Furthermore, machine learning techniques enable deeper analysis of historical price patterns, enhancing predictive accuracy. As traders incorporate these technologies, they can better identify lucrative opportunities arising from currency and equity interactions. Additionally, fintech innovations, such as mobile trading applications, allow traders to access market insights remotely. This flexibility can lead to more informed decision-making, ultimately improving trading performance. By harnessing technology, Forex traders can navigate the complexities of intermarket analysis effectively. Moreover, the strategic use of technology fosters efficiency, enabling traders to focus on execution rather than manual analysis. As the trading landscape evolves, embracing technological advances remains paramount for achieving sustained success in the Forex market.

In conclusion, mastering the interactions between currency and equity markets is essential for Forex traders. This mastery involves a thorough understanding of economic indicators, geopolitical events, market sentiment, correlation analysis, and technological advancements. By considering how these factors interplay, traders can formulate strategies that capitalize on market trends, ultimately enhancing profitability. Active engagement in the markets requires a commitment to ongoing education and adaptation. Traders must stay informed about best practices and innovative analysis techniques for optimal results. With the right approach, they can navigate the complexities of the Forex landscape while simultaneously understanding the broader economic context. Armed with the insights gained from intermarket analysis, Forex traders can refine their risk management practices, making informed decisions aligned with market conditions. This comprehensive understanding not only improves trading effectiveness but also builds confidence in executing strategies. Developers are continuously creating resources and tools that can assist traders in their intermarket analysis journey. As Forex trading continues to evolve, embracing these insights and innovations is crucial for success in a competitive environment. Ultimately, sophisticated analysis and strategic execution pave the way for prosperous outcomes in Forex trading.