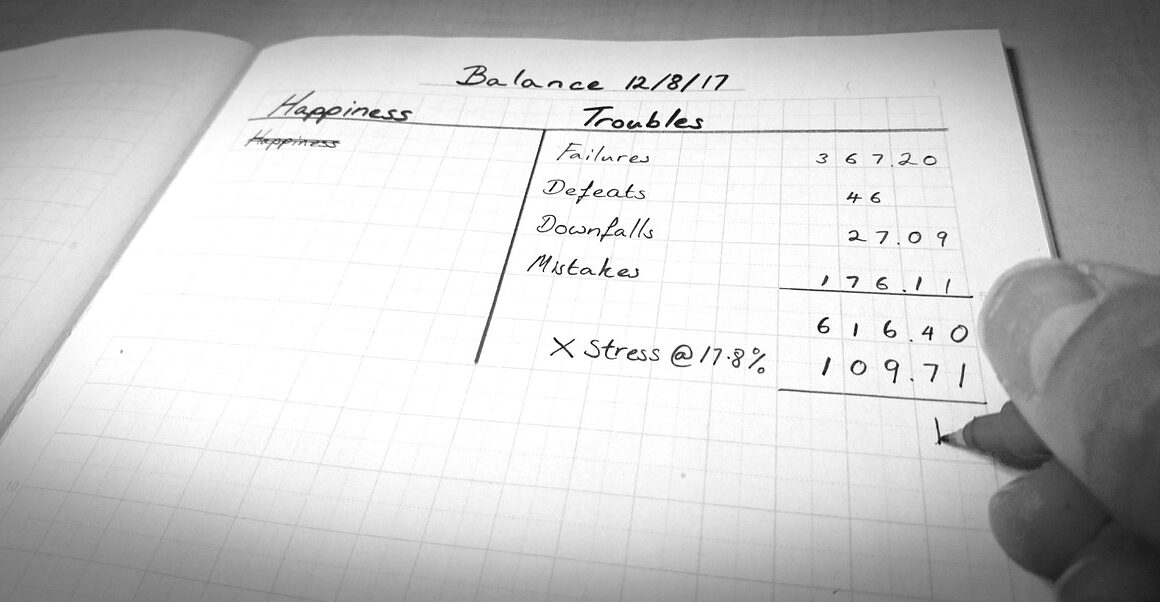

Analyzing Balance Sheets Through Financial Benchmarking

Understanding financial benchmarking is crucial for businesses, as it allows them to analyze performance metrics related to financial statements. Companies often compare their balance sheets to those of similar firms to gauge financial health and operational efficiency. This method facilitates identifying strengths and weaknesses, helping businesses set realistic financial goals. By utilizing key metrics such as liquidity ratios, leverage ratios, and return on equity, businesses can gain insights into their financial standing. Financial benchmarking is particularly useful in determining whether a company is over or under-leveraged compared to its peers. Additionally, it encourages improved financial reporting practices and transparency within organizations. Organizations that engage in financial benchmarking not only improve their performance but also build more robust financial strategies over time. Analyzing these metrics through benchmarking allows businesses to make data-driven decisions, allocate resources wisely, and plan for future growth. Benchmarking also creates opportunities for gathering invaluable feedback from stakeholders and industry experts, which can be instrumental in enhancing financial practices overall. Investing time in financial analysis sets the groundwork for achieving long-term financial stability and success.

When it comes to analyzing balance sheets, one key aspect remains liquidity management. Liquidity measures a company’s ability to meet its short-term obligations, which is vital for maintaining day-to-day operations. By benchmarking liquidity ratios such as the current ratio and quick ratio, companies can assess their financial health compared to industry standards. This analysis allows businesses to identify potential liquidity issues before they escalate into significant problems. For instance, a consistently low current ratio compared to peers may indicate a lack of sufficient working capital, prompting businesses to seek solutions for improving cash flow. Additionally, cash management strategies should be reviewed and optimized regularly through benchmarking analysis. This proactive approach can help organizations effectively manage their cash reserves while safeguarding against unforeseen financial challenges. Furthermore, employing financial ratios highlights areas where businesses might need to focus their attention, driving improvement by establishing performance targets. The ultimate goal of liquidity analysis is to provide executives with the necessary insights required for informed decision-making. Therefore, businesses can thrive when they ensure proper liquidity management aligned with strategic objectives and industry benchmarks.

Evaluating Leverage Ratios

The next area of focus when analyzing balance sheets through financial benchmarking involves evaluating leverage ratios. Leverage ratios measure the extent to which a company utilizes debt financing to fuel growth. A high leverage ratio can be a double-edged sword, providing both opportunities for expansion and risks of financial distress. Organizations need to benchmark their debt-to-equity ratio and interest coverage ratio against industry peers. These metrics reveal how much debt is being used relative to equity, as well as the company’s ability to meet interest obligations with its earnings before interest and taxes. Scrutinizing these indicators helps businesses identify potential warning signs of over-leveraging. A high debt-to-equity ratio compared to competitors might flag concerns about financial stability and increase the cost of capital. Moreover, implementing best practices in leveraging debt can aid in optimizing capital structure. As companies navigate economic fluctuations, it’s crucial for them to maintain prudent leverage levels. Ultimately, effective management of leverage ratios through consistent benchmarking ensures organizational resilience while achieving growth ambitions.

