Interest Rates and Inflation: Implications for Retirement Planning

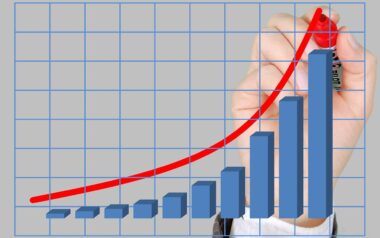

Understanding how interest rates and inflation interact is crucial for effective retirement planning. As individuals approach retirement, they often seek stability and growth in their financial investments. Rapid inflation can erode the purchasing power of these savings, while rising interest rates might increase returns on savings, but in a complex economic environment, this relationship can be unpredictable. Savvy retirees need to navigate this landscape diligently.

Inflation affects various aspects of retirement finances, influencing the types of investments that may be most beneficial. For example, retirees may consider stocks and real estate, which often outpace inflation over the long term. Fixed-income securities, like bonds, might seem appealing due to their stability, but if inflation exceeds the interest earned, retirees could lose purchasing power. Understanding these dynamics allows for informed investment selections.

Effect of Rising Interest Rates

Rising interest rates can serve two distinct roles in retirement planning. Firstly, they often lead to higher yields on savings accounts and certificates of deposit, allowing retirees to earn more from their investments. Conversely, higher interest rates can increase borrowing costs, affecting loans for housing or other purchases. This duality must be understood to create a balanced retirement strategy.

Retirees need to consider the implications of interest rates on their existing debt as well. For individuals nearing retirement, consolidating or refinancing can be beneficial, particularly in a rising-rate environment. Additionally, when assessing fixed income investments like bonds, individuals should evaluate their duration against forecasted inflation rates. These choices significantly influence long-term financial health during retirement.

The Importance of Inflation-Protected Securities

Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), have gained attention from retirees looking to hedge against inflation. TIPS provide guaranteed returns adjusted for inflation, making them ideal for preserving purchasing power. As inflation expectations fluctuate, incorporating these into a portfolio could mitigate risks associated with traditional fixed-income investments that lack such protections.

Moreover, diversifying a retirement portfolio with inflation-protected assets can help sequester a portion of funds against inflation’s adverse effects. This creates a balanced strategy emphasizing both growth through equities, and preservation with inflation-linked securities. Such diversification allows retirees to sustain their lifestyles even as prices rise, ensuring that they can enjoy their retirement without financial stress.

Adapting Retirement Strategies

In light of changing economic conditions, it becomes imperative that retirees remain adaptable. Regular reviews of financial plans must be conducted to ensure alignment with current interest rate environments and inflation statistics. These reviews offer opportunities to adjust asset allocations, ensuring that portfolios can withstand fluctuating market conditions and maintain their intended value during retirement.

Ultimately, developing a comprehensive retirement strategy encompasses understanding how interest rates and inflation impact overall financial well-being. Engaging financial advisors regularly can provide insightful analysis and projections based on prevailing trends. Retirees must balance risk with security, ensuring that their retirement years are defined by comfort rather than financial uncertainty.