How to Read and Understand Cash Flow from Operating Activities

Understanding financial statements is crucial for effective money management. Among these statements, the cash flow statement highlights cash inflow and outflow from operating activities. Cash flow from operating activities reflects a company’s ability to generate profit through its core business operations. This cash flow section helps investors assess how well a company can generate cash to cover its expenses and fund its growth. It indicates the liquidity of a business, showing whether it is generating enough revenue to sustain itself. To comprehend cash flow thoroughly, it’s essential to differentiate between operational cash flow and cash generated from investing or financing activities. Positive cash flow from operating activities is often a good sign for investors, but negative cash flow could indicate deeper issues. By analyzing the cash flow statement, one can identify trends over time. This helps determine the quality of earnings reported in the income statement. Additionally, understanding how operating cash flow relates to net income can provide valuable insights into financial health. Cash flow analysis is an essential skill for anyone looking to manage money wisely.

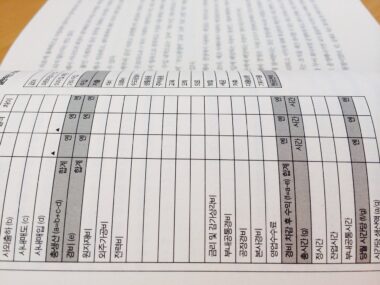

Cash flow from operating activities falls into two categories: direct and indirect methods. The direct method lists cash receipts and payments, providing clarity about cash transactions. Conversely, the indirect method starts with net income and adjusts for non-cash items. Each method offers a unique perspective on how cash flows relate to net income. For practical purposes, many businesses prefer the indirect method due to its alignment with the income statement. The most common adjustments involve changes in working capital, such as accounts receivable and inventory. Understanding these adjustments is vital for deciphering the cash dynamics of a company. It’s essential to note that effective cash management depends on regularly monitoring cash inflow and outflow. Operating cash flow can be affected by varying factors, including sales cycles and payment terms with suppliers. Investors often look for consistency in cash flows to predict future performance. Using cash flow statements effectively allows stakeholders to make informed decisions based on past performance and forecast future trends. By analyzing finance-related activities, you can gain deeper insights into a company’s operational efficiency and overall financial status.

Key Components of Cash Flow from Operating Activities

To accurately read and interpret cash flow from operating activities, one must recognize the key components involved. These components typically include net income, depreciation, changes in working capital, and non-cash expenses. Net income serves as the starting point for cash flow calculations and reflects the profitability of the company. Adjustments like depreciation—accounting for wear and tear on assets—must be added back, as these do not represent actual cash outflows. Working capital adjustments involve current assets and current liabilities, illustrating how business operations affect liquid cash. For instance, an increase in accounts receivable signifies that sales were made on credit, which can temporarily reduce cash flow. Conversely, an increase in accounts payable indicates that your company has delayed cash outflow, improving cash flow temporarily. By analyzing these adjustments, stakeholders can assess a company’s operational efficiency. This analysis becomes particularly important for investors seeking to understand the sustainability of cash flows. Ultimately, evaluating components within cash flow from operating activities is integral to making well-informed financial decisions and strategizing on investment opportunities.

When examining the cash flow statement, vigilance towards cash flow ratios is crucial. Ratios such as operating cash flow ratio and free cash flow ratio enable a deeper analysis of a company’s efficiency. The operating cash flow ratio measures the relationship between cash generated from operations and current liabilities. A higher ratio indicates excellent liquidity, reflecting the company’s capability to cover short-term debts. Conversely, the free cash flow ratio illustrates cash remaining after essential capital expenditures, thus showing how much cash is available for dividends, reinvestment, or debt repayment. Investors typically prioritize companies with healthy cash flow ratios, as they signify financial health and stability amidst volatile markets. Cash flow metrics can enhance investment strategies by helping anticipate company trends and financial security. Effective management of cash flow can lead to reduced financial stress, which is advantageous for long-term expansion. Understanding these ratios transforms one’s approach to evaluating prospective investments. Regular cash flow analysis fosters better control over an organization’s resources. Skills developed through cash flow assessment support overall financial capability while maximizing investment outcomes.

Understanding the Importance of Cash Flow Analysis

Cash flow analysis serves as a fundamental part of business operations management and investment evaluation. A strong grasp of cash flow dynamics can unveil the true picture of a company’s financial health beyond superficial profit margins. Often, profitable companies might struggle with liquidity issues due to cash flow discrepancies. Cash flow analysis enables investors and management to detect irregularities that could indicate deeper financial challenges, allowing timely interventions. Moreover, understanding cash flow serves as a risk management tool, increasing awareness of cyclical trends that could disrupt cash generation. Through this analysis, responsible decision-making is encouraged, ensuring the sustainability of operations. Regular assessment of cash flow statements can enhance operational efficiency by highlighting areas where improvements can be made. Also, stakeholders can predict changes in cash flows due to varying factors, including seasonality and external economic conditions. This foresight is significant for strategizing resource allocation during different phases of business. By emphasizing the importance of cash flow analysis, individuals can bolster their financial literacy and cultivate greater control over personal and organizational finances, paving the way toward informed investment choices.

Real-world applications of cash flow analysis can be observed through multiple case studies across various industries. These case studies illustrate how effective cash flow management substantially influences a company’s complement of strategies and business success. For instance, tech companies often experience rapid growth but may face cash flow constraints. By meticulously tracking cash flows, these companies can ensure they have sufficient resources for research and development, which is crucial for maintaining a competitive edge. Retailers may use cash flow analysis to manage inventory levels effectively and prevent overstock, while also aligning with consumer purchasing trends. In terms of preparation for emerging market fluctuations, proactive cash flow monitoring allows businesses to adapt to unexpected changes and secure financial resilience. Additionally, small businesses can benefit immensely by regularly analyzing cash flows to inform budgeting and forecasting. The adoption of cash flow management tools can further streamline this process, equipping companies with invaluable data for decision-making. The amalgamation of theory and practice within cash flow analysis underscores its indispensable role in achieving financial health across a spectrum of businesses.

Conclusion: Mastering Cash Flow for Financial Stability

In conclusion, mastering cash flow from operating activities is a vital skill in the scope of money management. Understanding how to read and interpret cash flow statements enhances one’s capability to make informed financial choices, whether personally or for businesses. By focusing on key components, stakeholders can effectively analyze operational efficiency and sustainability. Moreover, cash flow ratios provide insight that guides prudent investment strategies and resource management. The importance of cash flow extends beyond profit generation; it applies to ensuring a company has enough liquidity to meet obligations and pursue opportunities. Consistently monitoring cash flow empowers individuals and businesses alike to anticipate financial needs proactively. Ultimately, achieving mastery in cash flow analysis translates into stronger financial decisions and long-term stability. Whether evaluating current cash flow trends or planning for future growth, a robust understanding of cash flow dynamics remains instrumental in navigating the complexities of finance. This expertise not only safeguards investments but also fosters a culture of financial accountability. Embracing these principles will pave the path for enhanced financial literacy and success.