Digital vs. Paper: Storing Accounting Records Safely

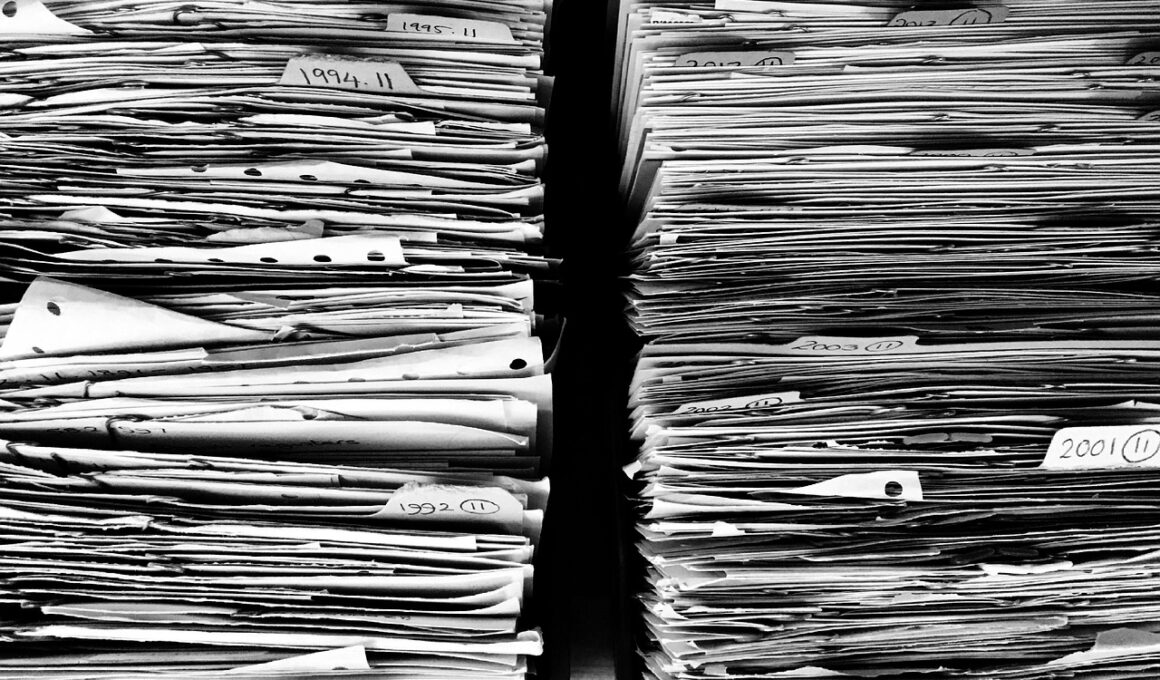

In the realm of accounting, the storage of records is pivotal not merely for compliance, but also for smooth operations. Historically, businesses relied extensively on paper documentation for their accounting records. However, as technology has advanced, we witness a shift towards digital storage. Each approach offers distinct advantages and challenges. Paper records are tangible, easy to review, and require no technological infrastructure. Yet, they are susceptible to damage from fire, water, or simple misplacement, risk factors that can compromise vital financial information. On the other hand, digital records can be stored securely in the cloud, offering greater protection against loss and unauthorized access. Furthermore, utilizing software for accounting enhances efficiency, allowing for quicker retrieval and easier analysis of data. Yet, transitioning to a digital storage system requires robust cybersecurity measures to guard sensitive financial information against breaches and unauthorized access. Businesses must weigh the pros and cons of each method, evaluating factors like cost, accessibility, and security protocols to determine the best way to manage their accounting documentation effectively.

Advantages of Digital Storage

Digital storage offers numerous advantages for accounting records management, appealing to modern enterprises. Firstly, digital documents save physical space by eliminating the need for filing cabinets packed with paper. Accessing information becomes more efficient, as digital files can be retrieved in seconds with just a few clicks. Furthermore, data can be easily organized, allowing for quick categorization based on months, transactions, or clients. Digital systems often include features that enable automatic backups, reducing the risk of data loss. Another significant advantage is the potential for integration with other software, which streamlines various business processes. For instance, integrating payroll and customer invoicing with accounting software can enhance operational efficiency. Moreover, digital records can simplify collaboration among teams, as files can be shared with multiple stakeholders regardless of their physical location. Investing in cloud storage solutions also enables businesses to access their accounts anytime, anywhere, enhancing flexibility. However, businesses must commit to training staff on secure data management practices. Additionally, meticulous procedures must be established for data entry to avoid inconsistencies that can arise from manual input.

While embracing digital storage presents many benefits, businesses should recognize potential drawbacks or challenges. One significant concern is the risk of cyber threats, such as hacking or malware, which can jeopardize sensitive financial data. To counteract these risks, robust security measures, including encryptions, strong passwords, and regular updates, must be taken seriously. Furthermore, the cost of transitioning to a fully digital system can be a barrier for some organizations. Initially, businesses may need to invest in reliable software solutions, hardware upgrades, and employee training. Continuous maintenance costs, including subscriptions to cloud services, add to long-term expense considerations. Additionally, employees comfortable with traditional filing systems may resist the transition. Thus, clear communication regarding the benefits of digital methods is essential to gaining buy-in from staff. Another challenge is the potential for technical issues or system failures. Backups and contingency plans should be implemented to ensure business continuity. Despite these drawbacks, a thorough understanding and commitment to a digital strategy can greatly enhance the overall efficiency of accounting practices. Many accounting professionals find that the advantages ultimately outweigh the challenges.