Another critical aspect of financial benchmarking lies in assessing profitability metrics. Profitability ratios enable organizations to understand their capacity to generate earnings relative to revenue, assets, or equity. Among the most significant profitability ratios are net profit margin, return on assets, and return on equity. Companies can compare these ratios against industry standards to determine their competitive standing. A higher-than-average return on equity signifies an efficient use of shareholder funds, while a low profit margin might raise flags regarding operational inefficiencies. Regularly benchmarking these profitability metrics ensures organizations remain focused on enhancing their profit margins through operational adjustments, cost control, and revenue growth strategies. Moreover, financial benchmarking fosters an environment of accountability and continuous improvement. When businesses strive to enhance profitability metrics, they create a culture that values performance, consistency, and resource optimization. Engaging with financial benchmarks allows companies to reevaluate their strategies regularly, ensuring they align with changing market dynamics and stakeholder expectations. Therefore, assessing profitability ratios helps guide strategic financial decisions and drive long-term sustainability.

Importance of Trend Analysis

In addition to standard benchmarking practices, incorporating trend analysis enhances the understanding of financial statements. Trend analysis involves studying financial metrics over a set period to identify patterns, fluctuations, and anomalies. This technique allows businesses to track performance over time, better informing their financial strategies. By visualizing data trends, companies can more easily identify areas of concern or opportunities for expansion. For instance, examining trends in net income can reveal how effectively cost-cutting initiatives translate into increased profitability. Similarly, tracking changes in key assets and liabilities can shed light on shifts in operational efficiency or risk exposure. When combined with benchmarking, trend analysis allows organizations to set realistic performance targets based on historical performance. This creates a powerful feedback loop in which companies can measure progress continuously and make timely strategic adjustments. Moreover, sustainable business practices and long-term growth often hinge on understanding changing market dynamics. Therefore, integrating trend analysis into financial benchmarking serves as an essential tool for proactive management and decision-making within organizations.

Another fundamental aspect of financial benchmarking is improving financial reporting. Accurate, transparent financial statements are critical for both internal stakeholders and external audiences. Companies can use benchmarks to enhance financial reporting by ensuring they comply with industry standards and regulations. This increased transparency fosters trust among investors, which is vital for securing financing and sustaining growth. Consistent benchmarking encourages organizations to adopt best practices in financial reporting, ensuring that the information they provide is relevant and reliable. Furthermore, improved reporting standards reduce the risk of misrepresentation, creating a robust foundation essential for sound decision-making. In addition to improving relations with stakeholders, effective reporting helps organizations to maintain compliance with changing financial regulations. To remain competitive, businesses should assess their reporting processes and determine how they can align with the benchmarks set by industry leaders. Doing so equips organizations with a framework to communicate financial information effectively. Ultimately, implementing high-quality financial reporting practices benefits businesses in their quest for credibility and stability in the marketplace.

Conclusion: Impact of Financial Benchmarking

In conclusion, the impact of financial benchmarking in analyzing balance sheets cannot be overstated. By leveraging comparative analysis, organizations can gain invaluable insights into their financial health and operational performance. These insights drive data-driven decision-making, resulting in improved financial strategies and business outcomes. Regular benchmarking enables companies to stay ahead of industry trends, providing them with the necessary tools to adapt to dynamic market conditions. Through consistent observation of liquidity, leverage, and profitability metrics, businesses can make preemptive adjustments to mitigate risks and enhance performance. Incorporating trend analysis while refining financial reporting practices further solidifies the role of benchmarking in achieving sustained success. Organizations that prioritize financial benchmarking foster a culture of accountability, transparency, and continuous improvement. In an increasingly competitive landscape, those who embrace these practices will likely outperform peers and achieve long-term growth. Therefore, understanding the nuances of financial benchmarking is essential for any organization striving to enhance its overall financial management practices and achieve sustainable success.

The necessity to engage in financial benchmarking transcends mere comparison; it encompasses a proactive commitment to self-improvement and strategic planning. By embracing financial benchmarking, organizations not only gain insights into their position relative to their peers but also create a roadmap for future endeavors. As financial landscapes continue to evolve, companies prioritizing benchmarking will position themselves favorably for success. As such, they can build resilient organizations that are not only capable of withstanding economic fluctuations but also adept at seizing opportunities. Integrating financial benchmarking into organizational practices ultimately serves to align goals, enhance operational efficacy, and invigorate innovative financial strategies. Moreover, it imbues companies with the confidence needed to tackle challenges with a strategic mindset. In essence, financial benchmarking is not merely a backward-looking exercise; instead, it is a forward-thinking tool that empowers organizations to adapt, grow, and excel in their respective markets.