The Influence of International Regulations on Financial Compliance

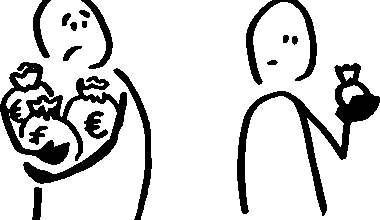

In today’s interconnected financial markets, adherence to international regulations plays a crucial role in ensuring compliance across various jurisdictions. Financial institutions are required to navigate a complex landscape of rules designed to foster transparency and accountability. These regulations not only govern domestic operations but also impose international standards that institutions must meet. Global regulatory frameworks aim to prevent financial crimes, promote ethical practices, and protect investors. This holistic approach is necessary due to the widespread implications of cross-border financial activities. Organizations must remain vigilant and adaptable in response to changing regulations that can vary significantly from one country to another. Therefore, firms invested in international finance must develop comprehensive compliance programs to ensure alignment with these evolving standards. Additionally, non-compliance can result in severe penalties including fines, sanctions, and reputational damage. The need for robust compliance measures is amplified by the increased scrutiny from regulators and the public. Institutions must also invest in employee training and technological solutions to facilitate compliance. As global financial markets evolve, the influence of international regulations on financial compliance will likely intensify.

The implementation of international regulations is not just a checklist for financial institutions but rather an integral part of maintaining trust in the financial system. Trust is essential for the stability and functionality of any financial sector, and regulations are designed to safeguard this trust. When institutions violate these regulations, the repercussions can be significant, affecting not only the firm in question but also the broader market. Investor confidence can wane, leading to decreased investments and potentially destabilizing entire economies. Therefore, a consistent approach to compliance helps uphold the integrity of financial markets globally. In addition to fostering trust, these regulations also encourage competition by ensuring that all players adhere to the same standards. However, navigating these complex regulations can be challenging, particularly for smaller firms with limited resources. Many businesses may struggle to keep pace with the constant updates and changes in legislation. Therefore, firms must invest in legal counsel and compliance officers to interpret these regulations correctly. In this dynamic environment, the ability to respond to regulatory changes swiftly can be a determining factor for success.

The Role of Regulatory Bodies

Regulatory bodies play a pivotal role in shaping the landscape of financial compliance on a global scale. These agencies are responsible for drafting, implementing, and enforcing regulations that govern financial practices across different countries. The establishment of bodies such as the Financial Action Task Force (FATF) and the Basel Committee on Banking Supervision has been critical in creating uniform standards. Such organizations collaborate with national regulators to assess compliance and address emerging risks. They also facilitate information sharing regarding best practices among member nations, further standardizing compliance efforts. By setting international standards, regulatory bodies help level the playing field for financial institutions, enabling fairer competition. Compliance with these standards is not merely a legal obligation but also contributes to the overall health of the global economy. Institutions benefit from adherence to regulations, as it fosters a culture of ethical conduct, enhancing their reputation. Conversely, non-compliance or inadequate compliance can lead to scrutiny and impose legal penalties, affecting a firm’s operational capabilities. Therefore, engaging proactively with regulatory bodies can lead to beneficial outcomes for financial institutions.

A significant aspect of international regulations is their emphasis on risk management. Regulatory frameworks mandate that financial institutions adopt comprehensive risk assessment processes to identify potential vulnerabilities throughout their operations. Institutions are required to formulate appropriate mitigation strategies to manage identified risks effectively. This necessity highlights the proactive nature of regulation, which seeks to prevent financial crises before they occur. Institutions that proactively manage risks are better positioned to navigate sudden changes in market conditions or emerging threats. By fostering a risk-aware culture, organizations can improve internal controls, reduce compliance costs, and enhance operational efficiency. Resource allocation towards risk management not only aids compliance but also strengthens resiliency in adverse situations. Furthermore, as the global financial landscape becomes more complex, the types of risks that institutions face are also evolving. Cybersecurity threats, geopolitical uncertainties, and compliance with anti-money laundering (AML) directives are just a few challenges that require vigilance. Adhering to international risk management standards enables financial institutions to remain competitive while ensuring they meet compliance obligations effectively. By prioritizing effective risk management, institutions can safeguard their interests as well as those of their stakeholders.

