Forex Charting Software Reviews: Tools for Technical Analysis

Forex trading has gained immense popularity over recent years, prompting traders to seek effective methods for analyzing the market. The right forex charting software can significantly enhance a trader’s performance by providing powerful tools for technical analysis. Various software options are available, and selecting the right one is crucial for optimizing trading results. This article will explore several highly recommended forex charting tools suited for both novice and experienced traders. By reviewing each software’s features, users can make informed decisions based on their individual trading styles and requirements. It is essential to understand the various functionalities these platforms offer, including real-time data analytics, customizable charting options, and user-friendly interfaces. Traders must consider the compatibility of the software with their preferred trading strategies and platforms. As the forex market runs 24 hours, easy access to technical analysis tools is vital for making informed decisions in a fast-paced environment. Ultimately, finding the ideal forex charting software can empower traders to make timely entries and exits, thereby improving their overall trading effectiveness and success.

Key Features of Forex Charting Software

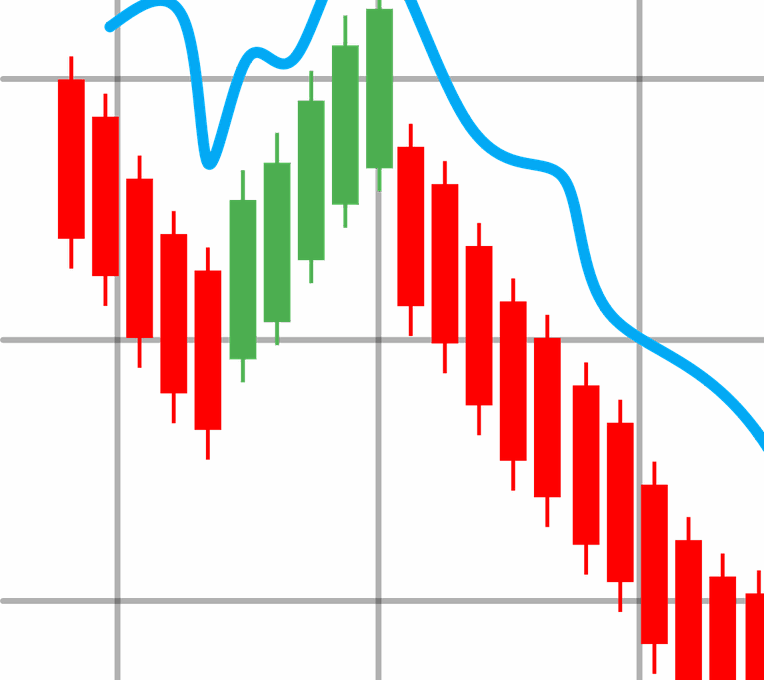

When evaluating forex charting software, several key features should guide your decision-making process. Firstly, look for real-time data feeds that keep you updated on market changes. A reliable software must provide seamless access to market data to capitalize on trade opportunities. Additionally, customizable charting options are essential, as traders have unique preferences for analyzing data. Being able to modify indicators and time frames allows traders to develop strategies tailored to their needs. Moreover, an intuitive user interface enhances the overall experience, making it easier for users to navigate various features. A software with a steep learning curve could deter traders from maximizing its potential. Furthermore, technical analysis tools such as Fibonacci retracements, trendlines, and oscillators must be included, empowering traders to conduct thorough analyses. Some platforms even integrate automated trading features, allowing algorithms to execute strategies based on predetermined parameters. Lastly, customer support and access to educational resources can enhance your learning curve, making these software options even more appealing. Thus, consider these features when selecting the right forex charting software to advance your trading journey.

