Interpreting Stock Market Signals for Forex Trading Decisions

Forex trading can significantly benefit from an understanding of stock market signals. The relationship between the two markets is critical for making informed decisions. Forex traders should monitor key stock market indicators that may influence price movements in currency pairs. These indicators include trends in major stock indices, such as the S&P 500 and NASDAQ. Additionally, changes in investor sentiment reflected in stock prices can provide clues about potential shifts in currency values. For example, if the stock market experiences a downturn, it may lead traders to seek safe-haven currencies, such as the USD or JPY. Recognizing these patterns helps traders anticipate moves in the forex market. Technical analysis of stocks can also provide valuable insights into forex trading strategies. By applying similar charting techniques used in forex to stocks, traders can identify correlations that assist in decision-making. Understanding correlations between different assets ultimately allows traders to maximize their profitability. Furthermore, keeping abreast of economic news that impacts stock markets can refine trading strategies in the forex market.

Identifying key stocks that affect forex can help traders capitalize on currency fluctuations. Major multinational corporations can significantly impact forex rates, notably when their earnings surpass or fall short of expectations. For example, companies like Apple or Amazon often have a direct correlation with the strength of the US dollar due to their substantial contributions to the economy. Traders need to observe the performance of such companies, as it reflects on the forex market. Another important factor to consider is how central bank policies influence both stock and forex markets alike. Interest rate changes, for example, can lead stock prices to rise or fall, thereby impacting currency values. Traders should also pay attention to geopolitical events, as they can create volatility in both markets. Significant political developments often lead to rapid price adjustments, providing trading opportunities. Utilizing financial news outlets and platforms can yield information about market dynamics affecting forex. Recognizing these relationships and signals enables traders to position themselves strategically in the forex market. Connecting stock performance with forex trading decisions enhances overall strategy, helping traders navigate fluctuating markets effectively.

Technical Analysis Techniques

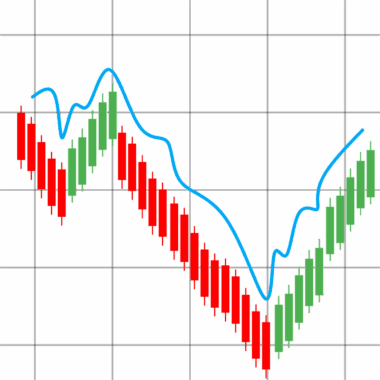

Technical analysis offers essential tools for interpreting stock market signals in forex trading. Traders commonly employ chart patterns and indicators to forecast price movements. Some popular tools include moving averages, RSI, and MACD. By analyzing these indicators, traders can identify potential reversal points in both markets. For instance, a bullish trend in stocks often correlates with a strong currency value. Traders should also explore divergence between stock and currency movements. If stock prices rise while the currency weakens, it may suggest an impending market correction. By understanding these signals, traders can develop strategies that anticipate adjustments in forex pairs. Furthermore, volume analysis can provide further insights; increasing volume alongside a stock price surge typically signals strength that may manifest in corresponding currency movements. Strategies that implement these technical analysis techniques can lead to more informed trading decisions. Combining stock analysis with forex strategies creates a nuanced approach. This multifaceted perspective can be vital for adapting to changing market conditions. Being capable of reading both landscapes can enhance a trader’s toolkit for successful forex trading.

Mastering fundamental analysis is equally important for linking stock and forex trading. Economic indicators such as GDP, unemployment rates, and inflation vastly affect both asset classes. Traders need to assess macroeconomic conditions to understand broader market sentiments. For example, positive economic news in the US might boost the stock market, subsequently strengthening the US dollar. Similarly, negative news can weaken both stocks and its corresponding currency. Keeping abreast of scheduled economic reports is essential for any trader looking to navigate these links. Moreover, international events, such as trade negotiations or global crises, can shift market dynamics markedly. As a result, forex traders should strategically plan their trades around such announcements. Developing a calendar to track important economic indicators supports making timely, educated decisions. Analyzing how specific stocks react to these reports allows traders to gain insights relevant to forex trading. Life is often unpredictable in financial markets; consequently, staying informed helps mitigate risks. Tying these fundamental aspects together can greatly enhance a forex trader’s proficiency in interpreting signals effectively.

