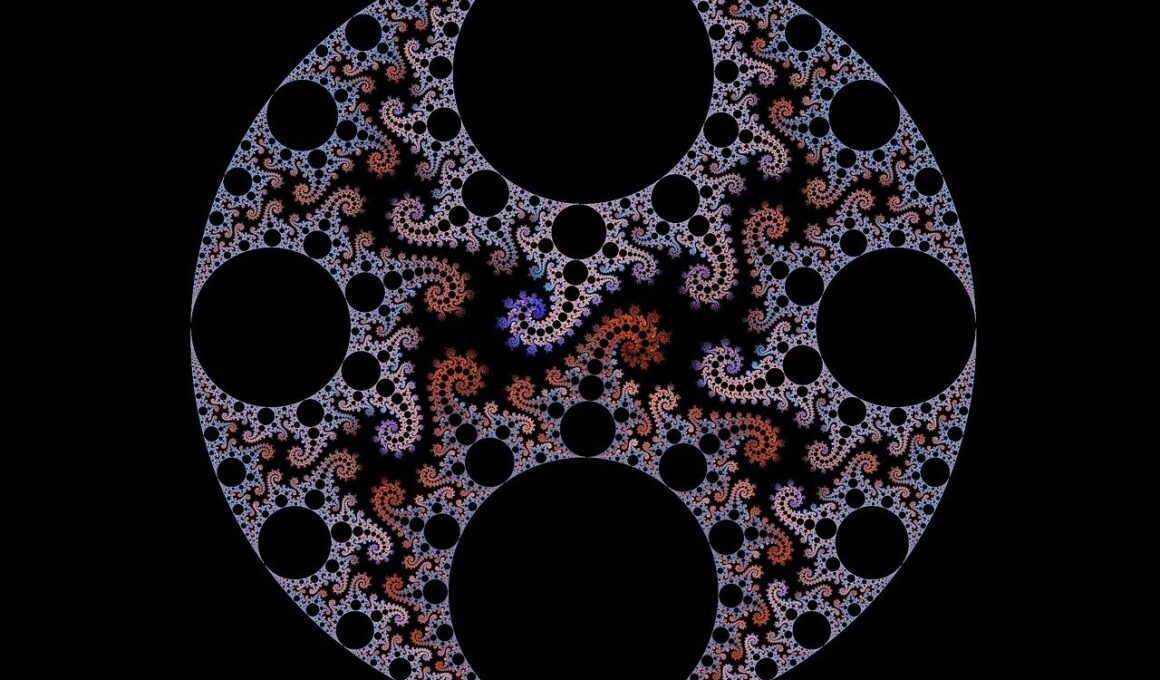

Complexity Economics and Market Efficiency Revisited

Complexity economics represents a shift from traditional economics by emphasizing the interdependence and dynamic interactions of various entities within the market. Unlike classical views that often assume equilibrium and rational agents, complexity economics recognizes the presence of agents whose behaviors adapt over time. This dynamism leads to emergent phenomena within markets that can drastically affect efficiency. For instance, market agents often exhibit path-dependent behavior, where past events significantly influence current decisions. With this framework, the market is understood as a complex adaptive system, where efficiency is rarely a stable state but a continually evolving aspect. Looking back at traditional efficiency theories, such as the Efficient Market Hypothesis, complexity economics raises important questions about their validity under conditions of uncertainty and variability. Notably, financial markets are characterized by unpredictable behaviors influenced by trader sentiments, global news, and technology. Thus, the revision of market efficiency through the lens of complexity requires fresh insights into how information is processed, as well as how new technologies can disrupt established patterns. A key takeaway is the importance of viewing markets as dynamic systems rather than static arenas, aligning well with real-world observations.

Dynamic Interactions within Markets

The interactions among agents within a market can yield patterns that are both complex and conducive to inefficiencies. In traditional models, individual agents are often portrayed as rational decision-makers, working toward maximizing their utility based on available information. However, the reality is far more nuanced, with agents acting based on incomplete information and cognitive biases. These factors foster a rich tapestry of behaviors that complicate standard economic predictions. For instance, phenomena like herding behavior and speculative bubbles frequently occur when agents follow others rather than relying strictly on fundamentals. Such situations can lead to market inefficiencies, resulting in sudden corrections or crashes that defy conventional wisdom. By modeling markets as networks of interconnected agents, complexity economics enables a more comprehensive understanding of these dynamics. Moreover, it provides tools to analyze how local interactions can create global patterns, emphasizing that the micro-level behaviors can lead to macro-level outcomes, often diverging from traditional expected results. This understanding encourages economists and market analysts to adopt a more holistic view of efficiency, recognizing the potential for inherent instability within complex market systems.

