The Role of Natural Language Processing in Credit Analysis

In recent years, the financial landscape has undergone significant changes, largely driven by technological advancements. Credit Rating Agencies (CRAs) play an essential role in assessing the creditworthiness of organizations and governments, and the integration of Natural Language Processing (NLP) has transformed this process. NLP, a branch of artificial intelligence, focuses on the interaction between humans and computers through natural language. For CRAs, NLP offers a mechanism to analyze vast amounts of text data, extracting valuable insights that were once time-consuming to obtain. By automating the evaluation of financial documents, news articles, and social media communications, NLP not only boosts accuracy but also enhances efficiency. This means that CRAs can deliver timely credit ratings, which are crucial for investors making informed decisions. The application of NLP in credit analysis also promotes a deeper understanding of the sentiment surrounding a specific entity. Moreover, with machine learning algorithms, NLP becomes more robust over time, learning from previous data to refine its analyses continuously and adapt to new circumstances and language nuances effectively.

With the burgeoning quantity of data available, the traditional methods of assessing credit scores are becoming inefficient. Historical data indicates that human analysts struggle to keep up with the deluge of information necessary for thorough evaluations. Here, NLP stands out as it processes information at lightning speed, helping CRAs to analyze credit risks more effectively. By utilizing tools for sentiment analysis, CRAs can evaluate public perception and media portrayal of an organization, thereby incorporating soft indicators into their assessments. This enriches the quantitative analysis of assets and liabilities with qualitative insights. Automated systems can sift through company disclosures, news articles, and even social media dialogues to compile sentiment trends and identify risks ahead of traditional methods. This proactive approach allows agencies to adjust their ratings promptly before adverse events occur. Furthermore, the combination of NLP with big data technologies provides CRAs with a comprehensive view of financial stability, ensuring their services remain relevant in an evolving market. The future lies in enhanced analytics capabilities, and CRAs that leverage NLP will undoubtedly stay ahead of the curve.

Challenges in Implementing NLP

Despite the numerous advantages of adopting NLP, the technology’s integration into CRAs is not without its challenges. One significant hurdle is the quality of data, as outputs are only as valuable as inputs. Data sources can often be noisy, ambiguous, or contradictory, which can lead to inaccurate assessments. Therefore, ensuring data cleanliness and relevance is paramount in NLP applications. Another challenge is the potential biases present within the training data, which may skew the analysis results. If a model is trained on biased information, it may perpetuate or exacerbate these biases in credit ratings, potentially leading to unfair assessments. Additionally, regulatory compliance poses as another obstacle; CRAs must ensure that their methodologies adhere to stringent standards while implementing new technologies. Transparency in algorithmic decision-making is critical to maintain trust among stakeholders. Finally, the dynamic nature of language presents a consistent challenge. Language evolves, and NLP systems require constant updating and retraining to remain effective. These challenges must be navigated thoughtfully to harness the true power of NLP in credit ratings.

