Interpreting Shareholders’ Equity and Retained Earnings

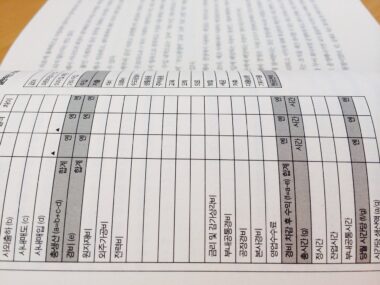

Understanding shareholders’ equity and retained earnings is essential for assessing a company’s financial health. Shareholders’ equity represents the net assets owned by shareholders, calculated by deducting total liabilities from total assets. This figure indicates how much of the company’s assets are financed through shareholders’ investments. Retained earnings, on the other hand, comprise the accumulated net income that has not yet been distributed as dividends. Evaluating both metrics helps investors determine the sustainability of a company’s financial structure. Components of shareholders’ equity include common stock, preferred stock, additional paid-in capital, and treasury stock. Each element serves to highlight how equity is structured, providing insight into the organization’s investment strategy. Investors should scrutinize these figures to measure financial performance over time, identifying patterns that may influence investment decisions. Understanding these financial statements requires attention to detail, prompting analysis beyond surface-level evaluations. By doing so, stakeholders can make informed judgments regarding a company’s potential for growth and stability. Hence, monitoring changes in shareholders’ equity and retained earnings is vital for making sound financial decisions in the investment landscape.

Shareholders’ equity is often categorized into various components, each revealing different insights about a company’s financial position. Common stock, which signifies ownership in the company, is often the largest portion of shareholders’ equity. On the other hand, preferred stock offers dividend priority over common stock, often with fixed dividends. Both types of equity reflect investor confidence and the company’s growth prospects. Additional paid-in capital reflects funds raised beyond the par value of shares, indicating investor willingness to pay more for ownership. Treasury stock represents shares repurchased by the company, effectively reducing the amount of equity available to shareholders. Monitoring the changes in these items provides crucial information about how management utilizes equity. Since retained earnings arise from net income, they indicate how profit is being reinvested versus distributed to shareholders as dividends. Investors need to interpret the entirety of shareholders’ equity to evaluate a company’s overall strategy effectively. Understanding how companies allocate earned profits affects perceptions of future performance and risk. Furthermore, successful enterprises often use retained earnings for expansion, reflecting management’s focus on growth and long-term viability.

Retained earnings play an essential role in financial statement analysis, acting as an indicator of a company’s growth trajectory. This metric is calculated from cumulative net income, minus any dividends paid out to shareholders, thus reflecting undistributed profits. High retained earnings can signal strong past performance and the potential for reinvestment into business operations. Conversely, declining retained earnings might suggest poor financial health, prompting investors to inquire about operational issues. Additionally, retained earnings impact the company’s ability to pursue new opportunities like acquisitions and expansions without taking on debt. A company with ample retained earnings may have a competitive edge in funding innovative projects without external financing. Investment strategies often hinge on analyzing retained earnings trends alongside revenues and expenses, highlighting their importance in understanding a firm’s sustainability. It’s crucial to contextualize retained earnings within the broader scope of financial reporting, considering how they relate to overall profitability and strategic growth. Stakeholders should always look for ways to compare retained earnings relative to industry benchmarks for a clearer picture.

The Importance of Clear Reporting

Clear and transparent reporting of shareholders’ equity and retained earnings is vital for stakeholders. Investors rely heavily on accurate financial statements to make informed decisions regarding their investments. A lack of clarity in these areas can lead to misinterpretations of financial health, affecting market confidence. Companies are required to present information on shareholders’ equity in compliance with accounting standards, ensuring that investors receive relevant data to assess performance. Moreover, significant fluctuations in equity can trigger auditing processes to ensure correctness and adherence to regulations. Providing context—such as the reasons behind changes in retained earnings—enhances transparency, building trust with investors. Corporate governance policies also advocate for straightforward communication regarding financial metrics to foster investor assurance. In the digital age, timely dissemination of accurate financial information supports not only investor relations but overall market stability. Taking extra efforts for clarity can improve a company’s reputation and investor loyalty. Therefore, firms should prioritize transparency around equity and earnings to establish a solid foundation for investor engagement over time.

Investors often utilize key ratios to analyze shareholders’ equity and retained earnings effectively. One significant ratio is the return on equity (ROE), which measures a company’s ability to generate profit from shareholders’ equity investments. A higher ROE signifies effective management in utilizing equity for profit generation, attracting potential investors. Another important ratio is the debt-to-equity ratio, which evaluates a company’s financial leverage and risk. A lower ratio is often preferred, indicating that the company relies less on borrowed funds and a stable equity position. Accurate analysis of these ratios provides insights into the company’s risk versus return profile, helping investors determine their investment strategy. Furthermore, analyzing trends in retained earnings alongside these ratios reveals the company’s earnings retention policy, operational performance, and strategic focus. Changes in these ratios over time can help forecast future performance, guiding investment decisions. Additionally, retaining earnings often correlates with reinvestment into the business, highlighting management’s beliefs about the company’s growth prospects. Thus, strategic analysis of these financial figures can help guide informed investment decisions, aiding stakeholders in understanding financial dynamics more comprehensively.

Potential Red Flags in Equity Reporting

When evaluating corporate financial statements, investors should be vigilant for potential red flags in equity reporting. Sudden decreases in shareholders’ equity may indicate underlying operational challenges, which merit closer examination. Additionally, excessive retained earnings without corresponding growth can signal management’s inefficiency or unwillingness to share profits with shareholders, raising questions about their motives. It’s essential to analyze the reasons behind changes in these figures to grasp financial stability comprehensively. Companies must disclose detailed information regarding equity transactions, including stock repurchases and changes in dividend policies, ensuring transparency. Investors should remain cautious if a company exhibits inconsistent growth patterns in retained earnings, diverging from industry averages. Abrupt spikes or drops in equity could imply manipulation or mismanagement, leading to reputational risks. Vigilance in monitoring equity reports fosters a more insightful investment approach. Moreover, companies engaging in aggressive accounting practices might obscure the true state of their finances, raising the risk of potential losses for investors. Thus, maintaining an informed perspective will support better decision-making regarding equity investments.

In conclusion, the ability to interpret shareholders’ equity and retained earnings is a fundamental skill for investors. Proper understanding of these financial components can influence investment decisions significantly. Analysis should involve examining not only the figures presented but also the context in which they operate. Tracking equity trends provides invaluable insights into a company’s financial performance and management strategies. Retained earnings help ascertain how profits are managed, offering a window into the company’s future. Regular evaluation of these components can reveal strengths and weaknesses, guiding strategic investment choices. Implementing a disciplined approach to financial analysis allows for more informed decisions within complex market environments. Transparency in financial reporting enhances investor confidence, fostering stronger relationships between companies and stakeholders. Investors should prioritize familiarity with these accounting concepts to boost their financial acumen effectively. Ultimately, understanding shareholders’ equity and retained earnings lays the foundation for long-term financial success and stability in investment portfolios.