Integrating Budgeting with Strategic Financial Planning

Integrating budgeting into strategic financial planning is an essential task for any organization aiming for success. It requires a comprehensive analysis of both short-term and long-term financial objectives, enabling organizations to align their resources effectively. A systematic approach to budgeting facilitates the prioritization of expenditures, ensuring that critical initiatives receive due funding. Additionally, aligning budgets with strategic goals helps organizations navigate through uncertainties. Engaging stakeholders in the budgeting process fosters ownership and accountability, which can lead to improved financial performance. As budgets are typically time-bound, they can serve as benchmarks against which progress can be measured. It is important for organizations to leverage historical data, market trends, and projections to formulate robust budgets. By integrating these elements, organizations can be more flexible and responsive to changes in their environment. Understanding the financial landscape is crucial, as is adopting a proactive mindset that considers both current circumstances and future opportunities. Organizations must also establish clear communication channels, allowing for seamless collaboration among departments, which is vital for successfully integrating budgeting with broader financial planning efforts.

Budgeting is not just a routine task; it is a crucial strategic activity that drives organizational success. By integrating budgeting with strategic planning, organizations can ensure that their financial resources are allocated in alignment with their mission and vision. This approach helps minimize resource wastage and allows for effective prioritization of key projects. Another significant advantage of this integration is enhanced forecasting accuracy. An accurate budget reflects the anticipated financial performance and provides a clear roadmap for future growth. Organizations that employ effective budgeting techniques are better positioned to identify potential pitfalls and opportunities, thus allowing them to respond promptly. Furthermore, engaging executive leadership in the budgeting process encourages a culture of financial accountability throughout the organization. Regular reviews of budget performance against strategic objectives help ensure that any deviations are swiftly addressed. As a result, organizations benefit from improved decision-making capabilities. Additionally, integrating budgetary concerns into the overall strategic planning facilitates better resource allocation across departments. This leads to improved operational efficiency and maximized returns on investment, ultimately driving sustainable growth for the organization.

The Role of Stakeholders in Budget Integration

The involvement of stakeholders is crucial when integrating budgeting with strategic financial planning. When various department heads and functional leaders participate in the budgeting process, they provide valuable insights into their unique challenges. Each department’s input into the budgeting framework helps create a more holistic view of the organization’s financial landscape. This inclusive approach fosters collaboration, ensuring that different perspectives are considered. Moreover, stakeholder engagement helps to align departmental budgets with overall corporate strategy, reducing the likelihood of discrepancies that can hinder progress. Additionally, establishing ownership among stakeholders promotes accountability and transparency in resource allocation. The collaborative nature of budgeting encourages departments to track expenses effectively, identifying areas for potential cost savings. Regular meetings and discussions can help stakeholders stay informed of any changes in organizational priorities. By having open lines of communication, organizations can ensure that budgets remain responsive to changes in strategic objectives over time. This ongoing dialogue ultimately contributes to the agility and resiliency of the organization as it navigates the complexities of the financial landscape.

Effective budgeting should also incorporate performance metrics that measure the success of strategic initiatives. By establishing key performance indicators (KPIs), organizations can track their financial health and progress towards achieving strategic goals. KPIs allow businesses to evaluate the effectiveness of their budgets in real-time. Organizations can adjust their expenditures based on these metrics to maximize the return on investment. Integrating financial planning with performance measurement aligns budgetary goals with strategic targets. It also promotes a culture of continuous improvement, as leaders can identify underperforming areas and implement corrective measures. Transparent reporting structures contribute to informed decision-making as all levels of management can view the budget’s alignment with strategic priorities. Furthermore, these practices cultivate trust among stakeholders, as they see the direct relationship between budgeting and organizational success. Review sessions focused on KPIs can guide budget adjustments, making them more proactive rather than reactive. Incorporating performance metrics into budgeting efforts reinforces the commitment to achieving strategic objectives. This strategy enhances overall departmental accountability and empowers teams to stay aligned with the organization’s mission.