Another important aspect to consider when selecting forex charting software is the availability of comprehensive analytical tools. A robust platform should offer various indicators, such as moving averages, MACD, RSI, and Bollinger Bands, enabling traders to gauge market momentum and price trends effectively. Additionally, built-in backtesting capabilities allow users to evaluate their strategies against historical data, providing insights into potential performance. The ability to simulate trades before risking real capital is invaluable for developing and refining trading strategies. Many traders benefit from social trading features, where they can follow the strategies of experienced traders, learning from their insights and techniques. Integration with mobile apps is critical as well, allowing traders to monitor the market and make critical decisions on the go. A seamless mobile experience ensures that users remain connected to the markets even when they are away from their desks. Furthermore, it is beneficial to read user reviews and testimonials to gain real-world perspectives on the software’s performance. Ultimately, a well-rounded software solution will encompass these features, meeting diverse trader needs while facilitating growth.

Popular Forex Charting Software Options

Several notable forex charting software options have gained traction in the trading community, providing diverse features to cater to various traders. One popular choice is MetaTrader 4 (MT4), which boasts an extensive selection of technical analysis tools, a customizable interface, and supports automated trading algorithms. It is a preferred platform for both beginners and experienced traders due to its versatility and user-friendliness. Another noteworthy option is TradingView, known for its advanced charting capabilities and social trading features. This platform allows users to share trading ideas and collaborate with other traders globally, fostering a vibrant community. Then we have NinjaTrader, designed primarily for futures and forex trading, which offers extensive charting tools, backtesting capabilities, and market analysis features. It is ideal for active traders seeking high-level analytical options. Additionally, Thinkorswim by TD Ameritrade supports both forex and stock trading, offering sophisticated charting options, real-time data, and advanced options analysis tools. Each of these platforms caters to a different segment of traders, enabling them to select a solution that aligns with their preferred trading strategies.

When choosing a forex charting software, consider the cost structure and available pricing plans, as they can vary considerably among platforms. Some software options, like MT4, are accessible for free, while others may require subscriptions or one-time payments. It’s crucial to evaluate whether the software’s features justify its cost. Moreover, seeking platforms offering free trials can provide insights into functionality and usability before committing financially. Look for educational resources, including video tutorials and webinars, often provided by brokers or software developers, to enhance your understanding of the platform. Access to a demo account is equally valuable, allowing traders to practice their strategies in a risk-free environment. Additionally, assess the software’s security features, including encryption and data protection policies, as financial data sensitivity necessitates a trustworthy platform. Customer service responsiveness is an often-overlooked factor; reliable support ensures a smoother user experience. In conclusion, while selecting forex charting software, balancing features, pricing, and support availability will lead to better trading outcomes.

Conclusion and Final Recommendations

In conclusion, the quality of forex charting software can significantly impact a trader’s ability to analyze market trends and make informed decisions. Taking the time to evaluate software based on key features, functionality, and user reviews can help you select the most suitable tools for your trading approach. MetaTrader 4 remains a popular choice due to its extensive capabilities and automated trading support. However, TradingView’s collaborative community and sophisticated tools are not to be overlooked. NinjaTrader also stands out for users focused on futures and forex, offering top-notch analytics and backtesting features. Before finalizing your choice, consider engaging with trial versions. This enables you to interact with the software, testing its features in real-world scenarios. Understanding how each software fits into your overall trading plan is crucial for maximizing your success in forex trading. Remember, investing in the right tools is equally as important as developing your trading strategy. Ultimately, with the right forex charting software in place, you can significantly enhance your technical analysis skills and trading performance.

As you embark on your journey in forex trading, diligent research will empower you to find the right charting software that meets your needs. Make sure to determine which features are non-negotiable for you and what additional tools might enhance your trading experience. Whether you prioritize automated features, social trading, or robust analytical tools, clarity on your priorities is essential. By refining your search and focusing on platforms that cater specifically to your interests, you increase the likelihood of finding software that enhances your market understanding and trading efficiency. Stay informed about new software updates, as technology is constantly evolving in the trading realm. In the fast-paced environment of forex trading, having a reliable strategy supported by effective tools is invaluable. By staying adaptable and open to ongoing learning, you’ll be well-positioned to navigate the complexities of the forex market while appreciating the myriad of options available in charting software. Ultimately, investing time in finding the right tools will lead to better trading outcomes, reflecting your commitment to becoming a successful trader.