Traditional vs. Modern Views on Ethical Finance: A Historical Comparison

The evolution of financial ethics has seen shifts that reflect broader societal changes, influenced by cultural, economic, and philosophical developments. In traditional views, ethics were often based on religious or community-focused principles. These principles helped guide the behavior of financial institutions and professionals, ensuring that their practices aligned with local beliefs and values. Financial activities were seen not just in economic terms but as part of a moral framework. Medieval and Renaissance thinkers emphasized virtues such as honesty, integrity, and fairness in dealings with money and contracts. This perspective maintained a communal approach to wealth, aiming to serve the greater good rather than merely seeking profit. Traditional ethical frameworks also stressed accountability, where moneylenders and traders were often scrutinized by their peers. Thus, early financial ethics incorporated a strong consideration of the societal impact of financial decisions. Over time, however, as economies transitioned towards capitalism, the focus began to shift towards individualism, emphasizing self-interest in financial practices. This historical context sets the stage for analyzing contemporary ethical frameworks and how they differ from their predecessors, defining the current landscape of financial ethics.

Transition to Modern Ethical Perspectives

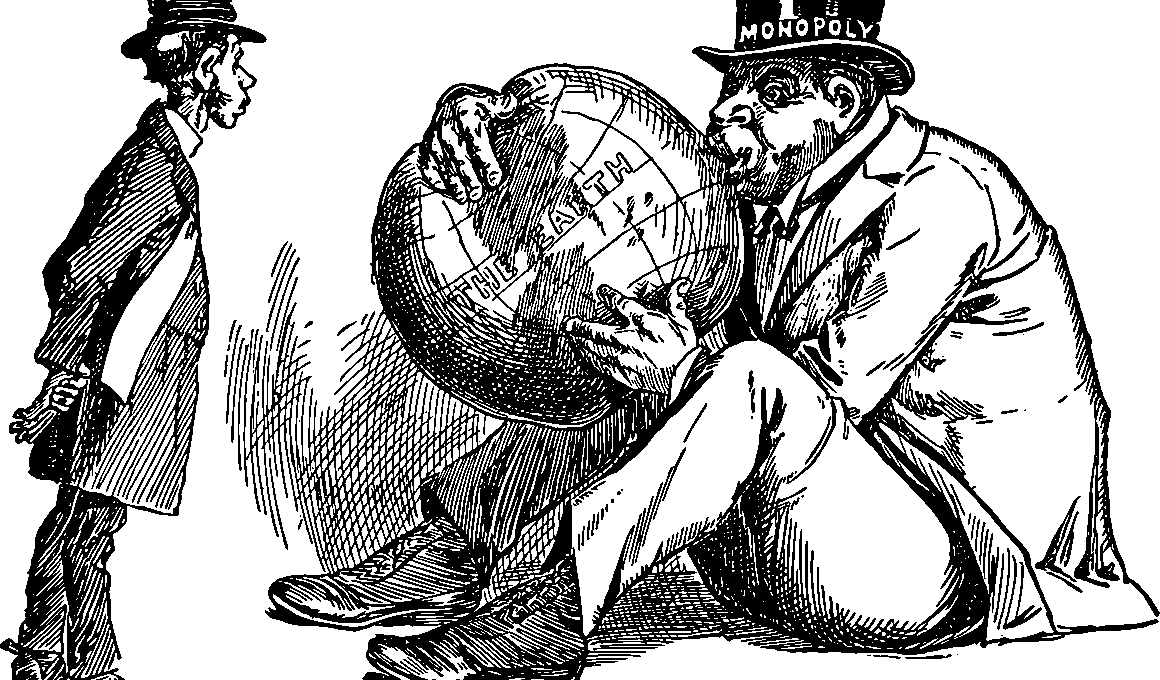

The modern era of finance is characterized by the rise of corporate governance and regulatory frameworks that aim to ensure ethical conduct. In contrast to traditional views where personal integrity was paramount, today’s financial ethics are more often codified in laws and corporate policies. With the emergence of globalization and technological advancements, ethical considerations have expanded. Modern financial corporations now face challenges such as data integrity, environmental responsibility, and global market regulations. This shift reflects a broader understanding that corporate actions affect not just shareholders but also stakeholders, including communities and environmental ecosystems. Ethical finance now often includes metrics for measuring social impact alongside financial returns. These consider how investments contribute to sustainable development goals and responsible investing practices. Despite this shift, critics argue that profit maximization often still dominates decision-making processes, raising questions about the genuine commitment to ethical standards. Furthermore, instances of corporate scandals illustrate the ongoing tension between profit motives and ethical responsibilities. The development of ethical finance has thus become a battlefield between these conflicting paradigms, requiring ongoing vigilance and innovative approaches to ensure that finance aligns with evolving ethical standards.

Another significant aspect of contemporary financial ethics involves the integration of technology and ethics in finance. Advancements such as artificial intelligence and blockchain raise new ethical dilemmas that challenge existing frameworks. For instance, AI algorithms can perpetuate bias if not designed with ethical rigor. Financial institutions must balance innovation with ethical responsibility, ensuring technologies are beneficial and not detrimental to society. Transparency in how data and algorithms operate has become a focal point, as stakeholders demand accountability. Modern finance thus finds itself navigating the complex intersection of technology and ethics. This is partly due to heightened consumer awareness and advocacy for ethical standards in financial services. The recent emergence of fintech has further complicated the landscape, where new players may not adhere to traditional regulatory constraints. This dynamic environment necessitates continuous adaptation of ethical guidelines to keep pace with the rapid changes technology brings. Moreover, there’s a growing push for ethics education among financial professionals, aiming to instill such values at the grassroots level rather than solely relying on institutional frameworks. Ethical finance today is both a response to historical practices and a proactive approach to future challenges.