Benefits of Paper Records

Despite the advantages of digital storage, there are undeniable benefits that paper records continue to provide in the accounting realm. Firstly, paper offers a sense of permanence and reliability, as tangible documents can be accessed without the need for technology. Some individuals prefer the physical aspect of handling documents, finding it easier to review and annotate printouts. Furthermore, regulations in certain sectors still necessitate keeping hard copies of documents, particularly in jurisdictions where compliance requirements demand it. Additionally, paper records can be stored independently without concerns about hacking or data loss due to technological failures or outages. For certain small businesses or sole proprietors, the costs associated with digital systems may not be justifiable, prompting them to continue relying on traditional paper filing methods. Moreover, when employees experience technical challenges, having physical records readily available eliminates downtime during critical accounting tasks. Whether conducting audits, preparing taxes, or maintaining compliance, paper remains a steadfast option for many. However, organizations considering hybrid systems can often enjoy the best of both worlds, utilizing the strengths of each approach to their advantage.

Transitioning between digital and paper systems is crucial for businesses seeking to enhance their accounting record management while remaining compliant with regulations. Hybrid systems that incorporate both digital and paper methods can yield benefits across various business contexts. This approach enables businesses to retain the advantages of paper, such as ease of access and reliability, while simultaneously taking advantage of the efficiency and scalability of digital platforms. For instance, businesses may choose to digitize certain vital documents while keeping others in physical form, particularly those required for audits or legal documentation. This strategy balances preservation and compliance with efficiency, reducing physical storage costs. Organizations can also consider employing document scanning services that facilitate the transformation of paper records into digital formats while ensuring proper data organization. By continually evaluating the evolving needs of their accounting practices, businesses can cultivate a systematic approach that leverages emerging technologies while honoring traditional methods. Consequently, providing employees with the right tools and training is essential, ensuring seamless collaboration and effective management of their accounting records in both formats.

Best Practices for Record Management

Effective record management is paramount in both digital and paper systems to ensure compliance and security. Businesses should adopt best practices that streamline the storing of accounting records safely. Firstly, a clear organizational structure is vital; naming conventions and consistent file organization facilitate easy access to documents. For digital records, employing a secure cloud storage solution is advisable to prevent unauthorized access. Regular training of employees on cybersecurity protocols helps create a culture of awareness. In addition, having a robust data retention policy establishes clear guidelines on how long records should be maintained, assisting compliance efforts. Businesses must also schedule regular audits of both digital and paper records to ensure consistency and identify discrepancies. Furthermore, physical records should be stored in controlled environments with limited access to mitigate risks of loss or damage. For digital files, regular updates and backups should be automated to avert data loss. Set clear protocols for data entry and management, emphasizing accuracy above all else. Ultimately, adherence to these best practices ensures that businesses can operate more efficiently and mitigate risks associated with improper record management.

In conclusion, the decision of digital versus paper records in accounting embraces various considerations, from cost-effectiveness to compliance. Criminal activity like fraud has highlighted the need for secure data management systems. Nevertheless, both methods have unique advantages rooted in organizational preference, business size, and industry requirements. Digital storage systems increase efficiency and accessibility, while paper documentation retains relevance for those valuing permanence and organizational simplicity. Finding the ideal balance based on individual business needs will set an organization up for long-term success. When developing their strategy, organizations must consistently evaluate both methods’ effectiveness, weigh their pros and cons, and be flexible in their approach. Continuous improvements can ensure that they remain compliant with ever-changing regulations. Digital technology is rapidly advancing, but traditional methods still hold their ground. Businesses might consider adopting a phased approach: transitioning gradually to digital records while still maintaining vital paper backups. Partnering with professionals in the accounting field can provide the insights necessary to navigate these complexities effectively. Thus, fostering a culture of innovation while honoring time-tested practices will optimize accounting record management.

Ultimately, the objectives of accounting documentation storage remain focused on safety, accessibility, and regulatory compliance. Both digital and paper methods contribute significantly to achieving these goals, and organizations should formulate a strategy that employs both approaches to cover all bases. As companies evolve with technological advancements, they must ensure employees remain well-versed in skills for efficiently managing records in a digital environment. A successful strategy often involves assigning specific individuals or teams to oversee record management, thereby ensuring accountability. Moreover, businesses should continually seek feedback on the effectiveness of their systems and adjust as necessary. Encouraging a proactive mindset about document storage and management will equip teams to navigate challenges effectively. It is also critical to understand industry trends that may dictate the need for change, ensuring organizations remain flexible. Those that can adapt communications around policies, training, and technologies confidently will be positioned for continued growth. Long-term success in accounting relies on a well-thought-out combination of digital and paper records. Companies investing in record management solutions are ultimately safeguarding their financial future and ensuring sound business practices.