Using News Trading Strategies in the Forex Market

News trading strategies are essential tools for traders in the Forex market. Understanding economic indicators, political events, and market sentiment can significantly influence currency movements. News events like interest rate decisions and employment reports often create volatility, providing opportunities for traders. By analyzing how markets react to news, traders can better plan their trades. Timing is crucial in this strategy; traders must act swiftly to capitalize on price changes resulting from impactful news. Utilizing tools such as economic calendars can help keep track of upcoming announcements. It’s also vital to interpret news beyond just the headlines, as market reactions can differ according to expectations. A well-structured approach to news trading involves both preparation and post-release analysis. Additionally, emotional discipline plays a major role in news trading success. Traders should establish rules for entry and exit points based on news events. Practicing these strategies on a demo account before implementing them in live trading situations is advisable. This can help mitigate risk and refine skills. Ultimately, news trading can be a profitable strategy when paired with careful analysis and risk management.

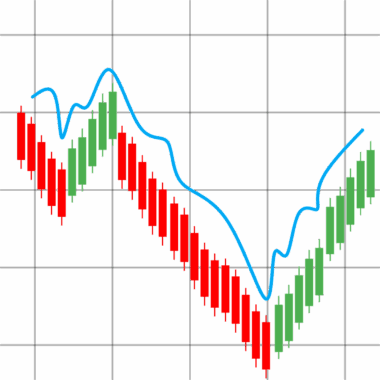

Successful news traders often rely on technical analysis alongside fundamental data. This dual approach helps to identify potential entry and exit points based on price charts. Combining technical indicators with news sentiment may provide traders with a clearer picture of market trends. The strategy should encompass a well-researched methodology that is regularly updated according to the evolving economic landscape. Utilizing various time frames can aid in recognizing short-term volatility while maintaining an eye on long-term trends. Traders should also consider the context of the news events—understanding the implications of a central bank’s decisions can significantly affect currency pairs. Additionally, monitoring different news sources is essential for gathering diverse perspectives on market-moving events. Engaging with reputable financial news platforms can keep traders informed and provide deeper insights. Leveraging technology through trading platforms that offer real-time news feeds and analysis can enhance awareness. Furthermore, joining forums and community discussions can be beneficial for sharing strategies and learning from others. Continuous education in economic conditions and financial principles remains crucial for traders. Consistent practice and adaptation lead to mastery in news trading strategies within the Forex market.

One of the critical aspects of news trading is managing expectations. Unexpected outcomes can lead to rapid price swings, which may not always align with predictions. Hence, traders must develop a calculated risk management strategy, including determining position sizes that match their risk tolerance. Setting stop-loss and take-profit orders ensures that potential losses are limited while locking in profits. It is also vital to review trades after a news event; evaluating what worked and what didn’t will inform future decisions. Traders should aim to learn from mistakes and successes in equal measure. Moreover, diversifying trades by investing in different currency pairs can mitigate risk exposure while taking advantage of various market conditions. Some traders prefer to specialize in specific currency pairs, honing their expertise over time. Establishing a routine that includes regular analysis of past news events can enhance future performance as well. New traders are often advised to start with less volatile currencies until they gain confidence. Continuous improvement through education, practice, and adaptation of strategies is essential. Thus, active participation in training sessions or reading relevant materials is beneficial for your growth.

Understanding Economic Indicators

Economic indicators serve as a backbone in news trading strategies within the Forex market. These indicators, such as GDP, unemployment rates, and inflation, greatly shape a country’s economic health. Traders track these indicators to anticipate central bank actions, which directly affect currency values. For instance, a strong GDP growth report might signal that a currency may appreciate due to potential interest rate hikes by the central bank. Conversely, disappointing economic data could lead to depreciation. Understanding the context behind these indicators adds another level of analysis. For example, a low unemployment rate might still not create favorable conditions if wage growth remains stagnant. Thus, discerning the nuances of economic reports can provide traders an edge. Access to reliable and timely data allows traders to act quickly when making decisions based on economic reports. Using an economic calendar ensures that important releases are not missed. This tool displays the expected dates and times of indicators, alongside their historical impact on the markets. Therefore, being equipped with accurate information sets the stage for informed trading decisions that align with broader market trends.