Lessons from Historical Perspectives

Exploring the history of financial ethics reveals essential lessons that contemporary practices can learn from. Traditional ethics stressed accountability and the societal implications of financial conduct, which can enrich modern approaches. For instance, while the concept of maximizing shareholder value has often dominated corporate strategies, the traditional view encourages a broader approach that considers community welfare and ethical obligations. History reminds us that ignoring ethical principles can lead to significant societal consequences, such as economic crises or loss of public trust. The repetitive nature of financial scandals serves as a cautionary tale, indicating the need for a robust ethical framework that stands the test of time. Additionally, the historical accountability within financial practices suggests that transparency must be woven into the operations of modern financial institutions. By learning from past failures and successes, today’s financial professionals and organizations are better equipped to navigate the complexities of ethical dilemmas inherent in finance. This historical understanding fosters a nuanced appreciation for the importance of ethics in maintaining the integrity and sustainability of financial markets. Such insights pave the way for developing more responsible financial practices moving forward.

As the dialogue around financial ethics evolves, the emergence of ethical investment strategies highlights a modern trend aligning finance with moral values. These strategies include socially responsible investing (SRI), environmental, social, and governance (ESG) investing, and impact investing. Historically, investment decisions focused mainly on financial returns, but there is a growing shift towards considering the environmental and social impact of investments. Modern investors, particularly millennials and Generation Z, prioritize ethical considerations in their portfolios, leading financial companies to adapt their approaches. This trend exemplifies a broader societal movement towards sustainability and responsibility. By investing in enterprises committed to ethical practices, investors can contribute to positive changes in society, aligning their money with their values. Additionally, the rise of technologies that allow for more transparent investment tracking has made it easier for investors to hold companies accountable. This shift reflects a significant departure from traditional investment principles that often overlooked ethical considerations. As ethical finance grows more mainstream, the challenge lies in balancing financial objectives with genuine ethical commitments, ensuring that the focus remains not just on returns but also on creating beneficial societal outcomes.

Future Directions in Financial Ethics

Looking ahead, the landscape of financial ethics is bound to further evolve as societal expectations change. The ongoing globalization of markets and the advent of digital currencies introduce new ethical challenges that will require innovative solutions. Financial professionals must grapple with the implications of cross-border transactions, digital assets, and the regulatory landscape, ensuring that ethical considerations remain paramount. Furthermore, as consumers become increasingly aware of ethical implications in finance, organizations will need to enhance their transparency and accountability. This evolving scrutiny from consumers could lead to stronger demands for corporate social responsibility (CSR) and ethical behavior in financial practices. Additionally, there will likely be calls for more comprehensive training and standards in ethics for financial professionals to prepare them for emerging dilemmas in the industry. Institutions may explore novel frameworks that encompass not only profitability but also sustainability and community well-being. The future of financial ethics depends on embracing both tradition and innovation, harnessing historical insights while adapting to modern complexities. How the industry responds to these challenges will be instrumental in shaping the ethical finance landscape of tomorrow.

The historical comparison of traditional and modern views on financial ethics reveals a complex interplay of principles that continue to shape financial practices today. Understanding these perspectives offers valuable insights into the evolution of ethical standards in finance, emphasizing the importance of history in informing current practices. With lessons gleaned from past ethical frameworks, contemporary financial ethics can promote a balanced approach that considers both profit and social responsibility. The commitment to ethics in finance is increasingly vital in today’s interconnected world, as financial decisions impact various stakeholders and the environment. As we progress, it is crucial to nurture a culture of ethical awareness and adaptability among financial practitioners. Those who seek to bridge the historical context with modern demands will not only foster trust and integrity in the profession but also ensure finance serves the broader goals of society. Embracing both traditional wisdom and modern innovation will be essential in advancing ethical finance. By aligning financial practices with ethical standards, we can create a better future where finance supports genuine social progress, demonstrating that integrity and profitability can coexist harmoniously and beneficially.

In conclusion, the historical comparison between traditional and modern views on ethical finance illustrates the importance of adapting ethical practices in response to changing societal values. Historical perspectives remind us of accountability and community welfare, vital for sustainable financial operations. As financial institutions continue to navigate the complexities of modern markets, these insights serve as critical reminders of their responsibilities. Businesses that effectively integrate ethical considerations into their operations can enhance their reputation and ensure long-term success. The convergence of traditional ethics with modern demands opens new avenues for responsible finance, fostering stakeholder trust and commitment. Historical lessons provide a roadmap for current and future practitioners, helping them to remain grounded amidst evolving ethical challenges. This dialogue not only emphasizes the continuity of ethical finance but also highlights its necessity in promoting equitable and just financial systems. Aspiring financial professionals must engage with this historical context as they shape the future. Ultimately, fostering a culture where ethical considerations are integral to financial practices will be paramount in creating a sustainable and responsible financial ecosystem that benefits society as a whole.