Comparing Major and Minor Currency Pairs for Trading

In the realm of foreign exchange strategies, traders must familiarize themselves with the distinctions between major and minor currency pairs. Major currency pairs consist of the most liquid currencies, typically including the US dollar, euro, and Japanese yen. These pairs are traded most frequently, making them ideal for new traders seeking reliable opportunities. The minor currency pairs, on the other hand, involve less frequently traded currencies that offer unique opportunities and risks. Understanding the dynamics of each category is crucial for enhancing one’s trading strategy. Major pairs tend to have lower spreads and higher liquidity, while minor pairs may experience higher volatility and less liquidity. Furthermore, it is essential to analyze economic indicators that impact these currencies. This knowledge allows traders to anticipate price movements and make informed decisions. Ultimately, increasing awareness about both major and minor currency pairs improves a trader’s performance in foreign exchange markets. Knowing when to engage with each type can lead to significant profit margins and successful long-term strategies. Investing time in this research can yield dividends when implemented correctly within a tailored trading approach.

Major currency pairs, such as EUR/USD and USD/JPY, benefit from stable economic indicators and significant trading volumes. This high liquidity means that traders can enter and exit trades with greater ease and potentially narrower spreads. Major pairs often respond predictably to global economic news, making them an appealing choice for many traders. Conversely, minor currency pairs such as AUD/NZD or GBP/CHF may present more unpredictability, leading to higher risks but also potentially higher rewards. The lower transaction volumes in these pairs result in wider spreads, which can impact profit margins if not managed carefully. Traders should understand that major pairs often involve established economies with stable political landscapes, reducing the likelihood of sudden market changes. Detailed technical and fundamental analysis can be highly beneficial for both types of pairs. However, minor pairs may require traders to stay informed about geopolitical factors that can suddenly impact price movements. Therefore, optimizing trading strategies according to the unique characteristics of major and minor pairs can lead to more informed and strategic trading decisions over time, enhancing overall trading success and risk management.

Risk Management Strategies for Currency Trading

Effective risk management is fundamental for forex traders dealing with both major and minor currency pairs. Regardless of the pair selected, implementing a solid risk management strategy can safeguard capital and enhance trading results. For major pairs, establishing stop-loss orders is crucial due to their high liquidity, allowing traders to limit potential losses during volatile periods. Traders analysis should also focus on position sizing, determining the appropriate amount of capital to expose in each trade methodically. Conversely, minor pairs present added volatility, requiring traders to adjust their risk parameters accordingly. Increased awareness of economic factors impacting these currencies can also help anticipate potential fluctuations. Traders might consider diversifying their portfolios between major and minor pairs to mitigate risk further, utilizing various approaches like swing trading or scalping. The key is to remain disciplined and consistently apply risk management techniques to protect profits while allowing for the pursuit of new opportunities. Whether trading major or minor currency pairs, effective risk management ensures that traders maintain their edge in the highly volatile forex market, leading to more sustained success over time.

A vital aspect of trading both major and minor pairs is understanding the impact of economic news releases. Major currency pairs often react strongly to high-impact economic reports, such as non-farm payrolls and interest rate announcements from central banks. Traders should be aware of their release schedules to gauge how these events might influence market movements. By staying updated on trends and forecasts, traders can better anticipate price adjustments following significant news. Additionally, minor currency pairs may experience sharp movements due to regional economic conditions or geopolitical tensions that affect the lesser-known currencies involved. Monitoring economic calendars and subscribing to reputable news sources will provide traders with valuable insights into upcoming announcements that can significantly impact their trading decisions. Following these economic events as part of a comprehensive strategy allows traders to capitalize on potential spikes in volatility. Furthermore, adapting trading techniques in response to anticipated market changes can lead to maximizing profit opportunities. Successful trading in both major and minor currency pairs hinges on a trader’s ability to interpret and respond to economic data dynamically.