Correlation and Diversification

In forex trading, understanding market correlations is crucial to strategic decision-making. Currency pairs often correlate with various assets, including stock markets. For instance, a strong correlation typically exists between certain equity indices and currencies in their respective economies. Recognizing these correlations can help traders identify promising forex opportunities or hedge their investments. Correlations can change, leading traders to diversify their portfolios. By creating a diversified trading strategy, traders can reduce risks associated with relying on one market trend. Moreover, during turbulent economic times, diversification helps protect capital. This practice encourages exploring lesser-known currency pairs alongside mainstream ones. Such strategies allow traders to adapt to varying market conditions while capitalizing on diverse opportunities. Traders should familiarize themselves with positive and negative correlations within their trading strategies. An example of a negative correlation might be observing that when emerging market stocks fall, safe-haven currencies thrive. Keeping these dynamics in mind enables proactive trading. The forex market reacts rapidly to global events, ultimately making correlation strategy imperative for successful forex trading.

Risk management plays a vital role in executing forex trades influenced by stock market signals. Establishing a risk-management plan helps limit potential losses associated with market volatility. Rather than relying solely on intuition or emotions, traders should implement calculated risks. They should begin by determining their maximum risk tolerance and applying it consistently across trades. Creating stop-loss orders is a common method to protect against unforeseen market movements. Additionally, employing a position size calculation based on trade risk can enhance strategy. Keeping a trading journal documenting each action helps traders learn from experiences, both rewarding and disappointing. This habit allows monitoring progress and refining skills. Establishing consistent practices can lead to improved decision-making over time. Moreover, accurately measuring exposure to forex trades offers further risk reduction. Traders often hedge their positions, using options or inversely correlated assets, which provides added safety against adverse market changes. Ongoing education about emerging forex strategies should be a priority. By remaining adaptable, forex traders are better positioned to respond effectively to stock market signals.

Conclusion and Future Considerations

In conclusion, understanding how to interpret stock market signals can enhance forex trading decisions significantly. Applying insights from stock trends and economic news allows for improved forecasting. As new technologies emerge and market dynamics shift, ongoing adjustments to trading strategies will be necessary. This adaptability will prepare traders to face future challenges, ensuring relevancy in their approaches. Continuous learning will empower traders to excel through changing environments. Expanding knowledge of different markets and how they interact is paramount in achieving long-term success. By maintaining a comprehensive view on financial markets, traders can refine their skills, thus contributing to overall profitability. Collaboration and sharing insights within trading communities can build knowledge further. Connecting with other traders who focus on intermarket analysis can yield beneficial information. Ultimately, forex trading integrates various indicators and signals that require a multifaceted perspective. Pursuing this understanding can lead traders toward remarkable success and provide a significant edge over competitors. With diligent research and practice, traders can thrive in an ever-evolving landscape.

To succeed in today’s dynamic trading environment, integrating multiple strategies and insights is essential. Opportunities arise when traders effectively correlate stock performance with currency movements. Mastering analysis of these intermarket relationships enhances the overall strategy. As global influences grow, adapting methodologies will be crucial for navigating future trading scenarios. Therefore, traders must remain vigilant and open to learning about developing economic trends and patterns. Utilizing various resources for economic news, analysis, and market insights ensures an advantage in decision-making. Embracing technological advancements in trading platforms will further refine the execution of trades. Utilizing tools that analyze vast amounts of data quickly improves insight capability for upcoming market moves. Continuous engagement in educational resources, forums, and webinars can further enhance traders’ expertise. By investing time in mastering these techniques, traders can expect to see positive results in their trading endeavors. The journey of learning never truly ends, and those willing to adapt will thrive amidst changing landscapes. Creating a personalized system for managing trading strategies based on stock signals will undoubtedly give traders the upper hand as they navigate the complexities of forex trading.