Balancing Risk and Reward: Executive Compensation Strategies

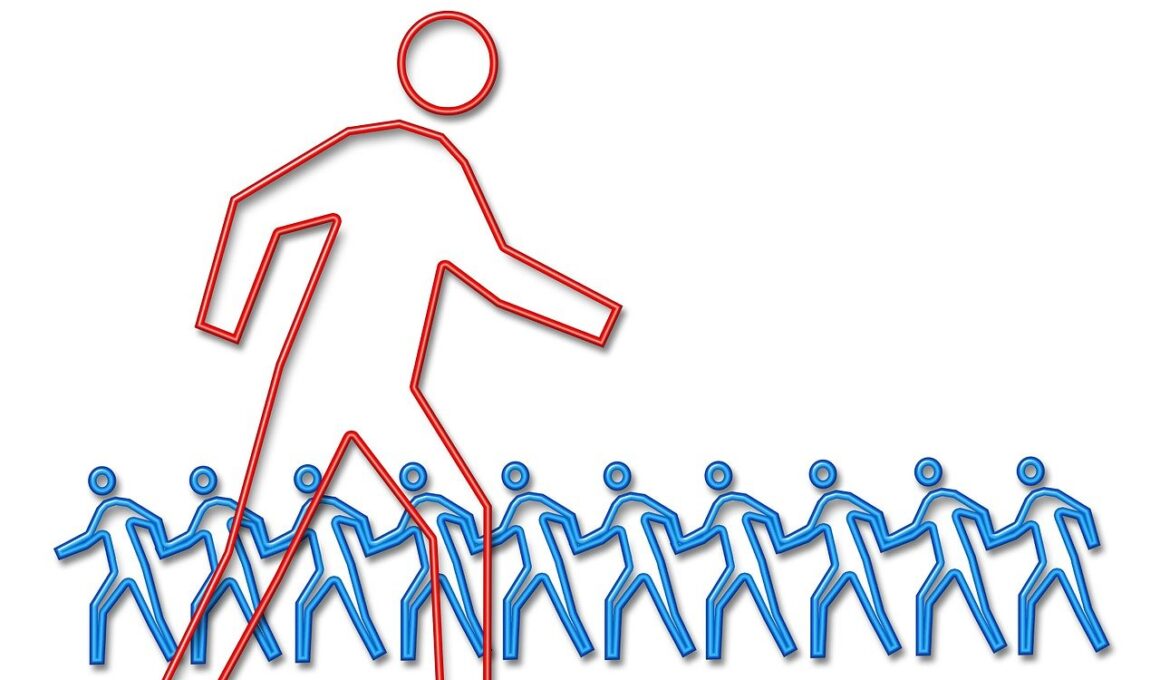

Effective executive compensation strategies are essential for businesses aiming to align the interests of their leaders with those of stakeholders. These compensation packages often include a mix of salary, bonuses, and equity-based components. By providing incentives, companies encourage executives to focus on long-term value creation rather than short-term gains. However, this balance is not always easily achieved. Stakeholders must ensure that components are structured to minimize excessive risk-taking while rewarding performance. For instance, salary components need to be competitive to attract talent, but they must not overshadow performance-based pay, which should ideally reward sustainable outcomes. The complexity of these packages can lead to criticism if they are perceived as disproportionately benefiting executives at the expense of shareholders.

The design of executive compensation packages requires careful consideration. An effective strategy incorporates various performance metrics, such as revenue growth, profitability, and stock performance. By incorporating these elements into the compensation structure, companies can drive desired behaviors among executives. Moreover, transparency plays a critical role in how these packages are managed. Stakeholders should be fully aware of the rationale behind the metrics chosen for performance evaluation. It is important to communicate clearly to shareholders how each performance metric contributes to value creation over time. This clarity can foster trust and mitigate concerns surrounding allegations of excessive pay.

Linking Compensation to Performance

A robust executive compensation strategy links pay directly to performance outcomes. This alignment helps to ensure that executives are motivated to pursue strategies that benefit the entire organization. When compensation is tied to specific achievements, this encourages prudent decision-making and long-term planning. Many companies utilize key performance indicators (KPIs) to establish these links. KPIs can encompass qualitative factors, such as leadership effectiveness, and quantitative measures, such as financial returns. By establishing a clear connection between pay and performance, companies can navigate the complex landscape of executive compensation effectively. Continued assessment of these KPIs also supports adjustments in compensation as market conditions change.

Variable pay components, such as bonuses and stock options, have become increasingly popular in executive compensation packages. These components create a risk-sharing dynamic between executives and the company, aligning their interests more closely with those of shareholders. However, the design of these variable components is crucial. They should be structured to reward long-term performance rather than temporary spikes in company performance to avoid fostering risky behavior. Implementing vesting periods for stock options can also mitigate excessive risk-taking, ensuring that executives remain committed to the organization’s long-term goals. Initiatives like these are critical for maintaining a balanced compensation strategy.

Regulatory Considerations

Regulatory considerations also significantly impact executive compensation strategies. Governments and financial regulatory bodies are increasingly scrutinizing the structures of these compensation packages. Firms may face pressure to adopt more transparent and equitable practices due to rising shareholder activism. Compliance with such regulations is essential not only for legal reasons but also for maintaining credibility and trust with stakeholders. Additionally, regulatory frameworks often encourage companies to establish more rigorous internal governance standards, further aligning executive remuneration with company performance. This scrutiny ensures that compensation practices are not only competitive but also ethically sound and responsible.

Board oversight is key to ensuring that executive compensation aligns with corporate governance principles. Compensation committees should regularly review the effectiveness of compensation strategies to determine if they produce desired outcomes without unnecessary risk. These committees play a pivotal role in assessing how compensation packages reflect overall company strategy and performance. Engaging independent advisors can also bring added clarity and objectivity to this process. By incorporating diverse perspectives in the evaluation process, boards can minimize potential pitfalls in executive pay structures. This oversight is vital for fostering accountability and transparency in executive compensation.

Future Trends in Executive Compensation

Future trends in executive compensation will likely focus on sustainability and environmental, social, and governance (ESG) metrics. Companies are increasingly recognizing the importance of integrating ESG factors into their performance evaluations. As stakeholders become more concerned about corporate social responsibility, compensation packages that reflect these values will likely gain prominence. For example, tying bonuses to specific sustainability goals may become a standard practice. Additionally, firms are expected to remain adaptable in their compensation strategies to respond to changes in the market environment. This adaptability will support the long-term success of organizations, ensuring they remain competitive while also fulfilling their corporate responsibilities.

In conclusion, balancing risk and reward in executive compensation is a critical aspect of effective corporate governance. Companies must develop well-structured compensation plans that align the interests of executives with those of shareholders. This involves careful consideration of performance metrics, regulatory compliance, and ethical considerations. In an evolving corporate landscape, acceptance of best practices and oversight are essential in maintaining a fair and impactful compensation strategy. Fostering a culture that supports transparency and accountability will allow organizations to thrive in today’s competitive markets. As companies navigate the intricate dynamics of executive compensation, these strategies become increasingly vital for achieving long-lasting success.