International Financial Institutions and Anti-Corruption Efforts

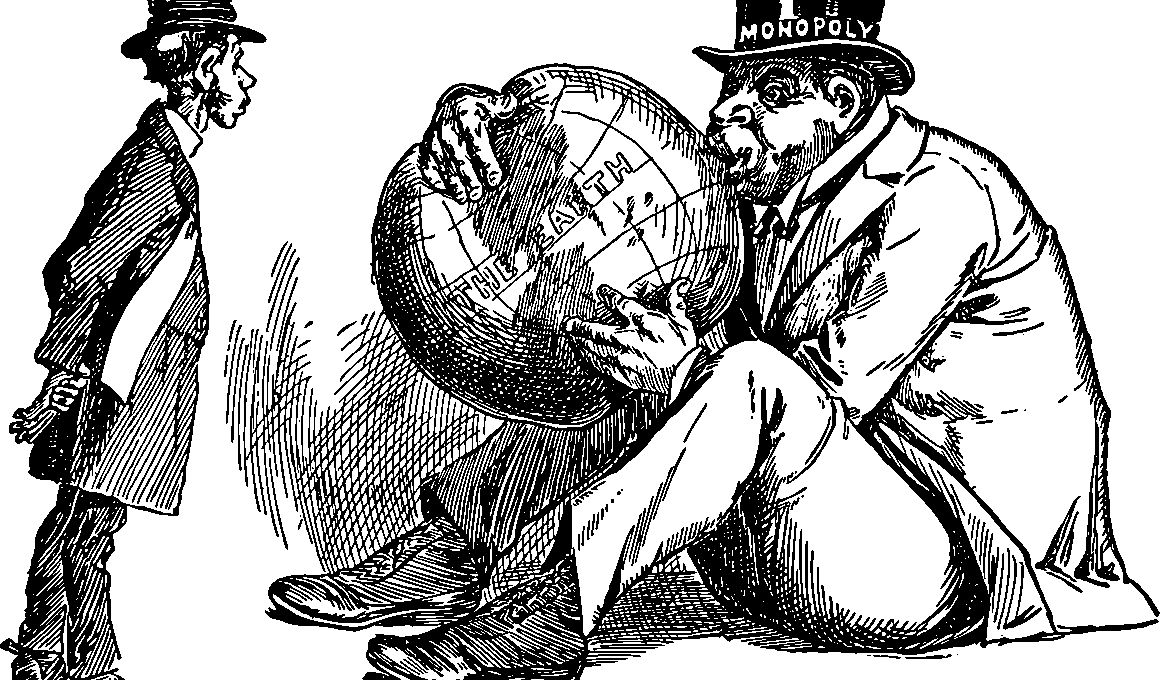

International financial institutions (IFIs) are pivotal in the global economy, helping countries navigate financial challenges and improve economic stability. These institutions, including the International Monetary Fund (IMF) and the World Bank, offer financial assistance and policy advice designed to foster growth. A significant part of their operational framework is dedicated to combating corruption, which undermines economic development and trust in public institutions. Corruption can come in various forms, such as bribery or embezzlement, and can severely affect a nation’s economic health. IFIs play a crucial role in promoting transparency and accountability, essential for effective governance. They advocate for best practices in financial management, resource allocation, and project execution. By establishing rigorous monitoring systems and enforcing strict anti-corruption measures, these institutions strive to ensure that aid and resources are used effectively. Furthermore, the partnerships developed between IFIs and governments can yield strategies aimed at reducing corruption risks. Such collaborations help pave the path toward sustainable development and enhanced financial integrity, ultimately benefiting communities and stakeholders reliant on these institutions for development support. A united effort against corruption builds a robust economic foundation worldwide.

In examining the role of IFIs in anti-corruption initiatives, it is vital to analyze their strategies and methodologies. Each institution employs diverse tactics directed toward diminishing corruption levels in recipient countries. For example, the IMF has implemented rigorous conditionality measures linked to its financial assistance, stipulating reforms that promote transparency. These measures ensure that countries adhere to anti-corruption frameworks, enhancing accountability within governmental operations. On the other hand, the World Bank focuses on developing comprehensive governance frameworks that strengthen institutions susceptible to corrupt practices. These frameworks emphasize enhancing the capacity of various sectors, thus mitigating vulnerabilities to corruption. Additionally, IFIs engage in capacity-building initiatives, training local officials in governance and anti-corruption measures tailored to their specific cultural and economic contexts. The importance of local engagement cannot be overstated; grassroots initiatives allow local communities to hold leaders accountable and foster a culture of transparency. Another significant aspect of IFIs’ efforts includes extensive research and data collection to monitor corruption patterns globally, establishing benchmarks against which countries can measure their progress. All these strategies collectively contribute to a more educated approach in combating corruption effectively.

IFIs face several challenges in implementing anti-corruption strategies effectively, influenced by political climates and institutional resistance within recipient nations. Political instability often hampers reform processes, as administrations change and priorities shift, complicating collaborative efforts. In some cases, local governments may resist IFI-backed reforms, viewing them as infringements on sovereignty or as synonymous with foreign meddling. Consequently, IFIs must adopt adaptive strategies that accommodate local political dynamics while maintaining their anti-corruption objectives. Building trusting relationships with governments and active stakeholders is essential for successful implementation. Moreover, local civil society organizations (CSOs) play a critical role in advocating for transparency and can serve as partners in IFI initiatives. Collaborating with CSOs allows IFIs to gain insights into the local context and tailor their anti-corruption frameworks effectively. Despite these challenges, the commitment to anti-corruption remains paramount, as it ultimately strengthens the legitimacy of both the institutions involved and the governments they assist. As the landscape of international finance evolves, IFIs must continue innovating their approaches to address corruption head-on while ensuring financial assistance achieves its developmental goals.

