Stochastic Models for Longevity Risk Assessment

Longevity risk is a critical concern for pension funds, impacting their financial stability and the adequacy of retirement income for members. As lifespans increase, the obligation of these funds to pay benefits also rises, necessitating sophisticated analysis and modeling techniques. Stochastic models provide a framework for understanding the uncertainties surrounding life expectancy. They can capture the variability of mortality rates and project future liabilities accordingly. These models often utilize historical mortality data, actuarial life tables, and demographic factors for enhanced accuracy. One of the challenges in implementing these models is the complexity involved in accurately predicting long-term trends in longevity. Improved accuracy can lead to better-informed investment strategies and risk management practices within pension funds. Furthermore, stochastic models enable fund managers to assess different scenarios and their impact on financial outcomes. By adopting this analytical approach, pension funds position themselves to manage longevity risk more effectively, providing assurance to stakeholders regarding the long-term viability of retirement benefits. Proper integration of stochastic models into risk assessment frameworks is essential for ensuring the stability and sustainability of pension fund operations in an ever-evolving demographic landscape.

The effectiveness of stochastic models depends significantly on their underlying assumptions and the data used for calibration. One key aspect is choosing between parametric and non-parametric methods, which influences the model’s flexibility and predictive capabilities. Parametric models typically assume a specific distribution for mortality rates, while non-parametric approaches rely on observed data without such assumptions. Both methods possess their advantages and drawbacks, often necessitating a hybrid approach for best results. For instance, by incorporating machine learning techniques, pension funds can enhance predictive accuracy by analyzing vast datasets and identifying trends not evident through traditional methods. Additionally, scenario analysis plays a pivotal role in evaluating the implications of various longevity assumptions, bounding the possible future outcomes through stochastic simulations. Stress testing also becomes essential, allowing funds to understand potential vulnerabilities related to changes in longevity trends. These analytical tools support fund decision-makers as they design strategies that optimize asset allocations against potential liabilities. Embracing these advanced methodologies, pension funds can substantially mitigate longevity risk and ensure they meet their commitments, ultimately safeguarding the financial future of their members and beneficiaries.

Moreover, incorporating demographic changes into stochastic models is essential for accurately assessing longevity risk. As populations evolve due to factors like declining birth rates and immigration patterns, pension funds must adapt their models to reflect these changes accurately. Studies have shown that lifespan variations can differ significantly across different demographic groups, necessitating tailored approaches for distinct population segments. Analyzing factors such as socioeconomic status, geographic location, and lifestyle choices can provide insights into longevity predictions. These nuances underscore the importance of a granular approach in risk modeling, emphasizing that one-size-fits-all solutions are often ineffective. By segmenting populations and correlating demographic variables with longevity outcomes, funds can better estimate future liabilities. Additionally, adjusting for these factors allows pension funds to develop targeted communication strategies, fostering transparency with stakeholders regarding the risk landscape. Engaging members through education and outreach initiatives becomes increasingly vital in navigating the evolving longevity challenge. Consequently, pension funds must not only focus on quantitative assessments but also qualitative interactions with their constituents, reinforcing their commitment to managing longevity risk pragmatically and thoughtfully.

Engaging stakeholders is critical in developing a robust longevity risk management strategy. Stakeholders, including beneficiaries, employers, and regulators, must understand the implications of longevity trends on pension funds. Transparent communication is key to fostering trust and understanding, particularly in presenting the assumptions and methodologies underlying longevity risk assessments. Regular updates and educational initiatives can equip stakeholders with insights into the dynamics affecting pension fund viability. Predictive analytics plays a significant role here, enabling funds to model various retirement scenarios and communicate potential outcomes effectively. Utilizing visual aids such as charts, infographics, and reports can enhance stakeholder comprehension of complex models and data. Engaging with financial advisors and experts can further bolster stakeholder confidence, as professional insights can validate the methodologies employed in longevity risk analysis. Furthermore, advocacy for policy reforms encompassing retirement systems can emphasize the importance of adaptation towards longevity challenges. By actively involving stakeholders in discussions and decision-making processes, pension funds can establish a shared understanding of risk management strategies. In doing so, they can unite efforts to safeguard the financial sustainability of the institution while securing the retirement futures of their members.

