Biometric Authentication and the Future of Secure Payments

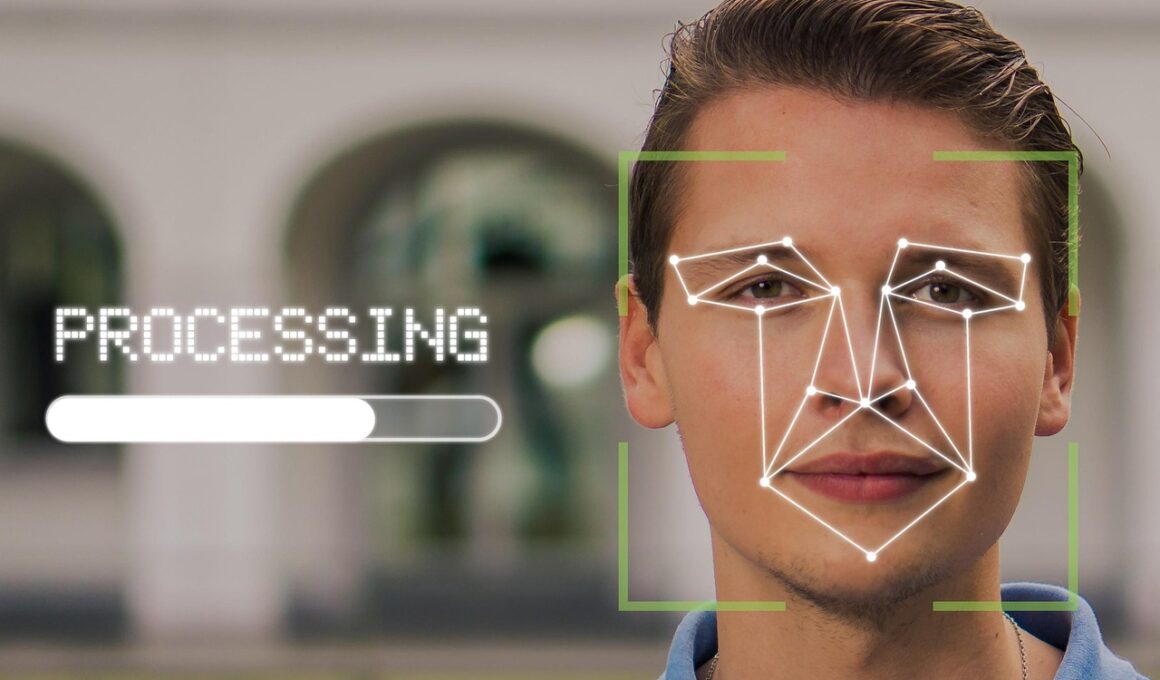

In the rapidly evolving financial technology landscape, biometric authentication has emerged as a game-changing element within the field of digital payments. Leveraging unique physical attributes such as fingerprints, facial recognition, and iris scans, biometric technology offers a seamless and secure alternative to traditional passwords. This level of security is especially crucial as cyber threats become increasingly sophisticated, necessitating stronger defenses against fraud and identity theft. Consumer confidence is directly linked to security measures; thus, implementing biometric solutions can enhance user experience, assuring customers that their transactions are safe. As financial institutions explore these technologies, they also focus on balancing security and convenience. This balance allows users to validate transactions quickly while maintaining robust encryption and data protection protocols. Furthermore, the integration of biometrics facilitates touchless transactions, essential in today’s health-conscious environment. With advancements in AI and machine learning, biometric systems continue to evolve, improving accuracy and reducing false positives. The convergence of these technologies creates an ecosystem where secure payments are not only desirable but expected. Moreover, regulatory frameworks are adapting to ensure that these innovative payment methods align with established laws and guidelines, fostering trust in these newer technologies.

As the adoption of biometric authentication expands, several factors influence its integration into mainstream digital payment solutions. One critical aspect is user education; customers must understand the benefits and implications of using biometric methods. Educating the public can foster acceptance and address privacy concerns associated with data storage and usage. To alleviate these fears, financial institutions must communicate clearly how biometric data is collected, stored, and secured. Transparency is vital since consumers are increasingly protective of their personal information in a world filled with data breaches. Additionally, different regions may have varying levels of readiness for biometric technology based on regulatory constraints and consumer willingness. Collaboration between tech companies and financial organizations will be crucial in developing standards that promote security while accommodating regional preferences. Moreover, companies developing biometric solutions must prioritize accessibility, ensuring that individuals with disabilities can also benefit from these technologies. Continuous innovation in this space will likely yield multi-modal solutions, where several biometric factors are combined for enhanced security. These developments will reshape user experiences, pushing aside the traditional reliance on passwords while ensuring that financial transactions are conducted in a safe environment accessible to everyone.

Challenges and Considerations in Biometric Security

Despite its promise, biometric authentication presents several challenges that need addressing for it to achieve its full potential in digital payments. A significant consideration is the potential for biometric spoofing, where attackers attempt to bypass systems using fake fingerprints or photos. Innovations in matching algorithms as well as adaptive technology are essential in combatting such fraudulent attempts. Another challenge relates to the storage of biometric data, which raises substantial privacy concerns. Regulatory compliance is imperative, as firms must navigate laws governing personal data and privacy rights, ensuring their systems are fortified against attacks. Moreover, the process of capturing biometric data should not add friction to the user experience; it needs to be fluid and effortless. The technology behind biometric scanners must continually evolve to ensure that accuracy and speed meet consumer expectations. Furthermore, there is the risk of creating a digital divide, with people from underserved communities lacking access to advanced technologies required for biometric authentication. Addressing these hurdles will require cooperation across industries, as well as continued investment in research and development to enhance the reliability of biometrics.