The Impact of Corruption on Development

Corruption has a profound negative impact on development, affecting economic growth and public trust. When resources are misappropriated, investments are diverted away from essential services such as healthcare, education, and infrastructure. Consequently, this degradation limits the prospects for sustainable development, exacerbating poverty and inequality in affected nations. The cumulative effect of corruption not only stymies economic progress but also engenders a culture of impunity that further discourages investment, both domestic and foreign. Insufficient transparency and accountability mechanisms worsen these effects, creating environments where corruption flourishes. For international financial institutions, understanding the specific impacts of corruption is paramount in formulating effective anti-corruption policies. Recognizing that corruption undermines their missions, IFIs work tirelessly to address this challenge through tailored programs and initiatives that seek to restore credibility in financial allocations. Central to their efforts is promoting governance reforms that prioritize transparency, citizen participation, and effective regulatory frameworks. Furthermore, enhancing public service delivery remains critical to ensuring developmental outcomes are met and that the benefits of aid translate into tangible improvements in the lives of citizens. By addressing such challenges, IFIs affirm their commitment to fostering lasting change worldwide.

In recent years, the conversation surrounding the collaboration between IFIs and technology in anti-corruption efforts has gained significant traction. Technological advancements provide new avenues for promoting transparency and accountability in financial institutions. For instance, blockchain technology can enhance traceability in financial transactions, thereby minimizing opportunities for corruption. By implementing transparent systems, stakeholders can track resources and identify irregularities in real time. The adoption of digital platforms not only streamlines processes but also enables citizens to access valuable information regarding government expenditures, fostering citizen engagement and activism. Likewise, data analytics tools allow IFIs to analyze corruption patterns swiftly, informing decision-making processes and policy formulation. However, the integration of technology into anti-corruption efforts must be approached cautiously, considering barriers to access and potential misuse. IFIs must collaborate with local stakeholders to ensure that solutions are inclusive and effective. Additionally, data privacy and cybersecurity considerations are paramount to safeguard sensitive information. Ultimately, leveraging technology offers promising opportunities to enhance anti-corruption initiatives and create more transparent financial environments conducive to economic growth and development.

Another significant strategy employed by international financial institutions in combatting corruption involves fostering inclusive economic participation. By prioritizing inclusiveness, IFIs not only empower marginalized communities but also encourage broader societal engagement in governance processes. A well-informed and active citizenry contributes to a robust accountability framework that seeks to deter corrupt practices. Furthermore, promoting gender equality within economic participation becomes essential, as women often face unique barriers in accessing financial services. By addressing gender disparities, IFIs can contribute to strengthening families, communities, and overall economic resilience. Through support for microfinance initiatives and entrepreneurship training programs, IFIs strive to bring unbanked populations into the financial system, generating earned income and active participation in local economies. Additionally, this broader economic participation reinforces social contracts, fostering trust in institutions. As communities become more integrated in economic activities, they become stakeholders in the governance processes impacting their lives. Collective action against corruption also flourishes when diverse voices are included, ensuring that initiatives reflect the aspirations and needs of all citizens. Ultimately, inclusive economic frameworks enrich both governance and development outcomes, key objectives for international financial institutions.

Conclusion and Future Directions

International financial institutions continue to face immense challenges in their anti-corruption efforts, yet they persist in developing innovative and effective strategies for combating corruption. Looking ahead, the integration of social, political, and technological considerations into their frameworks will be crucial in ensuring their approaches remain relevant and impactful. Embracing partnerships with local stakeholders, including civil society and the private sector, paves the way for collaborative solutions that reflect local contexts and priorities. Increased focus on data-driven methodologies allows IFIs to evaluate their initiatives continually, enhancing transparency and effectiveness in combating corruption. Moreover, prioritizing inclusivity and addressing gender inequalities enables international financial institutions to promote more equitable development outcomes. As global challenges evolve, so too must the tactics employed by IFIs to address corruption and its associated ramifications. By staying adaptive and responsive to the dynamic landscape of corruption, IFIs can play an essential role in fostering a culture of integrity and accountability. Ultimately, their unwavering commitment to combating corruption remains vital for achieving sustainable development goals and improving lives worldwide. The path forward requires collective action and a concerted effort to uphold the principles of good governance.

In conclusion, recognizing the importance of anti-corruption in the missions of international financial institutions necessitates a concerted and informed approach. Through collaborative partnerships and a commitment to promoting transparency, these institutions can facilitate transformative change worldwide while addressing the pervasive issues of corruption. Their multifaceted strategies, from promoting inclusivity to leveraging technology, will continue to shape the future of global finance and development. As these institutions evolve, so too does the need for ongoing engagement and innovation in enhancing governance structures worldwide. By committing to anti-corruption efforts, IFIs solidify their role as catalysts for positive change, driving the agenda toward a world characterized by accountability and sustainable development. The efficacy of these initiatives ultimately hinges on the collaboration between international financial institutions and local actors, ensuring that gaps are bridged, and local needs are met. Moving forward, it is imperative that all stakeholders align their efforts toward a coherent strategy, reinforcing a commitment to the fight against corruption. Only through sustained dedication and the adoption of best practices will the objectives of international financial institutions in promoting development be realized.