Technological Advancements in Modeling

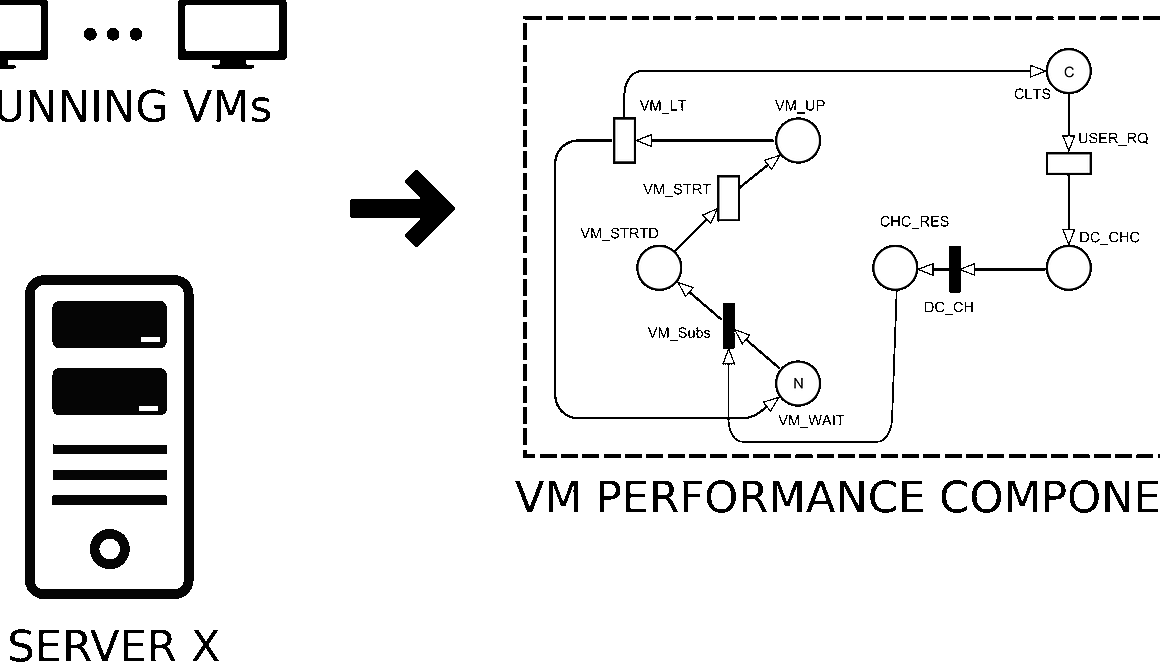

Technological advancements have revolutionized the framework of stochastic models for assessing longevity risk. The increasing computing power and availability of big data facilitate complex algorithms capable of analyzing mortality trends. Machine learning and artificial intelligence methodologies have emerged as potent tools in this realm. These techniques can automate data processing and provide real-time insights into longevity patterns, improving predictive accuracy significantly. By incorporating advancements such as natural language processing, pension funds can analyze unstructured data from various sources, including social media, health records, and research studies, further enriching their models. As a result, funds gain a comprehensive view of societal changes impacting longevity. Additionally, the advent of cloud computing enables pension funds to collaborate with researchers and other stakeholders efficiently, sharing data and insights seamlessly. This collaborative environment fosters innovation in model development, driving continuous improvements in longevity risk assessments. Furthermore, introducing blockchain technology offers potential for enhanced data security and traceability of vital statistics. Ultimately, by leveraging technological advancements, pension funds can strengthen their ability to manage longevity risk, ensuring that they meet their future obligations while adapting to an ever-changing economic and demographic landscape.

Regulatory frameworks surrounding pension funds significantly impact how longevity risk is assessed and addressed. Regulators often impose stringent requirements for risk reporting and management practices, compelling funds to adopt more sophisticated methodologies. As pension funds navigate these regulations, the integration of stochastic models becomes increasingly essential. Regulatory bodies are beginning to recognize the importance of allowing flexibility in modeling approaches, enabling funds to tailor their strategies based on specific demographics and risk profiles. Additionally, compliance with international standards provides a benchmark for pricing longevity risk, ensuring a level playing field among funds. The ongoing development of these regulations necessitates close monitoring and adaptation by pension funds, ensuring alignment with best practices. Moreover, active participation in industry forums allows pension funds to influence policy discussions on longevity risk management. It fosters a proactive approach to evolving regulations while also addressing stakeholder concerns. By being at the forefront of regulatory development, pension funds can anticipate changes and implement necessary adjustments to their models. Ultimately, this responsiveness strengthens their resilience against longevity-related financial pressures and enhances overall stability in the pension landscape.

In conclusion, as longevity risk continues to pose significant challenges for pension funds, the utilization of stochastic models is paramount for effective risk assessment and management. These models enable a deeper understanding of longevity trends, allowing for informed decision-making and strategic planning. By adopting a comprehensive approach that incorporates demographic nuances, stakeholder engagement, and technological advancements, pension funds can better navigate the complexities of longevity risk. Integrating robust analytical frameworks not only positions funds to meet their financial obligations but also supports the sustainability of retirement systems as a whole. Moreover, continuous adaptation to regulatory landscapes and advancements in analytical methodologies fosters a culture of resilience and responsiveness. Pension funds must remain vigilant, embracing innovation and collaboration to enhance their longevity risk assessments. Education initiatives and transparent communication can further strengthen stakeholder trust, ensuring that funds are well-prepared to confront the uncertainties ahead. Ultimately, the commitment to proactively managing longevity risk will significantly impact the long-term success of pension funds, securing beneficial outcomes for retirees and underpinning the financial health of future generations.