Consumer acceptance of biometric payment solutions is primarily influenced by the perceived benefits versus risks. Users often weigh how much security they gain versus their concerns over privacy and data usage. Studies show that consumers are more likely to embrace biometric methods when they are assured about the safety of their data through transparent practices. Institutions must focus on building a trusted reputation, implementing robust security measures that prioritize the protection of biometric data. Creating educational campaigns highlighting successful use cases can also be effective in furthering acceptance. Financial institutions should actively engage with customers, gathering feedback and addressing concerns surrounding these innovative solutions. User experience design is another critical element; systems must be intuitive and require minimal steps to authenticate. Additionally, the experience must be consistent across devices, ensuring that switching from mobile to desktop platforms remains smooth. The future of digital payments is closely tied to consumer sentiment regarding biometrics. Financial institutions that can effectively manage perceptions and provide reassurance while maintaining rigorous security will be in an advantageous position within the competitive market. Listening to customers and adapting to their needs will ensure biometrics serve as a bridge to safer, more efficient payments.

The Role of Regulations and Standards

Regulatory bodies have an essential role in shaping the future of biometric authentication within the digital payment space. As biometric technology advances, so too must the laws that govern its use. This includes ensuring that consumer data is handled in compliance with privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe. Regulatory frameworks should promote innovation while safeguarding consumer rights, creating a secure environment where advancements can flourish. Institutions adopting biometric solutions must remain informed about evolving standards to ensure compliance and avoid legal pitfalls. Establishing industry-wide standards can help standardize biometric practices, making it easier for consumers to know what to expect when transacting. Additionally, standardization can help foster interoperability among systems across different platforms. As most consumers increasingly engage with multiple financial services, a universal standard would provide consistency. Collaborative efforts among all stakeholders—governments, businesses, and tech developers—can create guidelines that protect user privacy while allowing for the seamless integration of biometric technologies into daily financial transactions. Ultimately, well-crafted regulations will shape the trust consumers place in biometric payments, influencing adoption rates in diverse markets.

The technology behind biometric authentication is continually evolving, driven by advancements in artificial intelligence and machine learning. These technologies improve the accuracy and efficiency of biometric systems, reducing the chances of errors and enhancing user experiences. Notably, as algorithms become more sophisticated, systems can learn from user patterns and environments, adapting to provide robust security measures. This dynamic approach to safeguarding transactions enables financial institutions to stay ahead of potential threats, ensuring a responsive defense mechanism. Moreover, ongoing research is likely to lead to even more innovative biometric modalities beyond fingerprints and facial recognition—such as voice or behavioral biometrics, which offer additional layers of identity verification. As these technologies mature, consumer trust in biometric payments is likely to increase proportionately, encouraging wider adoption. Businesses must stay abreast of such developments to maintain a competitive edge while ensuring consumer safety. Partnerships with technology companies specializing in biometric innovations can facilitate their integration into existing systems efficiently. Adopting a forward-thinking mindset towards these innovations will enable financial institutions to not only adapt but thrive within an increasingly complex digital economy steeped in biometric technology.

The Future of Financial Technology and Biometric Payments

Looking ahead, the future of financial technology is poised to be heavily influenced by biometric authentication. As consumers demand faster, more secure payment options, financial institutions must innovate to meet expectations. The seamless integration of biometrics into everyday transactions is set to redefine the customer experience. With the continuous rise of e-commerce and mobile payments, using biometrics as a form of verification will become not just a luxury but a necessity for security. Moreover, as technologies evolve, biometric solutions will likely incorporate multi-factor methods, combining several verification techniques for enhanced security. Such systems will appeal to businesses seeking to reduce fraud while offering customers a frictionless experience. Emphasizing safety and convenience will enhance customer loyalty, resulting in increased market share for those who excel in implementing cutting-edge biometric technologies. Future regulations will likely evolve to provide clear guidelines that not only secure consumer data but encourage innovation in the fintech space. The collective effort of businesses, technology developers, and regulators will be essential for ensuring the responsible expansion of biometric payments within the financial ecosystem, driving growth in digital payments while maintaining security and user confidence.

In conclusion, as we step deeper into the digital age, biometric authentication stands as a pillar of future secure payment solutions. Its integration promises not only enhanced security but also improved user experience. As advancements continue, both consumers and industry stakeholders must adapt, embracing the changes that accompany this cutting-edge technology. The financial landscape will evolve alongside these innovations, creating a pathway toward more secure, efficient, and user-friendly payment systems. By foreseeing potential challenges and proactively addressing them, organizations can ensure that biometric systems serve their intended purpose without compromising user trust or privacy. As this technology matures, it will open doors for financial institutions that understand and effectively implement these new methodologies. The importance of data protection, regulatory compliance, and consumer education cannot be overstated. Ultimately, the success of biometric authentication will depend on the collaborative efforts of the fintech community to create a safer, more streamlined payment environment. As we move forward, the demand for secure payments will drive continuous innovation in biometric technology, reshaping how financial transactions are conducted in the modern world.