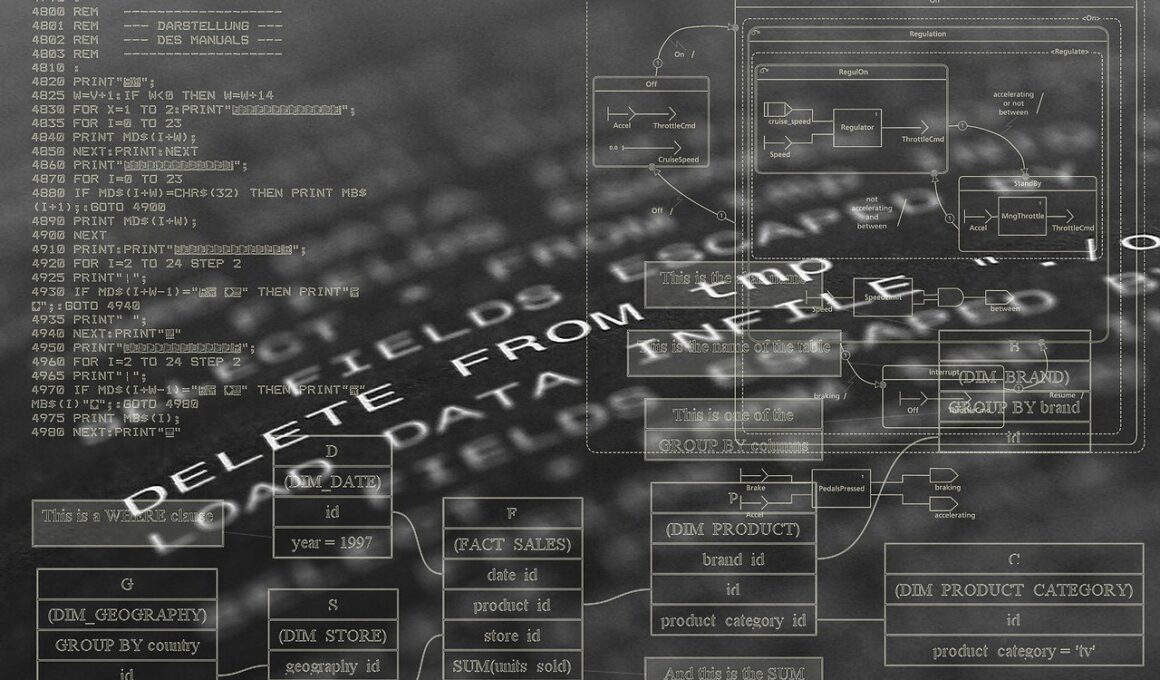

Organizations such as CRAs can choose to employ various NLP techniques to enhance their credit assessment processes. Text mining and sentiment analysis are among the most effective methodologies for digging deep into qualitative data. These approaches help CRA analysts work more efficiently, structuring unstructured data and extracting meaningful insights. For instance, text summarization techniques can condense lengthy financial reports into essential elements, enabling analysts to focus on critical insights. Moreover, topic modeling can reveal underlying themes in large text corpuses, helping analysts identify common factors that influence credit ratings. Furthermore, entity recognition assists in pinpointing names of organizations and relevant data points, streamlining the evaluation process. Machine learning models, when combined with these NLP techniques, can identify patterns and anomalies that human analysts may overlook. The learning cycle improves over time, fostering predictive capabilities in rating securities and bonds, enhancing the quality of recommendations provided to investors. Thus, implementing NLP techniques creates a synergistic effect that significantly elevates the analytical workplace within CRAs.

The Future of NLP in Credit Rating

As technology continues to evolve, the future of Natural Language Processing within Credit Rating Agencies looks promising and promisingly transformative. The advent of new AI-driven technologies can augment existing NLP capabilities, allowing CRAs to forecast credit trends with higher precision than ever. The potential to integrate emerging tools such as deep learning will facilitate even deeper analyses of complex datasets, leading to more informed credit evaluations. Furthermore, the continued development of multilingual NLP systems ensures that CRAs can operate across borders without linguistic barriers. This expansion is crucial in an increasingly globalized financial environment where multi-national corporations require comprehensive analysis in various languages. Moreover, the real-time capabilities of modern NLP will likely become the norm, leading to immediate adjustments in credit scores based on new data. This agility allows investors to make quicker, more informed decisions and improves market efficiency. Furthermore, the collaboration between human analysts and NLP systems will continue to be essential, maximizing strengths from both technologies in providing well-rounded assessments. Ultimately, as CRAs embrace these advancements, they gain competitive advantages, ensuring relevancy in a rapidly changing financial landscape.

Another promising avenue for the future of NLP in credit analysis is the focus on ethical considerations and transparency. As consumers demand accountability, CRAs must establish frameworks that allow for scrutiny over their algorithms and methodologies, which enhances trust among stakeholders. Initiatives aimed at uncovering the ‘black box’ of machine learning will foster understanding and confidence in ratings. Furthermore, organizations can develop ethical guidelines to prevent discrimination and foster inclusivity within credit scoring models. Another layer of development could include cooperation between regulatory bodies and credit agencies to create standards that govern the integration of NLP technologies. This partnership can alleviate concerns regarding biases and discrimination while promoting the fair representation of diverse organizations within credit assessments. Another forward-thinking approach could involve creating educational programs for analysts to ensure they’re equipped with the necessary skills to work alongside advanced NLP systems. Investing in talent development will be critical for adapting to technological changes and ensuring that skilled analysts can interpret and contextualize insights extracted from NLP effectively while maintaining the human element in the credit analysis process.

Conclusion

In summary, Natural Language Processing is fundamentally changing the landscape of Credit Rating Agencies, making assessments more accurate, timely, and informed than ever before. As CRAs continue adopting these technologies, the credit evaluation process becomes more agile, adapting to the challenges presented in an ever-changing economic environment. Through effective NLP implementation, agencies can unlock insights previously unobtainable through conventional methodologies, ultimately improving the financial decision-making landscape for investors. While challenges exist in the blending of AI and traditional analysis, the benefits presented by NLP technologies far outweigh the hurdles of implementation when approached thoughtfully. The focus should remain on developing the necessary infrastructure to support ethical use and building robust algorithms that serve all stakeholders fairly and equitably. The time has come for automation and AI to complement human intuition and expertise. Credit Rating Agencies leveraging NLP and other technologies will not only enhance their service quality but also contribute positively to the broader financial ecosystem. The future of credit ratings is bright—powered by technology, driven by insights, and rooted in fairness.

The journey of integrating Natural Language Processing into Credit Rating Agencies reflects a broader transition in financial technology. More than mere trends, these advances signal a significant shift in how data is interpreted and utilized for decision-making in various sectors. By enhancing the capabilities of CRAs, NLP empowers them to respond proactively to the varying dynamics of the financial world. Ultimately, this intersection of technology and financial integrity paves the way for a more transparent, efficient, and reliable credit analysis landscape, benefiting both organizations and investors. As CRAs continue to innovate, they stand poised to enrich the dialogue around credit assessment while embracing the potential of transformative technologies in a rapidly evolving global economy.