One critical question in the realm of complexity economics is how information cascades impact market efficiency. Information cascades occur when individuals make decisions based primarily on what others have chosen, rather than their own private information or analyses. In financial markets, this can manifest as sudden price runs resulting from the actions or sentiments of a small group of influential traders. Such cascades often lead to the dramatic impacts on stock prices, far detached from the underlying value of the assets. This phenomenon highlights the pitfalls of the Efficient Market Hypothesis, where all available information is assumed to be reflected in asset prices. Instead, complexity economics illustrates that prices reflect not just information, but also the emotional and cognitive states of the market participants. Market sentiment, therefore, becomes a critical variable that contributes to inefficiencies. By understanding the role of information cascades, economic models can incorporate more realistic behavioral assumptions, ultimately enhancing our predictive capabilities regarding market movements. This nuanced approach holds the potential for better investment strategies, policy formulation, and theoretical advancements in economics.

Adaptive Behaviors and Market Fluctuations

Agent-based models serve as a critical tool for understanding the adaptive behaviors of market participants. These models allow economists to simulate interactions among agents with diverse strategies, beliefs, and information capabilities. By adjusting their behaviors based on outcomes and market conditions, agents evolve over time, creating an environment rich in complexity. This adaptability is vital in understanding fluctuations that traditional economic models struggle to explain, particularly during times of financial crises. During such periods, adaptive behavior often leads to non-linear dynamics that can produce extreme volatility. Consequently, rather than fluctuating around an equilibrium, prices may swing dramatically based on changes in market sentiment, regulatory challenges, or external shocks. Consequently, the results obtained from agent-based simulations illustrate how chaos theory can be integrated into economic analysis, revealing how small changes in agent behavior can yield disproportionately large market movements. Through this lens, the once clear distinctions of market efficiency become blurred, emphasizing the role of unpredictability in economic systems. By acknowledging these dynamics, policymakers and investors can better prepare for and respond to market fluctuations.

Complexity economics also sheds light on how crises can emerge from seemingly innocuous interactions. This perspective runs counter to traditional approaches, which often view crises as exogenous shocks rather than endogenous phenomena born of aggregate behaviors. Financial markets exhibit properties such as fragility and robustness, which can coexist. The interactions of diverse agents following their frameworks can amplify micro-level disruptions into macro-level crises. For example, the 2008 financial crisis can be studied through the lens of complex systems theory, where the failure of a few institutions had ripple effects throughout the financial infrastructure, leading to widespread economic turmoil. Such events highlight the importance of resilience and adaptability in economic systems. Tools derived from complexity economics prioritize the networked structure of financial systems over isolated risk assessments. This new focal point provides valuable insights into mitigating risks and designing more robust economic policies that account for the interconnectedness of financial institutions. In particular, systems thinking helps identify key leverage points for intervention, enabling preemptive measures to prevent systemic failures from spiraling into wider crises.

Policy Implications of Complexity Economics

The implications of complexity economics extend well beyond theoretical realms and into practical policies that could affect market efficiency. Given that traditional approaches often focus on linear relationships and equilibrium states, complexity economics urges governments and regulators to approach policies with a mindset that embraces uncertainty and variability. Policymakers must consider the unintended consequences that can arise from interventions aimed at stabilizing financial systems. For example, regulations intended to prevent risky behaviors could inadvertently constrict genuine market innovation and adaptability. Consequently, a reevaluation of policy frameworks is crucial in the landscape of modern economics. Emphasizing adaptive regulations that can evolve in response to market changes fosters a more resilient economic environment. Additionally, promoting transparency and information-sharing between agents can help mitigate the asymmetries that lead to inefficiencies and cascading failures. Collaborative platforms that facilitate adaptive learning can enhance market efficiency by fostering more informed decision-making among participants. Importantly, the ability to modify regulations swiftly based on emerging evidences allows systems to remain responsive to evolving conditions, ultimately promoting a healthier market landscape.

In conclusion, complexity economics invites a revolutionary understanding of market efficiency that transcends traditional economic paradigms. The revelations gleaned from modeling complex adaptive systems provide profound insights into the unpredictable nature of markets and the behaviors of agents. A focus on dynamic interactions, emergent behaviors, and the role of information in shaping market sentiments leads to a richer comprehension of efficiency, recognizing it as a fluid target rather than a fixed point. Such insights challenge the tenets of classical economics and advocate for a more inclusive approach that factors in behavioral aspects alongside quantitative data. As economic landscapes continually evolve due to technological advancements, changing regulatory environments, and socio-economic shifts, the insights drawn from complexity economics will be invaluable in navigating these complexities. The potential for systemic change carved out by emerging theories encourages further exploration of the interconnected nature of economic systems. In an age where volatility and uncertainty are the norms, the organizational frameworks inspired by these concepts will help policy analysts and practitioners forge pathways toward sustainable economic development.