The Impact of Unethical Practices on Financial Markets

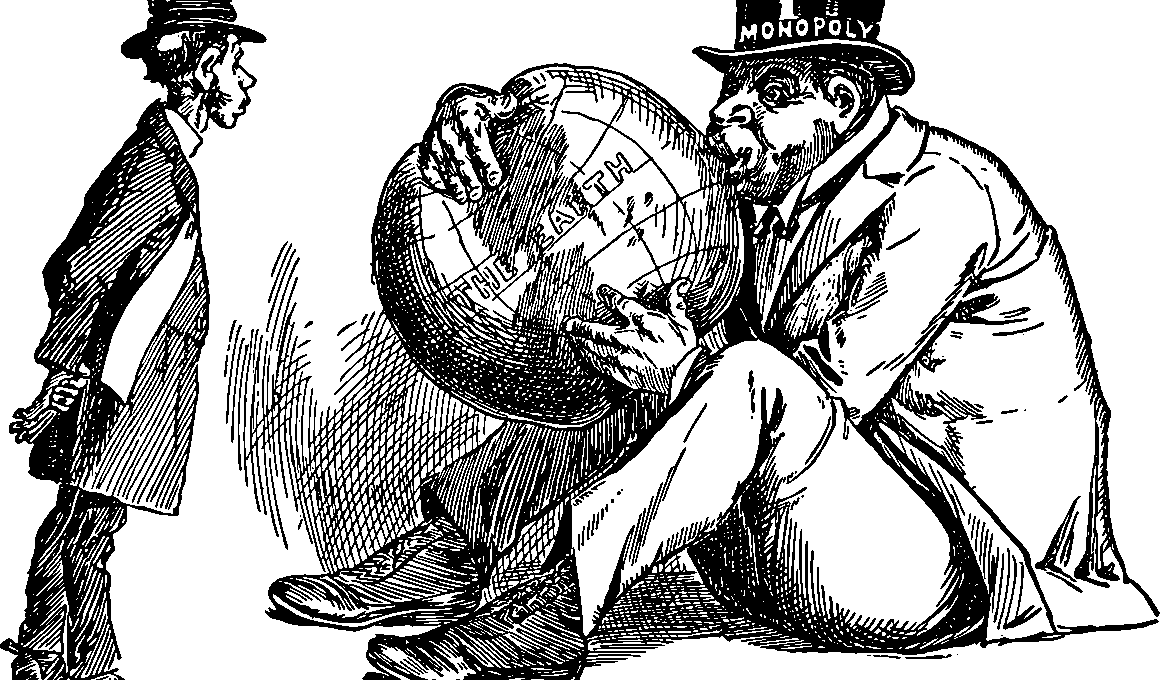

Unethical practices in financial analysis can create serious ramifications for both investors and the market at large. When analysts prioritize personal gain over ethical evaluation, it leads to distorted information. Investors rely heavily on accurate reports to make crucial decisions about buying or selling stocks. When the integrity of this information is compromised, it can lead to significant financial losses. Take, for example, cases of insider trading, where confidential information is used for unfair profit. Such actions not only erode trust among public investors but can also result in legal actions against perpetrators. Moreover, when unethical behavior becomes systemic, it fosters an environment that encourages deceit rather than transparency. Affected stakeholders include not just individual investors, but also companies and regulatory bodies that must cope with the resulting lack of confidence. Ultimately, this cycle of unethical behavior can stymie market growth and innovation as players become wary of trusting one another. To mitigate these risks, stringent regulations and ethical guidelines must be implemented, encouraging ethical competition among financial analysts and institutions. Only through commitment to integrity can healthy financial markets be ensured.

The prevalence of unethical practices has revealed systemic weaknesses in financial systems globally. Many investors are lured into a false sense of security by deceptively optimistic research reports. Consequently, these unrealistic projections can artificially inflate asset prices, causing bubbles that inevitably burst. During these financial crises, the aftermath is devastating, with countless individuals losing their savings and livelihoods. Additionally, the repercussions of unethical conduct can taint the reputations of established firms and even whole industries. For instance, companies embroiled in scandal often face not only financial penalties but also a long-lasting damage to their credibility. Rebuilding trust post-scandal proves challenging, as clients demand evidence of ethical rigor and accountability. Furthermore, regulatory agencies become vigilant, adding layers of scrutiny that may hinder operational flexibility. This strangulation of innovation can stifle competitiveness, placing ethically sound firms at a disadvantage. Thus, firms are faced with a paradox: strive for ethics while competing against those who disregard them. Education in ethical financial practices must become integral in professional training, ensuring that upcoming analysts embrace responsibility and contribute positively to financial markets.

