The Use of Software Tools in Financial Forecasting

Financial forecasting has become an integral part of business planning processes. Organizations increasingly employ software tools to enhance accuracy and efficiency in prediction models. Among the benefits, these tools allow financial analysts to process large datasets seamlessly. They automate various calculations and functions, providing significant time savings compared to manual methods. This efficiency means that companies can make quicker, more informed decisions. The software also allows for better visualization of data through dashboards and reports, making the insights easier for stakeholders to interpret. Furthermore, many tools come equipped with advanced analytical capabilities, such as predictive analytics and scenario analysis, helping businesses anticipate future financial conditions. These features encourage proactive rather than reactive decision-making. By employing software, companies can track performance, evaluate potential risks or opportunities, and adjust their strategies accordingly. The integration of these technologies has resulted in a notable shift towards data-driven decision-making within organizations. Thus, investing in financial forecasting software is essential for maintaining competitiveness and ensuring long-term sustainability.

Understanding the different types of software tools available is crucial. Various software solutions cater to different aspects of financial forecasting. Some popular options include Excel-based solutions, specialized financial forecasting software, and cloud-based platforms. Excel remains invaluable due to its flexibility and extensive features. Companies often customize spreadsheets to fit their unique forecasting models. However, specialized software provides tailored functionalities designed for financial analysis. Tools like Adaptive Insights or SAP Analytics Cloud offer more sophisticated solutions to financial forecasting challenges. Additionally, cloud-based platforms enhance collaboration by allowing remote access and data sharing among teams. This ensures that financial forecasts remain consistent across departments and geographical boundaries. Budgeting, forecasting, and reporting can thus be more streamlined than ever before. Another tech trend is the integration of artificial intelligence and machine learning into forecasting software tools. These technologies can analyze historical data patterns to provide predictions with higher accuracy. As accuracy is paramount in financial forecasting, the integration of AI becomes a pivotal advantage. Businesses that leverage these advanced technologies will be better positioned to adapt to market changes.

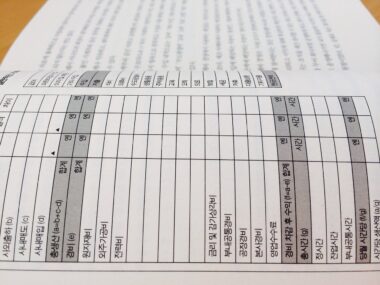

Additionally, data integration is a pivotal element in optimizing financial forecasting. Organizations often struggle when attempting to consolidate data from numerous sources, but modern software tools mitigate this issue. Many have built-in functionalities to pull data from various platforms, such as ERP systems or accounting software, minimizing manual entry errors. Data integration ensures that financial forecasts are based on the most accurate and comprehensive information available. Moreover, these tools provide automated updates, allowing for real-time adjustments in response to changing market conditions. Thus, they foster a more agile decision-making environment. Improved data accessibility fuels collaboration among departments, leading to holistic forecasting efforts. For instance, when sales and marketing teams share insights within one platform, financial forecasts become more accurate as they reflect various business aspects. Furthermore, proper security measures within these tools safeguard sensitive financial information against unauthorized access. Consequently, companies can confidently leverage integrated systems to enhance forecasting reliability while remaining compliant with regulations. The role of data integration in advancing financial forecasting cannot be understated, as it plays a crucial role in aligning business strategy with market demands.

The Role of Predictive Analytics

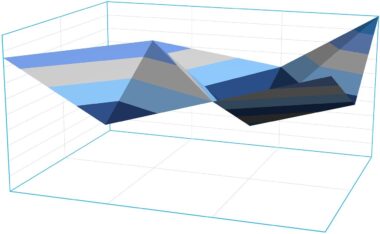

Predictive analytics transforms financial forecasting by employing historical data to make insightful projections. Through statistical algorithms and machine learning techniques, companies identify patterns in past data, allowing them to forecast potential outcomes more accurately. As businesses face constantly shifting markets and increasingly complex financial environments, the need for predictive analytics becomes evident. The ability to analyze data trends can help organizations anticipate challenges and opportunities, ensuring they remain proactive in their strategies. Furthermore, predictive analytics can gauge the potential impact of different scenarios and inform decision-makers about the most viable paths forward. For example, using predictive models might reveal underlying drivers affecting cash flow, enabling the finance team to devise strategies to mitigate risks. This application of technology further enhances budget preparations and revenue forecasting. Moreover, forward-looking financial statements produced through predictive analytics provide stakeholders with a clearer picture of future performance. Therefore, employing tools that integrate predictive analytics into the financial forecasting process can significantly influence an organization’s capacity to achieve strategic objectives effectively.