Technological Impact on Compliance

The advancement of technology has revolutionized how financial institutions approach regulatory compliance. Innovative tools and technologies, such as artificial intelligence and machine learning, have emerged as vital assets in managing compliance functions efficiently. These technologies enable organizations to automate time-consuming processes, reduce errors, and enhance data analysis capabilities. Automation allows institutions to monitor transactions in real-time, improving their ability to detect suspicious activities automatically. Moreover, compliance management systems that leverage technology can provide organizations with insights into compliance risks, helping them to adjust their strategies proactively. The integration of technology into compliance not only streamlines operations but also ensures adherence to regulatory changes, which can frequently occur. Additionally, technology supports robust reporting mechanisms, allowing institutions to provide regulatory bodies with accurate data at any given moment. However, with these advancements come challenges, particularly concerning data privacy and security. Financial institutions must balance the benefits of technology with the necessity of safeguarding sensitive information. Addressing these challenges requires ongoing investment in cybersecurity measures and employee training to navigate the complexities that technology introduces into compliance practices.

Another important consideration regarding international regulations is their impact on corporate culture within financial institutions. Governance practices and ethical standards are often deeply influenced by compliance expectations. Institutions that prioritize effective compliance programs tend to cultivate a culture of accountability and ethical behavior among their employees. Such a culture emphasizes the importance of adhering to laws and regulations while also promoting ethical decision-making across all levels of the organization. Training programs that inform employees about relevant international regulations form a significant part of this culture. When employees are equipped with knowledge and resources, they are more likely to contribute positively to organizational integrity. A strong compliance culture can help mitigate risks associated with regulatory breaches, ultimately protecting the organization’s reputation and financial stability. In contrast, firms that neglect to instill such values may face higher incidences of non-compliance, leading to regulatory scrutiny and potential punitive measures. Thus, international regulations act as catalysts for fostering a culture rooted in transparency and ethical governance, influencing how institutions operate fundamentally.

Future of Financial Compliance

Looking ahead, the future of financial compliance will likely be shaped by ongoing developments in international regulations and increased globalization of finance. As financial markets continue to evolve, regulatory bodies will also adapt their frameworks to respond to new challenges and risks. Institutions will need to remain agile in their compliance strategies, consistently evaluating how emerging regulations affect their operations. Global cooperation among regulatory bodies will play a crucial role in aligning compliance standards across nations, promoting fairer practices and reducing regulatory arbitrage opportunities. Moreover, increased focus on sustainability and responsible finance may lead to the development of new regulations addressing environmental, social, and governance (ESG) issues. Therefore, organizations will not only need to manage traditional compliance but also stay ahead of progressing paradigms in responsible finance. This multifaceted approach to compliance will require comprehensive training and awareness initiatives to equip financial professionals with the skills necessary to adapt to a dynamic landscape. As compliance evolves, financial institutions that demonstrate adaptability and commitment to meeting regulatory requirements will strengthen their reputations and ensure long-term success.

In conclusion, the influence of international regulations on financial compliance is unmistakable. Organizations operating within the global finance landscape must recognize the importance of these regulations to ensure their legitimacy and effectiveness. Through proactive engagement with regulatory bodies, investment in technology and training, and fostering a culture of compliance, firms can mitigate risks associated with regulatory breaches. Moreover, staying informed about changes in international regulations will be pivotal for navigating a complex and fast-evolving financial environment. Institutions that prioritize compliance as a core component of their operations will not only protect their interests but contribute positively to the overall stability of the financial system. In a world where global finance is continually interconnected, adherence to regulations will ultimately enhance the integrity and sustainability of the financial landscape. Therefore, embracing these regulations and viewing them as opportunities for improvement rather than mere obligations can empower firms to thrive in this challenging and competitive field. The journey towards robust financial compliance is ongoing and calls for dedication, innovation, and active participation, paving the way for a responsible and ethical finance industry in the future.