Furthermore, analyzing the right news events can help traders effectively strategize their positions before an official announcement. For example, observing pre-release speculation and market movements can offer insights into potential outcomes. Assessing historical data about how markets reacted to past events can improve forecasting abilities. Traders should also be aware that various forms of media may influence market sentiment—ranging from news articles to social media commentary. Consequently, being engaged with these platforms helps to gauge how other traders and analysts are likely to react. This sensitivity to market psychology can significantly influence trading strategies during critical news releases. Some traders may prefer to focus exclusively on high-impact news events, while others may diversify their approaches. Ultimately, integrating various forms of analysis—both fundamental and technical—creates a more comprehensive trading strategy. Addressing different risk scenarios enhances preparedness as situations evolve. Tracking currency correlations may yield additional perspectives on potential market behaviors. Adopting a flexible mindset and agility in strategy can lead to commendable trading outcomes. A commitment to continuous learning about the ever-changing market dynamics remains vital.

Conclusion: The Art of News Trading

Successful news trading in the Forex market combines skillful analysis with disciplined execution. Traders who can blend fundamental insights with technical acumen often find themselves at an advantage. Emphasizing the need for structured strategies and proactive risk management is crucial in navigating volatile market conditions. Establishing protocols for trading can minimize impulsive decisions during fast-moving events. Adapting strategies based on ongoing analysis and improvements enhances overall performance. A willingness to embrace new tools or technologies—like market sentiment indicators—can also serve beneficial. Traders frequently analyze the reactions of major institutions to news releases as an additional strategy. Drawing insights from institutional behaviors often clarifies market directions post-announcement. Being aware of the economic environment and keeping an open mind adds depth to trading approaches. Moreover, continuously developing personal trading skills through education and practice ensures staying relevant in this dynamic marketplace. Therefore, news trading, when approached with coherence and discipline, may pave the path toward sustained profitability. In summary, diligence and skillful execution elevate a trader’s effectiveness when operating in a rapidly changing forex landscape. This continuous journey of exploration leads to success and growth.

In conclusion, the journey of mastering news trading strategies requires dedication and perseverance. Achieving success entails not only understanding the mechanics of market movements but also engaging deeply with economic contexts. Creating a robust analytical framework supplemented by effective news tracking methods strengthens trading outcomes. Engaging consistently with market updates fosters an adaptive mindset that can navigate the unpredictable nature of the Forex market. Implementing disciplined techniques while recognizing major economic signals allows traders to seize lucrative opportunities. Ultimately, embodying a comprehensive understanding of the risks involved ensures informed decisions. This amalgamation of knowledge and execution forms the essence of effective news trading strategies. Whether a novice or experienced trader, the dynamic world of Forex commands attention to trends and data points. Forging robust relationships within trading communities enriches the learning experience and promotes further growth. Such interactions often lead to valuable insights and collaboration. As the trading landscape continues to evolve, embracing new strategies fosters resilience for the future. Continuous adaptation will ensure traders remain competitive. Exploring the horizons of the Forex market continuously expands growth opportunities and enriches the overall trading experience.

Through experiential learning and confronting challenges, trading skills can be refined further. Diversified exchanges allow for robust portfolio development, balancing risk and reward. Focusing on specific trading currencies or economic sectors can cultivate greater expertise and enhance market understanding. Successful traders often share their methodologies and engage with emerging market trends to cultivate better strategies. In the end, effective news trading hinges on leveraging knowledge and skills judiciously to benefit overall performance. By blending data analysis with proper execution, traders can create sustainable approaches that adapt to changing market dynamics. This shifting landscape requires readiness to engage with novel trends and phenomena. Relying on continual education alongside pragmatic experience will ensure that traders excel within the complex tapestry of financial markets. An ongoing commitment to mastering the art of news trading fosters personal growth and professional excellence. Understanding past mistakes leads to better decision-making as the trader matures. Therefore, creating a strong foundation rooted in knowledge and skills shapes future successes within the ever-evolving Forex domain. The culmination of disciplined strategies, awareness of economic indicators, and emotional resilience will ultimately determine how traders navigate global markets.