Consequences for Stakeholders

The ramifications of unethical financial practices extend beyond individual investors to diverse stakeholders, including businesses and regulatory entities. A significant impact is felt in the catastrophic losses sustained by those who place trust in misleading information. Employees may experience layoffs and endure a deteriorating workplace environment due to declining business performance. Moreover, businesses involved in unethical scrutiny may face shareholder upheaval and potential bankruptcy due to a tarnished reputation. Stakeholders begin to voice discontent, pressuring management to adopt ethical policies. As a response, firms may implement initiatives to restore credibility and build consumer confidence. These measures include training programs and a shift in corporate culture towards transparency and accountability. By doing so, they not only aim to mitigate legal repercussions but also strive to regain stakeholder trust. Additionally, market analysts and journalists play a crucial role in holding unethical actors accountable, serving as watchdogs and advocating for best practices. They offer insights about potential risks associated with unethical behavior, reminding financial professionals of their pivotal role in fostering a healthy market landscape, allowing for informed decision-making in investing.

In response to growing ethical concerns in financial analysis, there has been a movement towards stricter regulations and standards. Regulatory bodies have proposed more rigorous compliance measures to enhance transparency in reporting practices. However, these regulations must be balanced with the need for innovation and speed in the financial markets. Efficient reporting processes are essential for investors who demand timely data to make informed decisions. As a result, imposing stringent rules without consideration of the underlying market dynamics may provoke resistance from financial entities. Moreover, a culture that encourages ethical practices must be cultivated within firms; this includes establishing ethical codes and fostering an environment that promotes accountability. Through continuous professional development, analysts can be made aware of the repercussions of unethical behavior and incentivized to promote integrity. Ethical training programs are becoming crucial in finance schools and corporate training sessions, stressing the importance of truthful reporting. Collective efforts towards ethical behavior can diminish the prevalence of dubious practices in the financial landscape, leading to a healthier ecosystem for investment and growth in the market. Consequently, a proactive stance in ethics is imperative for a robust financial future.

The Role of Technology

In contemporary financial analysis, technology is influencing ethical standards and practices in significant ways. Through data analytics and artificial intelligence, analysts can reduce human error and biases in financial reporting. However, these advancements also pose challenges regarding ethical decision-making. With increasing reliance on technology, there may be a detachment from traditional ethical values, as algorithms and models focus on profitability rather than integrity. Moreover, the use of technology can lead to complexities that obscure accountability, making it difficult to track responsibility in unethical conduct. Thus, the integration of ethical frameworks within technological systems is imperative. Firms are beginning to recognize the importance of embedding ethical considerations into the design and implementation of financial technologies. By aligning technological advancements with ethical values, companies can ensure that innovation does not come at the expense of integrity. Training professionals to understand both ethics and technology can create a new breed of analysts who uphold ethical standards while leveraging modern tools effectively. This approach fosters a dialogue surrounding trust, reinforcing the notion that technology should serve to enhance ethical practices in finance, not undermine them.

As financial markets continue to evolve, the implications of unethical practices must remain at the forefront of discourse. Comprehensive discussions led by both academic institutions and industry forums are crucial for fostering a better understanding of ethical financial analysis. Central to these conversations is the acknowledgment that financial markets thrive on trust, which must be continuously nurtured. Educational initiatives targeting future analysts can illuminate the long-term benefits of ethical practices, encouraging a forward-thinking mindset that values consumer rights and market stability. Moreover, legal repercussions for unethical behavior need to be enforced strictly, with penalties that deter malfeasance in the financial sector. Public awareness campaigns can also empower investors to recognize unethical practices, promoting a more vigilant and informed base that demands accountability. Furthermore, collaboration among industry leaders can lead to the establishment of best practices and ethical benchmarks that cultivate trust between securities and society at large. In the end, a commitment from all financial stakeholders to uphold ethical standards is paramount to safeguarding the integrity of financial markets and fostering resilience in the face of changing dynamics.

Moving Forward

Looking forward, a symbiotic relationship between ethics and financial analysis is critical for sustainable market growth. Stakeholders must prioritize ethics as a fundamental pillar of their business strategies, fostering a culture where integrity is non-negotiable. Furthermore, market participants are increasingly recognizing that sustainable investment practices often lead to better long-term performance, aligning financial success with ethical considerations. By promoting socially responsible investments and pushing for greater transparency, the finance sector can develop reputation and trust amongst consumers. Industry leaders play a pivotal role in setting the tone for ethical behavior by leading by example and advocating for comprehensive ethical training. Support from regulators is also key to creating a fair playing ground, providing clear guidelines, and enforcing compliance. Consumers must make informed choices based on ethical considerations, advocating for transparency and accountability among financial institutions. The journey towards ethical financial analysis does not overly stress legislation but focuses on fostering a culture of accountability, where ethics form the backbone of professional conduct. Ultimately, the future of the financial markets depend on a collective commitment to ethics, benefiting all stakeholders and enhancing overall market integrity.

This is another paragraph with exactly 190 words…