Time Frames and Their Importance in Forex Swing Trading

Forex swing trading is a popular strategy for traders looking to profit from price movements over several days to weeks. Swing traders typically rely on technical analysis and chart patterns to identify potential entry and exit points in the market. One of the crucial elements in swing trading is understanding the different time frames and how they impact trading decisions. Time frames, from minutes to daily charts, can provide unique insights into market sentiment and price action. Choosing the right time frame can help traders avoid false signals and improve their overall trading performance. In this rapidly moving market environment, swing traders must remain adaptable and aware of changes that can occur in various time frames. Some traders may prefer to focus on longer time frames, such as the daily or weekly charts, allowing for more extended periods for price movements. Others may choose shorter time frames for more immediate opportunities and faster decision-making. Regardless of the time frame, consistent analysis and monitoring of price action are vital for successful swing trading in the Forex market.

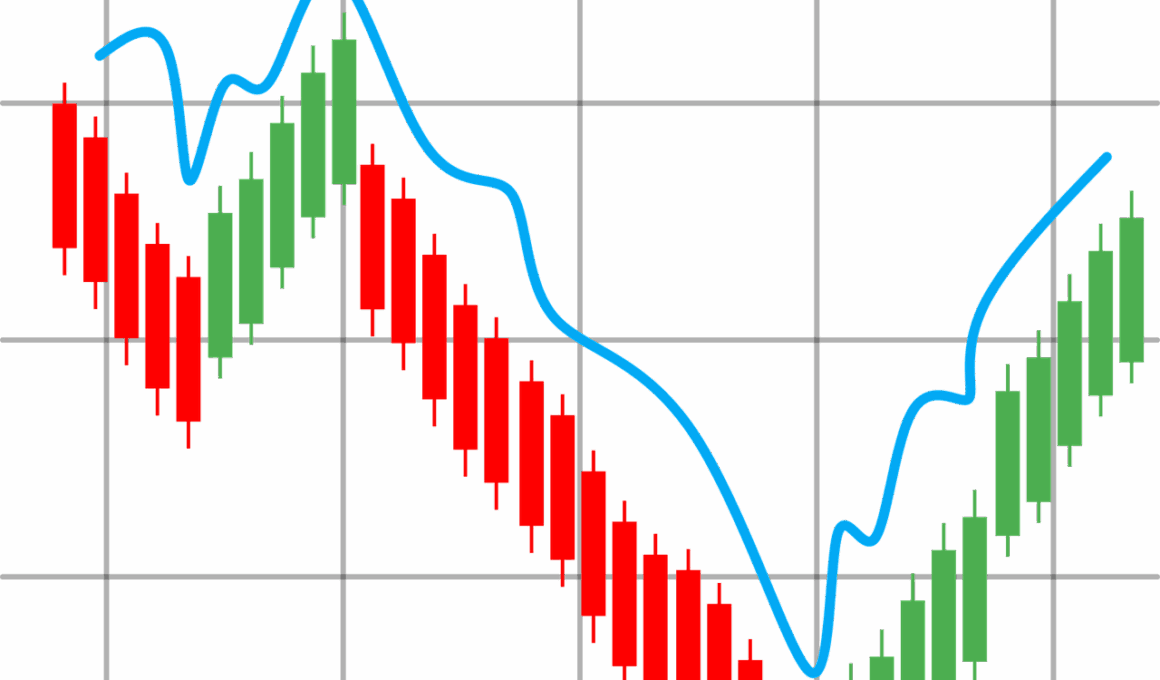

Understanding the relationship between time frames is essential for swing traders. Each time frame can reveal different aspects of the market that can significantly influence trading decisions. For instance, if a trader observes an upward trend on a daily chart, it might indicate overall bullish sentiment. However, a quick look at a shorter time frame, such as a 4-hour chart, could reveal potential resistance levels or retracements that might impact short-term trading positions. Effective swing trading requires a combination of both long-term and short-term analysis to make informed decisions. It is essential to be aware of how different time frames can present conflicting signals. Hence, traders often use multiple charts to get a clearer picture of trends and price movements. By cross-referencing signals from various charts, traders can improve their chances of entering profitable trades. Furthermore, utilizing tools like moving averages and oscillators can help in understanding potential entry and exit points across different time frames. Ultimately, swing traders who incorporate a multi-timeframe analysis approach are more likely to experience success in the dynamic Forex trading environment.