The Role of Technical Analysis in Trading

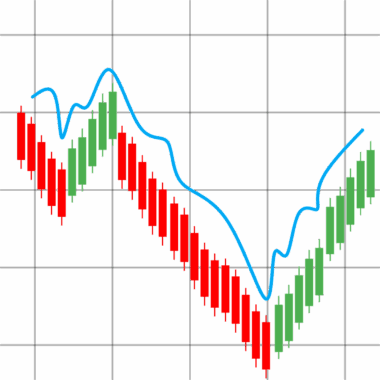

Technical analysis plays a crucial role in trading both major and minor currency pairs effectively. Traders utilize price charts, indicators, and historical data to identify potential market trends and make informed decisions. The application of popular tools such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels can significantly assist traders in understanding entry and exit points. Major currency pairs often display clear patterns due to their liquidity, enabling traders to apply technical analysis with higher precision. In contrast, while minor pairs may exhibit higher volatility, incorporating robust technical indicators remains essential. Traders can harness these tools to filter out noise and develop strategies to capitalize on short-term fluctuations. By consistently analyzing price action, traders can formulate predictions and tailor their techniques accordingly. Furthermore, utilizing backtesting strategies can refine approaches for both major and minor pairs, ensuring reliable performance over time. As technical analysis remains an influential strategy, combining it with a comprehensive understanding of market dynamics will enhance overall trading outcomes.

Another crucial aspect for traders to consider is the differences in trading hours associated with major and minor currency pairs. The forex market operates 24 hours a day, but not all pairs experience equal activity at all times. Major currency pairs see significant trading volumes during the overlapping hours of major trading sessions, such as London and New York. This increased activity often leads to improved liquidity and tighter spreads, perfect for active traders looking to capitalize on quick price movements. On the other hand, trading minor pairs may prove to be challenging during off-peak hours when liquidity decreases, resulting in wider spreads and potential slippage. Timing your trades effectively and understanding the best hours to trade specific pairs can lead to improved performance. Moreover, traders should prioritize the development of a personalized trading plan that accounts for their preferred trading style and risk tolerance. Evaluating these elements can facilitate better execution and optimal results, regardless of selected trading pairs. Ultimately, recognizing and adapting to changes in trading hours will play a pivotal role in trader success.

Conclusion: Finding Your Optimal Trading Style

In conclusion, the choice between trading major and minor currency pairs hinges on various factors, including risk tolerance, market knowledge, and trading style. While major currency pairs may seem like the safe choice due to their liquidity and stability, minor pairs can also yield significant opportunities for those willing to conduct thorough research. Traders must determine their individual strengths and preferences before diving into the market. A well-rounded trader often blends elements from both categories, allowing for diversifying strategies that leverage the unique characteristics of each pair type. Continual learning through practice and enhanced market understanding can empower traders to find the optimal balance between risk and reward. Crafting a comprehensive trading plan can optimize trading decisions, leading to sustainable success. Importantly, frequent evaluations of trading performance alongside adaptations to market conditions will ensure long-term growth. Embracing both major and minor currency pairs will not only enrich a trader’s experience but also improve their overall profitability. Ultimately, trading success in the forex market relies on the ability to remain flexible and responsive to the ever-changing market landscape.

In the realm of foreign exchange strategies, traders must familiarize themselves with the distinctions between major and minor currency pairs. Major currency pairs consist of the most liquid currencies, typically including the US dollar, euro, and Japanese yen. These pairs are traded most frequently, making them ideal for new traders seeking reliable opportunities. The minor currency pairs, on the other hand, involve less frequently traded currencies that offer unique opportunities and risks. Understanding the dynamics of each category is crucial for enhancing one’s trading strategy. Major pairs tend to have lower spreads and higher liquidity, while minor pairs may experience higher volatility and less liquidity. Furthermore, it is essential to analyze economic indicators that impact these currencies. This knowledge allows traders to anticipate price movements and make informed decisions. Ultimately, increasing awareness about both major and minor currency pairs improves a trader’s performance in foreign exchange markets. Knowing when to engage with each type can lead to significant profit margins and successful long-term strategies. Investing time in this research can yield dividends when implemented correctly within a tailored trading approach.