Moreover, collaboration features offered by modern financial forecasting tools lead to improved results. When multiple team members can work together seamlessly, the accuracy and reliability of financial predictions increase. Many software applications emphasize communication, allowing users to share data, comment on forecasts, and make adjustments in real time. These collaborative capabilities are particularly essential for companies with distributed teams, as they reduce the risk of miscommunication. Additionally, the unified platform fosters a culture of transparency, where all stakeholders can access updated information regarding financial forecasts. This access enables better alignment among departments such as finance, human resources, and operations. Each department views the same metrics and data inputs, ensuring consistency across the organization. Collaborative forecasting not only improves the accuracy of predictions but can also enhance team engagement and ownership of the forecasting process. Understanding the roles of different departments in financial predictions helps organizations foster interdisciplinary approaches to strategy development. Therefore, investing in tools that support collaboration is a necessary step for modern organizations aiming to improve their financial forecasting capabilities.

Automation Enhancements

Automation features significantly elevate the financial forecasting process. The ability to automate repetitive tasks allows financial analysts to focus on strategic decision-making rather than time-consuming data management. Streamlining tasks such as data input, calculations, and reporting decreases operational inefficiencies. As automation reduces human error, the reliability of outputs increases; this is especially paramount in financial forecasting where precision is essential. Furthermore, some software tools provide automated alerts regarding changes in key metrics or thresholds, helping organizations stay agile and responsive. Notably, historical performance analysis can also be automated, resulting in faster updates to forecasts based on the most recent data. The ability of tools to generate instant reports enables timely insights for stakeholders, enhancing their understanding of the company’s financial position. Consequently, integration with other tools facilitates an efficient workflow across departments. Automation can lead to enhanced productivity and quicker decision-making. Overall, implementing automation in financial forecasting tools proves beneficial in producing reliable forecasts while freeing up resources for higher-value tasks. Organizations that prioritize automation will experience more efficient operations and improved strategic alignment.

Finally, ongoing training and support for employees are essential in maximizing the benefits of financial forecasting software tools. As technology advances, staff must receive continuous training to stay up-to-date with software functionalities and best practices. Organizations that invest in learning opportunities for their employees often see greater adoption and utilization of these tools. Additionally, robust customer support from software providers is invaluable; it ensures users can troubleshoot potential issues quickly, enhancing overall satisfaction with the tools. Regular workshops or online courses can keep employees abreast of new features and enhancements, ultimately leading to better financial forecasting outcomes. Moreover, an informed workforce is better equipped to provide meaningful insights grounded in data. Thus, companies can reinforce their collective understanding of financial forecasting principles, fostering a culture of shared knowledge. Moreover, facilitating discussions around forecasting processes including technology adoption helps promote engagement. Emphasizing the importance of tailored training initiatives will empower employees in their daily roles. As organizations continue to rely on software tools, providing ongoing support is critical to long-term success.

In conclusion, financial forecasting is evolving rapidly due to technology advancements. The use of software tools enhances accuracy, efficiency, and collaboration among team members. Integration of predictive analytics further strengthens forecasting by enabling data-driven decision-making. Automation enhances productivity by minimizing repetitive tasks, while collaborative features ensure consistency across departments. To fully harness the potential of these tools, organizations must prioritize ongoing training and support for employees. This will not only enable better technology adoption but also improve the overall financial forecasting process. Investing in quality forecasting software can determine an organization’s competitive advantage. By creating a culture that embraces technology and continuous improvement, businesses are better positioned to navigate uncertainties in the market and achieve sustainable long-term growth.