Choosing the Right Time Frame for Swing Trading

When navigating the Forex market, selecting the appropriate time frame is crucial for successful swing trading. Less experienced traders may gravitate towards shorter time frames, mistakenly believing that they will provide more opportunities. However, swing trading requires patience and an understanding of market dynamics at a larger scale. Generally, swing traders may focus on higher time frames for overall market trends, identifying potential entry points based on these trends. Conversely, using lower time frames allows for more precise entry and exit points, which can optimize profit potential. A common practice is to work with a combination of daily and hourly charts, allowing traders to confirm trends and refine entries. Additionally, aligning the trading plan with selected time frames can lead to enhanced execution and increased confidence in trading decisions. It’s essential that swing traders regularly assess their strategies and adjust their time frames as necessary, depending on market conditions. Recognizing the right time frame can lead to better risk management, enabling traders to set tighter stop-loss levels that correspond to market volatility.

Moreover, understanding market volatility is fundamental when selecting time frames for swing trading. Forex markets can experience varying degrees of volatility, significantly impacting price movements. Higher volatility in shorter time frames can create opportunities for quick gains, but it can also increase the risk of adverse market movements. Swing traders must evaluate market trends alongside volatility levels to optimize their trading positions. For instance, when trading in a highly volatile environment, a trader might choose to utilize longer time frames to minimize exposure to rapid fluctuations. Conversely, during periods of lower volatility, engaging in shorter time frames could present more trading opportunities. It’s beneficial for traders to incorporate volatility indicators, such as the Average True Range (ATR), to gauge market conditions effectively. Taking the time to analyze and adapt to volatility can lead to more effective trading strategies, enhancing the probability of success in Forex swing trading. Ultimately, adopting a flexible approach and continuously assessing market conditions will assist traders to navigate and thrive in differing time frames successfully.

The Role of Indicators Across Different Time Frames

Indicators play a significant role in swing trading, providing traders with essential tools to make informed decisions. When analyzing different time frames, traders must consider how specific indicators can behave under various conditions. For example, moving averages can smooth out price action, helping traders identify the direction of the trend more easily. On a daily chart, a moving average might offer an overview of overall market strength, while on an hourly chart, it might reveal potential reversal points. Using oscillators, such as the Relative Strength Index (RSI), can provide valuable insights into overbought or oversold conditions in both shorter and longer time frames. Additionally, traders should be wary of relying exclusively on one indicator; using multiple tools can create a comprehensive trading strategy. Recognizing how indicators perform across time frames can lead to more effective technical analysis and improved trade execution. Keeping an eye on how price action reacts to support and resistance levels on different time frames can also increase traders’ situational awareness and decision-making efficiency.

Finally, successful swing traders often develop their trading plans based on their understanding of time frames and indicators. A well-defined trading plan encompasses entry and exit criteria, risk management strategies, and clearly defined profit targets. By utilizing higher time frames for trend identification and lower time frames for precise trade execution, traders can create a balanced approach to swing trading. Additionally, traders may benefit from incorporating back-testing strategies to evaluate how their plan performs before actual implementation. Regular capital allocation review during trading can also contribute to successful swing trading. Enhanced discipline and adherence to the trading plan are vital for long-term success. The Forex market is a highly competitive environment, and traders who consistently refine their strategies stand a better chance of achieving significant returns. Whether trading during periods of high volatility or calmness, understanding the importance of time frames will be a deciding factor in determining overall success in Forex swing trading. Implementing effective strategies based on time frame analysis can lead to sustained profitability.

Conclusion: The Impact of Time Frames in Forex Swing Trading

In conclusion, recognizing the impact of time frames in Forex swing trading is essential for traders seeking to navigate the complexities of the market. Understanding the dynamics between various time frames can greatly improve trading decisions and enhance profit potential. Utilizing a structured approach that combines different time frames, thoughtful analysis of price movements, and diligent risk management strategies can create a favorable trading environment. Knowledge of indicators, along with consistent market monitoring, ensures traders remain informed about shifting trends and opportunities. Moreover, adaptability in trading is crucial, as market conditions can fluctuate frequently. By embracing a multi-faceted approach to time frames, traders can better position themselves for success in the Forex market. Maintaining discipline, flexibility, and a willingness to learn are vital attributes for any trader. As Forex swing trading continues to evolve, staying current with market trends and time frame dynamics will be a cornerstone for a trading strategy aimed at consistent profitability. Therefore, investing time in understanding time frames can yield significant benefits for swing traders in pursuit of financial success.

As a final note, ongoing education in Forex trading practice can refine skills and strategies.Attending webinars, reading articles, and joining trading communities will allow traders to exchange ideas and experiences, all of which are vital for continuous improvement. Staying informed about economic events and news releases affecting the Forex market also helps traders better anticipate price movements within different time frames. With consistent practice and focus on time frame analysis, traders can achieve a deeper understanding of market mechanisms. Armed with the right knowledge and tools, aspiring traders can navigate the fluctuating nature of Forex swing trading with greater confidence and clarity. Developing a mindset of resilience and adaptation will serve long-term trading goals, reflecting in improved results and profitability in the Forex market.