Derivatives Pricing Models: An Insight into Valuation Techniques

Derivatives pricing models play an essential role in the financial markets, providing necessary valuation techniques for various financial instruments. These instruments include options, futures, and swaps, which are widely utilized to hedge risk and speculate on future price movements. A key aspect of derivatives pricing is the determination of fair value based on the underlying asset’s price dynamics. Each pricing model addresses different elements such as volatility, interest rates, and time decay, which can significantly impact pricing outcomes. The models widely used include the Black-Scholes model, binomial models, and Monte Carlo simulations. Each of these models has unique applications in different market conditions, enhancing the trader’s ability to make informed decisions. For instance, the Black-Scholes model is particularly favored for European options due to its theoretical framework for option pricing. On the other hand, the binomial model is more flexible, allowing for American options valuation, which can be exercised at any time before expiry. Overall, understanding these pricing models can empower traders and investors in their trading strategies and risk management approaches.

The Black-Scholes model stands out as one of the foundational frameworks in the derivatives market. Developed by economists Fischer Black, Myron Scholes, and Robert Merton in 1973, this model provides a mathematical approach to calculate the theoretical price of European call and put options. The model assumes a constant risk-free interest rate, efficient markets, and log-normal distribution of asset prices over time. Variance and volatility are critical components in this model since they directly impact option pricing. Black-Scholes revolutionized the finance industry by introducing a formula that could accurately estimate option prices based on observable market inputs. However, it does have limitations, particularly in addressing more complex options and dynamic market conditions. Additionally, the assumption of constant volatility often diverges from reality since markets experience fluctuations. Despite these limitations, the Black-Scholes model remains a foundation for further derivatives pricing innovations. Financial instruments and trading strategies continuously evolve, emphasizing the need for refined models that can better reflect the complexities of modern financial markets and investor behaviors.

Understanding Binomial Models

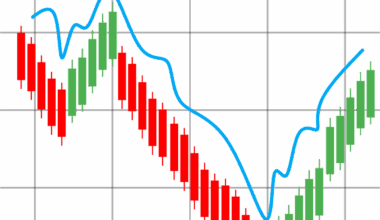

Binomial models are another vital list of valuation techniques employed in derivatives pricing. The binomial option pricing model (BOPM) presents a more adaptable approach compared to the Black-Scholes model. It accounts for various possible paths the underlying asset’s price might take over time, culminating in a tree structure from which future prices are computed in discrete time intervals. By implementing this method, traders can evaluate American options which can be exercised at any point before expiration, thus offering greater flexibility. The binomial model hinges on the concept of ‘up’ and ‘down’ movements in the asset’s price at each interval, allowing a straightforward calculation of potential payouts. The binomial model provides options pricing alternatives under varying scenarios and is especially useful for teaching purposes due to its intuitive nature. Several iterations of the model can produce increasingly accurate results as more time intervals are added. This process allows traders to visualize and grasp the potential outcomes of their investments and helps them strategize effectively in volatile market conditions.

Monte Carlo simulations present yet another advanced approach to options pricing, especially beneficial for pricing complex derivatives. This statistical technique uses random samples and computational algorithms to model therefore capturing a wide range of possible market outcomes. By simulating different paths for the underlying asset’s price, traders can gauge probable prices and payoffs based on a multitude of scenarios. This method is exceptionally powerful for evaluating options with multiple sources of uncertainty or path-dependent features, making it ideal for exotic options. Unlike the Black-Scholes or binomial models, Monte Carlo simulations do not require the assumption of constant volatility or distribution of returns, leading to more nuanced asset value assessments. However, it is computationally intensive and may require considerable time and resources, especially as the complexity of the derivatives increases. Investors often leverage Monte Carlo simulations in conjunction with other models to augment their analysis. Effectively incorporating this technique enhances decision-making by offering a comprehensive view of potential future prices and risk profiles across fluctuating market conditions.

Market Implications of Pricing Models

The implications of derivatives pricing models extend beyond individual trades, affecting the broader market dynamics and liquidity. Various pricing models contribute to a more efficient market environment by providing standardized methods to assess derivatives’ values, thus incorporating new information quickly. Traders and investors rely on these models to inform their strategies, and discrepancies between theoretical values can lead to arbitrage opportunities. As more traders engage with derivatives in complex ways, the demand for sophisticated pricing models and technologies has intensified. Market makers use these models to quote bid-ask spreads more accurately, improving liquidity within the financial markets. Furthermore, heightened accuracy in pricing fosters trust in the markets, ultimately attracting additional investors. Properly priced derivatives can also minimize systemic risks that could arise from mispricing, enhancing the overall financial stability of markets. As the sophistication of financial instruments grows, so too does the importance of accurate and reliable pricing models, which must adapt accordingly to meet emerging challenges and opportunities in a constantly evolving landscape.

Continuous development in pricing models reflects the evolving landscape of derivatives and financial technology. Techniques and models continually adapt to meet the needs of traders and investors exposed to increasingly complex instruments. Innovations in algorithmic trading and artificial intelligence (AI) are transforming how pricing models are constructed and implemented. AI-powered models offer substantial advantages such as predictive analytics, reducing the time required for analyses while improving accuracy. Consequently, these technologies bolster traders’ confidence in their decision-making processes. Furthermore, as data availability increases and computational power grows, model accuracy continues to evolve, enhancing the understanding of market behaviors. This shift has profound implications for risk management, as intricate models can render more accurate assessments of potential risks, leading to improved strategies. The integration of real-time data into pricing models is shaping the future of trading. However, while innovation offers numerous benefits, it is also critical for traders to remain adaptive and aware of the basics of traditional pricing models. Balancing the use of advanced techniques with foundational knowledge is essential for future success in derivatives trading.

Conclusion: The Future of Derivatives Pricing

In summary, derivatives pricing models serve as vital tools in the financial markets, facilitating informed decision-making for traders and investors. Models like Black-Scholes, binomial approaches, and Monte Carlo simulations provide various methods of valuation, each suited to specific market conditions and instrument types. As the derivatives landscape becomes more intricate, so too does the need for advanced pricing models that accommodate unique complexities. The next generation of derivatives pricing will likely incorporate cutting-edge technologies, including AI and machine learning, to enhance predictive capabilities and decision-making processes. Understanding both foundational and innovative pricing models will remain crucial for market participants looking to navigate the challenges of modern trading. As competition and innovation redefine the markets, continuous education and adaptation will pave the way for successful trading practices. Ultimately, a robust grasp of pricing techniques will empower traders to derive maximum value from their investments, solidifying their positions in an increasingly competitive environment. The future of derivatives pricing remains optimistic, driven by innovation and a deeper understanding of market dynamics.

The necessity of having comprehensive knowledge about derivatives pricing models cannot be overstated. It is imperative for all market participants, including traders, fund managers, and financial advisors, to stay informed about current models and their implications. Engaging with various models enhances understanding and facilitates better responses to market fluctuations. Moreover, integrating technological advancements into pricing methodologies will help optimize risk assessment. To navigate successfully through financial markets, continuous learning and understanding of these models are key factors for proving success. Knowledge of derivatives pricing standardizes approaches, ensuring fair pricing and contributing to market integrity. Each model presents unique features, strengths, and weaknesses that influence the valuation process. Thus, selecting the right model for specific circumstances can significantly affect outcomes. As markets evolve and new financial instruments emerge, the relevance of competent pricing models continues to rise. Overall, masterful engagement with derivatives pricing techniques will ultimately play a crucial role in shaping future trading environments and strategies.