Technology’s Role in Budget Management

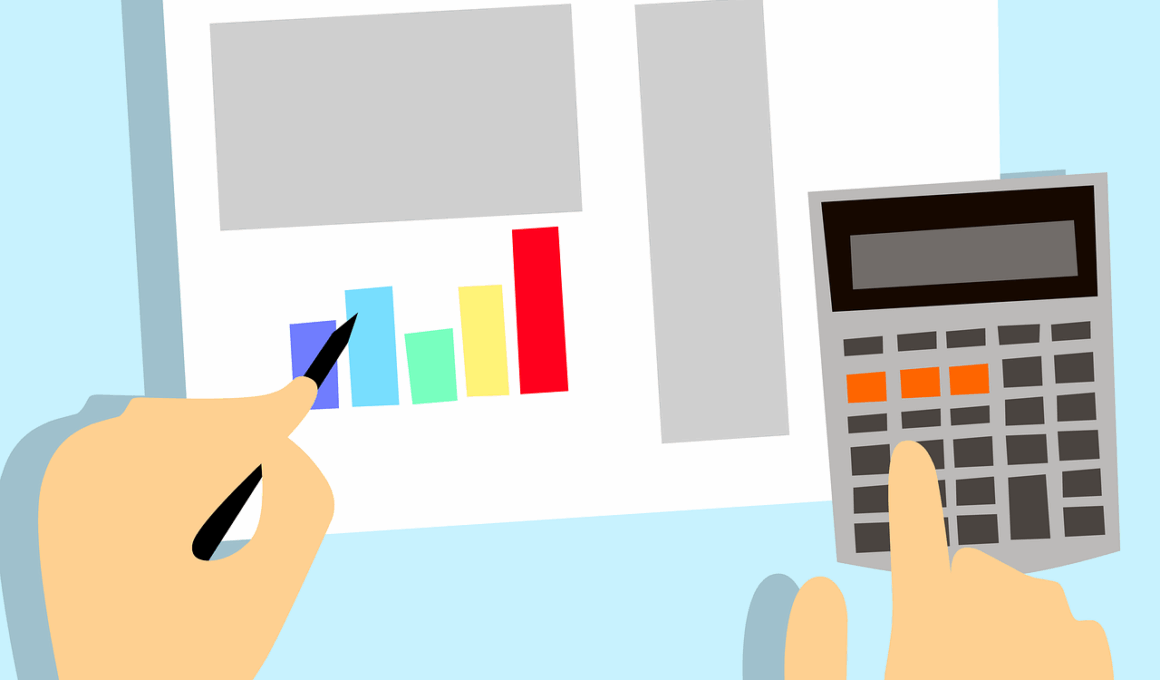

In the modern business environment, technology plays a pivotal role in integrating budgeting with strategic financial planning. Financial software tools can streamline the budgeting process by automating data collection and analysis. These tools enable organizations to create more accurate budgets by leveraging historical data and forecasting models. Moreover, technology enhances collaboration by allowing real-time sharing of budget information among stakeholders. This accessibility increases transparency and facilitates better communication among departments. Organizations can also use cloud-based solutions to enhance remote collaboration, ensuring that all team members can contribute regardless of location. Budgeting software often includes analytics capabilities that allow organizations to visualize their financial data effectively. By identifying trends and variances quickly, businesses can make informed decisions swiftly. Additionally, technology enables businesses to simulate different scenarios, providing insight into possible outcomes. This capability empowers organizations to be proactive in their financial planning and strategically adapt their budgets. As businesses embrace digital strategies, they should continually evaluate technological solutions that can improve budgeting practices, thereby optimizing their operational efficiencies.

The integration of budgeting with strategic financial planning requires a forward-thinking approach to resource allocation. Businesses must adopt a long-term perspective when crafting their budgets. This involves identifying potential investments that align with corporate strategies and goals. By prioritizing projects that contribute to strategic objectives, organizations can ensure that their financial resources are deployed effectively. Furthermore, regular assessments of budget alignment with strategy enable businesses to remain agile in their financial planning. Continuous refinement of budgets based on changing market dynamics is essential for success. Alternatively, rigid budgeting practices can stifle innovation and limit growth opportunities. Hence, organizations should embrace flexibility in their budgeting processes while adhering to strategic priorities. Encouraging innovation within budgeting can also lead to unconventional approaches that yield positive financial outcomes. This evolution within budgeting aligns corporate objectives with innovation, fostering a culture that embraces new ideas. As organizations navigate competitive landscapes, integrating budgeting with strategic planning becomes a critical determinant of sustainability and long-term success. Ultimately, continuous refinement ensures that budgets remain relevant and valuable tools for guiding organizational growth.

Conclusion and Best Practices

In conclusion, integrating budgeting with strategic financial planning is paramount for organizational success. To maximize the effectiveness of this integration, businesses should adopt a few best practices. Firstly, fostering collaboration across departments is crucial, as it ensures diverse perspectives inform the budgeting process. Secondly, organizations should leverage technology to enhance budgeting accuracy and efficiency. Utilizing data analytics tools enables companies to uncover insights related to budgeting performance. Thirdly, an ongoing review of budget performance against strategic goals is essential. This enables organizations to identify gaps and opportunities for improvement proactively. Fourthly, aligning stakeholder incentives with budgetary outcomes enhances accountability throughout the organization. Lastly, developing a culture that embraces flexibility promotes adaptability within budgeting, encouraging proactive adjustments. By adhering to these best practices, organizations can enhance their budgeting processes. This approach not only supports strategic financial planning but also contributes to improved financial performance. Consequently, companies that effectively integrate budgeting with strategic planning position themselves for sustained growth and success in an ever-evolving business environment. Investing time and resources into refining budgeting practices pays dividends by ensuring that financial resources are aligned with long-term objectives.

Financial Forecasting and Its Integration

Financial forecasting plays a vital role in the integration of budgeting with strategic financial planning. Accurate forecasts empower organizations to anticipate income and expenses, enabling them to plan their budgets more effectively. By utilizing various forecasting methods, such as trend analysis and scenario planning, organizations can simulate future financial conditions. These methodologies provide critical insights that ensure budgets are realistic and aligned with projected changes in market conditions. Additionally, organizations can utilize actual financial performance data to refine their forecasting models, incorporating lessons learned from previous periods. Accurate forecasts not only aid in the creation of budgets, but they also provide managers with tools to make informed decisions. By integrating forecasting into the budgeting process, organizations can link their financial planning to strategic objectives, enhancing overall effectiveness. Having a clear picture of financial expectations allows management to identify necessary adjustments during the budgeting cycle, fostering a culture of agility. Forecasting serves as a navigational tool that guides organizations toward achieving their financial goals. The overall success of integrating budgeting with strategic planning hinges on the quality of the underlying forecasts.